|

|

| Middle East and Africa Morning Review | Feb 5, 2026 |

|

| This e-mail is intended for Sample Report only. Note that systematic forwarding breaches subscription licence compliance obligations. Open in browser | Edit Countries on Top |

|

| Large EMs |

|

| Egypt |

|

|

|

|

|

|

|

| Nigeria |

|

|

|

|

|

| Middle East & N. Africa |

|

| Israel |

|

|

|

|

|

|

| Jordan |

|

|

| Lebanon |

|

|

|

|

|

| Morocco |

|

|

|

| Oman |

|

|

| Saudi Arabia |

|

|

| Tunisia |

|

|

|

|

|

|

| Sub-Saharan Africa |

|

| Angola |

|

|

|

| Ethiopia |

|

|

|

|

| Gabon |

|

|

| Ghana |

|

|

|

|

| Ivory Coast |

|

|

| Kenya |

|

|

|

| South Africa |

|

|

|

|

| Uganda |

|

|

| Zambia |

|

|

|

|

|

|

|

|

| Egypt |

|

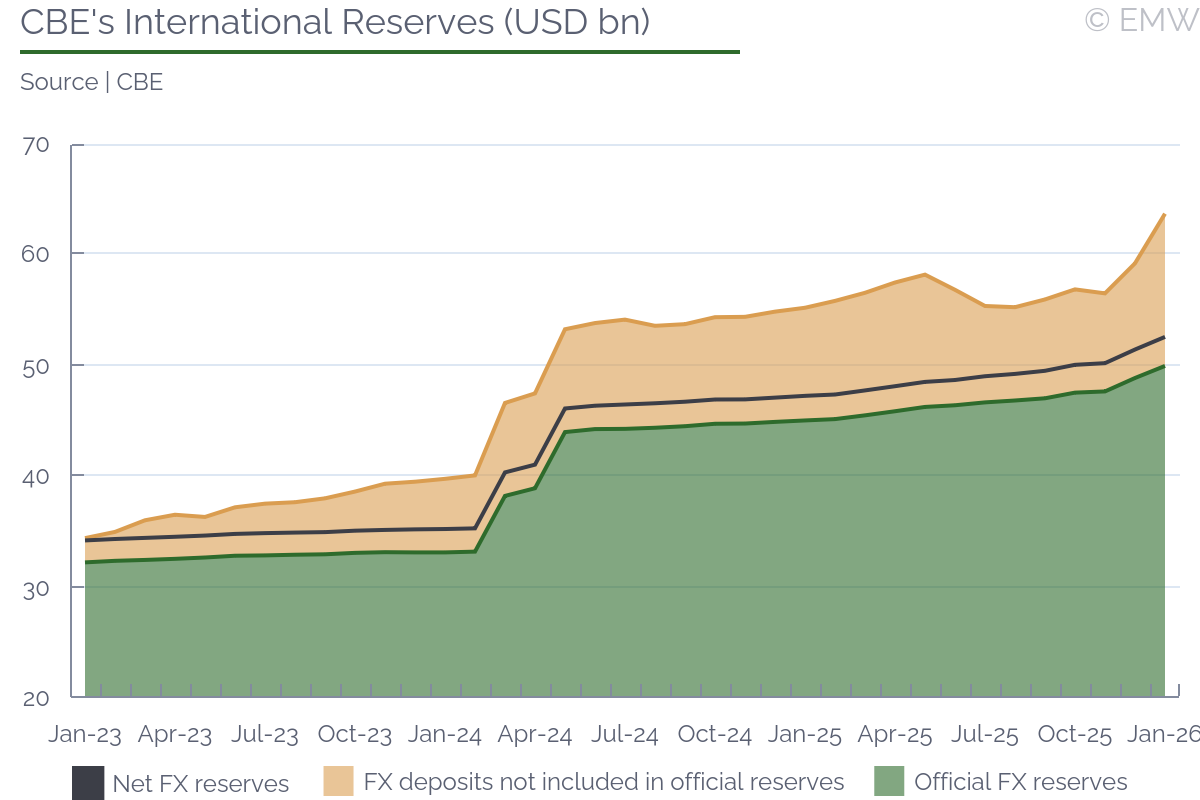

| Net FX reserves rise strong 2.2% m/m to USD 52.6bn as of end-January |

|

| Egypt | Feb 05, 12:07 |

|

- CBE's FX deposits in domestic banks, which are available as a source of FX liquidity, rose strong 33% m/m to USD 13.7bn

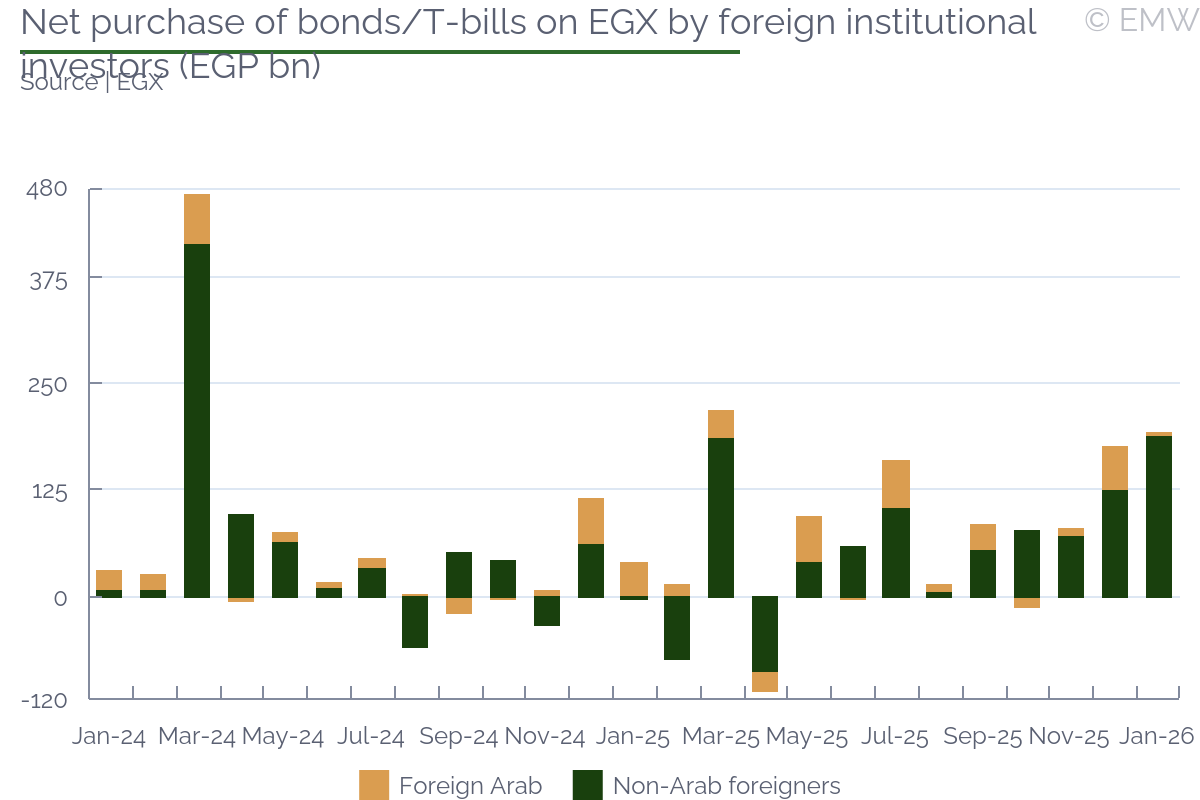

- Egypt received EUR 1.0bn tranche from EU in January, portfolio inflows surged that month

- Pound has appreciated since April 2025 due to strong remittances and portfolio inflows, robust tourism arrivals

- Foreign funds have been mostly net buyers of T-bills despite regional and global uncertainty

