|

|

| Morning Review | Feb 5, 2026 |

|

| This e-mail is intended for Sample Report only. Note that systematic forwarding breaches subscription licence compliance obligations. Open in browser | Edit Countries on Top |

|

| Large EMs |

|

| Czech Republic |

|

|

|

|

|

|

|

|

|

| Hungary |

|

|

|

|

|

|

| Poland |

|

|

|

|

|

|

|

|

|

| Turkey |

|

|

|

|

|

|

|

|

| Argentina |

|

|

|

|

| Brazil |

|

|

|

|

|

| Mexico |

|

|

|

|

|

| Egypt |

|

|

|

|

|

|

| Nigeria |

|

|

|

|

| India |

|

|

|

| Indonesia |

|

|

|

|

|

|

|

|

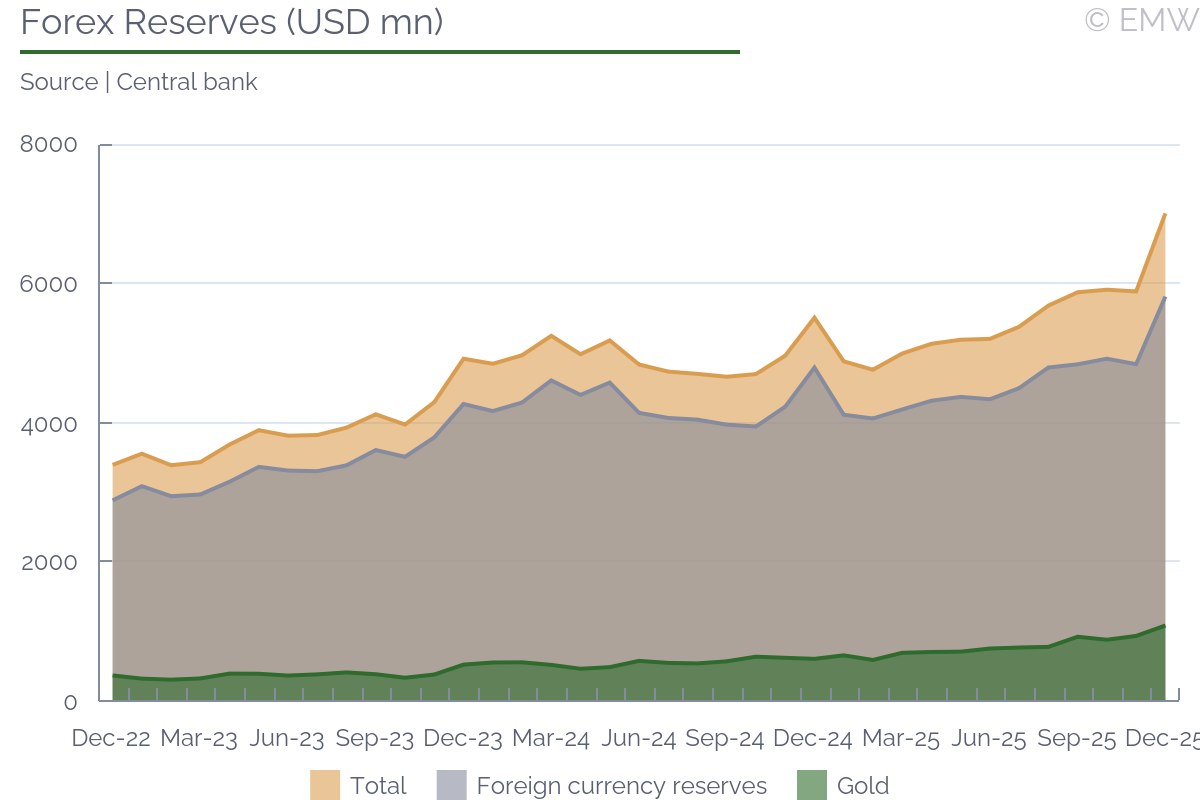

| Pakistan |

|

|

|

| Philippines |

|

|

|

|

| CEE & CIS |

|

| Albania |

|

|

|

| Armenia |

|

|

|

|

| Azerbaijan |

|

|

| Belarus |

|

|

|

| Bosnia-Herzegovina |

|

|

| Bulgaria |

|

|

|

|

| Croatia |

|

|

|

|

|

|

|

|

| Georgia |

|

|

|

|

| Kazakhstan |

|

|

|

|

| North Macedonia |

|

|

|

| Romania |

|

|

|

|

|

| Russia |

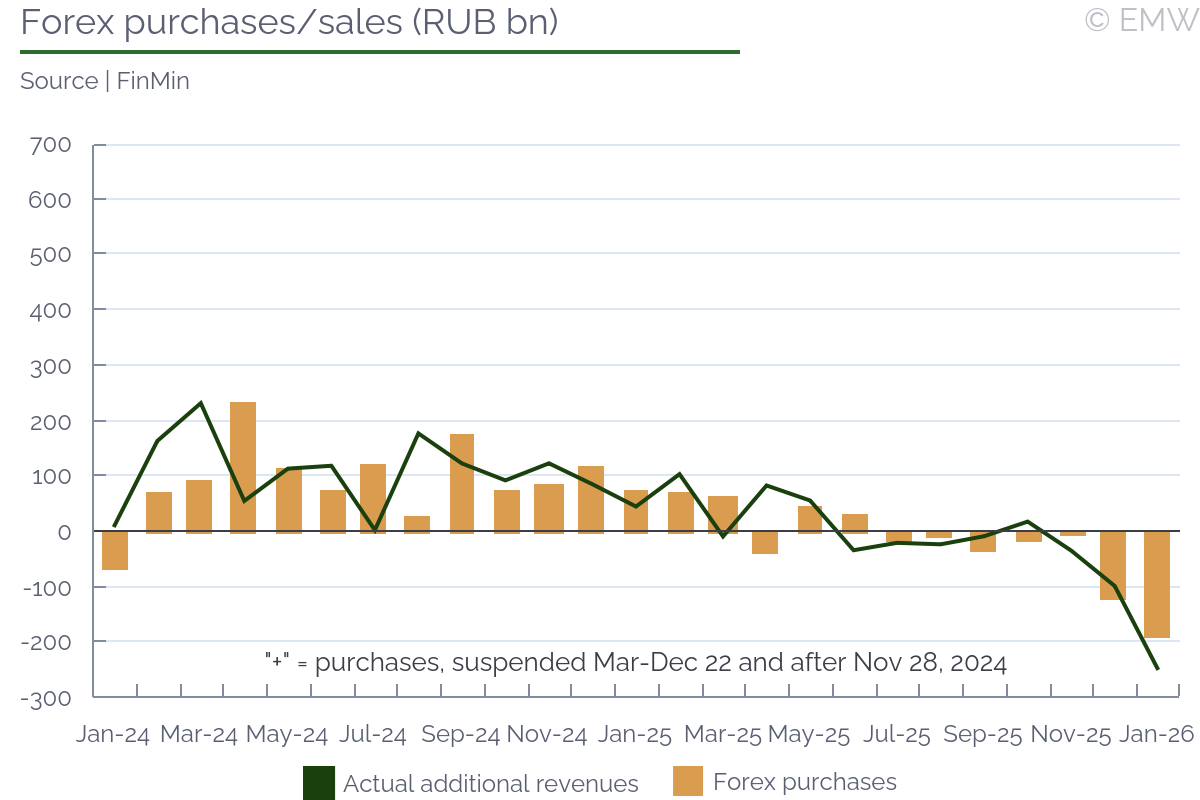

|

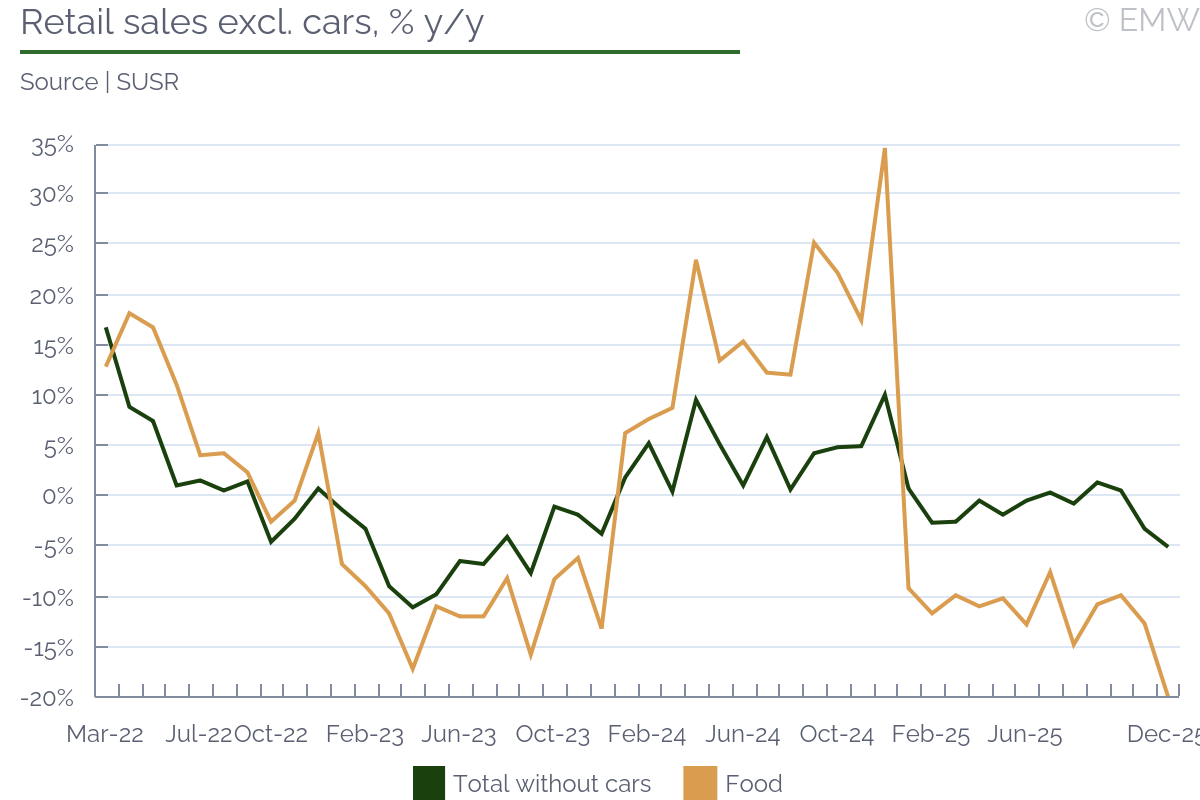

|

|

|

|

|

|

|

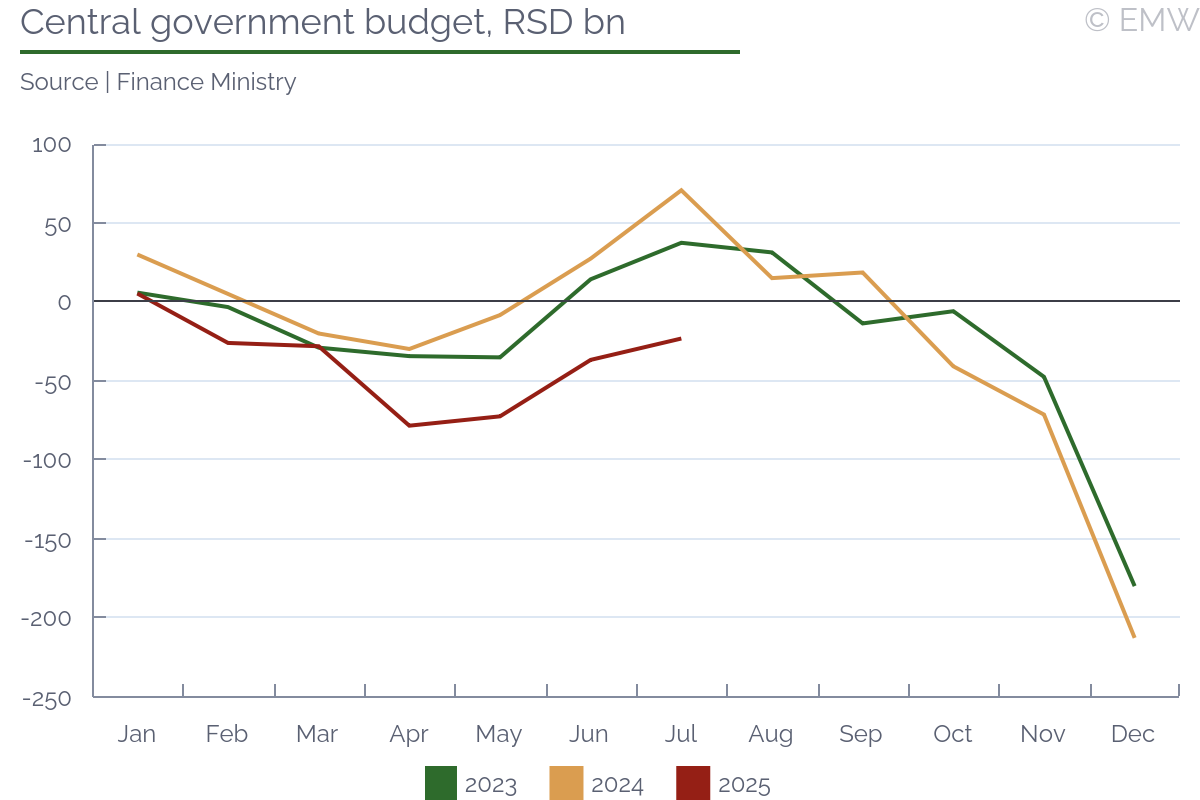

| Serbia |

|

|

|

|

|

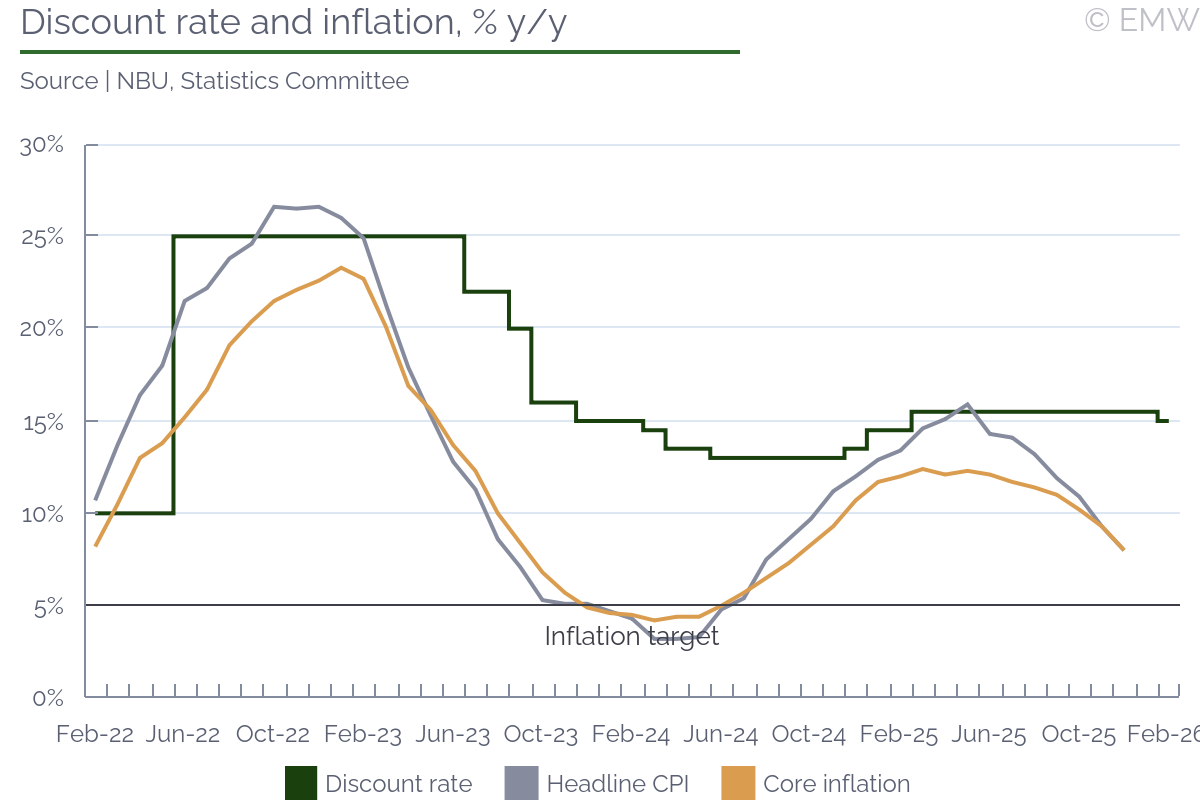

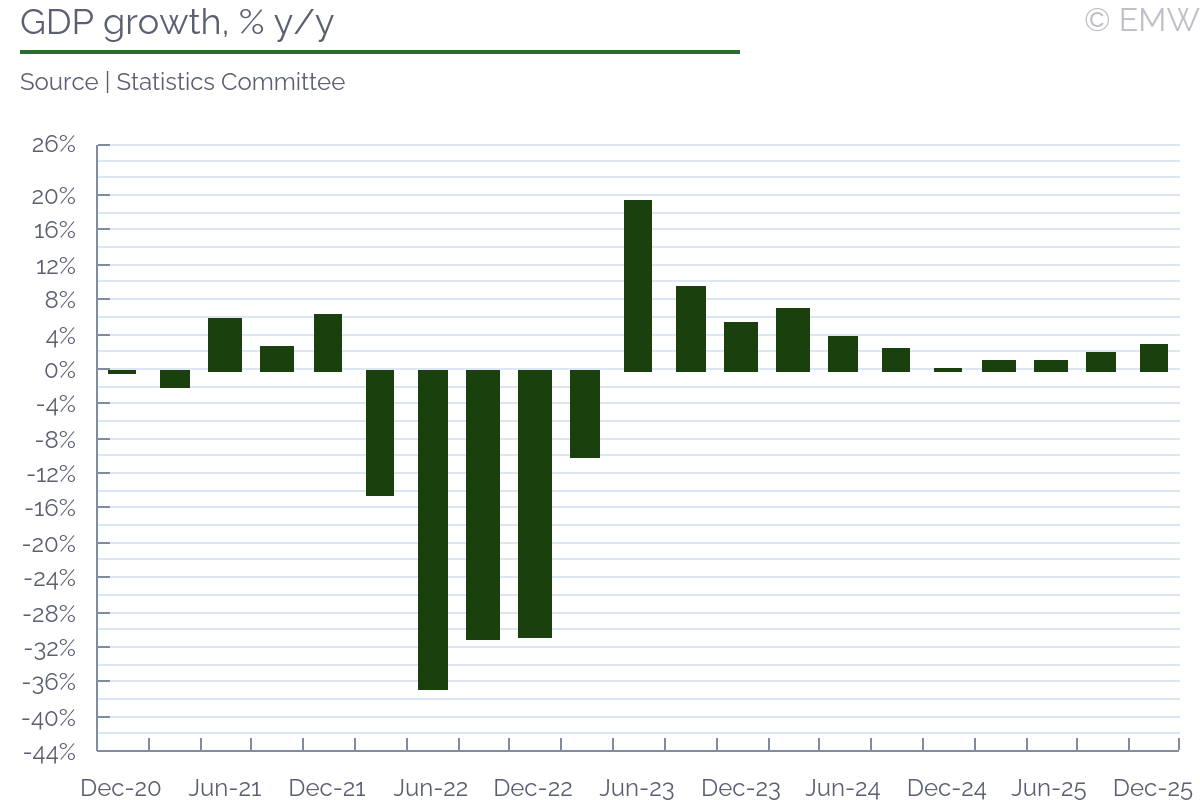

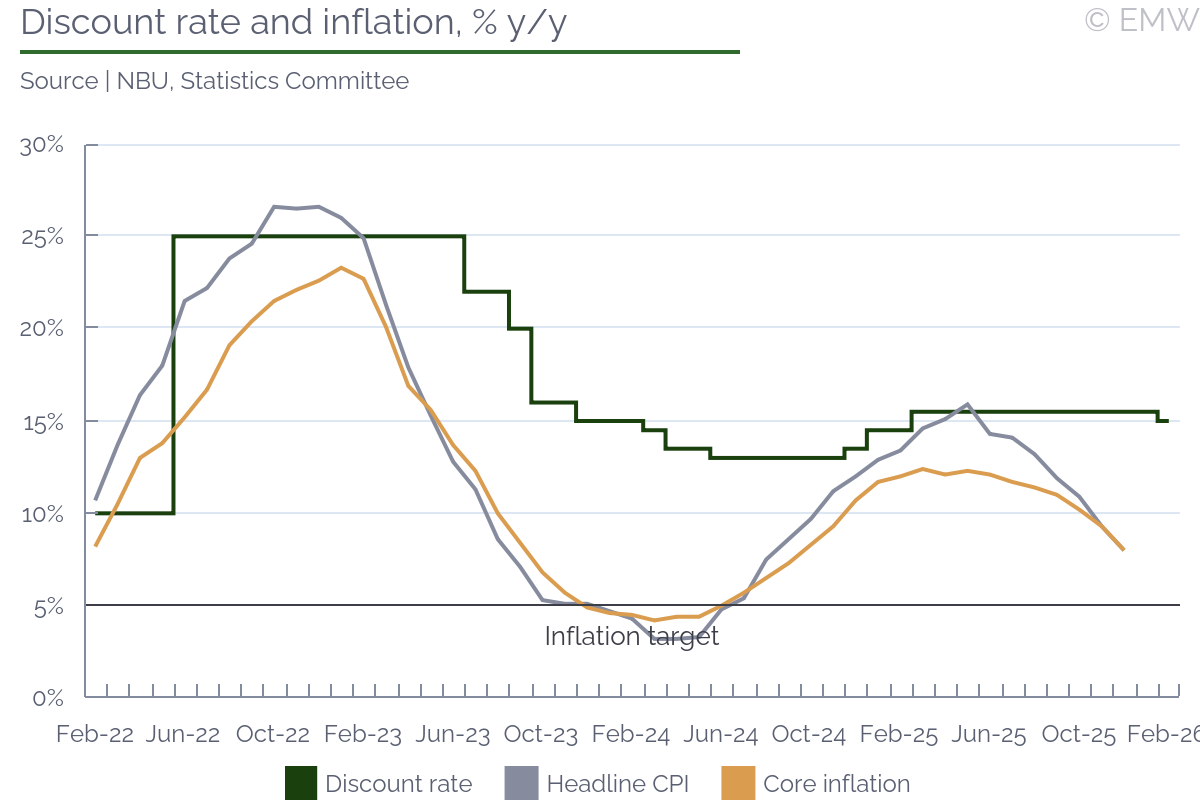

| Ukraine |

|

|

|

|

|

|

| Uzbekistan |

|

|

|

|

|

| Euro Area |

|

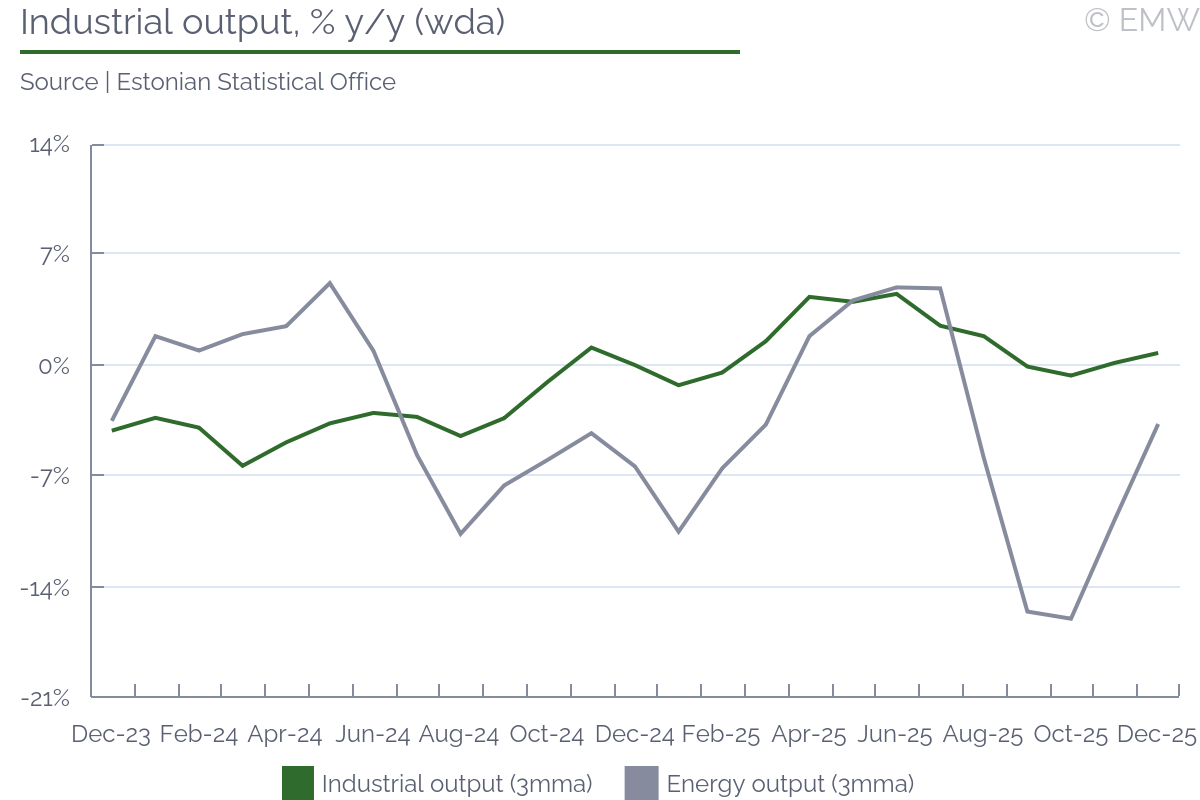

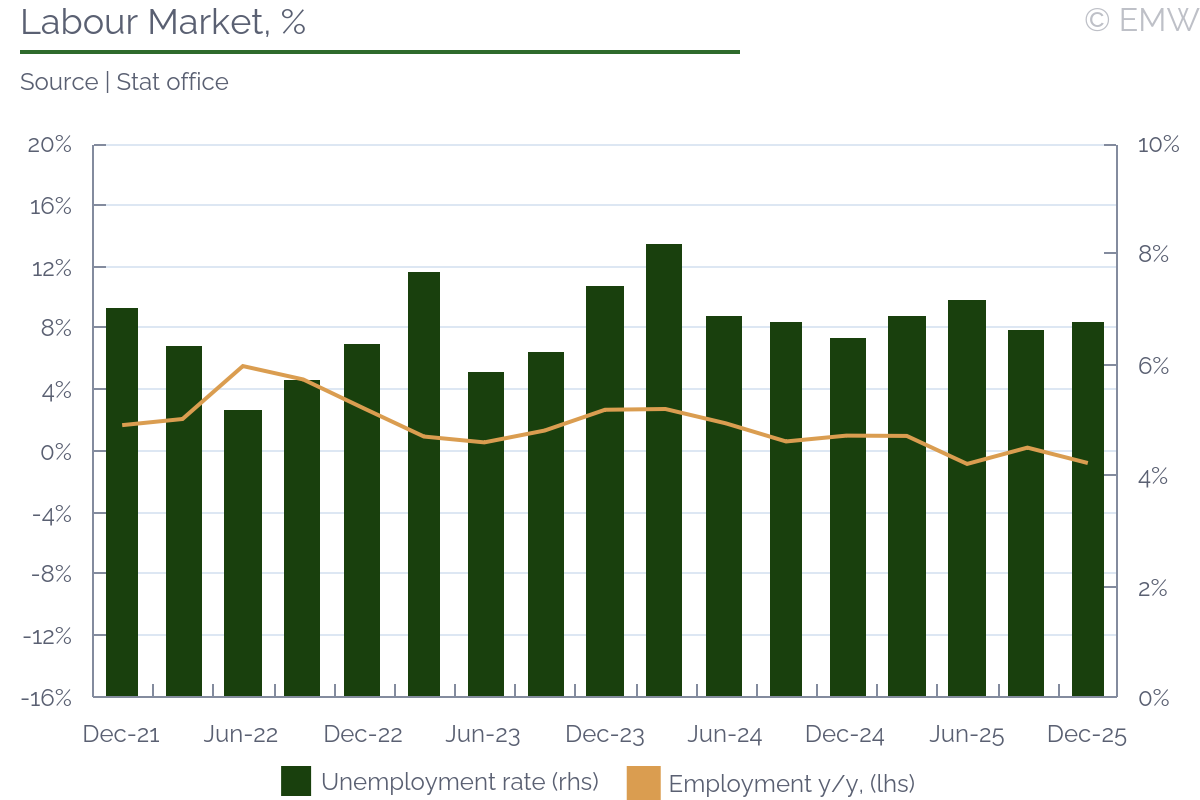

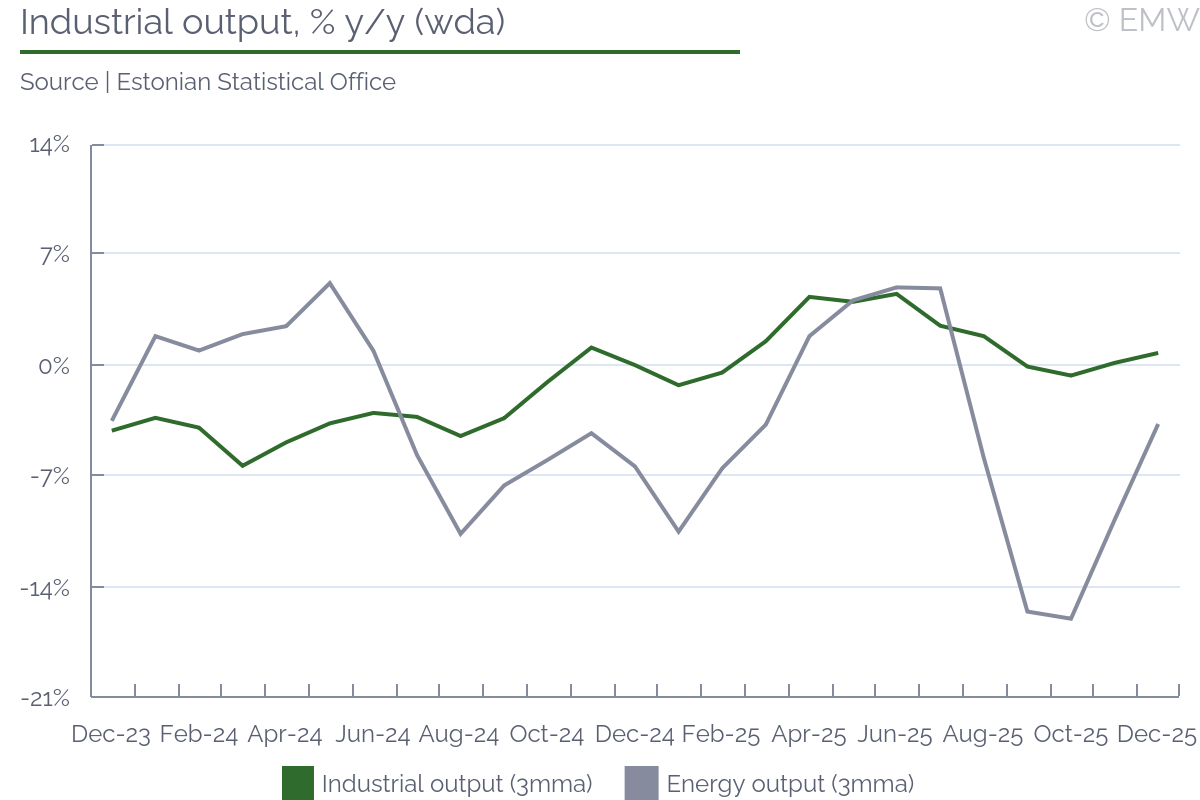

| Estonia |

|

|

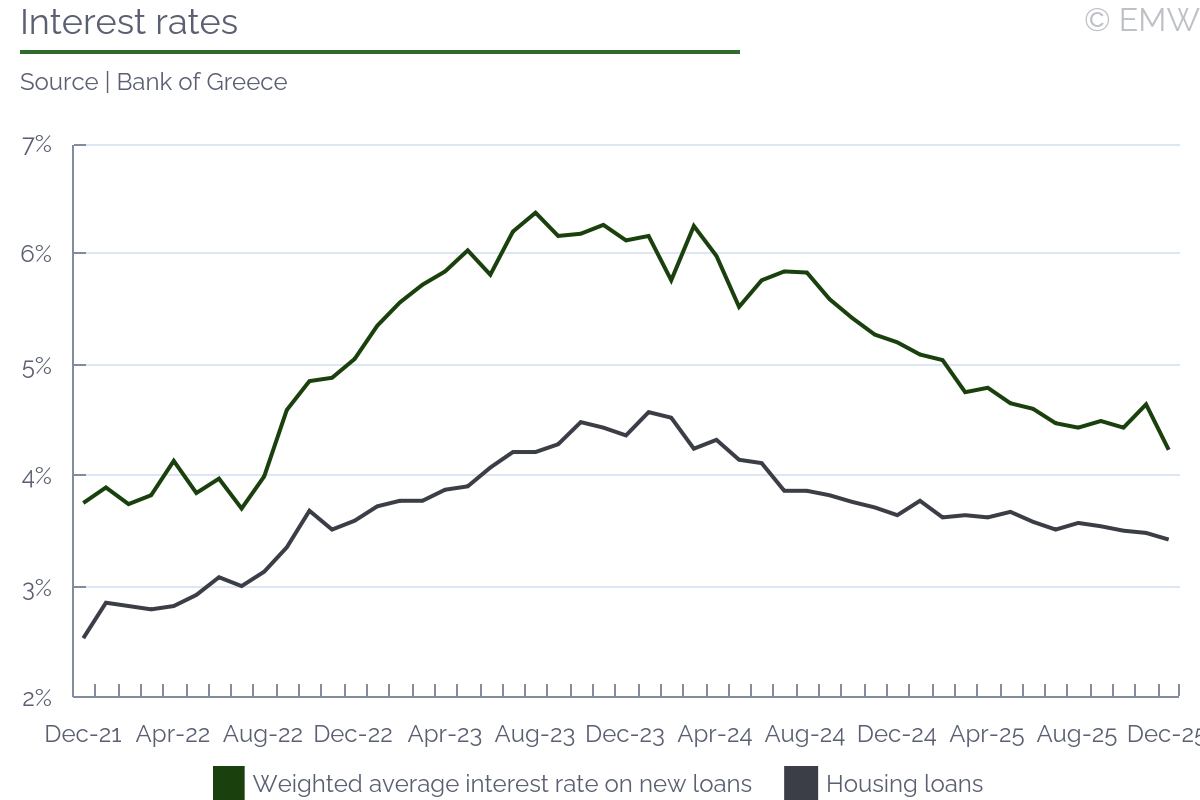

| Greece |

|

|

|

|

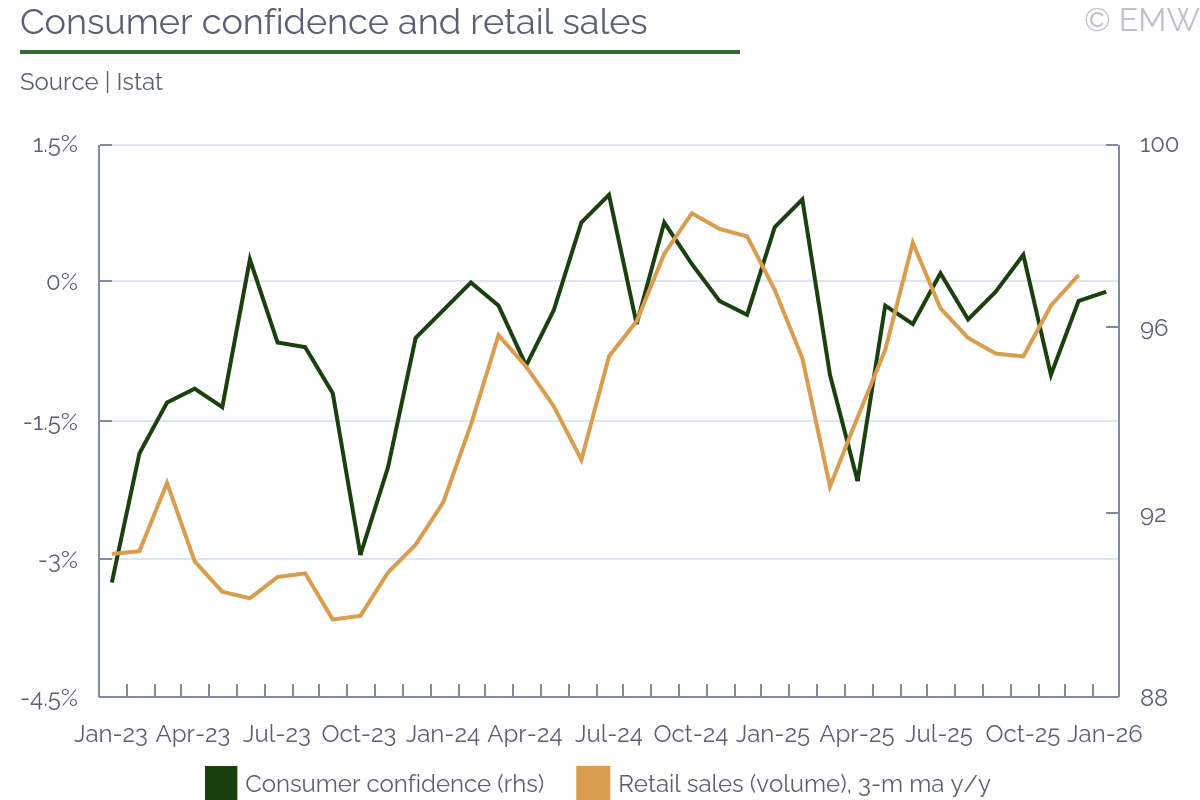

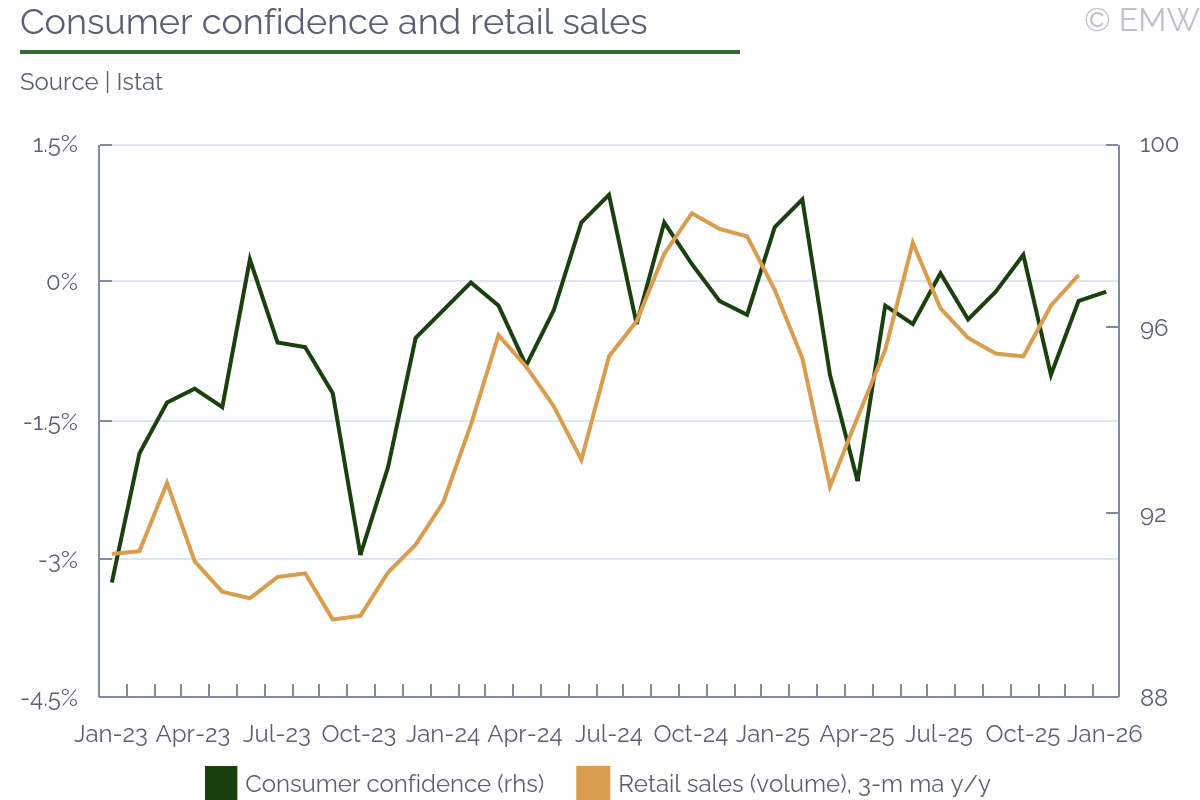

| Italy |

|

|

|

|

|

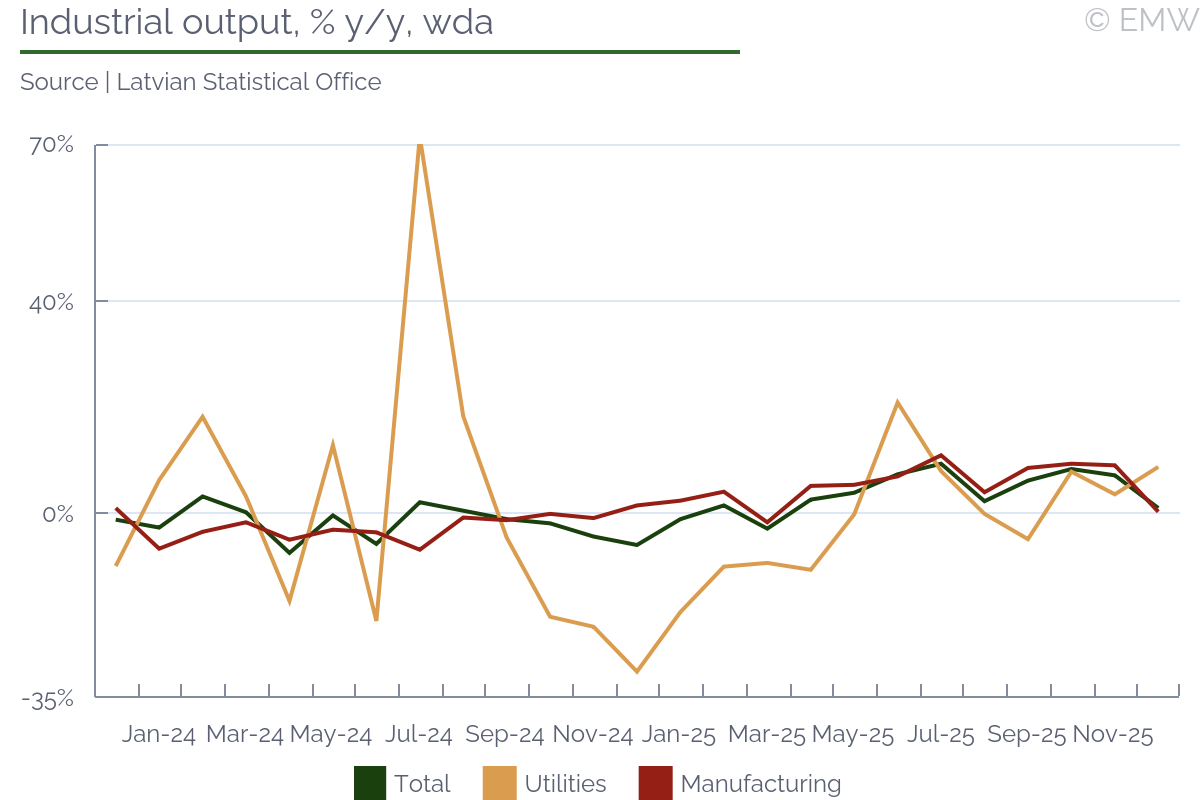

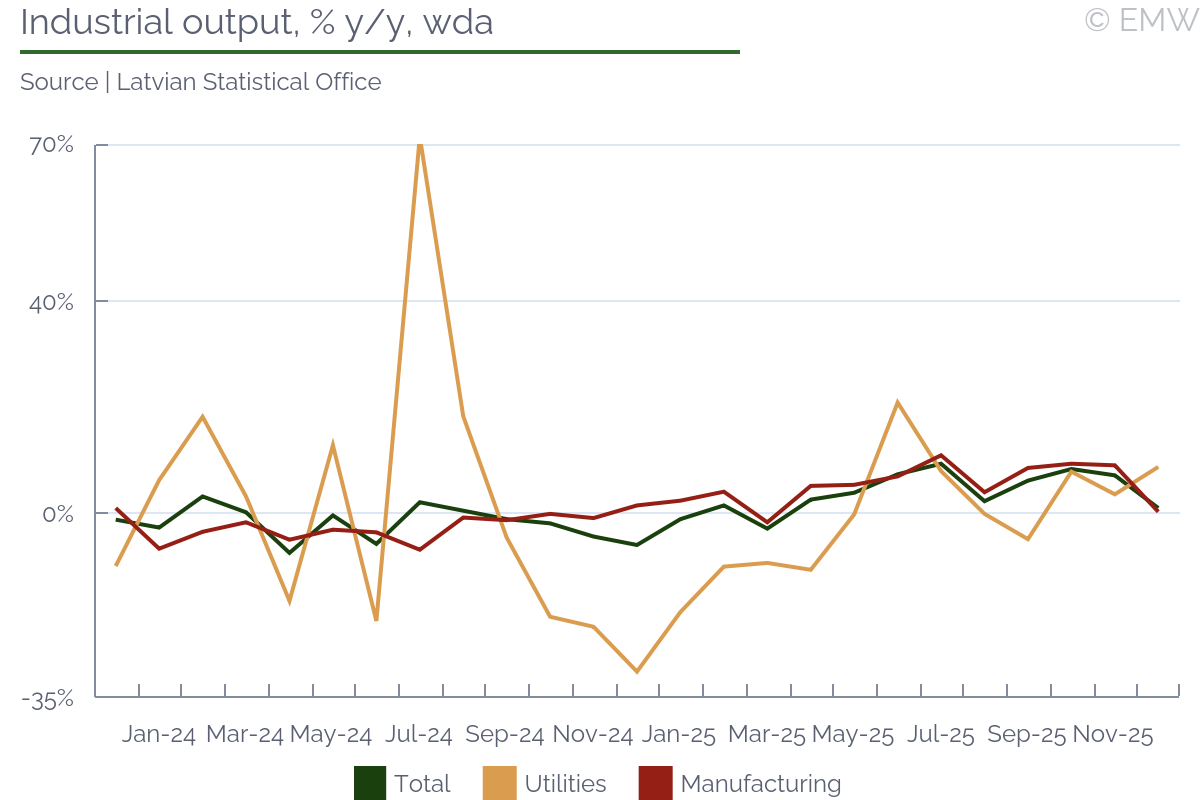

| Latvia |

|

|

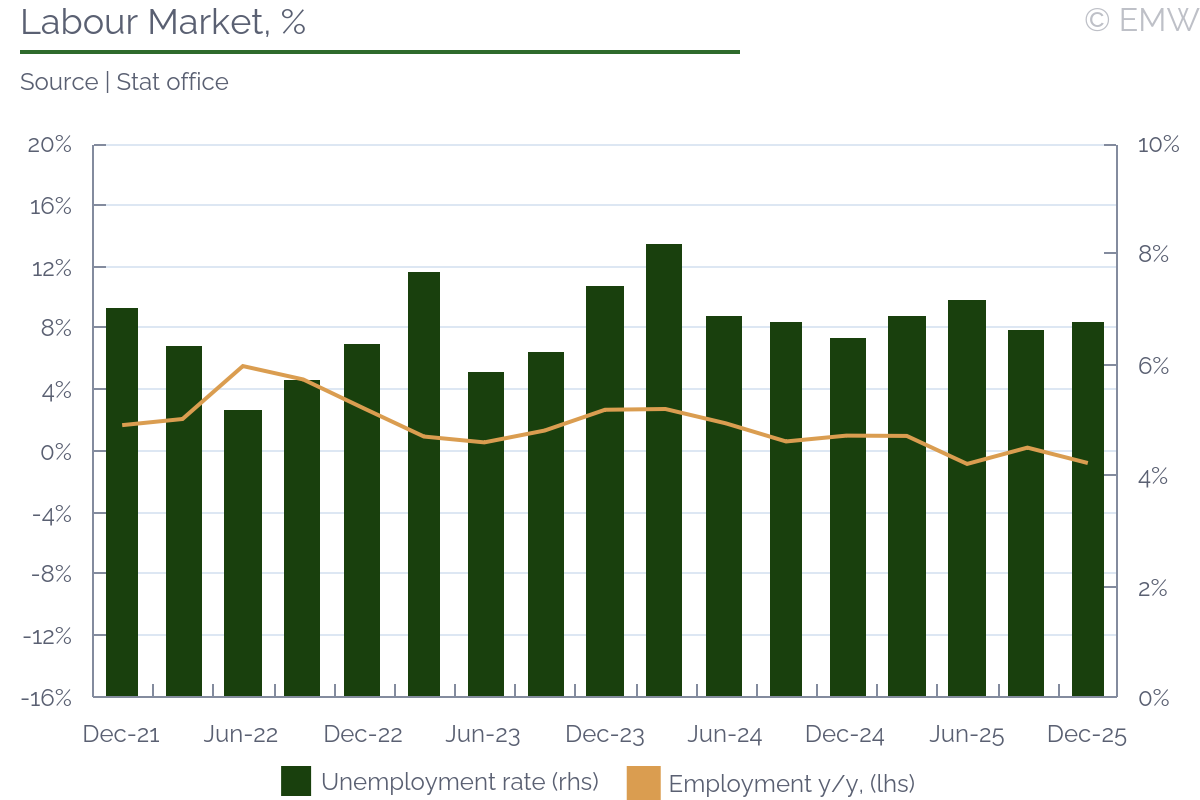

| Lithuania |

|

|

|

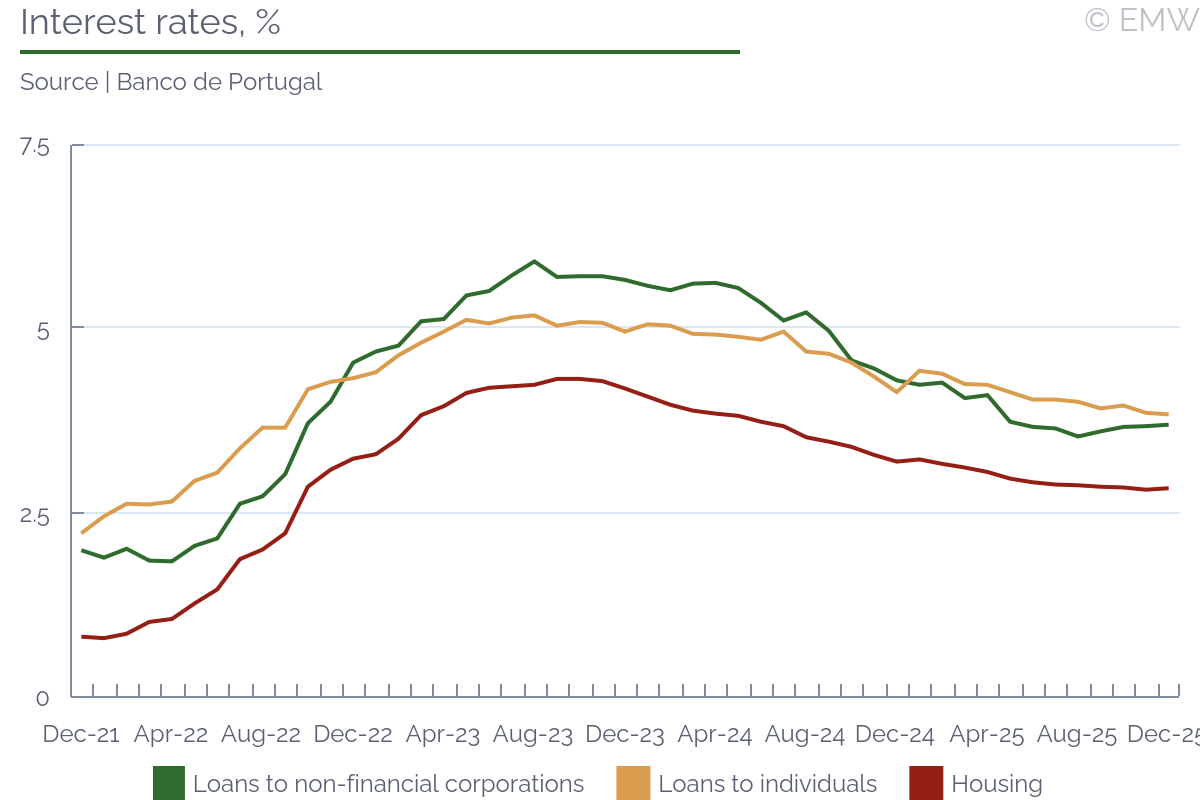

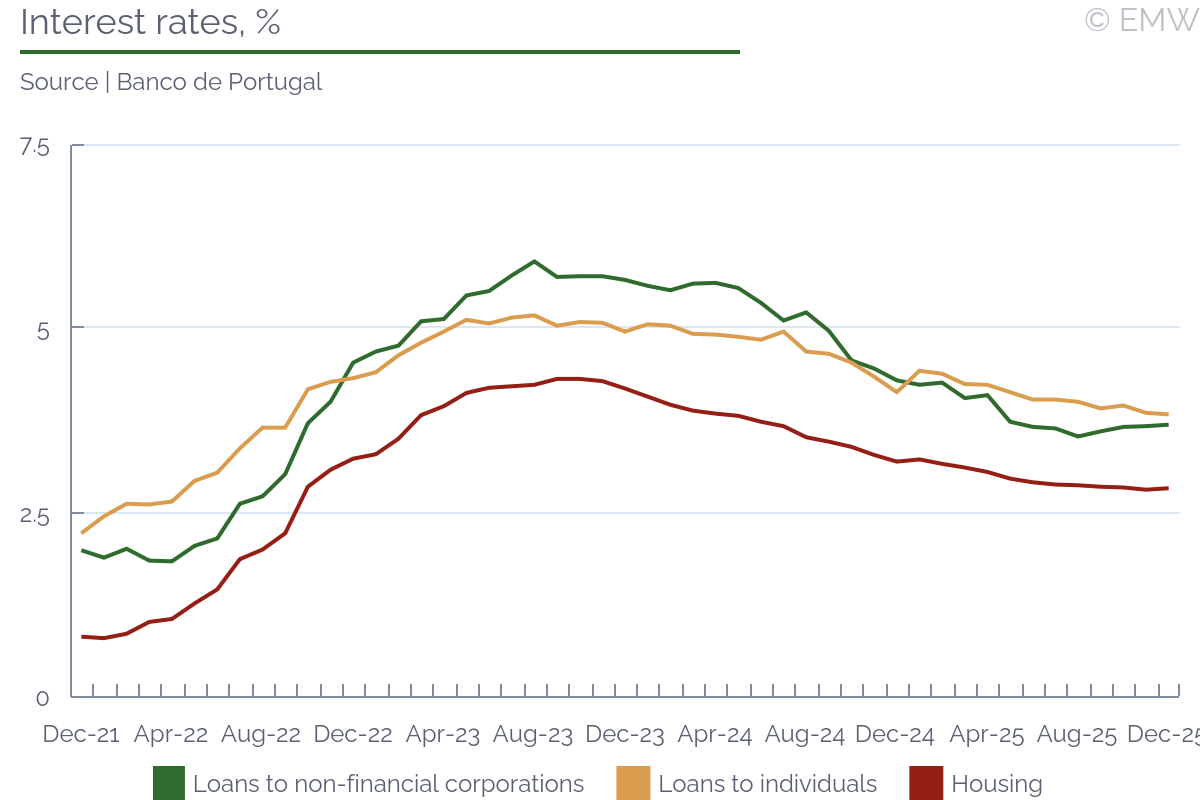

| Portugal |

|

|

|

|

| Slovakia |

|

|

|

|

|

|

|

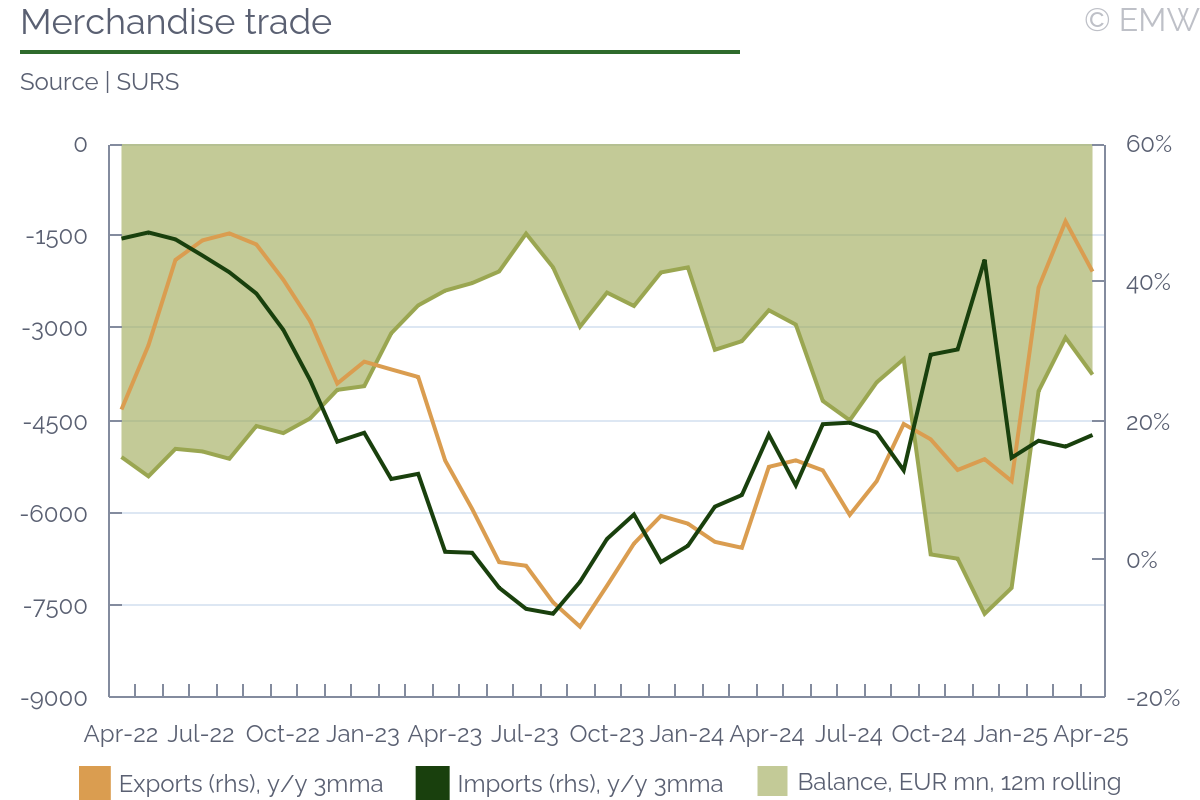

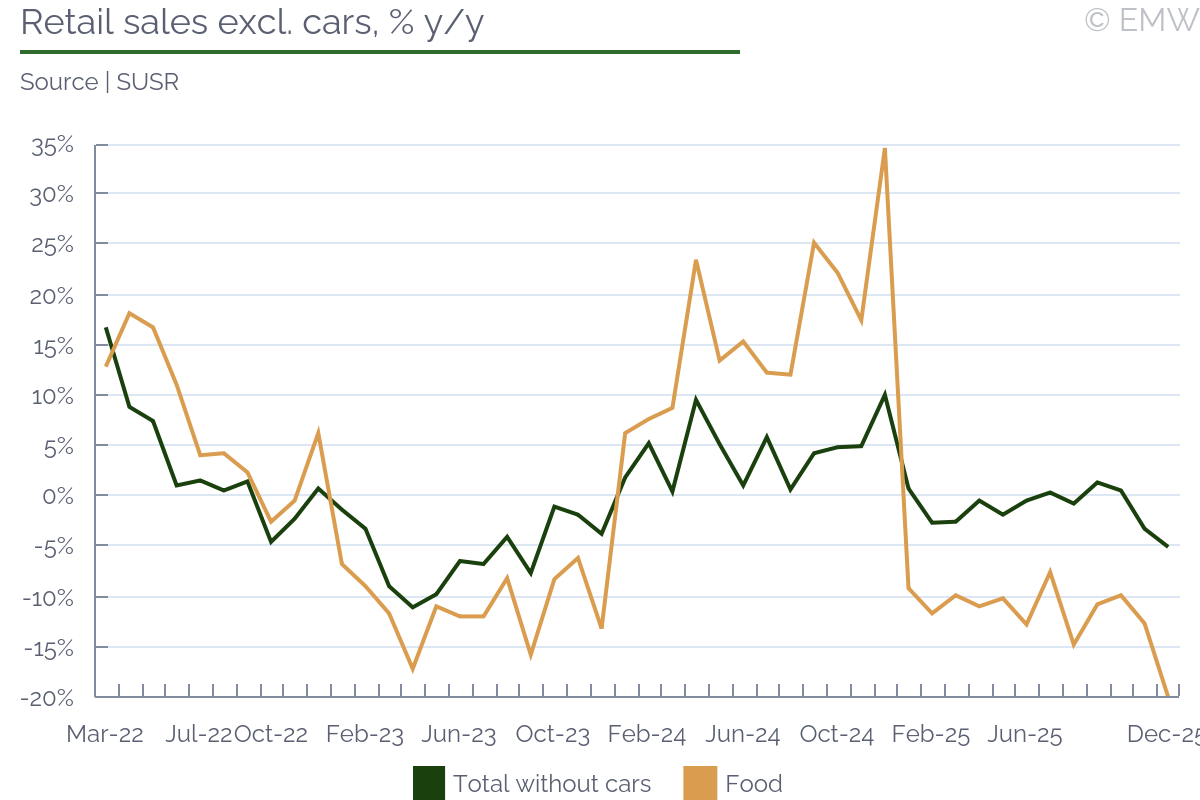

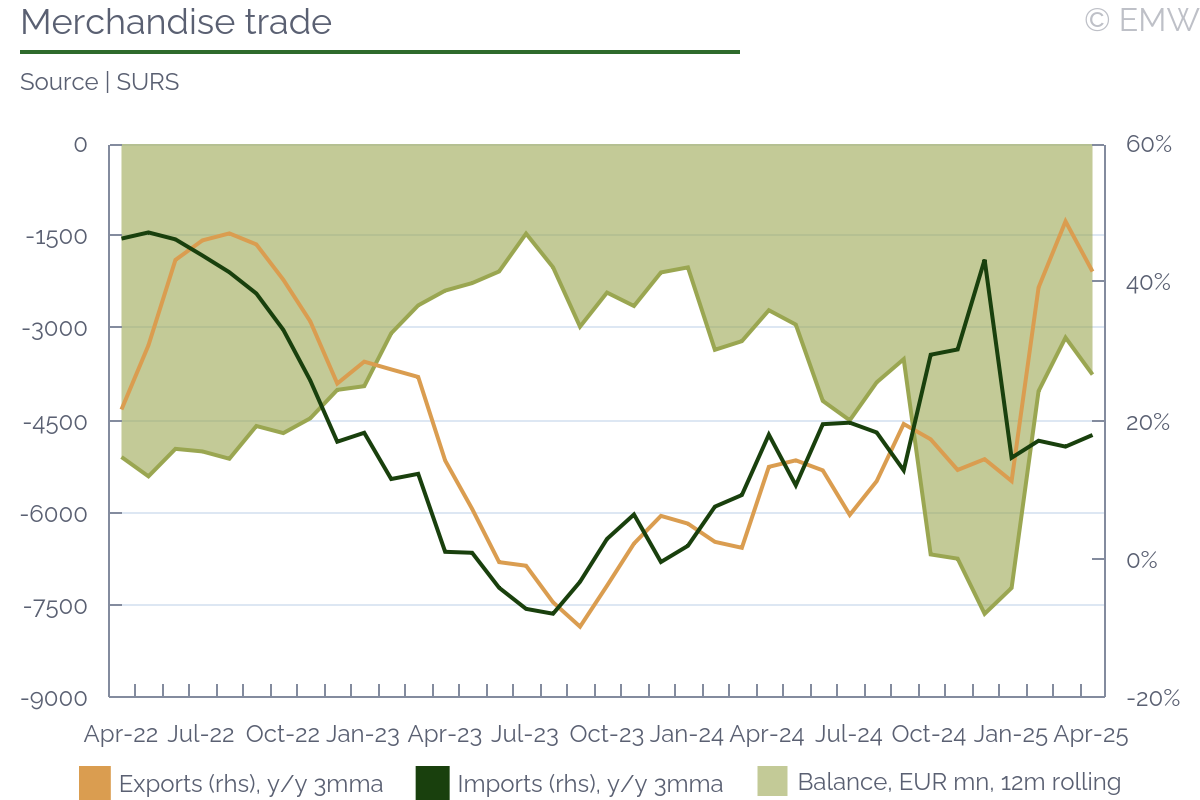

| Slovenia |

|

|

| Spain |

|

|

|

|

|

| Latin America |

|

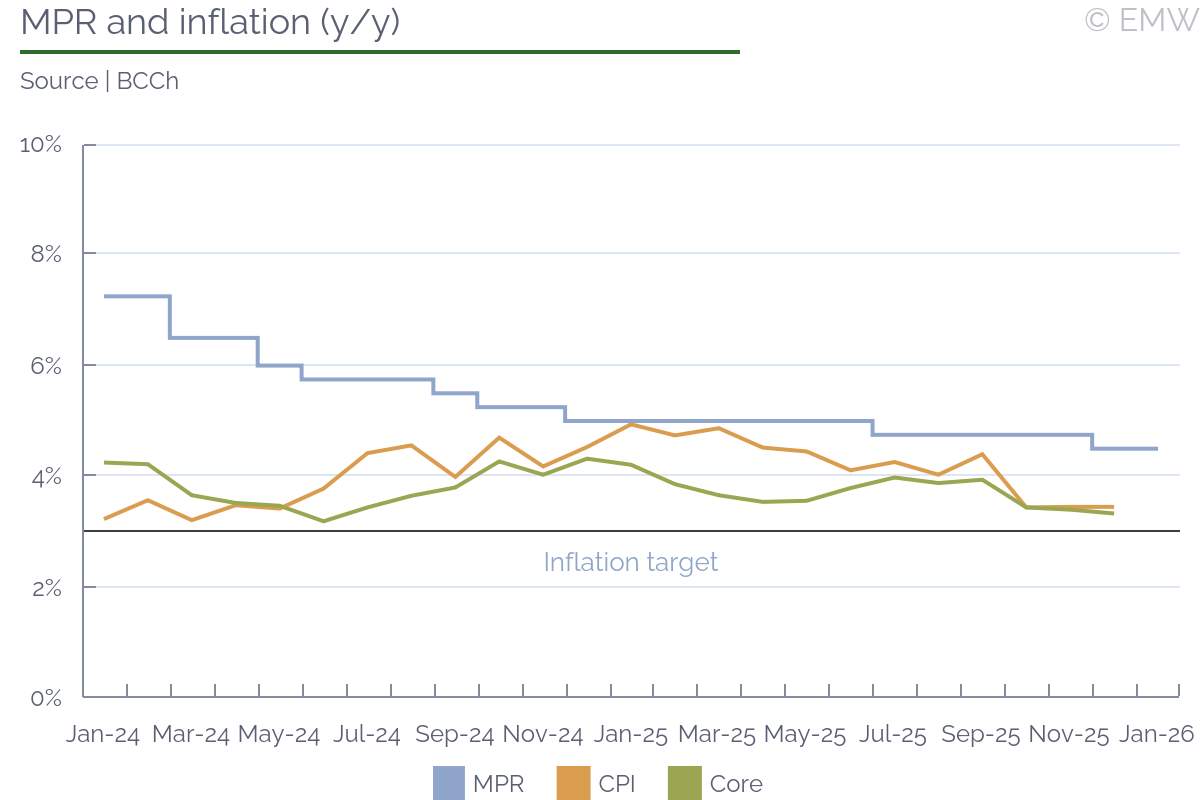

| Chile |

|

|

|

|

|

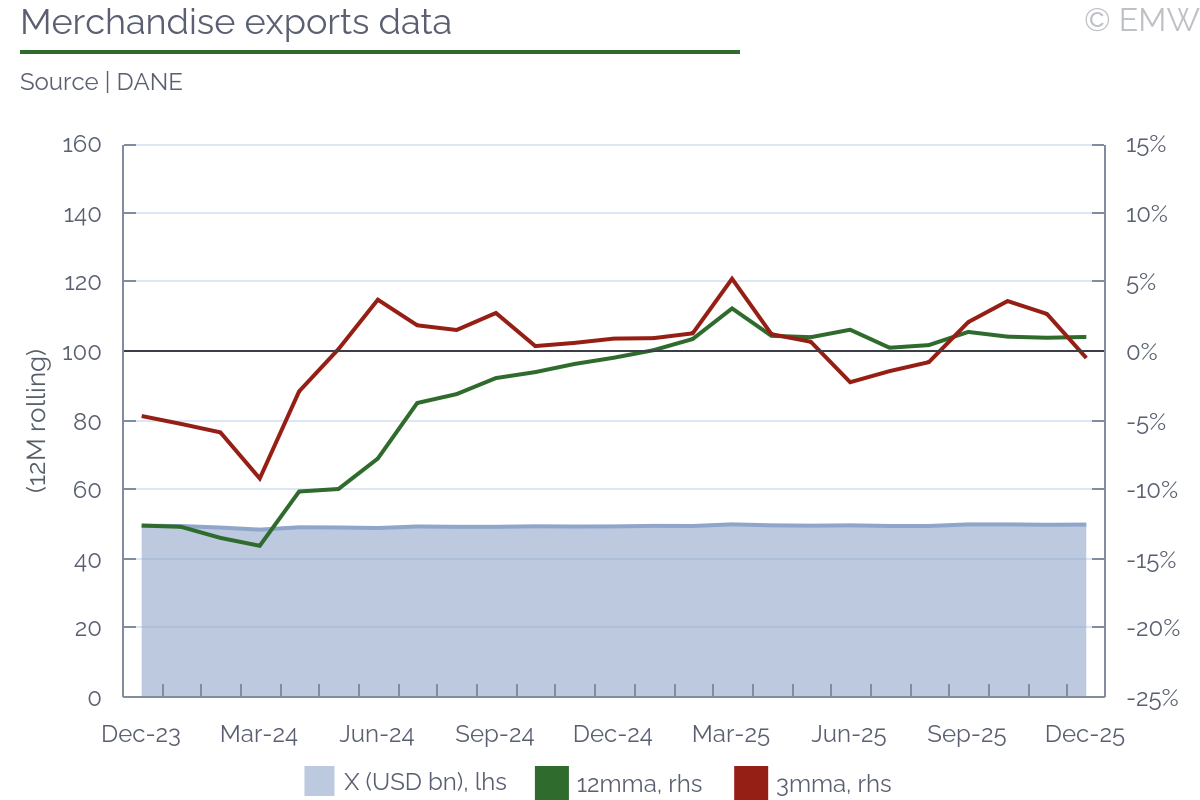

| Colombia |

|

|

|

|

|

|

| Costa Rica |

|

|

|

| Dominican Republic |

|

|

|

| Ecuador |

|

|

|

|

| El Salvador |

|

|

|

| Panama |

|

|

|

|

| Peru |

|

|

|

|

|

|

| Middle East & N. Africa |

|

| Israel |

|

|

|

|

| Jordan |

|

|

| Lebanon |

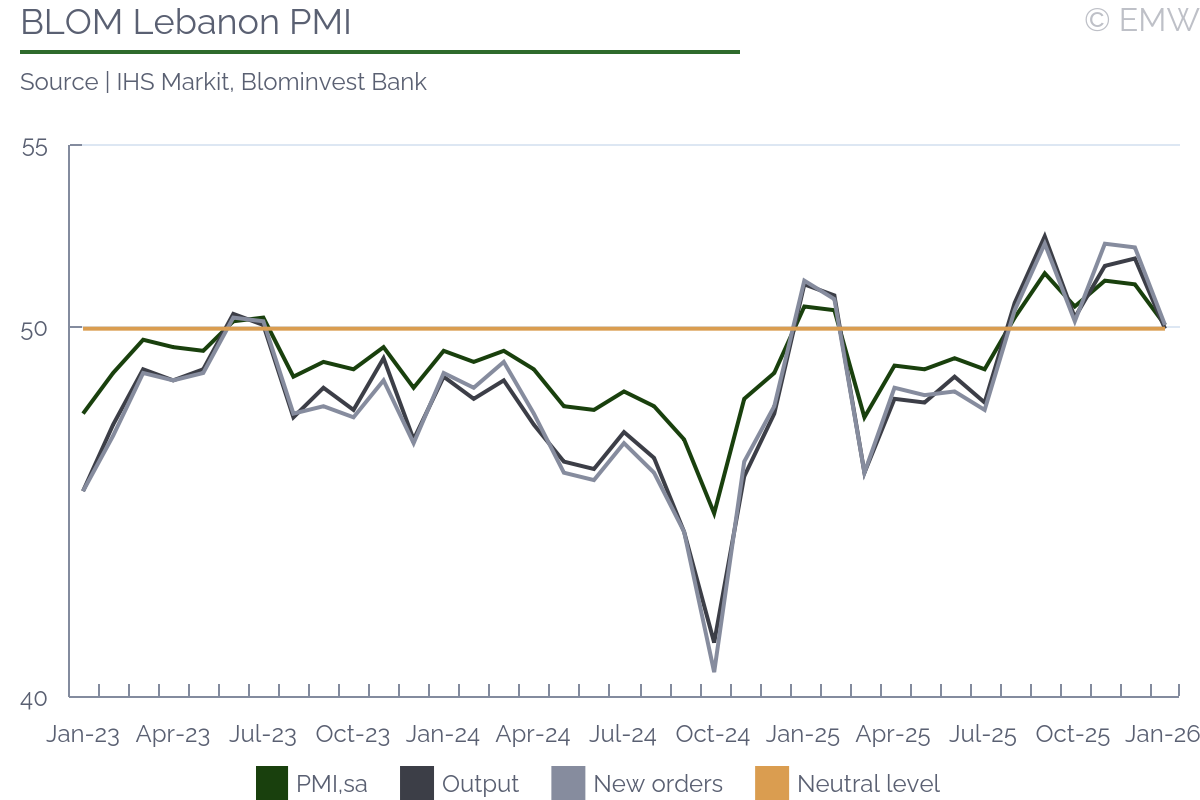

|

|

|

| Morocco |

|

|

|

| Oman |

|

|

| Qatar |

|

|

|

| Saudi Arabia |

|

|

| Tunisia |

|

|

|

|

|

|

| Sub-Saharan Africa |

|

| Angola |

|

|

|

| Ethiopia |

|

|

|

|

| Gabon |

|

|

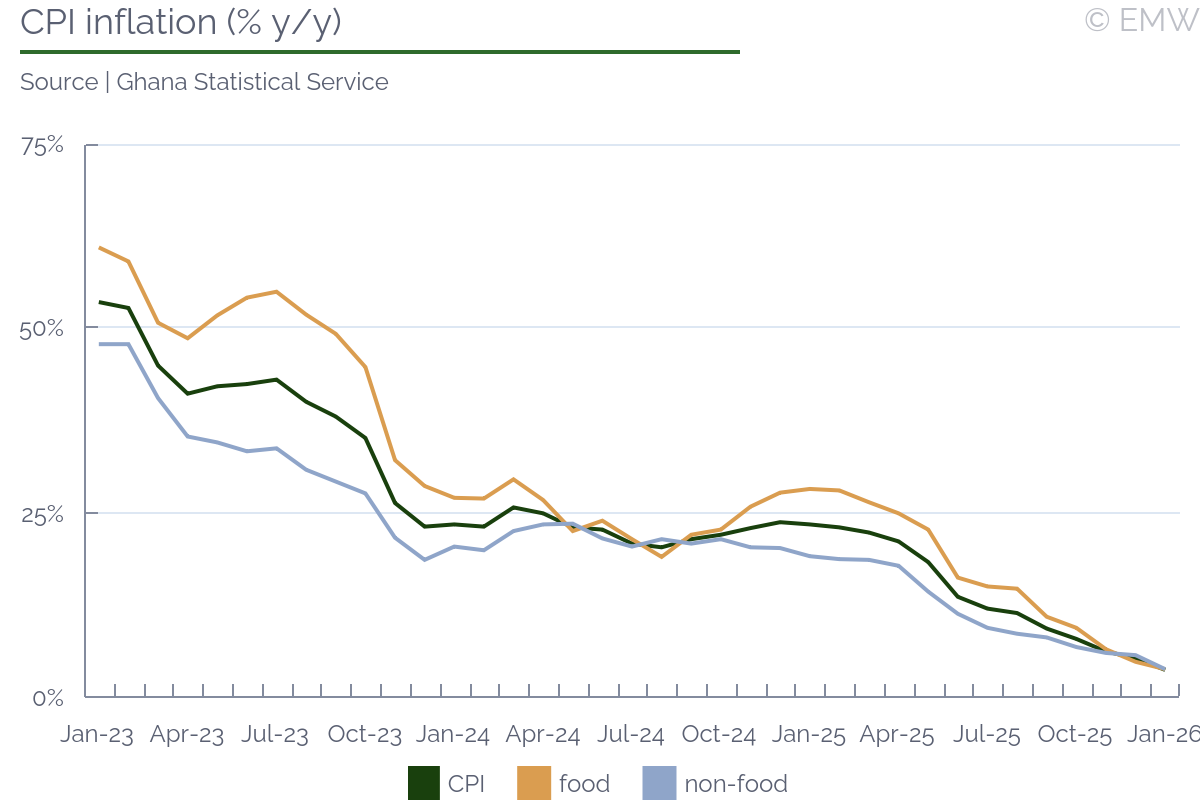

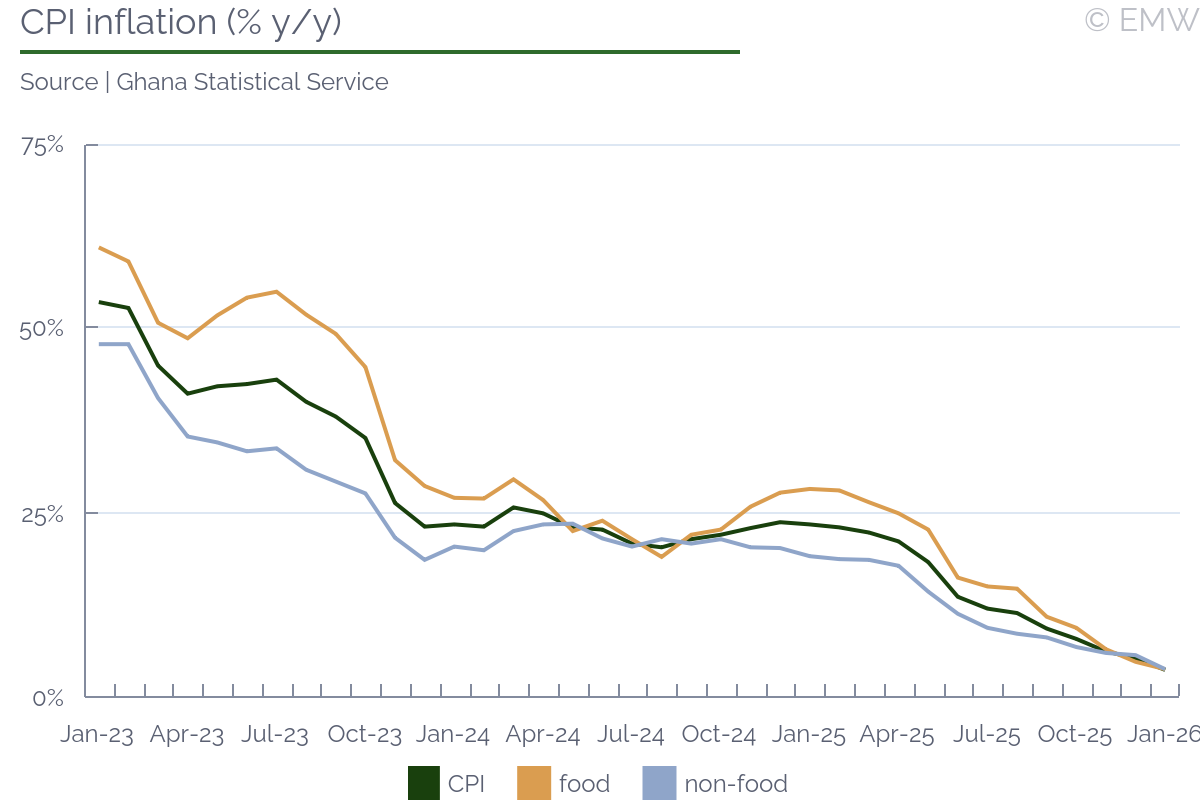

| Ghana |

|

|

|

|

| Ivory Coast |

|

|

| Kenya |

|

|

|

| South Africa |

|

|

|

|

| Uganda |

|

|

| Zambia |

|

|

|

|

|

|

|

|

| Asia |

|

| Malaysia |

|

|

|

| Mongolia |

|

|

|

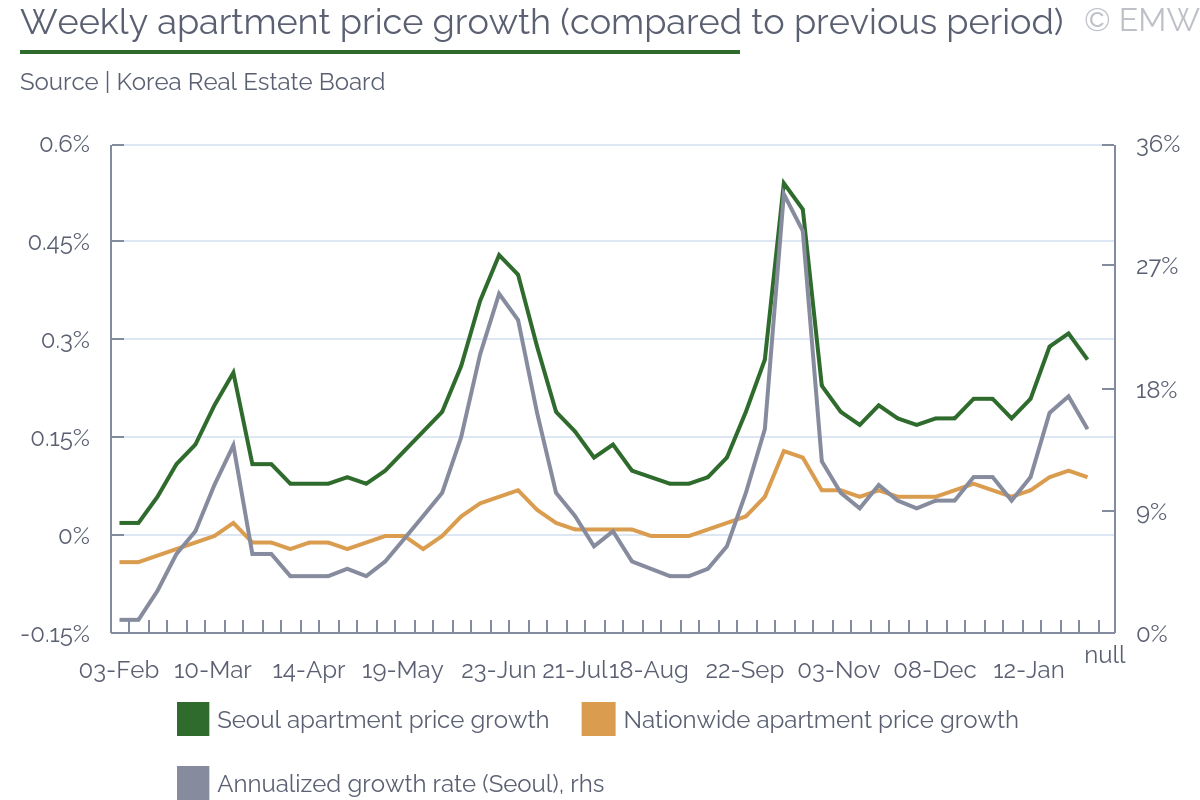

| South Korea |

|

|

|

|

|

|

|

| Sri Lanka |

|

|

|

| Thailand |

|

|

|

|

| Vietnam |

|

|

|

|

| Czech Republic |

|

| | Retail sales ease growth to 1.8% y/y in December, much below expectations |

|

| Czech Republic | Feb 05, 09:10 |

|

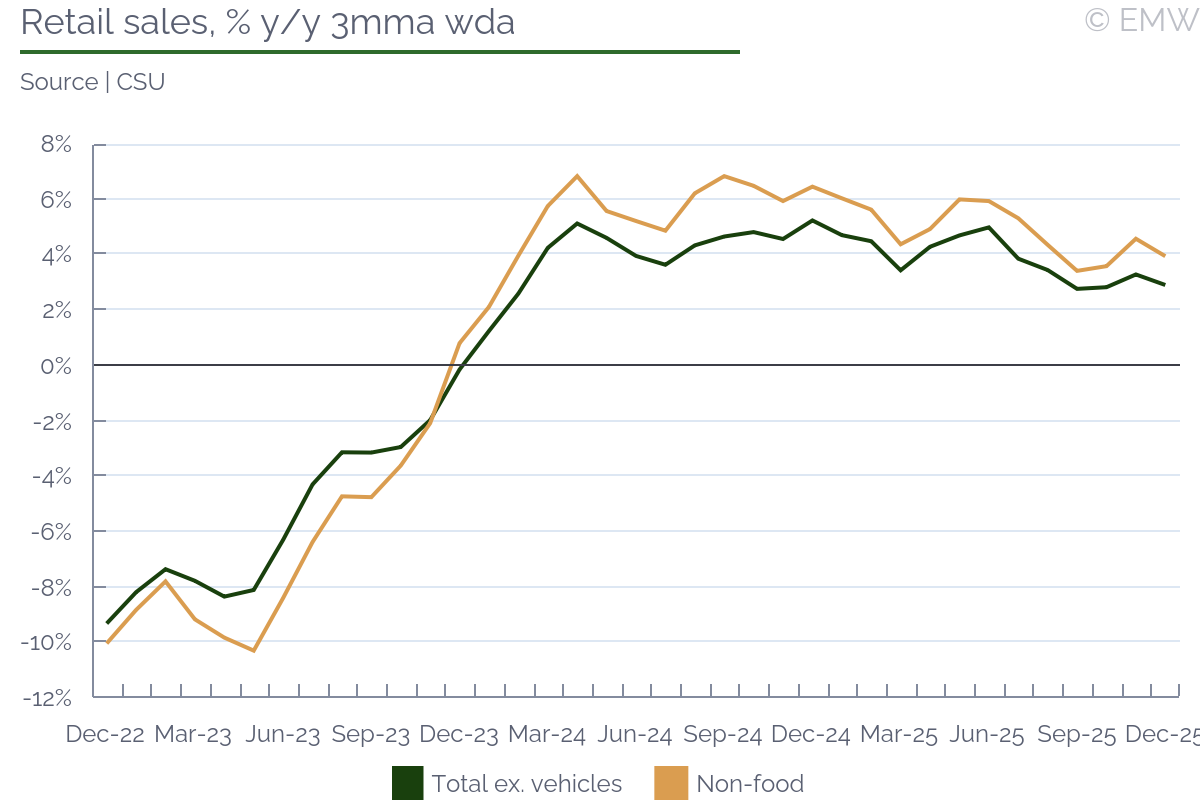

- Markets expected retail sales to rise by 3.4% y/y

- Online sales caused the big swing, rising by only 3.8% y/y

- Retail sales still rose by 2.9% y/y in Q4, up from 2.8% y/y in Q3

- Thus, household consumption growth remained robust, and we don't believe the December print will impact monetary policy