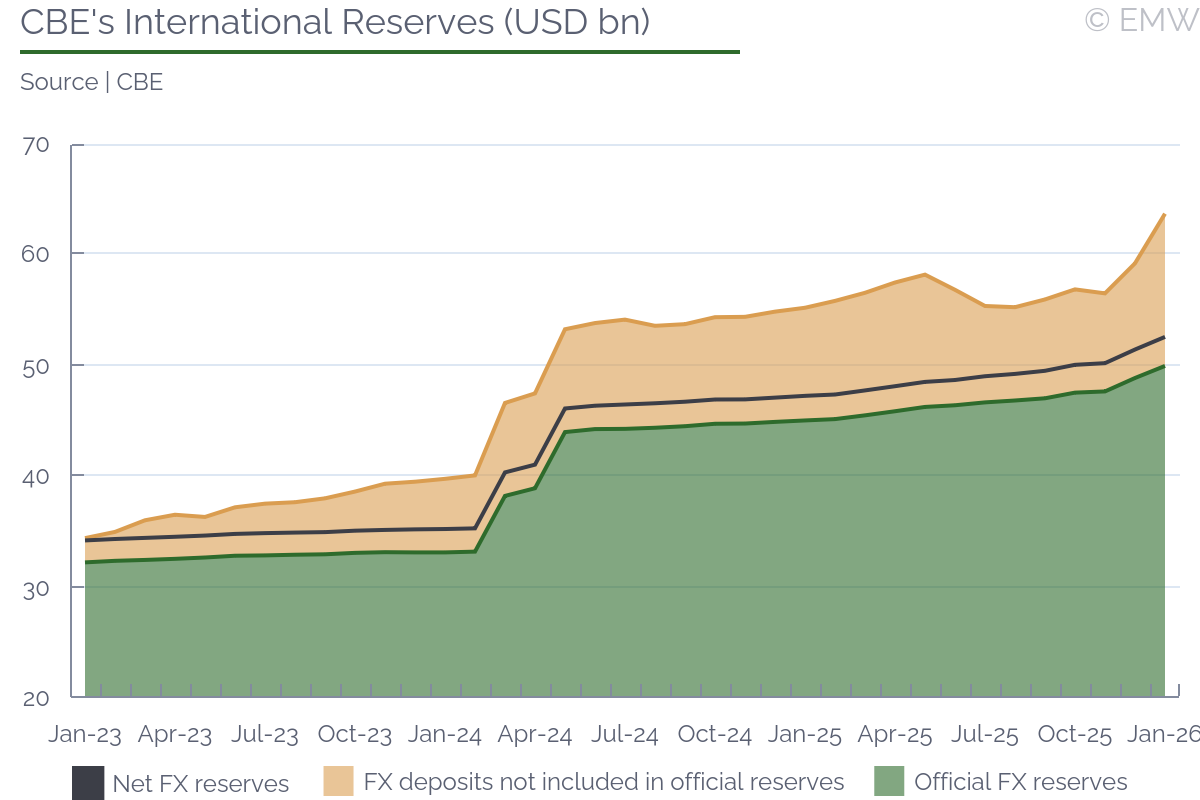

Egypt's net international reserves rose by USD 1.1bn or 2.2% m/m to record-high USD 52.6bn as of end-January, the central bank reported. The m/m increase was mostly due to Gold reserves (+USD 2.6bn, reflecting soaring prices), Currency and Deposits (+USD 1.3bn) and Securities (+1.0bn), while Reserve assets other than derivatives and loans to nonresident banks fell by USD 3.9bn. Egypt recorded another strong month of portfolio inflows in January and the EU disbursed an EUR 1bn tranche that month, whcih supported FX accretion. We note that FX reserves have surged since early 2024 after Egypt received USD 24bn in a massive real estate deal with the UAE, while long-delayed currency reform helped the government secure USD 8bn IMF financing and additional funds from development partners. Portfolio investors rushed in to buy short-term debt attracted by high nominal interest rates and improved FX liquidity. Foreign funds have bought around USD 38bn worth of T-bills and bonds on EGX's secondary market and another USD 8-10bn directly from the banks (not accounting for roll-overs and maturities), the latter boosting the foreign assets of the commercial banks and resulting in a surplus of the banks' NFAs for the first time in two years. Meanwhile, CBE's FX deposits in domestic banks, which are available as a source of FX liquidity, rose by sharp 33% m/m to USD 13.7bn at the end of the review month. We usually attribute the movement in this FX position to portfolio flows, and the increase in January aligns with the strong inflows reported by the stock exchange.  Egypt and the IMF reached staff-level agreement in December on the fifth and sixth reviews of the USD 8bn EFF program. The IMF Executive Board is expected to approve the reviews by the end of February, which will unlock USD 2.5bn tranche and will bring total disbursements under the program to USD 5.7bn. Separately, Egypt expects to receive another USD 1.3bn disbursement from the IMF's resilience and sustainability package. Meanwhile, the pound has continued to appreciate, partly due to surging portfolio inflows, strong remittances and tourism arrivals, and partly due to US policies aimed at weakening the USD. Analysts have turned more optimistic on the Egyptian pound, with many expecting it to remain broadly stable throughout the year despite anticipated interest rate cuts by the CBE and the large external debt payments due over the medium term. | Projected External Debt Service (USD mn) | | H2 2025 | H1 2026 | H2 2026 | H1 2027 | H2 2027 | | Projected MT and LT Public & Publicly Guaranteed External Debt Service | 11,471 | 18,158 | 14,182 | 8,666 | 10,191 | | Principal | 8,221 | 15,015 | 11,611 | 6,235 | 8,088 | | Interest | 3,251 | 3,143 | 2,571 | 2,430 | 2,103 | | Projected MT and LT Private Sector Non-Guaranteed External Debt Service | 279 | 303 | 439 | 391 | 308 | | Principal | 195 | 221 | 369 | 325 | 254 | | Interest | 84 | 82 | 70 | 66 | 54 | | Projected Short-Term External Debt Service | 14,113 | 17,822 | - | - | - | | Principal | 13,700 | 17,215 | - | - | - | | Interest | 412 | 608 | - | - | - |

| | Note: Projections made as of Jul 1, 2025 and using that FX rate | | Source: CBE's quarterly external report |

|

|

|

|

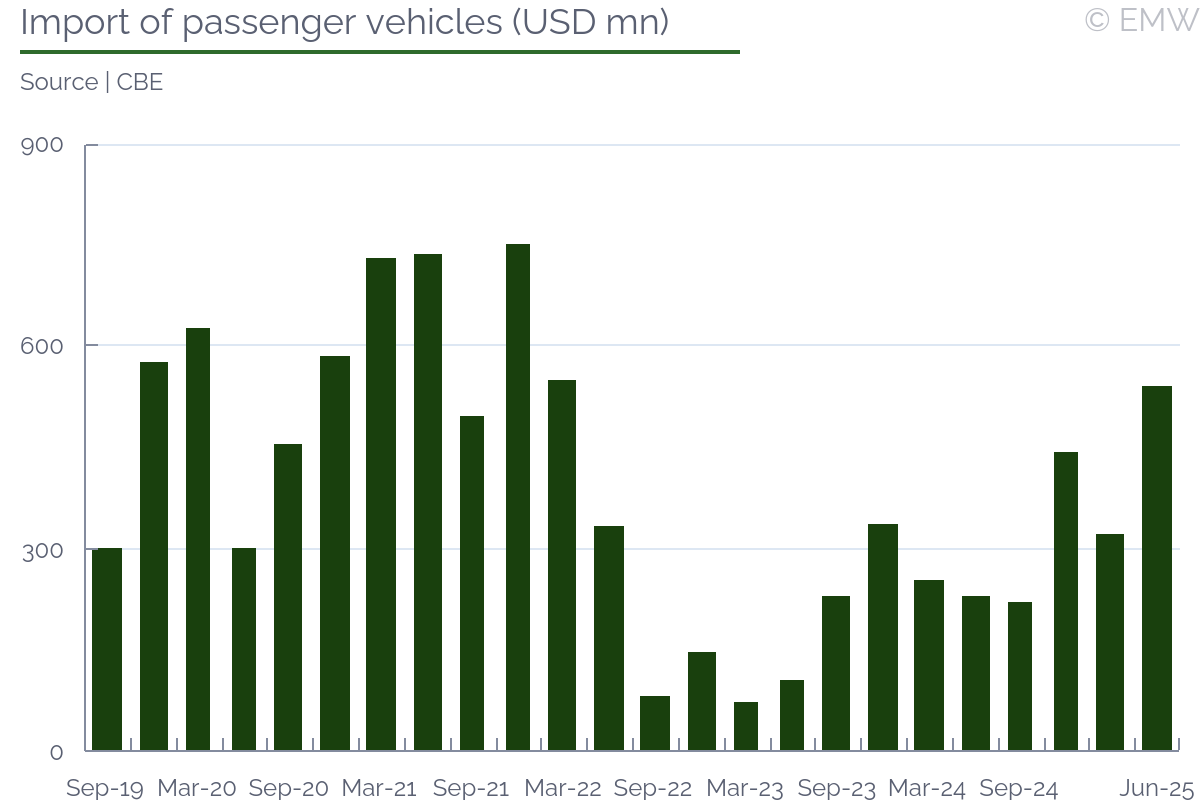

| Passenger car sales rise 6.7% m/m to 13.6k units in December |

|

| Egypt | Feb 05, 07:48 |

|

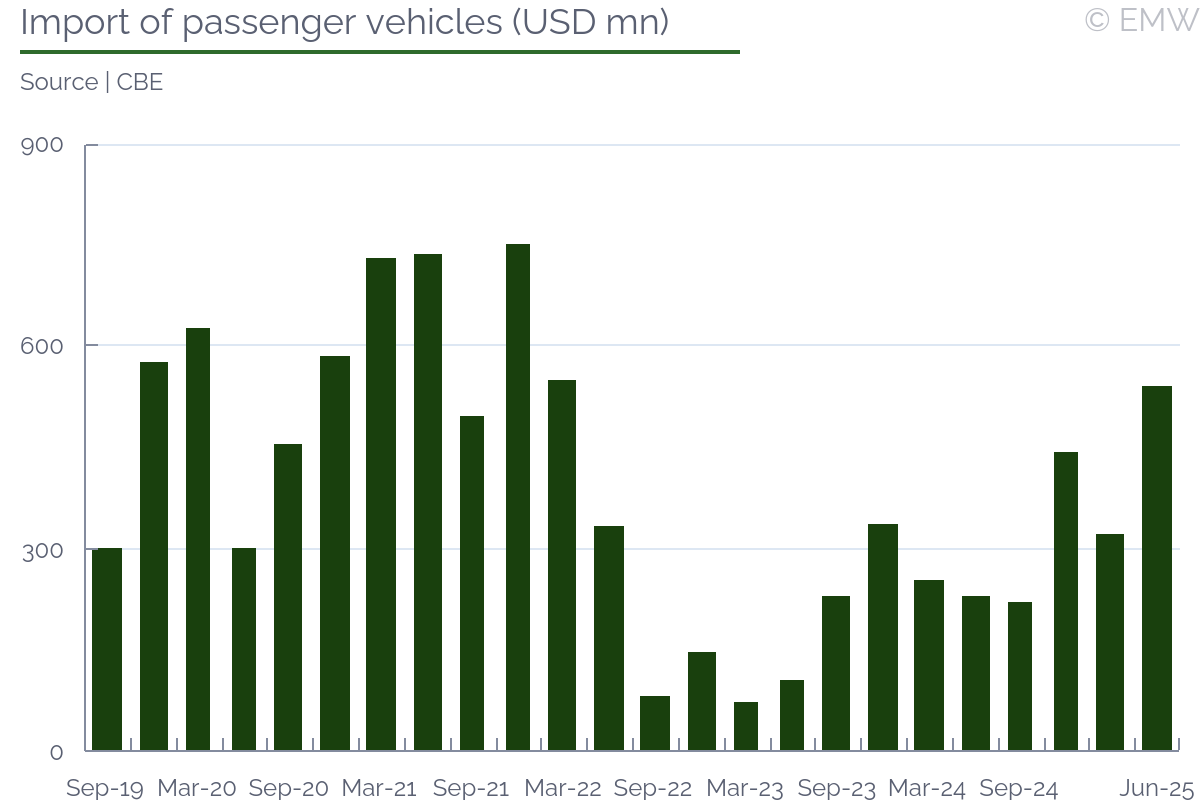

- Passenger car sales have recovered due to improved FX liquidity, growing confidence

- Egypt has announced a series of international deals to localize auto production

The number of passenger cars sold rose by strong 6.7% m/m to 13.6k units in December following a weaker increase of 1.2% m/m in the preceding month, according to local newspapers citing data from the Automotive Information Council (AMIC). AMIC is an industry association, which only reports data submitted by its member car dealerships. This is highest volume of sales since March 2022 - the second and the third largest ones were also recorded in 2025 - and continues the market's recovery streak, which has been building steadily since early 2025. In y/y terms, passenger car sales rose by sharp 28% following a 50% jump in the preceding month. Truck sales also rose robustly on the month (up 9% m/m), while bus sales fell by 15% m/m. Consequntly, total auto sales rose by strong 6.0% m/m quickening from a 3.1% m/m increase in the previous month.  The passenger car sales have been on a path of strong recovery since mid-2024 as FX liquidity and consumer confidence improved and FX uncertainty eased following a major currency reform. Further, the CBE has reportedly cleared most of the FX backlogs that had dragged on imports in recent years. Egypt has also over the past year announced a series of international deals to localize the production of automobiles, including e-vehicles. Meanwhile, the local press reports of a sustained drop in car prices on the domestic market. Local analysts attribute the sharp drop to a correction that follows years of overpricing. The recent pound appreciation should have also driven the prices of newly imported cars down, forcing car dealers to further cut prices across their inventories. | Auto sales (units) | | Oct-25 | Nov-25 | Dec-25 | | Passenger cars | 12,600 | 12,750 | 13,610 | | Bus sales | 1,200 | 1,295 | 1,105 | | Truck sales | 2,500 | 2,755 | 3,010 | | Total sales | 16,300 | 16,800 | 17,800 | | Total sales (y/y) | 69.8% | 55.6% | 37.4% |

| | Source: AMIC, local news reports |

|

|

|

|

| Egypt, Turkey set USD 15bn trade target by 2028 |

|

| Egypt | Feb 05, 07:13 |

|

- Sisi and Edrogan discuss trade, investment, and regional issues in Cairo on Wednesday

Egypt and Turkey signed several MoUs to boost cooperation across defense, investment, trade, and agriculture during President Erdogan's visit in Cairo on Wednesday. The two countries also reiterated their target to boost annual trade between them to USD 15bn by 2028, up from USD 9bn. Further, the two countries will seek to expand air and maritime links, including via a direct air freight route from Alexandria and Bursa. The talks also covered key regional issues of mutual concern, including developments in the Gaza Strip and the wider Middle East, as well as the situations in Sudan, Somalia and the Horn of Africa, the spokesman added. Under the MoUs, Turkey will open industrial zones in Borg El Arab, Al Alamein, and Gargoub, and possibly logistics centres. |

|

|

|

|

| Egypt | Feb 05, 06:46 |

|

Egypt, Türkiye share converging positions on regional issues: El-Sisi at presser with Erdoğan (Ahram) Egypt seeks deeper economic ties with Turkey: El-Sisi to businessmen (Ahram) Egypt, Türkiye set USD 15bn trade target in joint declaration (Ahram) Egypt vehicle sales jump 23% above 2025 average in December: AMIC (Ahram) EBRD invested record EUR 1.3bn in Egypt across 26 projects in 2025 (Ahram) IFC to invest USD 1.2bn in Egypt during FY2026 (Zawya) Egypt-Turkey trade exchange reaches USD 6.8bn in 2025: CAPMAS (Zawya) World Bank Funds 49 Projects in Egypt worth USD 346mn Over Four Years (Sada Elbalad) Egypt sees USD 12bn in annual foreign investment: El-Khatib (Egypt Today) Egypt to issue USD 2bn in international bonds during FY 2025/26 (Egypt Business) |

|

|

|

| | UAE deposits at Egypt's central bank |

|

| Egypt | Feb 05, 06:28 |

|

Question: How much do UAE deposits account for as a share of total foreign-currency reserves? The question was asked in relation to the following story: Net FX reserves rise 2.5% m/m to USD 51.5bn as of end-December Answer: The Arab countries (mainly Saudi Arabia, Kuwait, and UAE) have extended two types of deposits to Egypt's central bank - medium-term deposits, which are transparent, with clear maturity dates and interest payment schedules - and short-term deposits, which are more opaque. Both types of deposits are routinely rolled over. The UAE converted its USD 11bn medium-term deposit into a direct investment in the landmark Ras El Hikma deal from Feb 2024, and based on CBE's figures in its external sector reports, we estimate the UAE had a USD 5bn short-term deposit at the CBE as of June 2025. This figure is also mentioned in various news reports, so it seems credible. USD 5bn would account for about 10% of CBE's foreign reserves, and we think the deposit has remained at around this level. |