Retail sales, excluding vehicles, eased their growth to 1.8% y/y (wda) in December from 4.5% y/y in November (revised from 4.6% y/y), according to figures from the statistical office. The print was significantly worse than market expectations, which put retail sales growth at 3.4% y/y. Retail sales also fell by 0.1% m/m (sa), which is pretty untypical for the end of the year.  The biggest swing was again in online sales, which moved from a 15.4% y/y jump in November to a modest 3.8% y/y increase in December. It appears that discount campaigns were not extended at the expected rate, leading to much less holiday shopping. As a result, non-food sales eased their growth from 6.3% y/y in November to 2% y/y in December, being the main reason behind weaker headline performance. Fuel sales weakened as well, as their growth went from 6% y/y in November to 3.9% y/y in December. Regarding in-person shopping, the biggest deterioration was observed in sales of cultural & recreational goods, which fell by 1% y/y in December after rising by 3% y/y in November. There was weaker performance in other categories, but not nearly as impactful as the items listed above. Monetary policy impact Thus, it appears that households did most of their pre-holiday shopping in November when discounts were bigger. In all fairness, online sales performed strongly in December 2024, so there was a high base. Still, it appears that online shops really pushed the envelope with Black Thursday promotional campaigns this time, which reflected on year-on-year comparison. Thus, we believe this didn't reflect as much on household consumption growth, it just shifted it within the quarter. Retail sales rose by 2.9% y/y in Q4, similar to a 2.8% y/y increase in Q3, so no major change in patterns. Moreover, retail sales rose by 0.8% q/q (sa) in Q4, improving from a 0.1% q/q (sa) fall in Q3. As a result, we don't believe the December retail print will have any major impact on monetary policy. | Retail sales, y/y wda | | Dec-24 | Sep-25 | Oct-25 | Nov-25 | Dec-25 | | Total | 4.3% | 3.3% | 3.1% | 3.3% | 2.0% | | Vehicles | -1.0% | 4.4% | 4.3% | 0.7% | 2.6% | | Ex-vehicle | 6.4% | 2.8% | 2.5% | 4.5% | 1.8% | | Food, beverages and tobacco | 2.8% | -0.2% | -0.4% | 1.1% | 1.0% | | Non-food | 8.4% | 3.2% | 3.9% | 6.3% | 2.0% | | Retail sale in non-specialized stores | 4.0% | 0.2% | 0.1% | 1.5% | 1.4% | | Fuel | 7.5% | 9.4% | 4.3% | 6.0% | 3.9% | | IT and communication equipment | 1.1% | -4.7% | -3.4% | -1.5% | -1.8% | | Other household equipment | 2.3% | 1.4% | 0.2% | -1.0% | -0.7% | | Cultural and recreation goods | 0.6% | 3.5% | 7.1% | 3.0% | -1.0% | | Textiles, clothing, footwear | 3.9% | 1.6% | 6.9% | 0.9% | -0.5% | | Pharmaceuticals | 2.5% | 3.6% | 3.0% | 5.2% | 5.8% | | Cosmetics | 12.4% | 11.4% | 8.7% | 10.2% | 8.2% | | | Sales via mail and internet | 19.6% | 4.4% | 6.6% | 15.4% | 3.8% | | | Total, excl. vehicles, m/m sa | 1.6% | -0.2% | 0.3% | 0.8% | -0.1% |

| | Source: Czech stats office |

|

|

|

|

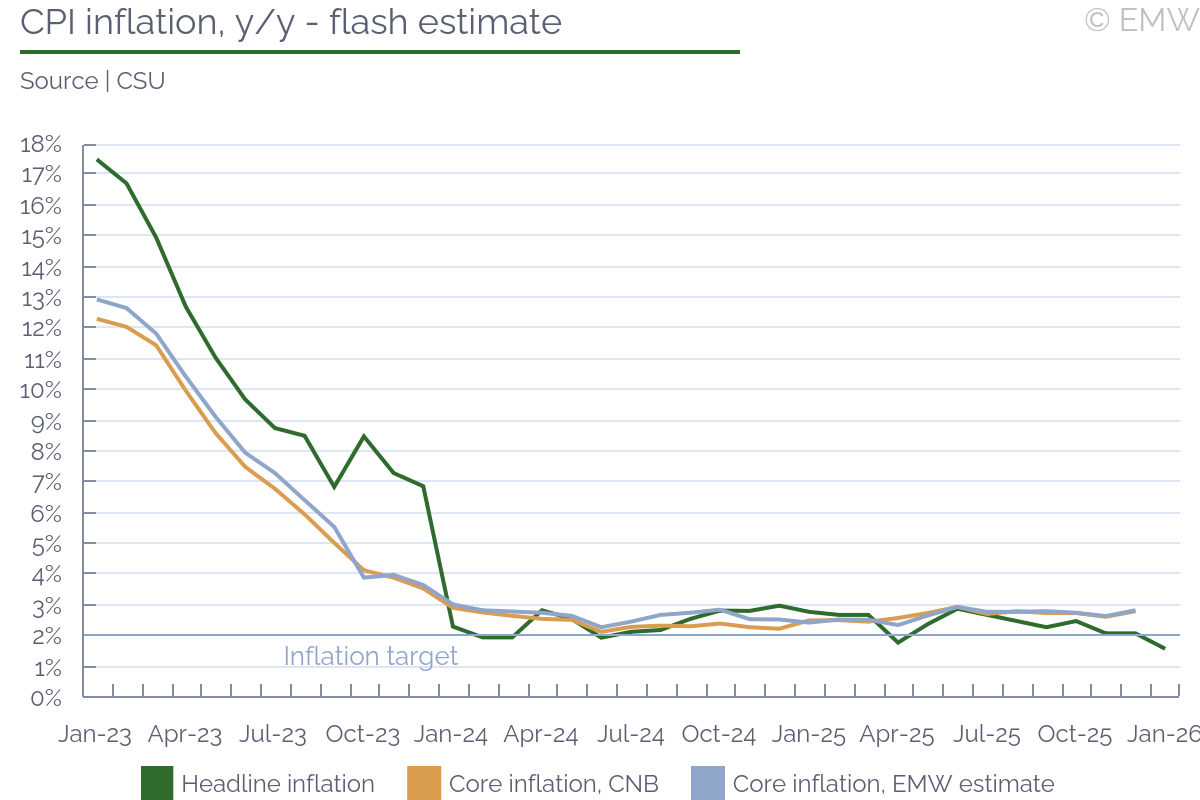

| | CPI inflation eases to 1.6% y/y in January, as expected - flash |

|

| Czech Republic | Feb 05, 08:53 |

|

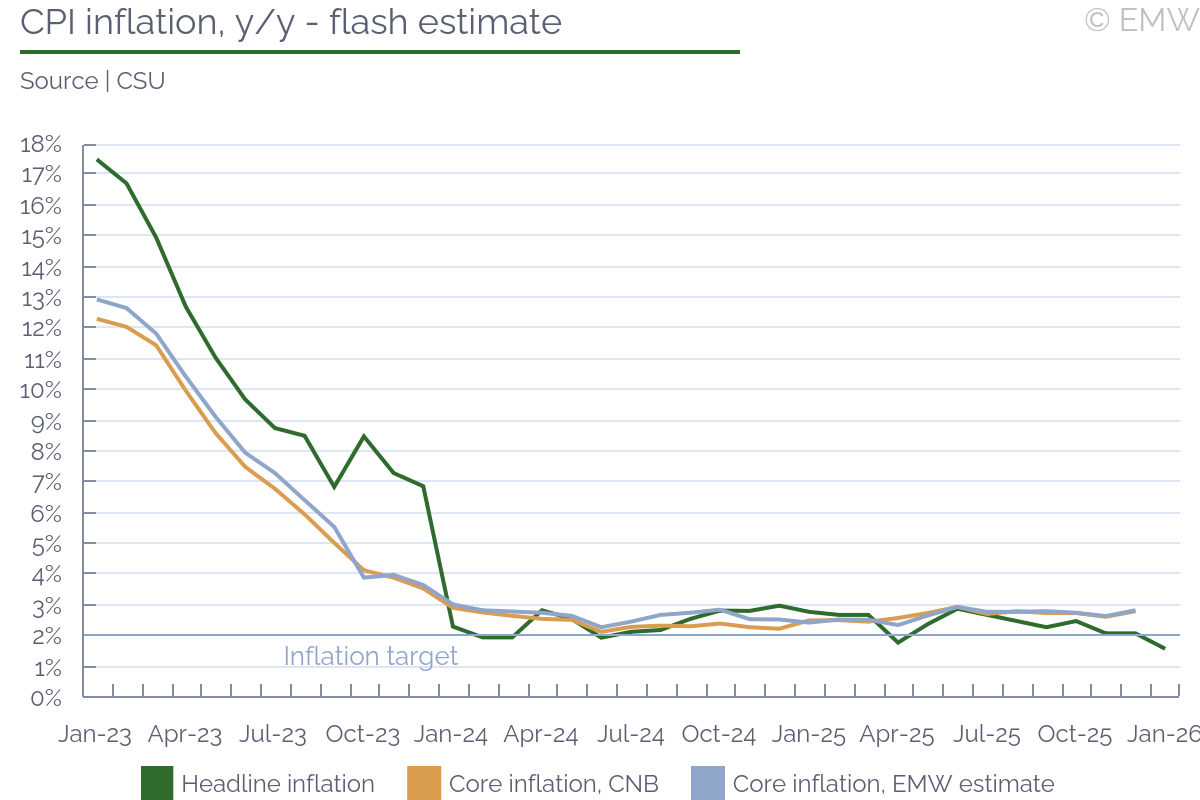

- The print matched market expectations precisely

- Energy prices were behind almost the entire deceleration in headline inflation

- This is due to the elimination of the renewable energy surcharge, as well as some energy price cuts

- Food prices eased growth as well, but their impact was almost completely negated by higher excise on alcohol and tobacco

- We estimate core inflation remained flat at 2.8% y/y, as service price growth remained robust, at 4.7% y/y

- Changes in the CPI basket shift the weight towards core goods and services

- We expect the CNB to keep the policy rate unchanged later on Thursday

- We also anticipate stable interest rates throughout H1, as long as inflation structure remains the same

CPI inflation eased to 1.6% y/y in January from 2.1% y/y in December, according to the latest flash release from the statistical office. The print matched market expectations, largely impacted by energy price cuts. Consumer prices rose by 0.9% m/m in January, slightly stronger than the expected 0.8% m/m, but the increase was softer than the 1.3% m/m reported a year ago.  Unsurprisingly, energy prices had the main impact on headline inflation, as they fell by 3.7% m/m and by as much as 7.9% y/y. They were responsible for almost the entire deceleration in headline inflation, though there was downward pressure from food prices as well, whose growth eased from 1.7% y/y in December to 1.3% y/y in January. As a reminder, the statistical office broke down the category that included, food, alcohol, and tobacco prices, and now alcohol & tobacco prices are in a separate chapter. This was just in time, as alcohol & tobacco prices reported a stronger increase, up to 4.7% y/y in January, faster by 0.6pps m/m. It reflects the 5% increase in excise tax rates, effective as of the beginning of the year. Thus, the tax impact mostly negated the downward push coming from food prices. Change in CPI basket gives a stronger weight to core goods and services Another thing to note is that the CPI basket has been revised, and services now have a bigger weight, up from 38% to 41.3%. Meanwhile, energy's weight was reduced, from 12.29% to 11.23%, which explains why the impact from removing the renewable energy surcharge and declared energy price cuts was lower than we estimated. Moreover, food & non-alcohol beverages had its weight reduced from 17.7% to 16.9%, which also mitigates the downward impact from lower food prices. While the flash release doesn't provide a very comprehensive look, it appears that the weight of core goods and services has increase, which means that core inflation will likely see a stronger weight as well. Core inflation likely to remain flat at 2.8% y/y Speaking of core inflation, we estimate that it remained flat at 2.8% y/y in January. Service price growth eased only marginally, from 4.8% y/y in December to 4.7% y/y in January, though the easing appears to have been mostly on the back of regulated services. Meanwhile, core goods' prices saw their growth slow down from 0.3% y/y in December to 0.2% y/y in January (EmergingMarketWatch calculation). Thus, it appears that core inflation will remain significantly elevated, though the gap with headline inflation is largely due to energy prices. As a reminder, energy prices are included in the goods' category, and are classified as regulated prices, even though they have some market component. Therefore, lower energy prices will have zero impact on core inflation, though there may be some indirect effect, through lower production costs. Monetary policy impact Given the persisting divergence between headline and core inflation, we expect that the CNB board will keep the policy rate at its MPC meeting later on Thursday (Feb 5). While headline inflation is now noticeably below the 2% target, the main reason is the government's move to eliminate the renewable energy surcharge. As a reminder, the CNB board stated clearly it will not consider that decision during monetary policy considerations. If energy prices are excluded, inflation actually accelerated slightly, from 2.9% y/y in December to 3% y/y in January, so inflation pressure has not abated outside that one-off effect. Future CPI prints may change this view, but as long as inflation number look like this, we don't see a room for monetary easing. The CNB will need to work harder than usual to argue its position, though, as the odds are many will expect that interest rates should decrease, at least slightly. There is a new staff forecast to be published this week, a summary coming on Thursday, and the full forecast on Friday (Feb 6), and it will be interesting to see how the projected inflation path has changed. There will also be adjustments to GDP forecasts, to the upside, so the odds are that core inflation projections will not be that favourable. In any case, we believe our expectation of stable rates throughout H1 still stands. There may be some window of opportunity to lower interest rates later, starting in Q3, but it will largely depend on inflation developments and price growth structure. The full CPI release, along with the new CPI basket, will be published on Feb 13. | CPI inflation, % - flash release | | Jan-25 | Oct-25 | Nov-25 | Dec-25 | Jan-26 | | Change, m/m | | Total, excluding: | 1.3% | 0.5% | -0.3% | -0.3% | 0.9% | | energy | 1.5% | 0.6% | -0.3% | -0.3% | 1.5% | | energy and non-processed foods | 1.3% | 0.6% | -0.4% | -0.2% | 1.3% | | energy, foods, alcohol and tobacco | 0.6% | 0.5% | -0.1% | 0.1% | 0.7% | | processed foods, alcohol and tobacco | 0.9% | 0.4% | 0.0% | -0.1% | 0.3% | | Foods and non-alcoholic beverages | - | - | - | - | 2.7% | | Alcohol & tobacco | - | - | - | - | 4.7% | | processed foods, alcohol and tobacco | 3.1% | 1.1% | -1.2% | -1.2% | 3.3% | | non-processed foods | 5.0% | 1.2% | 0.8% | -0.8% | 3.7% | | Energy (including fuel and oil) | 0.2% | -0.2% | -0.1% | -0.6% | -3.7% | | Services | 1.0% | 0.4% | 0.1% | 0.2% | 1.0% | | Goods | 1.5% | 0.7% | -0.6% | -0.6% | 0.7% | | Change, y/y | | Total, excluding: | 2.8% | 2.5% | 2.1% | 2.1% | 1.6% | | energy | 3.6% | 3.3% | 2.9% | 2.9% | 3.0% | | energy and non-processed foods | 3.6% | 3.3% | 3.0% | 2.9% | 3.0% | | energy, foods, alcohol and tobacco | 3.1% | 3.2% | 3.0% | 3.1% | 3.2% | | processed foods, alcohol and tobacco | 2.4% | 2.1% | 1.9% | 2.0% | 1.4% | | Foods and non-alcoholic beverages | - | - | - | 1.7% | 1.3% | | Alcohol & tobacco | - | - | - | 4.1% | 4.7% | | processed foods, alcohol and tobacco | 4.6% | 4.0% | 3.0% | 2.2% | 2.5% | | non-processed foods | 5.6% | 3.3% | 1.9% | 3.4% | 2.1% | | Energy (including fuel and oil) | -2.4% | -3.3% | -3.8% | -4.2% | -7.9% | | Services | 4.7% | 4.6% | 4.6% | 4.8% | 4.7% | | Goods | 1.7% | 1.3% | 0.6% | 0.4% | -0.4% |

| | Source: CSU |

|

|

|

|

| Government expectedly survives vote of no confidence |

|

| Czech Republic | Feb 05, 06:13 |

|

- No ruling coalition MP went against the government

- The pretext was the threats made by foreign minister Macinka against President Pavel

- Regarding Turek;s appointment as environment minister, which was the reason for these threats, PM Babis said the matter was closed

The government unsurprisingly survived its first vote of no confidence, which took place late on Wednesday (Jan 5). Only 84 opposition MPs voted against the government, with 101 votes (50% + 1 vote of all MPs) needed. No MP from the ruling coalition joined the opposition during the vote, showing the government has not lost any support in parliament. The pretext for the vote was the threats made by foreign minister Petr Macinka (Motorists) against President Petr Pavel. Macinka is unhappy that Pavel did not appoint Filip Turek (Motorists) as environment minister. It led to a massive rally in Prague last weekend, and an initiative supporting the president that quickly got 600,000 signatures. The opposition presented the no-confidence vote as an attempt to show resistance to this government, which has been far less respectful of the law than previously. Yet, we believe that the opposition missed an opportunity, as the scandal was apparently caused without the knowledge of PM Andrej Babis, so attacking Macinka directly could have been more effective. Regarding Turek, PM Babis said the matter was closed, and that Turek would not become minister. Yet, the Motorists apparently refuse to nominate anyone else, so the environment minister seat will remain vacant. Macinka is currently acting environment minister, and this could continue indefinitely. Still, we expect that Babis will insist the Motorists finally name someone else, to move things along. |

|

|

|

|

| Czech Republic | Feb 05, 05:53 |

|

Government survives vote of no confidence, no one from Babis coalition aids opposition (Lidove Noviny) Uncertainty with budget. Babis government lacks a new vision (Pravo) Babis: Turek matter is over, he will not be minister (Hospodarske Noviny) Babis at the president. Turek? We have more important things to work on (Mlada Fronta Dnes) Schillerova's plan to raise VAT payment threshold will help business. She needs to co-ordinate with Brussels, though (E15) Trump enters fight for rare earth metals. This time, he is doing it right (Lidove Noviny) Havlicek's preferential laws for firms: CZK 5bn is in the game (Hospodarske Noviny) Trump's actions are pushing Czech business to Africa. Exports rise at an unprecedented rate (E15) End of an era. Last carriage with coal goes out of Stonava mine (Pravo) Czechs drink less, but it is still much (Mlada Fronta Dnes) |

|

|

|

| Trust in new government reaches 32% in January - poll |

|

| Czech Republic | Feb 04, 14:34 |

|

- The previous government had only 25% trust last September, though

- Voters swung heavily along party lines, with ruling coalition voters backing the new government, and opposition voters being against it

- President Pavel enjoys 56% trust, again people being split across party lines

- Fire brigade, police, and the CNB are the three most trusted institutions

- The government is the least trusted one, just below the two houses of parliament

Trust in the new government reached 32% in January, according to an opinion poll of STEM, carried out on Jan 16-23. While trust is fairly low, it is noticeably better than what trust was in the previous government, at only 25% last September. There was a clear shift along party lines, as voters of the current ruling coalition improved their trust in the government significantly, while voters of the opposition decreased it. It is interesting that only 36% of Motorists' voters trust the government their party is in, possibly due to the issue around Filip Turek's appointment as environment minister. In contrast, trust in President Petr Pavel was 56%, slightly falling from September. Division is again across party lines, as opposition voters have a high level of trust, while government voters see trust not exceeding 46%. Again, the Motorists are the outlier in the poll, as 46% of them trust the president, while only 32% of ANO and 11% of SPD voters do. Among other institutions, the most trusted entity is the fire brigade, at 95% trust, followed by the police and the CNB (77% each), and local governments (75%). Meanwhile, the government is at the bottom in levels of trust, though closely behind the Chamber of Deputies (34%) and the Senate (40%). Trust in the EU was relatively low, at 42%, down 2pps from September. In all fairness, trust in the EU hasn't been above 50% since 2011, and this level of support has been in line with the average. Interestingly, trust in NATO is much higher, at 58%, and it has remained relatively stable over the past 30 years. |

|

|

|

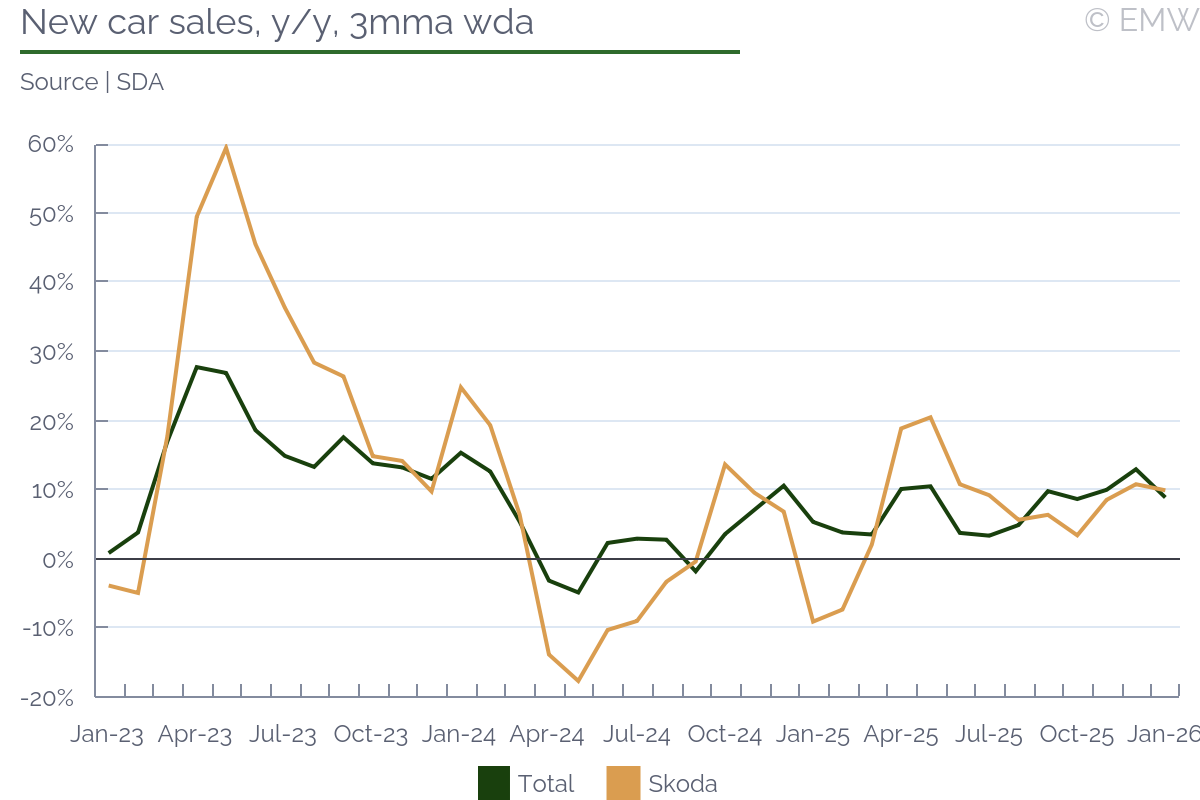

| New passenger car sales fall by 2.3% y/y in January |

|

| Czech Republic | Feb 04, 13:31 |

|

- Skoda Auto did better than the market, reporting an increase of 5.9% y/y

- Petrol cars were behind the headline drop, down by 5.7% y/y

- Meanwhile, plug-in hybrids saw another strong growth, up by 38.9% y/y

- The EV segment maintained a 10% market share, fairly stable since mid-2025

New passenger car sales fell by 2.3% y/y (wda) in January, down to 18,043 units, according to figures from the SDA, the car importers' association. In non-adjusted terms, sales fell by as much as 6.7% y/y, mostly due to there being one fewer working day in 2026 than in 2025. Still, Skoda Auto did better than the market, reporting an increase in sales by 5.9% y/y (wda), taking almost a 40% market share. By fuel, it was petrol cars that drove sales downwards, falling by 5.7% y/y in January. Meanwhile, sales of plug-in hybrids were the only larger segment to report a noticeable growth, up by 38.9% y/y. In all fairness, diesel and battery electric cars reported calendar-adjusted growth as well, but it was muted. As a result, the EV segment preserved a 10% market share, which has been the case since mid-2025. Used passenger car sales rose by 2.3% y/y in January, though they remained far behind new car sales. The used car segment has been reporting relatively steady monthly sales since 2024, and year-on-year changers have remained muted. Total vehicle sales, including buses, motorcycles, trucks, tractors, and trailers, rose by 1% y/y in January, out of which new vehicle sales increased by only 0.2% y/y. As a reminder, used vehicle sales rose by 14.5% y/y in 2025, mostly due to vehicles other than passenger cars. | Car registrations, y/y wda | | Jan-25 | Oct-25 | Nov-25 | Dec-25 | Jan-26 | | New passenger cars | -5.0% | 10.6% | 14.1% | 15.1% | -2.3% | | o/w: Skoda | -18.1% | 8.2% | 13.9% | 13.4% | 5.9% | | | Petrol | -6.8% | 17.2% | 15.7% | 18.0% | -5.7% | | Diesel | -11.9% | -12.2% | -1.5% | -9.8% | 2.9% | | Other, o/w: | 34.7% | 17.5% | 34.8% | 50.4% | 8.5% | | battery electric | 107.4% | -14.3% | 1.1% | 18.4% | 0.4% | | plug-in hybrids | 47.7% | 85.3% | 112.1% | 163.2% | 38.9% | | | Used passenger cars | -4.6% | 10.0% | 18.2% | 13.3% | 2.3% | | | Total | -6.1% | 8.6% | 13.5% | 8.7% | 1.0% | | New vehicles | -7.8% | 8.5% | 11.6% | 6.1% | 0.2% | | Used vehicles | -2.8% | 8.9% | 17.2% | 14.5% | 2.5% |

| | Source: SDA |

|

|

|

|

| | Taxes and contributions of self-employed |

|

| Czech Republic | Feb 04, 13:01 |

|

Question: Taxes and social contributions for the self-employed were projected to increase as per the draft 2026 budget presented by the last government, and the ANO had indicated that it was unlikely to support this increase. What is the status on this, please? The question was asked in relation to the following story: New 2026 budget brings modest fiscal loosening, big changes to come in 2027 Answer: The legislation is still being voted in parliament, but the ruling coalition has already proposed an amendment that blocks the increase. There is nothing about it in budget documents, however, and payments on behalf of self-employed are expected to rise slightly, by CZK 3bn. We reckon this is based on an expectation of higher taxable incomes (due to a strong GDP growth) and better tax collection, but the finance ministry doesn't specify that explicitly. It represents a downside risk on the revenue side. We must add that the wording is precisely the same as in the original budget bill, only the numbers are different, so the legislative change might not have been reflected yet. In the past, the Czech Fiscal Council has criticised governments for incorporating tax changes that have not been passed by parliament into budget bills, so this could be the reason it has not been mentioned. It still looks like the finance ministry is betting on the economic cycle and better collection to make up for cancelling the increase. |

|

|

|

| | New 2026 budget brings modest fiscal loosening, big changes to come in 2027 |

|

| Czech Republic | Feb 04, 12:02 |

|

- The state government deficit will reach CZK 310bn (3.5% of GDP), while the general government deficit - 2.2% of GDP

- There will be a one-off cash windfall related to EU funds, whose payment was delayed in 2025

- We see some downside risks to economy growth, given that euro area prospects are worse than in the original budget bill

- Gross financing needs are projected at 8.2% of GDP, we estimate net bond issuance at around CZK 250bn, given the EU funds' windfall

- The new budget bill is not compliant with the fiscal responsibility act, but there is no effective enforcement mechanism to remedy that

- No major shift in fiscal policy, most significant changes are left for 2027

- Public sector wage hike and removal of renewable energy surcharge are largely covered by spending cuts

- It still leaves the expiration of windfall tax unaddressed, though the EU funds' windfall may be able to cushion it

- EU flows, apart from the one-off windfall, will decrease mostly due to lower RRF payments

- 2026 will be the first year with a structural deterioration since 2022, setting up problems in the medium term

The new 2026 budget bill will bring only a modest fiscal loosening, despite some expectations, though some issues will remain. Given how the new ruling coalition took over the executive at the very end of 2025, it decided that there is no time for a major policy overhaul, which is why most policy commitments will be implemented as of 2027. This will be the watershed moment for fiscal policy, while 2026 will see policies largely unchanged. As a reminder, the 2026 budget set a deficit target at CZK 310bn (3.5% of GDP) at state government level, up from CZK 290.7bn (3.4% of GDP) in 2025. Meanwhile, the general government budget will see a deficit at 2.2% of GDP in 2026, up from 2% of GDP in 2025. While risks are technically on the downside, as GDP growth assumptions are optimistic, the 2026 budget will get an unexpected safety cushion, courtesy of the previous government. We refer to EU flows, as what the previous government did was to spend on EU-funded programmes in advance, with flows from the EU budget coming late. Thus, even though we see a non-negligible risk for a deterioration in the non-EU balance, it will be likely fully cushioned by the additional EU flows that were never received in 2025. As a reminder, the 2025 budget ended with a CZK 40.8bn deficit related to EU flows, so cash-based performance will likely turn out better than planned. We should emphasise that there isn't much the government can do, as EU rules do not allow these delayed payments to be included as revenue in the new budget. Risks to growth remain on the downside, mostly due to sluggish euro area growth Macroeconomic assumptions turned more optimistic since the first 2026 budget bill was presented, with GDP growth now expected at 2.4% in 2026, up from 2% in the original budget bill. In all fairness, this was largely fuelled by the domestic economy beating expectations in 2025, and projections now assume that household consumption will remain a strong driver of growth. There are also expectations of a solid recovery in investment, which is where uncertainty lies. We should note that the previous macroeconomic projections assumed euro area growth of 0.5%, while the current ones lower that to 0.3%. Thus, we see some downside risks to growth related to optimistic expectations. Risks are not excessive, however, as a tight labour market and a public sector wage hike are expected to push nominal wages upwards, so strong household consumption doesn't come out of nowhere. Factors also include a softer headline inflation, at 2.1%, which should also promote consumption. Thus, the odds are that if there are deviations, they will remain relatively manageable. Nevertheless, we continue to see downside risks as non-negligible, as recovery in Germany, a main export market, is far from guaranteed, and risks related to global supply chains remain significant. | Table 1. Macroeconomic framework | | Indicator | Unit | 2025 | 2026 | | GDP | CZK bn | 8,524 | 8,957 | | GDP | % y/y | 2.5 | 2.4 | | Private consumption | % y/y | 2.9 | 3.0 | | Government consumption | % y/y | 2.1 | 1.9 | | Gross fixed capital formation | % y/y | 0.9 | 3.1 | | Net exports | contribution, pps | -0.4 | -0.3 | | Inventories | contribution, pps | 0.9 | 0.1 | | | | | | GDP deflator | % y/y | 3.2 | 2.6 | | CPI inflation | % y/y | 2.5 | 2.1 | | Employment | % y/y | 1.0 | 0.1 | | Unemployment rate | % | 2.8 | 2.8 | | Wage bill | % y/y | 7.3 | 6.3 | | Current account balance | % of GDP | 0.6 | 0.3 | | | | | | EUR/CZK | | 24.7 | 24.1 | | Long-term interest rates | % | 4.3 | 4.6 | | Brent crude oil | USD/barrel | 69 | 61 | | Euro area GDP | % y/y | 0.6 | 0.3 |

| | Source: Ministry of Finance |

Fiscal loosening to remain modest in 2026, financing needs to rise Fiscal loosening is projected to remain modest in 2026, as the new government has decided that it will implement the bulk of its fiscal policy commitments in 2027. Thus, the general government deficit will reach 2.2% of GDP in 2026, up from 2% of GDP in 2025. It is indicative that the structural balance will also deteriorate, to 2.2% of GDP, which is in line with IFI projections of a modest negative fiscal impulse in 2026. Given medium-term risks to the fiscal framework related to ageing, this is hardly an advisable policy. Yet, it has been a conscious choice on behalf of the new government, which decided that voter anger with fiscal consolidation is more dangerous than a fiscal deterioration in the medium to long term. It is why pension reform will be rolled back, which will not have an immediate fiscal impact, but will deny future savings. The effective tax burden will decrease, from 33.2% in 2025 to 32.4% in 2026, largely due to the expiration of windfall tax. There are some residual payments due in early 2026, but this doesn't matter on an accrued basis, which is how general government parameters are calculated. In any case, the new government will have a reason to brag that it reduced the tax burden, in contrast with the previous one, which raised it to obtain to consolidate public finances. Financing needs to reach 8.2% of GDP in 2026, though one-off windfall related to EU funds may lower them The cost of structural deterioration can be seen in the gross borrowing requirement, which will rise from CZK 673.5bn (7.9% of GDP) in 2025 to CZK 733.6bn (8.2% of GDP) in 2026. As we mentioned above, there is a one-off windfall for budget performance on cash basis, which means that actual financing needs can end up lower than planned. Even then, financing needs are likely to end up at least modestly above those in 2025 in absolute terms. Gross bond issuance is planned at CZK 400-650bn, according to the funding and debt management strategy. Given that bond amortisation is projected at CZK 200bn, it puts net bond issuance at CZK 200-450bn in 2026. The budget law puts net long-term domestic financing at CZK 282.6bn, which falls comfortably within that range. Thus, the odds are net bond issuance will be around CZK 250bn, accounting for the windfall related to EU funds. No Eurobonds are planned, but the finance ministry may consider borrowing through EUR-denominated bonds issued under Czech law. As far as external borrowing is concerned, it is planned to be exclusively through bilateral loans from IFIs, most likely the EIB. Net long-term external financing is projected at CZK 43bn, all on loans, and the finance ministry plans to draw loans from the EIB for up to CZK 72bn to cover EUR financing needs. Structural deficit remains above legal limit, despite finance ministry's arguments The main issue that remains is that the fiscal framework and deficit targets remain above the limit set in the fiscal responsibility act. While the finance ministry has already drafted changes, proposing a shift to a net primary expenditure rule, the current law still applies, and it sets the structural deficit limit at 1.75% of GDP in 2026. As seen from the table below, the projected structural deficit is 2.2% of GDP. The finance ministry has tried to argue that it is implementing EU legislation, as well as resolving issues with uncovered expenses in the original budget bill. Furthermore, it considers the new bill as a revision, rather than a new piece of legislation, which would mean that structural deficit limits no longer apply. We consider such arguments as thin, and the Czech Fiscal Council agrees with us. Yet, the government is firmly decided to proceed with this budget bill, and there appears no one able to stop them. The fiscal responsibility act has no effective enforcement mechanism, and by the time this may become an issue, the law will likely be amended. For the sake of argument, we compared budget parameters to the proposed rule, according to which net primary expenditure can rise by no more than the sum of potential GDP growth and the GDP deflator (in nominal terms). Thus, the maximum net primary expenditure growth would be 4.3% in 2026, based on the latest finance ministry forecast. Yet, net spending growth comes nowhere close to that number, so the finance ministry is breaching even the new rule it plans to implement. | Table 2. General government, % of GDP | | 2024 | 2025 | 2026 | | Budget balance | -2.0 | -2.0 | -2.2 | | Structural balance | -1.7 | -2.0 | -2.2 | | Government debt | 43.3 | 44.6 | 46.2 | | | | | | Tax burden, % | 33.0 | 33.2 | 32.4 |

| | Source: Ministry of Finance |

No major shift in fiscal policy in 2026, one-off windfalls to cover initial spending spree As mentioned above, the government left most of its fiscal policy commitments for implementation in 2027, which means there are few changes in policy in 2026. The biggest policy changes regard the removal of the renewable energy surcharge and a deal to raise public sector wages by 8.4%. As far as the surcharge is concerned, it will create an additional expense of CZK 17.1bn, which was supposed to be covered by the surcharge. Meanwhile, the government has shown itself as quite generous regarding public sector wages, though the impact has been mitigated by a decision taken by the previous government. What we refer to is non-teaching staff at schools, whose salaries will be now covered by local governments. This was a contentious issue with the previous government, as local governments protested against being burdened with additional expenses. Yet, the previous government argued that it had raised the share of nationally collected tax transferred to local governments, so they didn't have such a strong argument. In case, this is how the central government will need to cover only about half of the cost of higher public sector wages, rather than the full CZK 47-48bn projected for the general government. In all fairness, both of these expenses were covered by reducing defence spending from the initial budget bill, and cancelling a conditional expense related to the expansion of the Dukovany nuclear power plant. On the other hand, the new government is not doing anything about the much lower tax revenues from corporate taxes, which will be caused by the expiration of windfall tax. While there will be some residual revenue due in early 2026 (only on cash basis), the gap is more or less equivalent to the CZK 26bn increase in the state deficit target, which remains unaddressed. | Table 3. Discretionary measures (major effects only) | | Item | CZK bn | Reason | | Windfall tax | -26.7 | Expiration, residual payments of CZK 6.9bn remaining | | Renewable energy subsidies | -17.1 | Cancellation of renewable energy surcharge | | Public sector wages | -23.4 | Average increase of 8.4% | | Defence | 21.0 | Reduction from original spending plan | | Dukovany nuclear plant expansion | 18.3 | Removal of planned conditional expenses |

| | Note: Only changes not related to economic cycle included | | Source: Ministry of Finance |