|

|

|

|

| Egypt | Feb 05, 06:26 |

|

Question: Is the gold held in reserve (approximately USD 18bn) fully available to the CBE, or is any portion of it used as collateral? The question was asked in relation to the following story: CPI inflation holds steady at 12.3% y/y in December, better than expected Answer: The gold reserves should be fully available to the central bank (CBE), because they are listed under Net International Reserves (NIR). According to the IMF's definition, Egypt's NIR are defined as the difference between gross reserve assets and foreign liabilities, and gross reserve assets exclude assets that are frozen, pledged, used as collateral, or otherwise encumbered. More importantly, the size of CBE's NIR under IMF's definition is pretty close to the value of NIR reported by the CBE, which suggests both institutions use the same definition, hence the reported gold reserves are not used as collateral. On the other hand, we could not find an official source that would suggest they are (or part of them is) used as collateral, but this is not always readily available information. To sum it up, we are confident the gold reserves are not used as collateral, but we are not 100% sure. You can find more information about the net and gross FX reserves and the contingent external liabilities in CBE's latest monthly report (here), page 65. |

|

|

|

| Nigeria |

|

| NNPC negotiating with Chinese company to revive state refinery |

|

| Nigeria | Feb 05, 08:46 |

|

- Talks with multiple potential investors in advanced stages for 4 refineries

- One Chinese firm plans to inspect a refinery soon

- NNPC is not selling refineries but is open to ceding partial equity

The Nigerian National Petroleum Corporation Limited (NNPC) is in discussions with a Chinese company to bring in experienced operators for one of its state-owned refineries, according to comments from chief executive officer Bayo Ojulari on Wednesday (Feb 4). The agency is aiming to revive the country's four refineries which have suffered years of losses and underperformance. An internal review conducted after Ojulari assumed his role last April revealed the refineries were operating at high costs, relying heavily on contractors and processing low volumes of crude. While the NNPC is not selling the refineries, it plans to cede a portion of equity to partners to allow the plants to self-finance their operations. The NNPC board approved a strategy to replace contractors with equity partners who have proven refinery expertise. According to Ojulari, talks with several interested parties are in advanced stages. He confirmed that one potential investor, a Chinese firm operating one of the largest petrochemical plants in China, is set to inspect a refinery soon. Nigeria has four refineries (two in Port Harcourt and one each in Warri and Kaduna) with a combined installed capacity of 445,000 barrels per day (bpd). The Port Harcourt refineries account for 210,000 bpd, while Kaduna and Warri have capacities of 110,000 bpd and 125,000 bpd respectively. Ojulari said the refineries were not commercially viable in their current state, operating at only 50-55% capacity despite steady crude supplies. |

|

|

|

|

| Nigeria | Feb 05, 08:13 |

|

Kwara massacre: FG faces heat as 100 feared dead (Punch) NNPC targets foreign partners as Dangote provides lifeline (Punch) GenCos dispute power subsidy claims as govt targets FAAC (Punch) Discos lost N72.86bn to unbilled power in November - Report (Punch) Nigeria saved N6tn through downstream oil reforms - FG (Punch) Setback for Electoral Reforms: Senate Rejects Mandatory Real-time Results Upload (ThisDay) FG: US Troops in Nigeria Restricted to Training, Intelligence Support (ThisDay) IMF Tips Nigeria as Africa's Third-largest Economy Ahead of Algeria (ThisDay) Dangote Refinery Denies Petrol Import Claims, Says Allegations False, Misleading (ThisDay) NNPC shuts state-owned refineries after assessments show value leakage - Ojulari (Nairametrics) FG discontinues road tax credits, says projects must follow appropriation (Nairametrics) |

|

|

|

| Over 160 people killed in attacks in Kwara state |

|

| Nigeria | Feb 05, 06:22 |

|

- Conflicting claims point to Boko Haram or Islamic State-linked Lakurawa

- Violence coincides with confirmation of small US troop deployment

On Wednesday (Feb 4), more than 160 people were killed in coordinated attacks on the villages of Woro and Nuku in Kwara state, in western Nigeria. This marks the country's deadliest assault this year. Gunmen opened fire on villagers and set homes and shops ablaze. Reports indicate that several people were also abducted. A local member of parliament blamed the Lakurawa, an armed group linked to Islamic State, but no group has claimed responsibility. President Bola Tinubu attributed the attack to Boko Haram. According to Amnesty International, attackers had issued threats to the communities for months before the assault. In a separate incident in the northwestern state of Katsina, gunmen killed at least 21 people in a door-to-door attack that broke a local peace pact between residents and armed groups. Additional assaults in northeastern Nigeria last week left at least 36 people dead. The attacks coincided with confirmation from Nigeria's defence minister that a small team of US troops is in the country to provide intelligence and training support at Nigeria's request. Recently, the Nigerian military said it has intensified operations against armed groups in Kwara and neighbouring areas, claiming successes against what it calls terrorist elements. |

|

|

|

| Israel |

|

| Expectations remain positive in most sectors – CBS business confidence |

|

| Israel | Feb 05, 13:15 |

|

- Negative expectations in hotels, regarding employment in construction

- Share of companies reporting strong shekel as major impediment surged in past one year

- Net balances indicate increase in sales in December compared to January

The expectations of the different economic sectors remained mostly positive for the next month (February), according to the latest business confidence survey of the stat office (CBS). The only sector that faced only negative expectations was the tourism sector as expectations for foreign arrivals, which have enjoyed positive values in the past two months, moved to the negative territory again, likely due to the increased geopolitical uncertainties with respect to the situation in Iran. Construction was the only other sector that saw a negative value for one of the components, namely employment expectations for February but the expectations about the changes in current activities remained positive and even improved. Industry, retail trade and services continued to enjoy positive expectations for the next month. In view of the steep shekel appreciation, the CBS published a survey about how industrial companies assess those developments and found out that the share of industrial companies that reported that erosion in profitability due to exchange rate fluctuations is a serious constraint to their operations has increased to 21% in January from a low of 10% in September. The share of high-tech industries reporting the strong shekel as a marked impediment to their activity has increased to 30% from 14% in September. The shares have increased from 6% and 7% in January 2025, respectively. The CBS said that the net balances on sales in industry, retail trade and the service were positive and indicate an increase in sales in December compared to November. The net balances regarding the financial situation remained positive in January with the exception of hotels, in which sector they even deteriorated. |