State government budget may see a one-off windfall related to EU funding The state government budget doesn't contain big surprises, aside from the factors listed in the previous section. Namely, windfall tax expired at the end of 2025, leading to a CZK 26.7bn tax revenue shortfall, while the cancellation of the renewable energy surcharge will push down non-tax revenue. Gross EU flows are also expected to fall, mostly due to expectations for lower RRF payments, though these could benefit from a one-off shortfall, thanks to the previous government. In more detail, the previous government went ahead and made some EU-related expenses before receiving payments from the EU budget, which resulted into a CZK 40.8bn cash deficit in 2025. These payments will be made in early 2026, and the January budget print has already indicated that. Yet, EU rules do not allow that unforeseen revenue to be included in the 2026 budget bill, which is why we will likely see a one-off windfall in 2026. Other than that, social contributions are expected to drive tax revenues, projected to rise by 7.2%. Corporate income tax revenue is expected to fall by 3.9%, entirely due to the expiration of windfall tax, even though economy growth and the higher corporate income tax rate (by 2pps to 21%) will have a positive impact. Excise tax revenue will also increase due to the planned 5% hike in alcohol and tobacco excise tax, with 2026 being the penultimate year when such hikes will apply. On the spending side, social expenses remain the primary growth driver, rising by 3.8%, followed by transfers (up 3.9%) and personnel (up 10.1%). The latter two categories reflect the need to cover renewable energy subsidies that were previously funded by the surcharge, as well as the 8.4% wage hike in the public sector. On the other hand, no major education subsidy is envisaged this year, which will reduce expenses. Furthermore, capital spending has maintained a modest growth, at 4.9%. While the new government has envisaged additional transport infrastructure spending by CZK 26bn, this is largely mitigated by the removing the planned expense on the Dukovany nuclear power plant. | Table 4. State government budget, CZK bn | | 2025 | 2026 | 2026/2025 | % y/y | | REVENUES | 2,086.1 | 2,117.8 | 31.8 | 1.5 | | Tax revenues | 1,840.1 | 1,915.5 | 75.4 | 4.1 | | Personal income tax | 184.7 | 196.0 | 11.3 | 6.1 | | Corporate income tax | 244.3 | 234.8 | -9.5 | -3.9 | | VAT | 414.0 | 416.0 | 2.0 | 0.5 | | Excise tax | 161.1 | 170.2 | 9.1 | 5.6 | | Social security contributions | 809.4 | 867.7 | 58.3 | 7.2 | | Other taxes | 26.6 | 30.7 | 4.2 | 15.8 | | Non-tax and capital revenues, transfers | 246.0 | 202.4 | -43.6 | -17.7 | | o/w: EU and financial programmes | 153.6 | 139.3 | -14.3 | -9.3 | | | | | | | EXPENDITURE | 2,327.1 | 2,427.8 | 100.8 | 4.3 | | Current expenses | 2,076.9 | 2,165.4 | 88.5 | 4.3 | | Personnel | 178.9 | 197.0 | 18.0 | 10.1 | | Maintenance | 200.4 | 216.5 | 16.1 | 8.0 | | o/w: debt service costs | 98.9 | 108.7 | 9.7 | 9.9 | | Social expenditure | 930.5 | 965.7 | 35.2 | 3.8 | | Transfers | 729.2 | 757.4 | 28.1 | 3.9 | | Other current expenses | 37.9 | 28.9 | -9.0 | -23.7 | | Capital expenses | 250.2 | 262.5 | 12.3 | 4.9 | | | | | | | o/w: Mandatory expenses | 1,796.9 | 1,907.2 | 110.3 | 6.1 | | | | | | | BALANCE | -241.0 | -310.0 | -69.0 | 28.6 | | w/o EU and financial programmes | -241.0 | -310.0 | -69.0 | 28.6 | | | | | | | FINANCING | 241.0 | 310.0 | 69.0 | 28.6 | | Domestic | 224.6 | 279.0 | 54.4 | 24.2 | | short-term | -7.4 | -3.6 | 3.8 | -51.3 | | long-term | 232.0 | 282.6 | 50.6 | 21.8 | | Foreign | 16.4 | 31.0 | 14.6 | 89.4 | | short-term | 0.0 | -11.9 | -11.9 | n/m | | long-term | 16.4 | 43.0 | 26.6 | 162.1 |

| | Source: Ministry of Finance |

EU flows to decrease mostly due to lower RRF payments Gross EU flows are expected to decrease by 9.3% in 2026, mostly due to lower planned payments from the Recovery and Resilience Facility. The previous government has managed to push absorption to about two thirds of the total allocation, which is why there is less to be received in 2026. As we have been pointing out in the previous sections, however, there will be a one-off windfall as far as EU flows are concerned. Namely, there were delays in planned EU flows in 2025, which will eventually arrive in 2026. There is already evidence of that in the January budget print, and we expect more in Q1. Thus, the odds are that we will not see an actual decline in EU-related flows in 2026, though under EU rules, these cannot be projected in the budget bill. There are no other major developments, as funding is now exclusively coming from the 2021-2027 MFF. | Table 5. EU and other financial programmes, CZK bn | | 2025 | 2026 | | Co-financing | EU | Total | Co-financing | EU | Total | | MFF 2014-2020 | 1.5 | 2.3 | 3.9 | 0.0 | 0.0 | 0.0 | | MFF 2021-2027, o/w: | 18.9 | 150.9 | 169.8 | 25.6 | 138.5 | 164.1 | | Cohesion policy | 8.2 | 74.1 | 82.3 | 10.7 | 87.3 | 98.0 | | CAP | 9.2 | 27.0 | 36.2 | 9.8 | 29.5 | 39.3 | | Recovery and Resilience Facility | 1.4 | 42.0 | 43.4 | 4.7 | 16.7 | 21.3 | | Connecting Europe Facility | 0.0 | 7.1 | 7.1 | 0.0 | 4.1 | 4.1 | | EU | 20.5 | 153.2 | 173.7 | 25.6 | 138.5 | 164.1 | | Financial programmes | 0.1 | 0.4 | 0.4 | 0.1 | 0.7 | 0.9 | | Total | 20.6 | 153.6 | 174.1 | 25.7 | 139.3 | 165.0 |

| | Source: Ministry of Finance |

Conclusion Overall, the 2026 budget will see a relatively modest fiscal loosening, though it will likely represent calm before the storm. Regretfully, we will witness structural deterioration for the first time since 2022. While there will be some one-off windfalls to cushion the impact on cash basis, the new government is clearly moving into a direction that will boost medium-term fiscal risks. Plans to roll back pension reform will deny future fiscal savings, and intentions to lower corporate taxes as soon as in 2027 will cause some short-term deterioration as well. Furthermore, the new government intends to lead a robust industrial policy, which will add to spending in the years to come. Thus, while 2026 will be relatively calm on the fiscal policy front, we expect that general government deficits will likely exceed 2.5% of GDP from 2027 onward. We expect that the government will be careful to maintain deficits within SGP rules, so the odds are the deficit targets will be closer to 2.5% of GDP than to 3% of GDP. Still, it will be a period with noticeable fiscal loosening that will create plenty of problems for the next administration. |

|

|

|

| Hungary |

|

| AKK raises bond issuance volume more than two-fold on primary auction |

|

| Hungary | Feb 05, 11:01 |

|

- Yields decline from previous tender, mostly for the longer bonds

The State Debt Management Agency (AKK) issued HUF 165.0bn of three-, five- and ten-year government bonds on the latest primary auction, AKK data showed. The issued amount was significantly higher than the original auction size of HUF 70.0bn with the AKK expanding the volume of all three bond series on the back of strong demand. Total bids reached HUF 350.1bn and translated into a bid-to-cover ratio of 5.0x, while the over-issuance brought the coverage ratio closer to AKK's implicit target of 2x. Average yields declined visibly compared to the previous auction two weeks ago with the downward pressure being more visible for the longer term bonds. Yields were almost flat with the respective secondary market benchmark rates, specifically 1-2bps lower for the three- and five-year bonds and 1bp higher for the ten-year bond. | Government bond primary auction on Feb 5 | | Offered amount, HUF bn | Placed amount, HUF bn | Bids, HUF bn | Average yield | Secondary market benchmark rate | Average yield on previous auction | | 3Y bond | 20.0 | 50.0 | 108.6 | 6.10 | 6.11 | 6.14 | | 5Y bond | 25.0 | 45.0 | 97.2 | 6.19 | 6.21 | 6.32 | | 10Y bond | 25.0 | 70.0 | 144.4 | 6.46 | 6.45 | 6.66 |

| | Source: AKK |

|

|

|

|

| Majority of voters consider opposition leader Magyar suitable for PM – poll |

|

| Hungary | Feb 05, 10:39 |

|

- Orban still leads significantly in terms of assessments for full suitability

- Balance of positive votes shifts in favour of Magyar since previous poll in Nov 2025

The majority 54% of voters considered the opposition Tisza Party leader Peter Magyar to be suitable for PM, according to a poll by the Median agency commissioned and published by the pro-opposition news portal Heti Vilaggazdasag. Magyar beat PM Viktor Orban who was considered suitable by 46% of respondents in the poll. The caveat in these figures was that Orban attracted definite approval for PM by twice as many voters than Magyar. Orban was considered fully suitable for PM by 31%, compared to 16% for Magyar. The difference was explained by a higher share of voters who considered Magyar as rather suitable - 38%. Some 15% of respondents labelled Orban as rather suitable. The lead of Magyar among the overall suitability votes represented an improvement over the previous Median survey from Nov 2025, the portal noted. Magyar and Orban were even with 48% of full or partial approval votes in the previous poll. We consider it possible that the slight decline of Orban's approval rating could be related to the child abuse scandal in a state correctional facility. The miscommunication about the results of Orban's meeting with US President Donald Trump regarding the alleged US promise for a financial shield could be another factor, weighing on voter perceptions about Orban, we suspect. At the same time, we explain the large difference between the full suitability vote between Orban and Magyar with the diverse voter base of the Tisza Party, as well as the fact that Magyar's leadership skills have not been tested yet. |