|

|

|

| Forex reserves increase by 1.5% m/m at end-January |

|

| Israel | Feb 05, 12:45 |

|

- Reserves hit another record high

- Revaluation effects, Eurobond back expansion in January

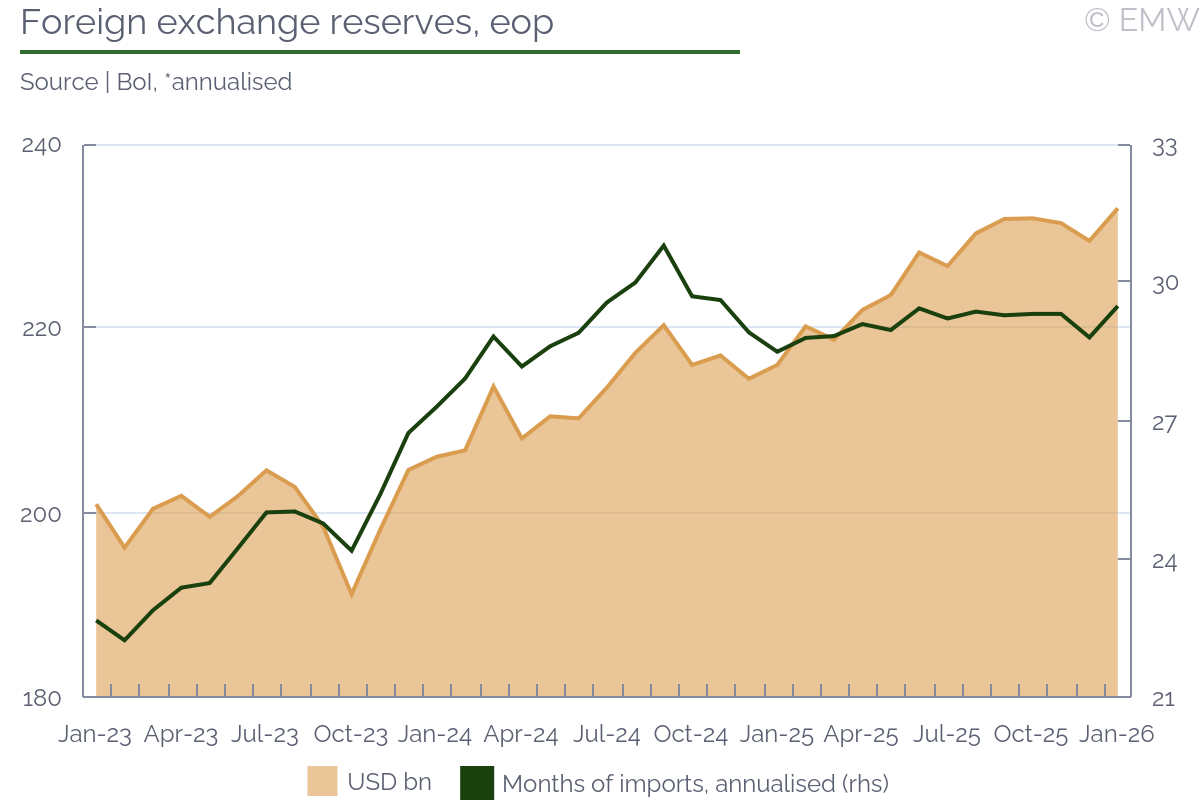

The foreign exchange reserves of the Bank of Israel (BoI) rose by 1.5% m/m or USD 3.54bn to USD 233.0bn at the end of January hitting another record high, according to the latest data from BoI. Revaluation effects were again the major driving force as they contributed by USD 3.07bn in the period. Government transfers also had a positive impact as they rose by USD 465mn in the month as a result of the Eurobond sale. There were no other significant flows in the month, according to the BoI. Forex reserves accounted for 39.9% of GDP at the end of January, the BoI said in the press release. The reserves secured 29.5 months of imports at the end of January, up by 0.7pps during the month, according to our calculations. The import-coverage ratio was the strongest since October 2024. |

|

|

|

| FinMin chief economist warns of effects from high debt/GDP ratio |

|

| Israel | Feb 05, 05:35 |

|

- If debt does not decline, annual losses of some 2-3% of GDP are expected

- If debt ratio declines by 10pps in next decade, annual growth rate might accelerate by 10-20bps

If the government debt/GDP ratio stabilises at a high level in the long run, it could lead to damage and heavy costs to economic activity and growth, according to a research of the chief economist at the finance ministry Shmuel Abramson. The review compares between two scenarios of stabilisation of the debt level over time at its current level of some 69% of GDP and a gradual decrease in the next decade. If the debt does not decline, this could lead to sustained annual losses of some 2-3% of GDP due to the anchoring of a higher interest rate environment, a steady increase in the government's financing needs, and a crowding out of investments in the business sector. Also, a high level of debt limits the government's ability to implement expansionary fiscal policy during a crisis, reducing the room for maneuver in dealing with future shocks. In contrast, if the debt-to-GDP ratio was to fall by some 10pps in the next ten years, this will encourage investment and raise labour productivity, contributing to an acceleration of about 10-20bps in the annual growth rate, the research shows. Fiscal convergence does not need to harm growth as long as it is carried out without tax increases or cuts that directly harm employment and investment. The chance of a scenario when faster GDP growth was the main reason for the debt ratio decline like in the post-coronavirus pandemic period is small and the government will need to take-proactive measures, according to the chief economist. |

|

|

|

|

| Israel | Feb 05, 04:59 |

|

For Six Hours, Israeli Settlers Rampaged Two West Bank Villages - While Soldiers Looked On (Haaretz) Israeli Military Confirms Killing Senior Hamas, Islamic Jihad Militants in Gaza Strikes (Haaretz) Israel's milk shortage shows how policy fights end up hurting the public EDITORIAL Milk rationing did not happen by accident. Protest tactics, rigid regulation, and stalled reform collided, leaving families paying the price for political and policy failure. (Jerusalem Post) Saudi media ramps up anti-Israel rhetoric, dimming normalization hopes REPORT (Jerusalem Post) The Knesset took from [finance minister] Smotrich and the Treasury the most significant administrative tool [promoting legislation through Arrangements Law] (Calcalist) Contrary to professional opinion: The government will approve the construction of an airport in the Negev (Calcalist) Bank of Israel against splitting the credit pool for businesses from the Arrangements Law: "The most important financial reform for the economy" (Calcalist) Chief Economist Warns: Stabilizing at Current Debt Level Will Cause Severe Damage to Growth (Calcalist) Nightly drama: Shas thwarted the vote - the Arrangements Law is in danger (TheMarker) Israel's growth is based on the Arrangements Law. Now the Knesset is eliminating it (TheMarker) In an unusual move: Bank of Israel warns against removing the credit database from the Arrangements Law (TheMarker) The Arrangements Law: Which reforms remained, and the struggles that have not yet been decided (Globes) The disintegration of the Arrangements Law is, above all, the disintegration of the Budget Division. (Globes) |

|

|

|

| Court orders PM to explain why Ben Gvir not fired |

|

| Israel | Feb 04, 15:47 |

|

- Court expands for second time panel to hear petitions against Ben Gvir to 9 justices

- Netanyahu, Ben Gvir should provide written responses by Mar 10, hearing to take place on Mar 24

- Ben Gvir says High Court has no authority to intervene in ministerial appointments

- Media say government could revive bill to prevent court from intervening in ministerial appointments

The Supreme Court issued today a conditional order requiring PM Benjamin Netanyahu to explain why he has not taken steps to remove from office national security minister Itamar Ben Gvir over allegations of improperly interfering in police operations. Netanyahu should address issues with respect to investigations and appointments in the police department. The High Court of Justice also made an unusual step to expand the panel reviewing the issue to nine justices from the previously appointed five while initially only three judges were sitting on the panel, to reflect the "weight and complexity" of the issue. Netanyahu and Ben Gvir should provide written responses by Mar 10 and a hearing on petitions submitted on the matter is set to take place on Mar 24. The High Court initially planned to hold the hearing on Jan 15 but decided to postpone it as Netanyahu did not provide substantive response and expanded the panel to five judges. Ben Gvir himself commented that the High Court lacks authority to intervene in ministerial appointments. Last week, Ben Gvir filed a petition with the Court that it should not issue a conditional order for his dismissal without a hearing. Moreover, local media reported that the ruling coalition was considering reviving advancing of a bill that prevents the court from intervening in the appointment or dismissal of ministers. The said draft legislation, the so called Deri law, named after the leader of the Haredi party Shas Aryeh Deri, was promoted in 2023 and was meant to allow Deri to become minister despite his criminal record. The Deri law has already passed a first reading in the Knesset and it can be finalized quickly if the Haredi parties decide to support it. The Court's move follows a legal opinion issued by Attorney General Gali Baharah-Miara a month ago claiming that Ben-Gvir has abused repeatedly his authorities by intervening in sensitive police matters and has harmed the police independence in response to petitions filed with respect of some controversial moves of the minister. Baharav-Miara said that the minister has repeatedly violated a compromise reached in April 2025 that limited his involvement in police appointments and directing operational activity. |

|

|

|

| Jordan |

|

| Government sells JOD 200mn in 10-year T-bonds at lower yield |

|

| Jordan | Feb 05, 08:59 |

|

- Yield declines to 5.99%

- Auction was oversubscribed, signaling strong investor interest

Jordan's central bank sold 10-year T-bonds worth JOD 200mn at its latest auction that was held on Feb 4, according to a statement by the institution. The auction saw high demand as the bids submitted for the 10-year T-bonds reached JOD 315mn, of which JOD 200mn were retained. The weighted average yield on the accepted bids printed at 5.99%, down from 6.30% compared to the previous issue of the same instrument on Sep 9. We remind that the country's central bank has cut its main interest rates six times since September 2024 in line with similar moves by the US Federal Reserve due to the peg of the local currency to the US dollar. Furthermore, the kingdom's CPI inflation has remained unchanged at 1.3% y/y in December. |

|

|

|

| Lebanon |

|

| President reaffirms May elections despite diaspora voting dispute |

|

| Lebanon | Feb 05, 12:42 |

|

- Aoun emphasizes holding elections on schedule as parliament remains divided over expatriate ballot arrangements

- Talks with National Moderation bloc MPs also cover airport reopening and regional economic revival

President Aoun reiterated his commitment to holding parliamentary elections on schedule during a meeting at Baabda Presidential Palace with MPs from the National Moderation bloc Mohammad Sleiman, Sajih Attieh, and Ahmad Kheir, accompanied by former MP Hadi Hobeish. According to the presidency, Aoun "informed the delegation that his position remains firm regarding holding the parliamentary elections on the scheduled dates" in May, despite concerns over expatriate voting procedures. Resident Lebanese are set to vote on May 10, while the diaspora is due to vote a week earlier, on May 3. We remind that the issue of expatriate voting continues to divide the parliament. Lebanese Forces-led parties advocate allowing the diaspora to vote for all 128 seats, as in previous elections, while the Hezbollah-Amal alliance supports allocating six additional seats, as stipulated by the 2017 electoral law. Aoun also emphasized the need to strengthen security and stability in southern Lebanon following the Israeli withdrawal and full army deployment to the border, and reaffirmed the government's "irrevocable" decision on the arms monopoly. The meeting addressed regional development in Akkar, where MPs Sleiman, Attieh, and Kheir represent. The president confirmed preparations to reopen Rene Moawad Airport in Qleiaat and highlighted ongoing efforts to improve health, education, and infrastructure. Furthermore, MP Sleiman expressed support for Aoun's positions on arms control, army deployment, economic reforms, and Lebanon's reintegration into the international community. He urged faster operationalization of Qleiaat Airport, reopening the Lebanese University branch in Akkar, and reopening border crossings with Syria to boost local economies. |

|

|

|

| PM discusses energy cooperation with Jordan in Dubai |

|

| Lebanon | Feb 05, 12:35 |

|

- Talks include proposal for trilateral Syrian-Lebanese-Jordanian meeting on electricity and gas flows

- With sanctions eased, Amman and Beirut move to revive long-delayed electricity and gas links

Lebanon's PM Salam met Jordanian PM Jaafar Hassan on the sidelines of the World Governments Summit in Dubai to discuss strengthening bilateral cooperation and reviewing key regional developments. The talks underscored growing regional momentum to revive cross-border energy coordination as political constraints that long stalled cooperation begin to ease. During the meeting, the Jordanian side proposed an initiative to convene a trilateral Syrian-Lebanese-Jordanian meeting in Amman focused on energy and electricity cooperation. Salam welcomed the proposal, describing it as a constructive step toward enhancing regional coordination in critical sectors, according to the Lebanese state news agency. The proposed meeting would address the export of electricity and natural gas from Jordan and Egypt to Lebanon via Syria. Plans to import electricity from Jordan and natural gas from Egypt to fuel Lebanese power plants have remained stalled for years due to US "Caesar Act" sanctions previously imposed on the Syrian regime. Following the lifting of those sanctions after the regime's fall, the energy file has re-emerged as a central issue in Lebanon's political and economic landscape. Recent visits to Beirut by Egyptian PM Mostafa Madbouly and Jordanian PM Jaafar Hassan have helped revive discussions on regional energy interconnection. Under the Jordanian proposal, Lebanon would receive between 150 and 250 megawatts of electricity during peak demand hours. Egypt has also renewed its offer to supply natural gas through the Arab Gas Pipeline to operate the Deir Amar power plant, replacing costly fuel oil imports. In parallel with energy cooperation, Salam and Hassan agreed to organize a Jordanian-Lebanese business conference in April aimed at strengthening economic ties and encouraging private-sector collaboration between the two countries. On the sidelines of the summit, Salam also met with Gulf Cooperation Council Secretary-General Jasem al-Budaiwi to discuss preparations for an upcoming Lebanese-Gulf Investment Forum, signaling broader efforts to re-engage regional partners amid Lebanon's economic recovery push. |

|

|

|

| Army chief reaffirms country's path forward during Washington talks |

|

| Lebanon | Feb 04, 16:01 |

|

- Security meetings in Washington focus on sovereignty and disarmament efforts

- US welcomes disarmament efforts as Israel questions their sufficiency

Lebanese army chief Rodolphe Haykal said Lebanon is pressing ahead despite mounting challenges, underscoring his confidence in the armed forces and the country's ability to move forward as it emerges from a prolonged period of crisis and conflict. Speaking during a reception at the Lebanese Embassy in Washington, Haykal called for national unity and thanked the United States for its continued support for the Lebanese Army, while acknowledging that progress on the ground has yet to fully meet public expectations. He stressed, however, that concrete steps are being taken to strengthen state authority. Haykal's visit included a series of security meetings in Washington, coming as international attention remains focused on the army's role in reinforcing sovereignty. The U.S. Embassy welcomed the military's ongoing efforts to disarm non-state actors, a notable shift after a previous planned visit by Haykal was cancelled amid U.S. concerns that such efforts were insufficient. In January, the Lebanese Army announced it had completed the first phase of its disarmament plan targeting Hezbollah positions south of the Litani River, roughly 30 kilometers from the Israeli border, and is preparing to extend operations north of the river. After labeling the army's disarmament efforts insufficient, Israel stepped up its strikes on south Lebanon, focusing especially on areas north of the Litani river where the second phase of the plan will be carried out. |