|

|

|

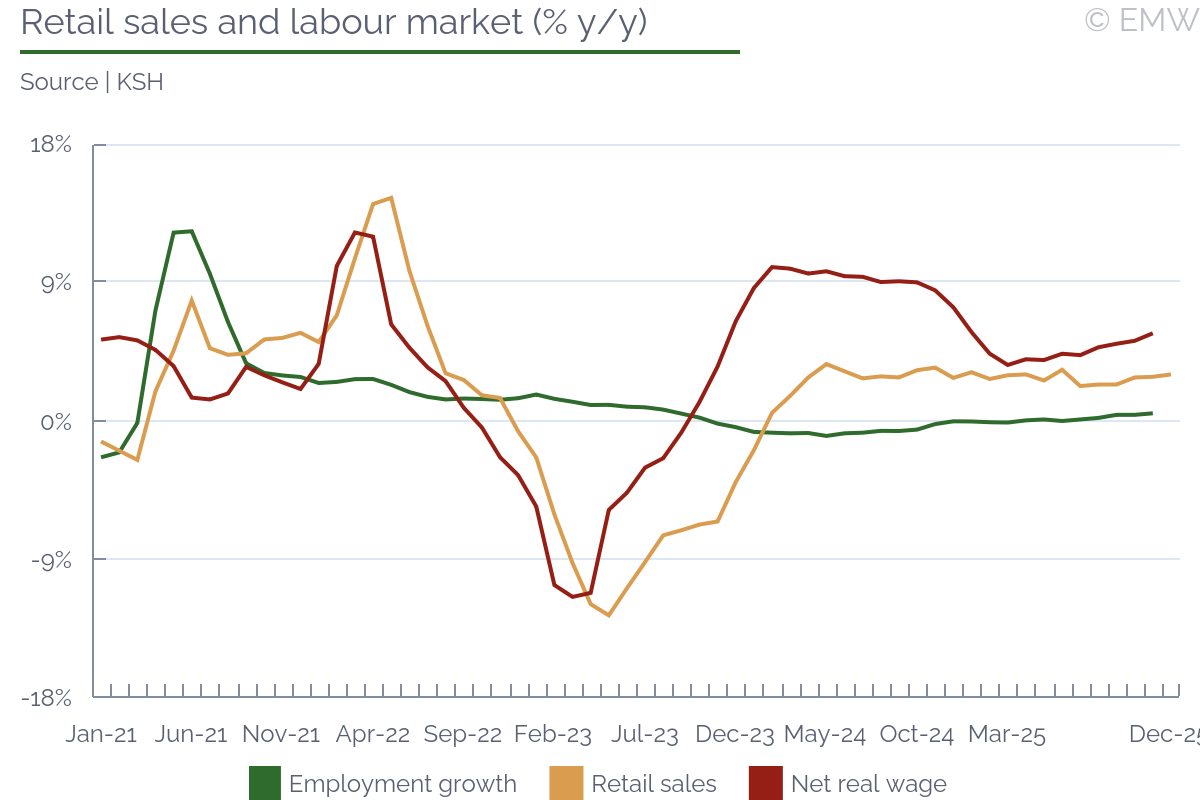

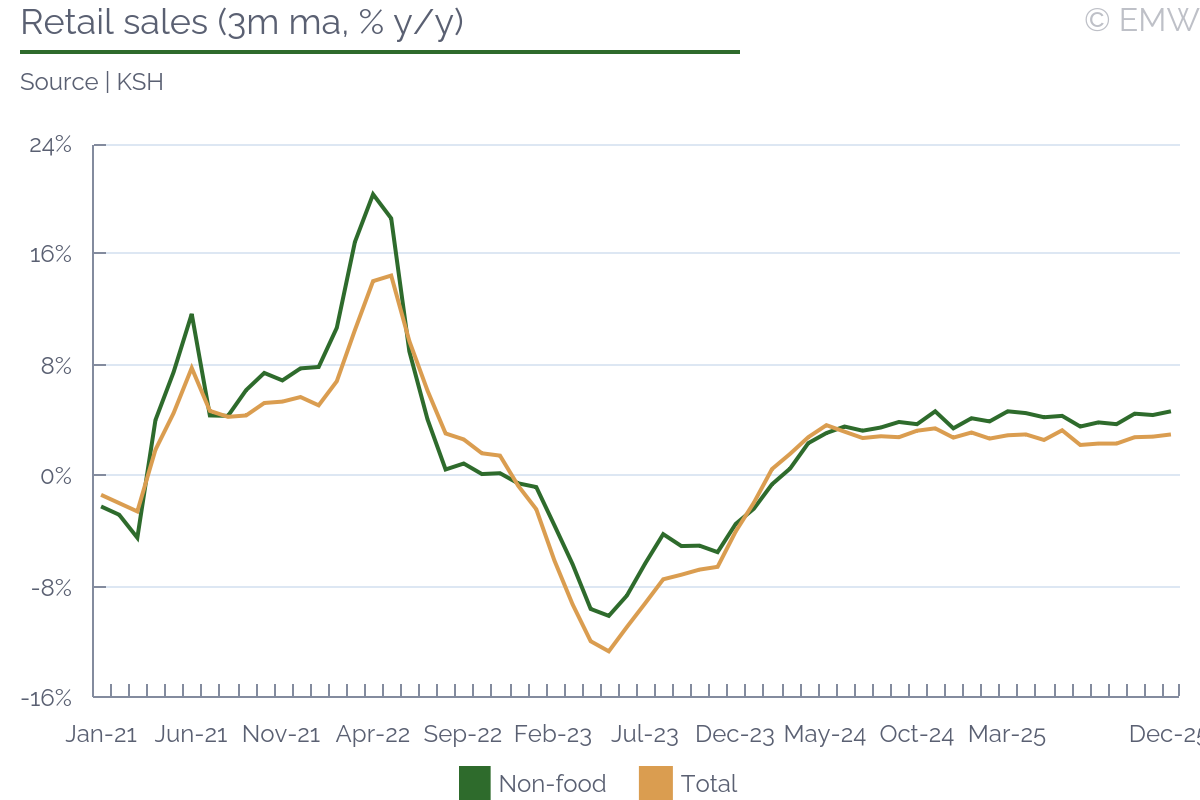

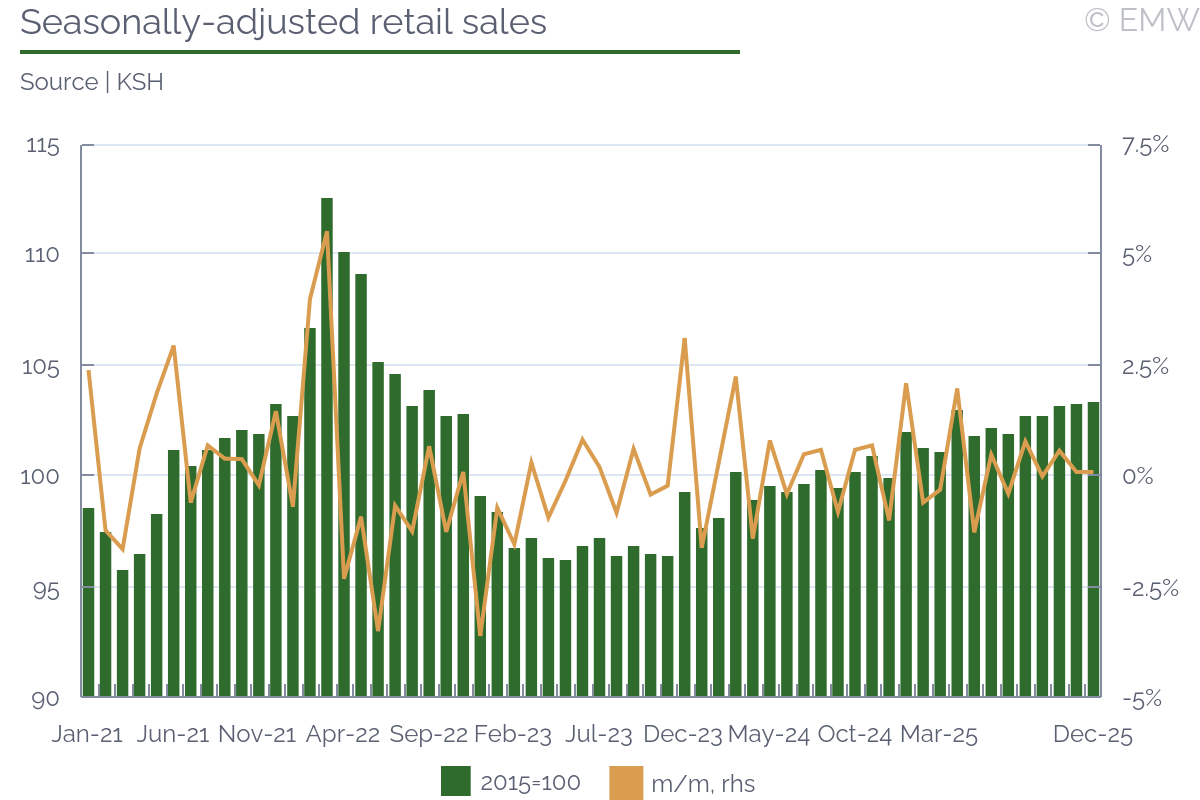

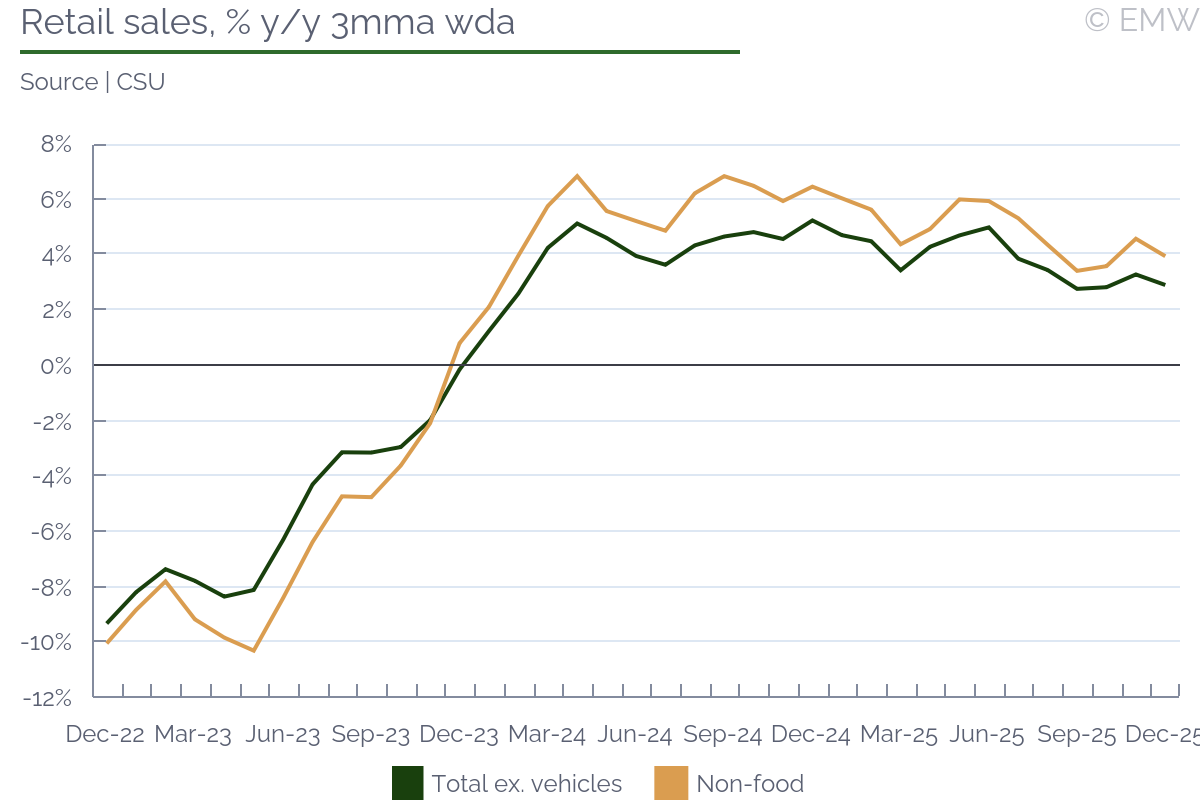

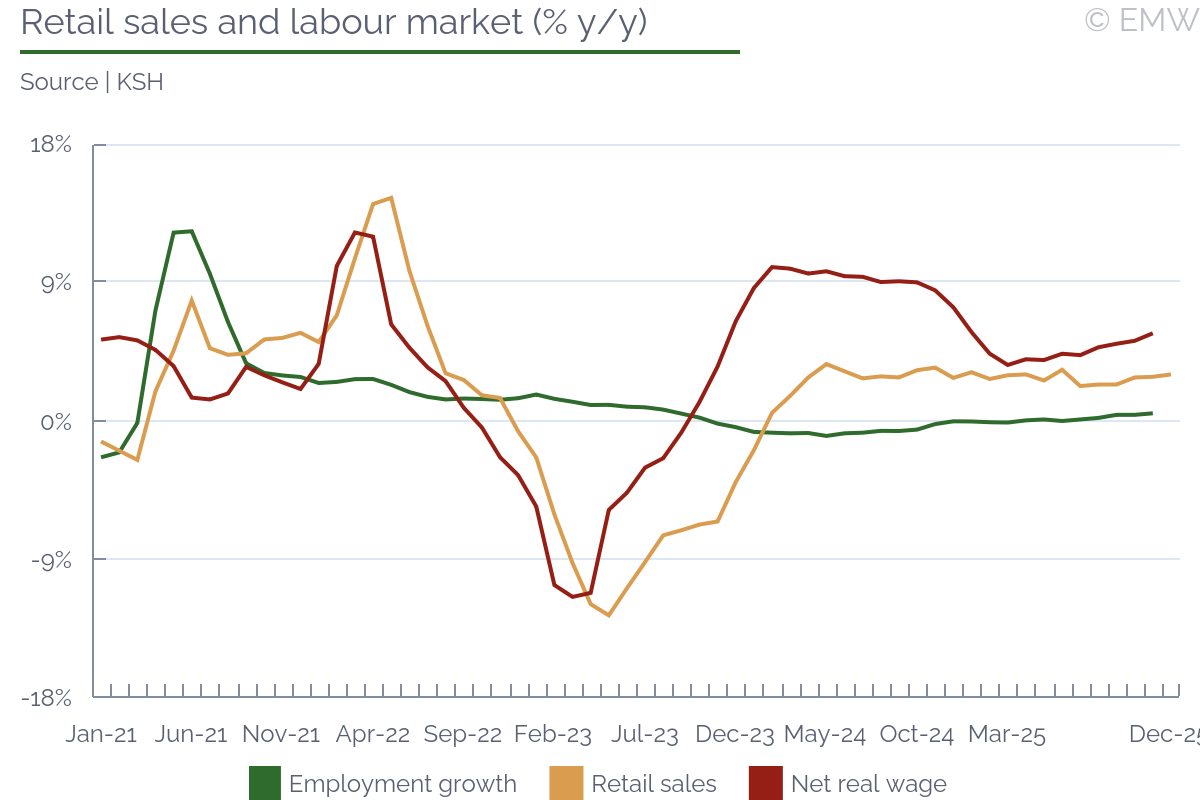

| | Retail sales growth accelerates to 3.5% y/y in December |

|

| Hungary | Feb 05, 08:08 |

|

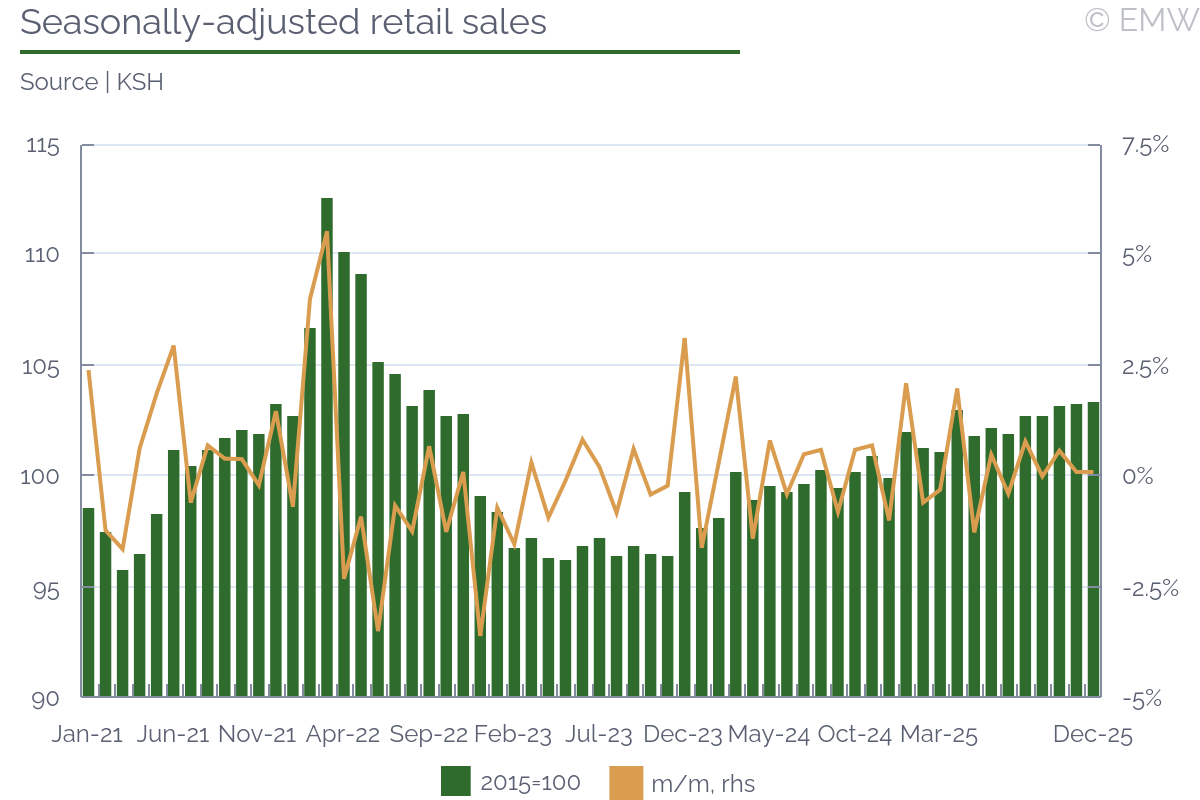

- Retail sales dynamics closely follows net real wage, employment trends

- Seasonally-adjusted sales rise by 0.1% m/m, recover to their pre-war levels

- Food, non-food segments weaken in December, remain below 2025 average

Retail sales increased by 3.5% y/y in December and picked up compared to the 2.5% y/y growth in the previous month, the statistical office (KSH) reported. The print was the third highest growth for the year so far and beat the cumulative 2.9% increase for the full 2025. We still do not consider it especially encouraging, given that the strength came entirely from the fuel segment, while food and non-food sales slowed down and were below the 2025 average. The growth pattern of total retail sales has closely followed the developments in the net real wage and employment, in our opinion signalling unchanged spending propensity during the past period. Seasonally-adjusted retail sales rose by 0.1% m/m in December, which extended the upward trend in retail sales since late 2023. The adjusted retail sales have rebounded back to their pre-war levels, we note.  Food sales slowed down to a 2.1% y/y growth in December. We think that food consumption has been supported by the government distribution of food vouchers for pensioners that were worth a total of HUF 82.7bn. The impact of this measure seemed to peak in November, keeping food sales relatively elevated in the last two months of the year, we assess. The slowdown in food inflation likely also supported food consumption in December, in our view. Non-food sales eased to a 4.3% y/y growth in December, mostly in line with the full-year growth of 4.4%. The breakdown showed improving demand for manufactured goods in non-specialised stores and consumer durables, which we attribute to improved borrowing appetite. Sales growth in clothing and electronics also picked up, but the favourable trends in these segments were completely offset by weakening in internet orders. Internet orders formed the highest 23.7% share of the total non-food sales in December and their y/y increase weakened notably to 2.8% y/y during the month, possibly indicating at least a temporary shift to conventional shopping around the end-year holidays, we believe.  Retail fuel sales were the only major segment with an upward drive, picking up to 1.7% y/y growth in December. The stronger growth seemed to reflect at least in part a low base from the previous year, in our opinion stemming from price impacts. The deferral of the automatic excise tax hike on fuels could keep fuel demand elevated in the short term, we expect. | Retail sales growth (y/y, calendar-adjusted) | | Aug-25 | Sep-25 | Oct-25 | Nov-25 | Dec-25 | | Retail sales | 2.4% | 3.0% | 3.1% | 2.5% | 3.5% | | Food | 2.2% | 3.0% | 1.2% | 2.6% | 2.1% | | Non-food | 4.9% | 3.5% | 5.2% | 4.6% | 4.3% | | Fuel | 2.2% | 0.5% | 0.6% | 0.7% | 1.7% | | Motor vehicles (not adjusted) | 9.6% | 10.9% | 3.1% | -4.0% | -1.2% |

| | Source: KSH |

|

|

|

|

|

| Hungary | Feb 05, 06:17 |

|

Head of Tisza research centre also admits that Fidesz victory would not be surprise (Magyar Nemzet) Home Start programme: Number of loan agreements disbursed exceeded 22K (Magyar Nemzet) PM Viktor Orban: We have funds to fulfill all our commitments (Magyar Nemzet) Paks II nuclear power plant - "first concrete" is being poured and actual construction work can begin (Magyar Nemzet) BMW and Mercedes fight back: Hungary could be front line of German-Chinese automotive war (Vilaggazdasag) PM Viktor Orban unexpectedly announces: He gave Trump dates for his arrival in Budapest - "American president owes us, come and greet the Hungarians" (Vilaggazdasag) PM Viktor Orban says it is unfair that producers receive HUF 50 for potatoes, while their price climbs to HUF 300 in stores (Vilaggazdasag) PM Viktor Orban: "We have achieved over 100% in past four years" (Heti Vilaggazdasag) Home renovation support for pensioners fails, even though PM Viktor Orban was very optimistic (Heti Vilaggazdasag) Government-friendly oligarch Lorinc Meszaros, MVM and E.ON distribution companies are exempted from special utility tax (Heti Vilaggazdasag) |

|

|

|

| Mercedes car plant downsizes production in Jan-Apr |

|

| Hungary | Feb 04, 13:46 |

|

- Workers report shift reduction, disassembly of production lines, delays in start of new recruitment

- Company links reduced shifts to restructuring, denies delays in capacity expansion plans

The Hungarian car plant of German automotive producer Mercedes has cut shifts gradually from three to one and entire production lines have been dismantled, the news portal 24.hu reported citing unofficial information by a plant employee. The reduction of the shifts meant in practice that capacity utilisation has been down to not more than 50% for months, according to the source. This process was not accompanied by layoffs, but workers had less work than before, it claimed. The news about the Mercedes plant come in contrast to recent reports that the capacity of the new BMW plant in Debrecen had been fully booked for 2026, so the company could need to add more shifts than initially expected, we note. The company denied that production lines have been disassembled for an alleged transfer to a Polish facility. It did confirm the shift reduction for the portal, saying it will last from January till April, but explained that the downsizing was due to the pending expansion of the plant with the completion of the new production facility, that was worth EUR 1bn. The plant was scheduled to start production of models based on two new company platforms, so deep transformations and restructuring was under way, it added. The reduction of the number of shifts had no impact on the core staff count at the plant, it underlined. The company further said that recruitment for the plant's expansion had started in Oct 2025, while the portal's sources claimed that this had not happened yet. The expansion was expected to add 3,000 jobs to the company's headcount in the medium term, we note. The portal G7 showed statistics from Opten, according to which employment at Mercedes Hungary increased to 4,980 people at end-2025, compared to 4,843 people at the start of the year. Output at the Mercedes plant was down by 43% y/y in Jan-Sep 2025, according to an analysis of the National Bank of Hungary (NBH), the portal reminded. The output shortfall could be likely explained by earlier company announcements for the relocation of the production of the CLA model to Germany, it noted. A simultaneous decision to bring the production of the A-Class model to Hungary could be executed no earlier than Q2, it said. The plant's expansion was progressing only slowly, so output of models based on the new platforms has been on hold, it reported. The company, however, stressed that preparations were going in line with plans and were currently in the stage of construction of two new buildings for body and assembly lines, and a third building for battery assembly. |

|

|

|

| Poland |

|

|

| Poland | Feb 05, 04:21 |

|

PiS tries to blackmail PSL with contacts with Trump [PiS tries to say that if PSL doesn't agree to back its govt it will seek to get Americans to cut off contact with Defense Ministry, which is led by PSL leader and Deputy PM Kosiniak-Kamysz] (Rzeczpospolita) Who wants to overthrow Tusk's govt [rumours say Trump wants to sink KO-led govt, transgressing prior norms; PSL to have PM, backed by PiS, but they would need one more partner and PSL rejects co-op with PiS; but Trump said to warn PiS against co-op with Braun's Konfederacja KP] (Rzeczpospolita) Polish labour market is becoming increasingly foreign-oriented [no. of foreigners legally working in PL rises 96,000 in 2025 to 1.29mn; rise came even as the number of employed for the year decreased] (Rzeczpospolita) Nawrocki targets Sejm Speaker Czarzasty (Gazeta Wyborcza) Finally, a real breakthrough in CHF case law (Rzeczpospolita) Who did President Karol Nawrocki pardon? (Rzeczpospolita) Supreme Court head Manowska to fight for re-election (Gazeta Wyborcza) Poles are concerned about safety of KSeF (Rzeczpospolita) Another crisis in govt protection service (Gazeta Wyborcza) Who earns the most in Poland these days (Gazeta Wyborcza) |

|

|

|

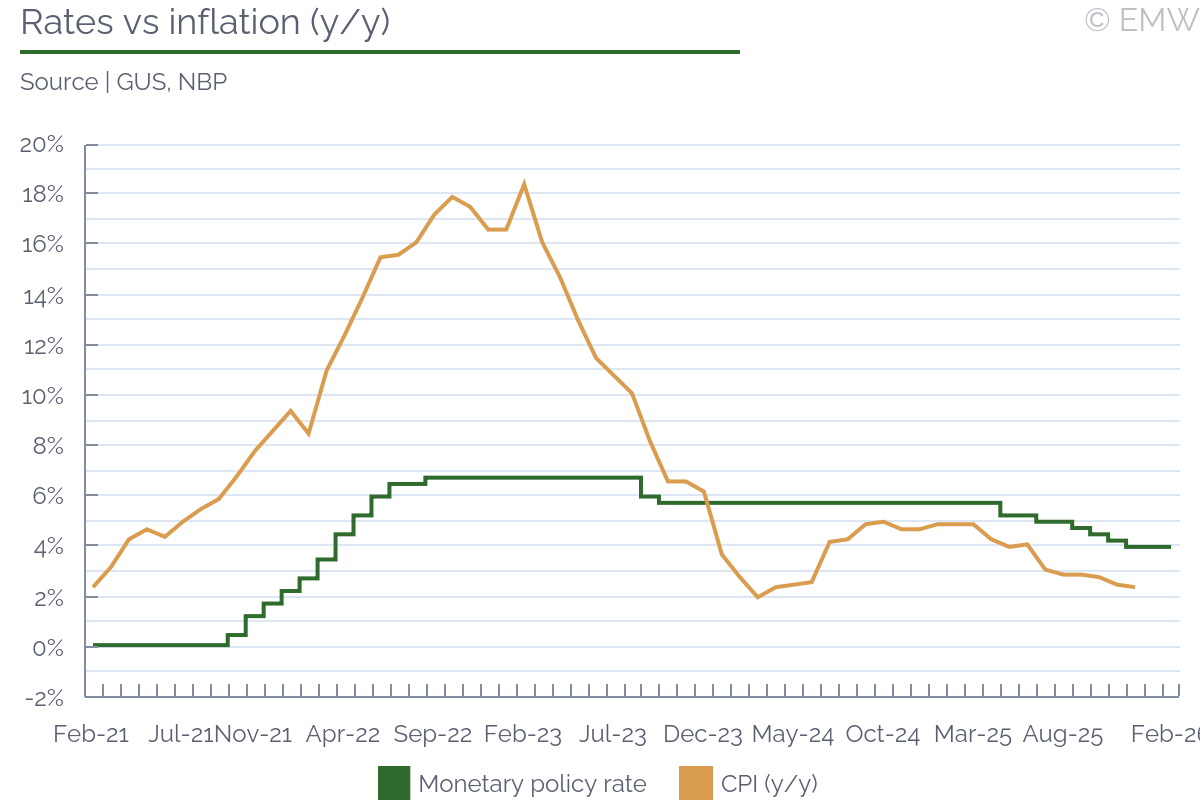

| MPC holds rates, but publishes dovish post-sitting statement |

|

| Poland | Feb 04, 15:23 |

|

- MPC says that inflation is likely to decrease in Q1, setting stage for March cut

The Monetary Policy Council held interest rates Wed. in a decision that matched the consensus, though defied a sizeable minority expecting a 25-bp cut, and published a post-sitting statement that was mostly the same as that published when it held rates in January with the exception that it contained a dovish outlook. The MPC indicated that it did not get updated CPI inflation data, and again noted that CPI inflation slowed to 2.4% y/y in December from 2.5% in November, as was already available for the January sitting [the stats office updates its basket once a year and changes its publication scheduled in Jan and Feb]. But whereas in January, the MPC only noted that core inflation was likely to have slowed in December, the MPC said in February that incoming information suggested that CPI inflation might decrease in Q1 2026 and remain at a level consistent with the NBP inflation target in the coming quarters. The MPC likewise said that GDP growth in 2025 was reported at 3.6%, which it said signalled that economic growth in Q4 2025 was probably close to that observed in Q3 2025 (3.8% y/y). It added that data from the labour market indicated that, despite an increase in December, wage growth in the enterprise sector slowed down over the course of the previous year. This was accompanied by a fall in employment in this sector, it said. Wage growth did rise in December, and we believe that probably worked against a cut in March, though the MPC does not seem very upset about it. The MPC comment on the outlook contained all the same factors as listed in January. It thus said its future policy will rely on incoming information on prospects for inflation and economic activity with risk factors listed as fiscal policy, the expected recovery of demand, further developments in wage growth, and the macroeconomic situation abroad, including changes in global commodity prices and inflation. To note, as in January, it dropped energy prices as a risk factor. Overall, the inclusion of the statement on the positive inflation outlook likely sets the stage for the MPC to cut rates again at its next policy sitting on Mar 3-4 even though the council will have only partial, preliminary inflation data for January (the final January and February inflation release won't come until Mar 13). But the MPC will have the updated CPI and GDP projections that will also extend the policy horizon to 2028. The new projection for 2026 is bound to be at least 0.4pp lower than the existing November one since the latter included a much higher power tariff. It can't be ruled out that some event will lead to a delay in the cut to April, but we believe there is a much stronger likelihood of the council cutting in March. |

|

|

|

| Loan demand to rise in Q1 2026 - NBP |

|

| Poland | Feb 04, 14:37 |

|

- Demand to grow for corporate, housing, and consumer loan segments in Q1

Banks expect to ease lending policies only for corporate loans in Q1 2026, but demand is expected to rise for the key sectors of corporate, housing, and consumer loans, according to the NBP's Senior Loan Officer Survey for Q1 published on Mon. The NBP noted that in Q4 banks eased lending criteria for most types of loans with the exception of consumer loans driven by increased competitive pressure from other banks. For Q1, it said that banks do intend to ease lending criteria for corporate loans but to maintain the current criteria for other types of loans. For corporate loans, lending criteria was eased in Q4 due to competitive pressure, with loan margins and non-interest costs of credit decreased and the maximum loan amount raised. Demand was unchanged in Q4 on the part of SMEs, but it rose for large enterprises as a result of increased demand for financing of working capital and fixed assets. For Q1, lending policies are to be eased and demand is to increase, especially on the part of large enterprises. In housing loans, Q4 saw lending policies eased also because of increased competitive pressure, but also because of lower NBP interest rates. Loan margins were reduced as well. Demand did actually fall slightly due to the deterioration of the economic situation of households and increased use of alternative sources of financing. Going to Q1, banks expect current lending policies to be maintained, though they do expect higher demand. Consumer loans saw no noticeable change in lending policies in Q4, though they did see an easing of most lending conditions due to competitive pressure and NBP rate cuts. Demand rose, partly due to increased demand for financing the purchase of durable goods and a decrease in the use of alternative sources of financing. For Q1, no changes in lending policy are expected, but demand is expected to continue to grow. | Senior Loan Officer Survey | | Item | Q4 2025 | Q1 2026 | | Corporates | Lending criteria eased, demand flat but for large firms | Lending policies to be eased and demand to grow, esp. for large firms | | Housing | Policy standards eased, but demand fell slightly | Lending policies to be maintained, demand to rise | | Consumer | No major changes, though lending terms ended; demand rose | Lending policies to be maintained, demand to rise |

| | Source: NBP Senior Loan Officer Survey |

|

|

|

|

| Glapinski, PM Tusk, and President Nawrocki said to be working on NBP mgmt deal |

|

| Poland | Feb 04, 14:24 |

|

- Three of 8 NBP Management Board members' terms expire in 2026

- This group includes Glapinski's right-hand and First Deputy Governor Kightley

- MPC's Litwiniuk said to want to join board

NBP head Adam Glapinski, PM Donald Tusk, and President Karol Nawrocki are reported to be in the midst of talks to agree on several coming replacements to the NBP's Management Board, the broadcaster TVN24 reported Wed. Glapinski leads the 8-strong board, all of whose members were named during the previous Law and Justice (PiS)-led rule. This group includes Glapinski's right-hand Marta Kightley, who is the first deputy governor of the NBP and whose term expires on Mar 8. Prior reporting suggested that Glapinski was willing to soften the Monetary Policy Council's view of the 2026 budget in return for support for Kightley from Tusk, who must countersign any nomination to the NBP Management Board that comes from the president. Another board member's term expires on Mar 1 (Piotr Pogonowski) and yet another on Nov 4 (Adam Lipinski, former close ally of PiS leader Jaroslaw Kaczynski). TVN24 reported that talks were expected to continue for some time. Glapinski was said to want Kightley to stay on the board. The report was too that MPC member Przemyslaw Litwiniuk wants to join the board. Litwiniuk's MPC term doesn't expire until Jan 26, 2028. He was named by the Senate, which is dominated by the ruling coalition (who would name his replacement if he were to leave early). If Tusk doesn't agree and no one replaces the board members, the board can operate with only 6 members, but once Lipinski's term expires in November there would not be enough members for a quorum. Overall, TVN24 presented the news as potentially leading to an "unprecedented" deal between Tusk, the leader of the senior ruling Civic Coalition (KO), Glapinski, who has always been close to PiS, and Nawrocki, the PiS-backed president popular among young far-right voters. It is unclear how far the deal will go, but it wouldn't be surprising to see Kightley renamed and then the other board positions involve some kind of compromise. One can, however, never rule out a political fight over this issue, particularly as the KO-led ruling coalition does like to point to alleged politicization at the NBP under the reign of Glapinski. That said, Glapinski has not been as dismissive of the government in recent monthly press conferences and perhaps he has been trying to get Kightley renamed. To note, if she is re-appointed, Kightley will become a leading candidate to succeed Glapinski in June 2028 since the NBP governor is nominated by the president, but must win an absolute majority in the Sejm (though her ultimate fate would depend on the Sejm to be elected in the autumn 2027 elections). Another final note is that a deal on this issue might make further progress in the State Tribunal case against Glapinski less likely. | NBP mgmt board | | Name | Position | Date appointed | Term expiry | Political ties | | Adam Glapinski | Governor | Jun. 22, 2022 | Jun. 22, 2028 | PiS | | Marta Kightley | 1st deputy governor | Mar. 8, 2020 | Mar. 8, 2026 | PiS | | Adam Lipinski | Deputy governor | Nov. 4, 2020 | Nov. 4, 2026 | PiS | | Piotr Pogonowski | Board member | Mar. 1, 2020 | Mar. 1, 2026 | PiS | | Marta Gajecka | Board member | Jan. 1, 2021 | Jan. 1, 2027 | PiS | | Pawel Mucha | Board member | Sep. 1, 2022 | Sep. 1, 2028 | PiS | | Rafal Sura | Board member | Jul. 28, 2022 | Jul. 28, 2028 | PiS | | Pawel Szalamacha | Board member | Oct. 12, 2022 | Oct. 12, 2028 | PiS | | Artur Sobon | Board member | Dec. 6, 2023 | Dec. 6, 2029 | PiS |