|

|

|

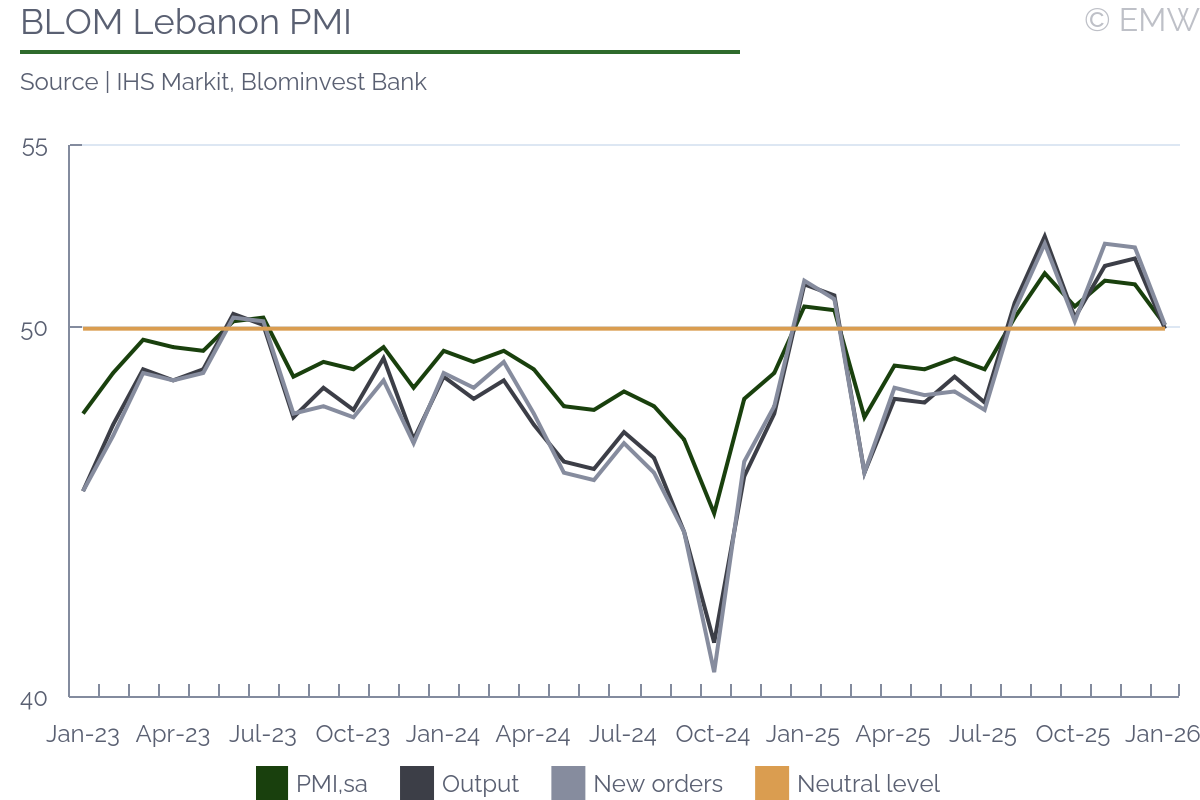

| | PMI signals softer improvement of private business conditions in January |

|

| Lebanon | Feb 04, 14:59 |

|

- Output stagnates as new orders rise only marginally at start of 2026

- Business sentiment remains pessimistic amid heightened security risks

Lebanon's private sector Purchasing Managers' Index (PMI) decreased to 50.1 in January, down from 51.2 in December, remaining just above the 50.0 no-change threshold and signaling a marginal expansion in business conditions for a sixth consecutive month, according to the latest S&P Global PMI report published today (Feb 4). The reading marked the weakest pace of growth during the current upturn and pointed to a clear loss of momentum at the start of 2026. The slowdown reflected softer trends in both business activity and new orders. Private sector output stagnated in January, ending a solid five-month expansion, as demand weakened noticeably. New orders increased only fractionally, weighed down by cancellations, postponed projects and subdued investment activity. Demand from international clients also declined slightly, adding to pressure on overall sales performance. In response to weaker demand, firms reduced purchasing activity for the first time since July 2025, cutting orders of raw materials and intermediate goods. While some businesses reported a lower need to replenish stocks, inventories continued to rise, extending the current accumulation trend to seven months. Supply chain conditions remained broadly stable, with delivery times showing little change during the month. Moreover, cost pressures persisted but eased. Purchasing costs increased due to higher import fees and rising metal and construction material prices, although the rate of inflation slowed to a five-month low. Output charges also rose at a softer pace, with only a small share of firms raising selling prices as they sought to protect margins. Looking ahead, sentiment among Lebanese private sector firms remained pessimistic, albeit slightly less negative than in December. Ongoing security concerns and fears of an escalation in regional military tensions continued to weigh on business expectations, highlighting the fragile nature of the recovery despite the PMI's record six-month run in expansion territory. |

|

|

|

| Morocco |

|

| Bank Al-Maghrib and AfDB launch merchant fund to accelerate electronic payments |

|

| Morocco | Feb 05, 06:21 |

|

- Pilot targets integration of 20,000 merchants by 2028

Bank Al-Maghrib in partnership with the African Development Bank (AfDB), has launched a pilot Acquisition Fund aimed at expanding merchant acceptance of electronic payments and strengthening digital financial inclusion. The pilot is co-financed with USD 1.21mn, including USD 700,000 from Bank Al-Maghrib and a USD 510,000 grant from AfDB, and will subsidise merchant onboarding through banks, payment service providers and fintech firms. The initiative focuses on reducing the cost barriers that limit electronic payment adoption by merchants. Support will include subsidies for POS terminals and QR-based solutions, partial coverage of transaction operating costs, and nationwide awareness and financial literacy campaigns. The pilot targets the integration of 20,000 merchants by 2028, at least 18,000 of whom will be equipped with electronic payment terminals, with particular emphasis on rural and peri-urban areas and on women-led businesses, which are expected to account for around 50% of beneficiaries. Results from the pilot will inform the design of a permanent merchant acquisition fund estimated at around USD 7mn by 2028, to be capitalised by the government, development partners and private-sector stakeholders. Morocco is one of the world's most cash-reliant nations, with 74% of transactions being cash-based as of 2022. The annual cash circulation amounts to some MAD 430bn, nearly 30% of GDP. In the first effort to promote growth of electronic payment, in September 2024, BAM has introduced a cap of 0.65% on interchange fees for domestic electronic payment transactions using cards issued in Morocco. The central bank is also working on a new national payments strategy that aims to promote electronic payment systems, reduce high cash usage, and enhance transaction transparency across the economy. |

|

|

|

| | External financing breakdown |

|

| Morocco | Feb 05, 04:56 |

|

Question: have u seen any breakdown of the external financing portion? 60 bn mad is ~ 6.5 bn usd which is a lot for morocco to do in eurobond market...i assume they are getting a decent chunk of that from sources other than eurobonds? Answer: hat I'm referring to is the plan for overall external funding given in the 2026 budget document, not necessarily Eurobonds, but also loans from commercial banks and IFIs. Morocco receives a solid share of its external funding each year from the World Bank and the AfDB. I haven't seen a more detailed breakdown of how this funding will be sourced, though. So far, its Eurobond issuance has been around USD 1bn a year with the largest issuance being in 2025 of around EUR 2bn. The question was asked in relation to the following story: Govt weighs international bond sale in Q1 - Media24 |

|

|

|

| Oman |

|

| Oman and Kuwait to build petrochemical complex in Duqm |

|

| Oman | Feb 05, 11:15 |

|

- OQ Group and Kuwait Petroleum International are developing a petrochemical complex

Oman's state-owned integrated energy company OQ Group and Kuwait Petroleum International (KPI) have signed an agreement to develop a major petrochemical complex in the Duqm Special Economic Zone, according to news reports. The agreement commits both companies to advancing the project, leveraging Duqm's port access, infrastructure, and low-cost feedstock for global competitiveness. The Duqm refinery is a USD 9bn joint venture between state-owned OQ Group and KPI and located in Oman's Duqm Industrial Zone. KPI is a subsidiary of state-owned Kuwait Petroleum Corporation. The Duqm refinery is a 50/50 OQ-KPI joint venture that was inaugurated in February 2024. It has a refining capacity of 255,000 barrels per day (bpd), thus raising Oman's total national refining capacity to 500,000 bpd. The project utilizes the Ras Markaz Crude Oil Terminal and an 80km pipeline to supply the refinery. The refinery typically processes a mix of 65% Kuwaiti crude and 35% Omani crude. While the refinery is already fully operational, OQ Group and KPI are now moving into the second phase of their master plan: the Duqm Petrochemical Complex. The refinery's current role is to provide the feedstock (raw materials) for this next phase. Here is what they are doing now: The goal is to take by-products from the refinery-such as naphtha, LPG, and natural gas liquids (NGLs)-and upcycle them into high-value chemicals like polyethylene and polypropylene. The two companies also want to build a new reformer unit to upgrade low-value naphtha into high-octane gasoline components. The timeline for completion is currently unclear. Additionally, the refinery may eventually transition to refining crude oil from countries other than Oman and Kuwait. Moreover, OQ Group and KPI are in talks with companies from Asia and the US to potentially join as a third partner to share the large investment costs and provide specialized technology. The reader should note that OQ8 is the official name and brand of the abovementioned Duqm Refinery. The name is a combination of its two parent companies: OQ and Q8 - the global brand name for KPI. Background OQ Group is Oman's leading integrated energy company, wholly owned by the government through the Oman Investment Authority, the country's sovereign wealth fund. It manages investments across the full energy value chain, from upstream exploration to downstream refining and petrochemicals. Formed in 2020 from the merger of nine entities, OQ rebranded to centralize Oman's oil and gas operations for better efficiency and profitability. The Special Economic Zone at Duqm (SEZAD) is the largest economic zone in the Middle East and North Africa. Spanning 2,000 square kilometres with a 90km coastline, it is the cornerstone of Oman Vision 2040. SEZAD is managed by the Public Authority for Special Economic Zones and Free Zones (OPAZ). Separately, Oman has ambitious plans to turn the historically sleepy port town of Duqm into a large city. Our understanding is that the city had a population of about 11,000 in 2010 and about 30,000 today. For decades, Duqm was a remote fishing village. Its transformation began in 2011 with the establishment of the SEZAD. |