| | Source: NBP |

|

|

|

|

| | Potential change of budget due to veto of alcohol and sugar tax moves |

|

| Poland | Feb 04, 14:04 |

|

Question: What happened to this in the end? Will the excise taxes be fixed in 2026 in the end? The question was asked in relation to the following story: FinMin says alcohol and sugar tax vetoes won't prompt 2026 budget changes Answer: There is no word about any fixing of the budget and I think the FinMin will just deal with the shortage, which isn't necessarily big at PLN 3bn or so. But it was known the president would likely veto these bills right from the beginning and so I have a feeling too that either the FinMin has created a reserve for this money or factored the fact that it wouldn't likely show up in the end. For political reasons, the FinMin wanted to underscore how the president's vetoes are undermining public finances even though the president slams the government for a high deficit. As for inflation, the thing to keep in mind is that the previous Law and Justice (PiS) government passed a long-term hike to the excise tax for alcohol and it is still due to rise by 5% in 2026 according to that schedule. For comparison, the government wanted to raise it by 15%. The excise on alcohol has been rising by 5% for the past couple of years, and it looks like this usually ups prices by about 1% in January and February as companies digest the rest of the increase. There will thus be a very slight rise, though my calculations show 0.1pp or so. The sugar levy wasn't supposed to rise, however, and so the lack of an increase will mean there is no inflation impact. In terms of excise, however, there is also a 20% hike of the excise on cigarettes on Jan 1. That followed the 25% rise in 2025 that went into effect on Mar 1, 2025. There was a steady hike in tobacco inflation last year that started before the hikes went into effect and saw 2.1% m/m and 2.6% m/m in Jan and Feb to 1.0-1.9% m/m increases for most months. The increase in 2026 will thus likely be spread out, but looks likely to add some 0.2pp to inflation or so. |

|

|

|

| Vehicle registrations fall 7.1% y/y in Jan |

|

| Poland | Feb 04, 13:51 |

|

- Registration declines compared with a big 21.6% y/y rise in Dec

- Registrations fall 40.1% m/m to 45,691 units in Jan from 76,290 units in Dec

- Samar lifts 2026 forecast and now expects 5% increase

Polish passenger car and light commercial vehicle (LCV) registrations fell 7.1% y/y to 45,691 units in January from 49,171 units the year before, according to data published Wed. by the car-market monitoring company Samar. The January total fell a sharp 40.1% m/m from 76,290 units in December. The company noted that January registrations traditionally fell from December levels due to lower institutional activity at the beginning of each year that in turn results from larger corporate purchases made by companies in the final quarter of the preceding year. Among passenger cars, institutional buyers comprised 63% of the market in January vs. 37% for individuals. Samar added that the December result was a record high, and significant demand in late 2025 might have been due to regulations that went into effect in 2026 that linked the depreciation limits for company cars to CO2 emissions. But it noted that Chinese autos continued to do well with a 10.2% market share (down from 14.5% in December but above the 8.2% share in 2025). In the breakdown, passenger car registrations fell 9.0% y/y to 40,284 units, which marked a 40.6% m/m fall. LCV registrations rose 9.8% y/y to 5,407 units in January in a total that marked a 36.5% m/m decrease. For 2026, Samar has increased its forecasts. It now expects passenger car registrations to rise to 625,000 in 2026, previously seeing 605,000-610,000. LCV registrations are to rise to 74,000, the target up from the previous 72,000-73,000. The new total is total registrations of 699,000, compared with 677,000-683,000 before. Samar's new full-year forecast would deliver a 4.7% rise for 2026, up from 1.4-2.3% before. Overall, vehicle registration totals continue to be relatively strong, reflecting corporate strength above all, but also the increasing penchant to buy lower cost Chinese cars. This general trend is expected to keep up in 2026, which is a year expected to see relatively fast GDP growth. Still, nominal GDP is seen rising some 6-7% this year and so the registration total looks to be slightly shy of that. | Car and LCV registrations | | Jan-25 | Aug-25 | Sep-25 | Oct-25 | Nov-25 | Dec-25 | Jan-26 | | Car registrations | 49,171 | 47,299 | 55,562 | 59,254 | 54,977 | 76,290 | 45,691 | | Change (m/m) | -21.6% | -15.3% | 17.5% | 6.6% | -7.2% | 38.8% | -40.1% | | Change (y/y) | 3.7% | 13.0% | 18.1% | 9.7% | 0.0% | 21.6% | -7.1% |

| | Source: Source: PZPM, Samar |

|

|

|

|

| | MPC holds key rate by 25bps at 4.00%, as mostly expected |

|

| Poland | Feb 04, 13:42 |

|

- Post-sitting statement to be published at 16:00 CET

- Glapinski to hold his presser on Thurs. at 15:00 CET

Poland's Monetary Policy Council decided Wed. to hold its key rate at 4.00% and though that matched the consensus expectation, a strong minority had expected another 25-bp cut, according to a statement. The MPC will publish its post-sitting statement at 16:00 CET. MPC head Adam Glapinski will give his monthly press conference on Thurs. at 15:00 CET to further explain the move beyond the usually brief post-sitting statement.  Overall, the MPC cut rates by 25bps in December, bringing to 175bps its reduction in 2025 and then indicating that it would take a pause in order to gauge the impact of its reductions and see where inflation goes in early 2026. But CPI inflation came in lower than expected in December, energy prices ceased to be an inflation threat, and that led some MPC members to say that February might see another reduction even though there is no new CPI inflation data. Statistics Poland (GUS) changes its release schedule early in the year while it updates the CPI basket, the new version of which will be released in mid-March. Those changes see no publication of flash inflation releases, meaning today's meeting was held with only the December data that the MPC had already for the January meeting that led to a rate hold. GUS will also publish only partial, preliminary inflation data for January, which will be out for the March sitting (held before the release of the new basket). Glapinski's comments on Thurs. will be key in determining the outlook, but, like many, we think the MPC will be in position to cut in March despite the fact it will not have full inflation data, but as the inflation and GDP projections will be updated for that sitting. That is because inflation is at the target and expected to stay there. There is also the lack of a big energy price spike that means the November inflation projection -- which was based on a no-policy outlook -- is over-estimated by maybe 0.4-0.5pp. Though economic activity is expected to pick up this year, much of that is due to higher investment. Still, Glapinski's comments on Thurs. will be key for the outlook, which is likely to see at least 50bps cut this year, but whether there is more or less will very much depend on the council's updated stance. | NBP interest rates | | Feb-23 | Feb-24 | Feb-25 | Nov-25 | Dec-25 | Jan-26 | Feb-26 | | Reference rate | 6.75% | 5.75% | 5.75% | 4.25% | 4.00% | 4.00% | 4.00% | | Lombard rate | 7.25% | 6.25% | 6.25% | 4.75% | 4.50% | 4.50% | 4.50% | | Deposit rate | 6.25% | 5.25% | 5.25% | 3.75% | 3.50% | 3.50% | 3.50% | | Rediscount rate | 6.80% | 5.80% | 5.80% | 4.30% | 4.05% | 4.05% | 4.05% | | Discount rate on bills of exchange | 6.85% | 5.85% | 5.85% | 4.35% | 4.10% | 4.10% | 4.10% |

| | Source: NBP |

|

|

|

|

| Energy minister notes seasonal heating prices can rise 10% in Dec and Jan |

|

| Poland | Feb 04, 12:36 |

|

- Poland has been hit by a cold spell of late

Energy Minister Milosz Motyka noted Wed. that though district heating costs are restricted by regulated tariffs, other prices can fluctuate a lot during the winter rising by as much as 10% in December and January before falling in February, according to comments made to public radio. In the wake of very cold weather that has hit Poland of late, Motyka said he doesn't expect a sharp increase in heating costs, and he noted that natural gas prices had fallen by 10% in recent days compared with the previous month. When asked if the government was preparing any special program to counter any rise in heating costs, he recalled that the government had already passed the heating voucher system for low-income district heating clients. Motyka also said that the energy system had performed well despite record gas and power consumption of late due to the cold. The minister added that Poland had a diversified energy mix that guaranteed energy security. On Feb 3, the national power system noted the highest ever demand, which was met by record power generation as well. Overall, heating prices were capped in the previous heating season, but these measures were lifted at end-June 2025. That led some heating prices to rise sharply, which prompted the government to launch the voucher system, though this is relatively minor. The very cold weather seen in Poland of late will no doubt hit some people hard, especially as there are many different sources of heat, from coal to peat to wood burning to gas and electricity for heat. Heating prices did also rise more than they had in recent years in September and October, though these gains have waned in the past two months. This factor will thus be something to watch going to January and February and the potential impact on inflation. |

|

|

|

| Turkey |

|

| Government advances bridge and highway privatisation plans |

|

| Turkey | Feb 05, 09:09 |

|

- Government tasks Ernst&Young on 15 July Martyrs, FSM bridge rights

- Plan spans nine toll highways and government brings BTY Group for technical work

The government reportedly moved forward with preparations to privatise the operating rights of two landmark Bosphorus crossings in Istanbul and a wider portfolio of toll-road assets, Bloomberg claimed, citing anonymous officials familiar with the matter. For this purpose, the government mandated Ernst&Young to advise on the potential sale of the operating rights for the 15 July Martyrs Bridge and the Fatih Sultan Mehmet Bridge, the portal added. The scope also covered at least nine toll highways and Canada-based BTY Group has been appointed as the technical adviser for the sale process, the same report indicated. Authorities planned to launch the formal tender process later in the year, while official sources have not yet confirmed the plans at the time of publication, Bloomberg noted. The same claims were also made as of September, we remind. As we have previously emphasised, we regard this initiative as highly probable, particularly given the trajectory outlined in the recent medium-term programme, which anticipated privatisation receipts for 2026 to be around TRY 185bn, approximately USD 4.25bn at present valuations. Notably, this figure stands in stark contrast to the annual average of TRY 34.5bn observed in recent years. |

|

|

|

|

| Turkey | Feb 05, 06:14 |

|

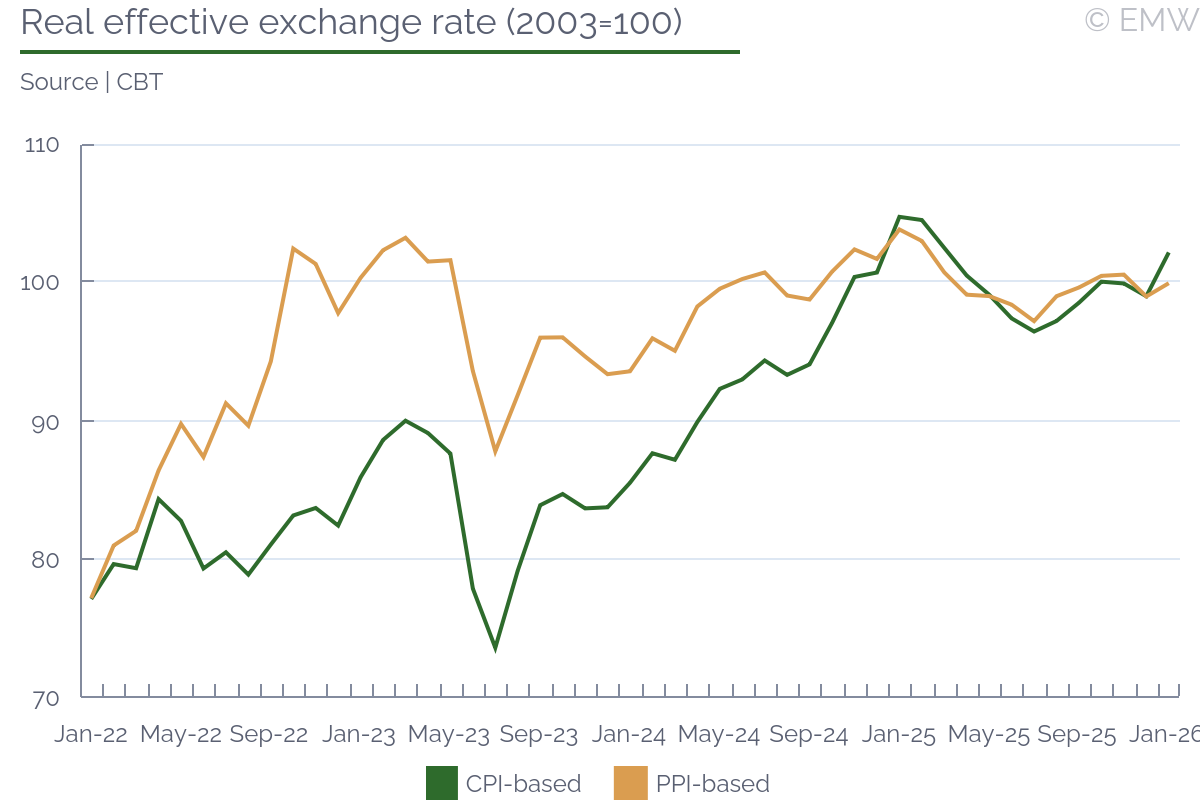

Turkey without terrorism report to be submitted to Parliament Speaker's office soon (Hurriyet) MHP MP Yildiz on former pro-Kurdish HDP co-chair Demirtas: We must abide by decisions of ECHR and constitutional court (Hurriyet) President Erdogan continues his middle east trip in Egypt (Hurriyet) CPI-based REER index rises to 102.17 in January (Sozcu) Turkish products are cheaper in German supermarkets than in Turkey (Sozcu) Turkish competition authority launches Android investigation into Google (Sozcu) FinMin Simsek: Economic program enters its final stage (Sozcu) Turkey's automotive sector continues its momentum: Exports record-breaking January (Sozcu) Price gouging inspections at chain supermarkets before Ramadan (Sabah) Stock market operation is centred in Istanbul and spanning eight provinces: 22 suspects arer detained (Sabah) President Erdogan on US-Iran tensions: We are ready to play facilitating role (Sabah) |

|

|

|

| | Peace commission nears final vote as right-to-hope clause enters text |

|

| Turkey | Feb 04, 16:28 |

|

- Commission finalises joint report endorsing right to hope consensus next week

- Parliament must enact laws to extend right to hope to PKK leader Ocalan

- Implementation affects multiple high-profile cases including Demirtas, Kavala, Yuksekdag

The cross-party commission report on the renewed Kurdish peace process was expected to be finalised the following week and the parties reached alignment on the 'right to hope' and that the text would include this element, MHP deputy chair Feti Yildiz stated following the meeting of the National Solidarity, Brotherhood and Democracy Commission's drafting group. He also said the commission did not face any serious political fracture lines and that the last meeting will complete the wording, move the document to a vote and then forward it to the speaker of the parliament. The commission planned to convene again in the coming days to give the report its final form, hold the vote and submit the outcome to the Assembly Presidency, the media noted. The report will recommend compliance with European Court of Human Rights rulings, Yilmaz said, a remark that came amid heightened debate after MHP leader Devlet Bahceli's recent comments on the right to hope and calls linked to the release of former HDP co-chair Selahattin Demirtas, we note. Stronger compliance line on Strasbourg jurisprudence could carry broader legal and political implications, since any shift that materially affected the Demirtas file could also intensify inspection around other high-profile detention and conviction cases, including those of Figen Yuksekdag and Osman Kavala, the media talks underlined. The right to hope framework rested on ECHR case law addressing life sentences without a realistic prospect of release, originating from the 2013 Vinter judgment against the UK, we remind. The court held that irreducible life imprisonment without a review mechanism breached Article 3 of the Convention, requiring a structured review of detention after a defined period, with legal commentary frequently referencing a review point around 25 years alongside periodic reassessment of release conditions. In Turkey's context, PKK leader Abdullah Ocalan's 1999 was subject to a death sentence converted into aggravated life imprisonment after the abolition of capital punishment in 2002, while subsequent legislative arrangements limited access to conditional release for certain categories of offences tied to state security and organisational activity. However, ECHR judgments found violations in relation to the absence of a release prospect and detention conditions at the Imrali prison, media-cited legal assessments said, yet Turkish authorities did not implement those rulings. To the best of our knowledge, enabling the right to hope for such cases would have required legislative action by the Parliament. At that stage, it remained unclear whether implementation would necessitate a constitutional amendment. Were this to be the case, the process would have demanded a supermajority of 400 votes, implying a breadth of cross-party consensus that was not apparent at the time, in our assessment. |

|

|

|

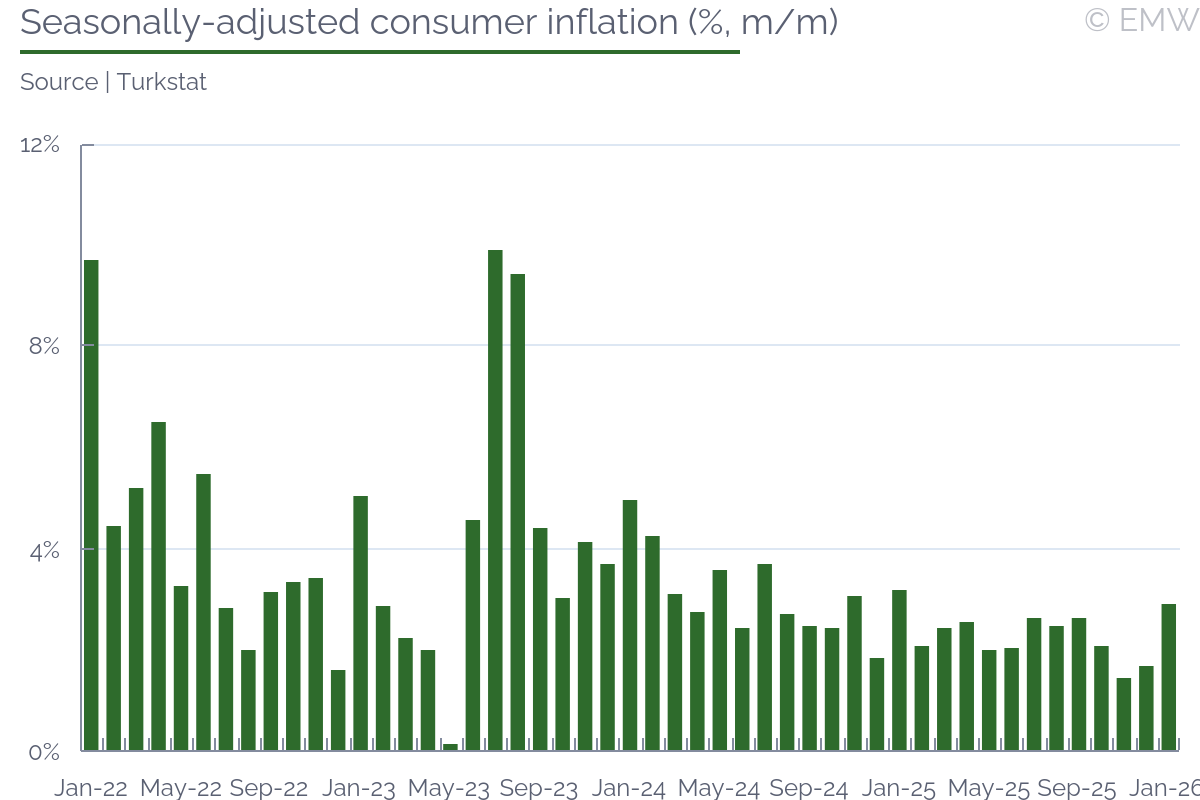

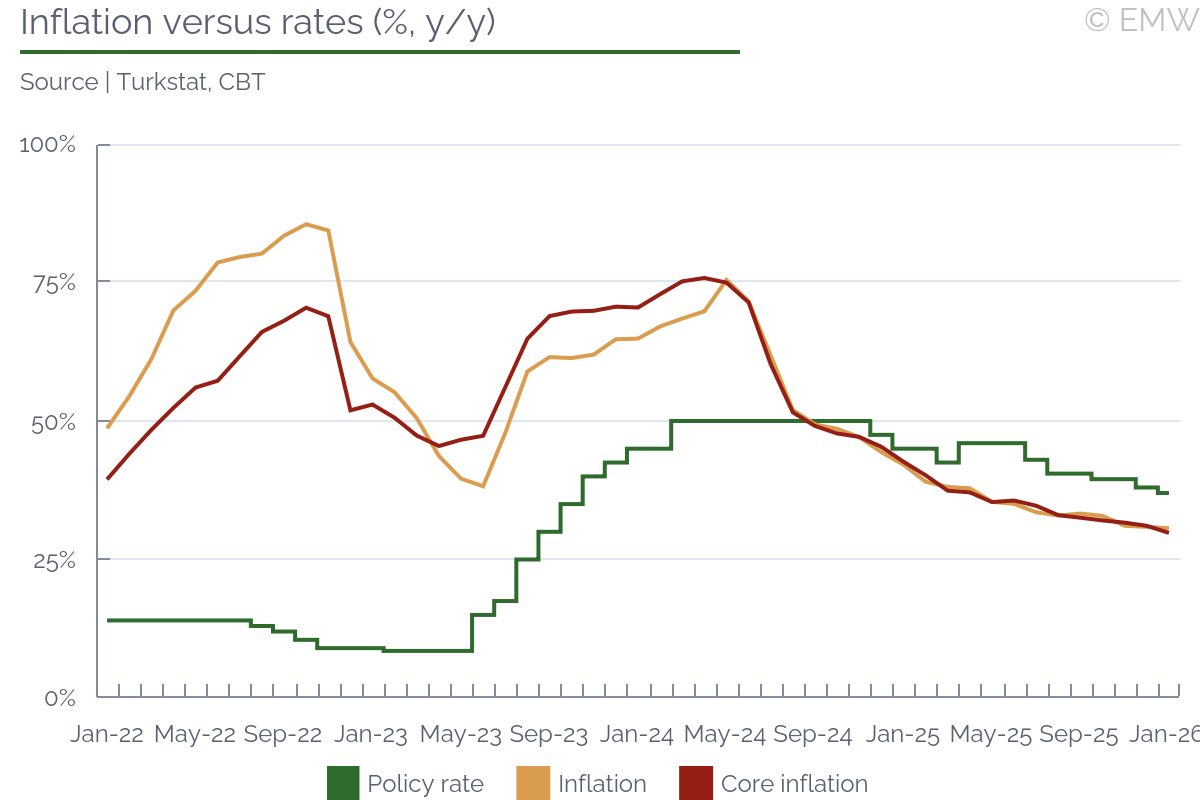

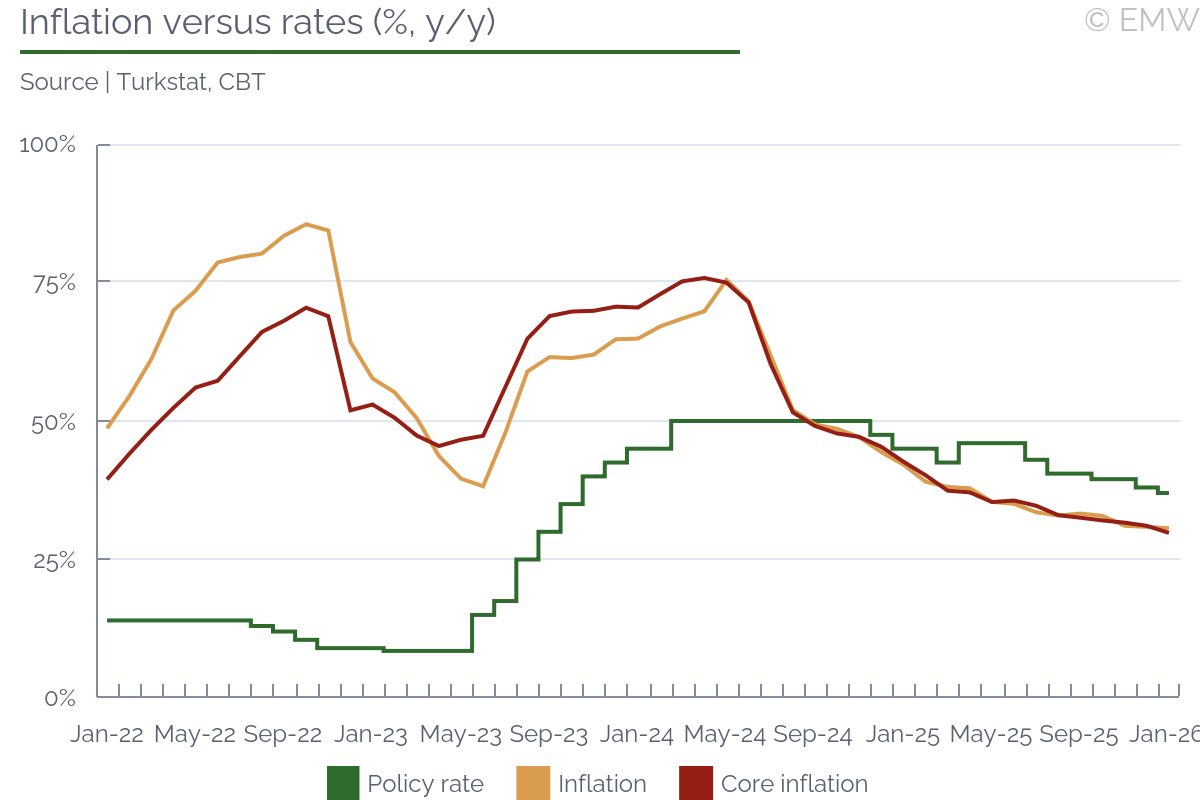

| Services inflation spikes while core goods inflation moderates – CBT |

|

| Turkey | Feb 04, 15:40 |

|

- Services inflation climbs by 7.4% m/m, carries larger weight in index with Turkstat's recent revision

- Food inflation rises as vegetables and meat prices climb sharply higher