|

|

|

| Saudi Arabia |

|

|

| Saudi Arabia | Feb 05, 08:10 |

|

Saudi Arabia and Kuwait sign energy cooperation agreements (Zawya) Germany's Merz heads to Saudi, Gulf in quest for new partners (Zawya) Saudi Arabia spearheads MENA IPO market growth in Q4, says report (Zawya) A Syrian official: Saudi Arabia to invest in new private Syrian airline (Maaal) Saudi Arabia, Turkey Sign Agreement on Renewable Energy Power Plant Projects (Maaal) Al-Hilal ranked third highest-spending club globally in the winter transfer window with EUR 71mn (Maaal) Neom green hydrogen project nears completion (AGBI) Saudi Arabia to announce major new Syria investments (AGBI) RLC Global Forum highlights role of Saudi youth in retail digital shift (Arab News) |

|

|

|

| Tunisia |

|

| No-confidence motion withdrawn against head of Regions, Districts Council |

|

| Tunisia | Feb 05, 08:55 |

|

- MPs cite consensus and dialogue after talks with Council president

- Motion had alleged governance abuses

A motion of no confidence filed against the President of Tunisia's National Council of Regions and Districts has been formally withdrawn, following talks between the Council's leadership and the deputies who sponsored the initiative. MP Ali Hsoumi announced the withdrawal on Feb 4, describing the outcome as a "victory of dialogue and the primacy of the national interest." He said a meeting between the Council President and concerned deputies allowed for a transparent discussion of the grievances that led to the motion and a broader exchange on the institution's functioning. According to Hsoumi, the Council President pledged to take into account proposals raised by MPs and demonstrated openness to addressing concerns in line with public expectations. The motion, initially submitted on Jan 30, had cited alleged abuses in management and an erosion of the Council's constitutional role. The withdrawal removes the immediate threat of leadership instability within the Council, one of the newer institutions created under Tunisia's revised political framework. We note that while the episode ends without a formal confrontation, it underscores ongoing institutional frictions and governance challenges within Tunisia's evolving political system. |

|

|

|

| BIAT arranges TND 140mn financing for 100 MW solar plant in Kairouan |

|

| Tunisia | Feb 05, 08:55 |

|

- Syndicated loan backs one of Tunisia's largest solar projects

- Total project cost stands at TND 280mn, plant to supply clean power to industrial users

Tunisia's largest private bank BIAT announced the arrangement and management of a TND 140mn (USD 48.9mn) syndicated loan to finance a 100 MWac photovoltaic power plant in Chebika, in Tunisia's Kairouan Governorate, marking a major private-sector contribution to the country's energy transition. The financing, signed on Feb 3, brings together BIAT, UIB, ATB and UBCI, with BIAT acting as arranger and agent. The project's total cost is estimated at TND 280mn, making it one of the largest solar power investments in Tunisia to date. The plant is designed to increase electricity generation from renewable sources while improving energy security and reducing carbon emissions. It will supply clean electricity to two domestic industrial users, lowering their reliance on conventional power and imported fuels. BIAT is participating as debt financier and equity investor through its subsidiary BIAT Capital Risque. Construction is expected to take 12 months and will follow environmental and social standards aligned with international best practices. We note that the project highlights the growing role of domestic banks in financing Tunisia's renewable energy expansion amid limited public resources. We recall that recently, French renewable energy producer Voltalia was awarded the 132 MW Wadidans solar project in southeastern Tunisia, reinforcing its growing presence in the country. With this award, the total capacity of Voltalia's projects under development in Tunisia now approaches 400 MW. The Wadidans plant, near the Menzel Habib site, is expected to produce enough electricity to supply approximately 200,000 inhabitants while avoiding nearly 120,000 tonnes of CO₂ emissions per year. Tunisia plans to increase the share of renewable energy in electricity production to 30% by 2030, up from around 6% at the end of April 2025. |

|

|

|

| Country extends state of emergency through end-2026 |

|

| Tunisia | Feb 05, 08:55 |

|

- Emergency powers prolonged for further 11 months despite improved security backdrop

- Interior ministry retains broad authority over assemblies, media and searches

According to media reports, President Kais Saied extended Tunisia's long-running state of emergency until 31 Dec 2026, prolonging a legal regime that has been in place almost continuously since November 2015. The latest extension runs for a further 11 months and preserves the interior ministry's wide-ranging exceptional powers. The emergency framework allows authorities to ban public gatherings, impose curfews, conduct searches without judicial authorisation, and monitor media and cultural activity, including press publications, broadcasting, and artistic performances. These measures were first introduced following a suicide bombing in Tunis in 2015 that killed 12 members of the presidential guard, amid a broader wave of militant attacks targeting security forces and foreign tourists. While Tunisia's security environment has improved materially in recent years, with authorities reporting the dismantling of militant cells and the neutralisation of senior extremist figures, the continued reliance on emergency powers highlights a persistent preference for pre-emptive control over a return to normal legal processes. The extension also comes against the backdrop of a highly centralised political system following Saied's consolidation of power since 2021. From a political-risk perspective, the repeated renewals underscore the institutionalisation of emergency rule rather than its use as a temporary response to acute threats. Although officials argue the framework remains necessary to safeguard public order and prevent a resurgence of extremist violence, the absence of a defined exit strategy raises concerns over legal certainty, civil liberties, and investor perceptions of governance stability. |

|

|

|

| World Bank pledges continued financial, technical support for reform agenda |

|

| Tunisia | Feb 05, 08:55 |

|

- Talks focus on social protection, water, transport and energy

- Cooperation to align with 2026-2030 development plan

The World Bank reaffirmed its commitment to supporting Tunisia's reform and development path, signaling continued engagement through financing and technical assistance over the medium and long term. The Bank's Regional Director for the Maghreb and Malta, Ahmadou Mustapha Ndiyi, made the remarks during a meeting with Tunisia's Minister of Economy and Planning, Samir Abdel Hafid, as part of a working visit aimed at reviewing the country's development priorities for the coming period. According to the Ministry of Economy, discussions focused on the progress of ongoing World Bank-financed projects and the broader framework for cooperation in 2026. Priority sectors include social protection, water management and flood protection, with additional preparatory work underway for projects in transport, health, energy, environment and sanitation for the 2027-2028 period. Ndiyi noted improvements in several economic indicators, which officials said would help inform the design of future cooperation programmes. Minister Abdel Hafid welcomed the level of engagement and stressed that World Bank support remains aligned with national priorities under Tunisia's Development Plan 2026-2030. We recall that the World Bank expects Tunisia's economy to grow by about 2.6% in 2025, with growth moderating to an average of around 2.4% in 2026-27, according to the January 2026 Global Economic Prospects. The outlook reflects a recovery in agricultural output following favourable weather conditions, alongside continued support from tourism and remittance inflows, while easing inflation and gradual monetary easing provide some cyclical relief. In November last year, the WB and the Tunisian government signed a USD 430mn financing package, including USD 30mn in concessional funds, to support Tunisia's Energy Reliability, Efficiency, and Governance Improvement Program (TEREG). The five-year initiative is designed to modernize Tunisia's electricity sector by accelerating renewable energy deployment, improving the operational and financial performance of the national utility STEG, and enhancing governance. Through TEREG, Tunisia aims to attract USD 2.8 billion in private investment, add 2.8 gigawatts of new solar and wind capacity by 2028, and create more than 30,000 jobs, primarily in renewable project construction. |

|

|

|

| Angola |

|

| New Angola–WB mechanism targets delivery along Lobito corridor |

|

| Angola | Feb 05, 05:41 |

|

- Initiative aims at aligning priorities and speeding up implementation of key Lobito-related projects

- Corridor is expected to significantly impact economy by generating USD 1.6 to USD 3.4bn annually over the next 30 years

The government and the World Bank are formally launching a new coordination mechanism for the Lobito Corridor through an inaugural meeting today in Luanda, aimed at accelerating development of this strategic regional infrastructure. The mechanism brings together senior officials from Angola, the Democratic Republic of the Congo, and Zambia, alongside multilateral institutions, financial actors, and development partners, with the goal of aligning priorities and improving coordination across borders. The initiative focuses on speeding up implementation of key projects in rail transport, integrated logistics, trade facilitation, sustainable energy, and agricultural and mineral value chains, while supporting broader economic and social development along the corridor. Recognised as one of the most promising logistics platforms in Southern and Central Africa, the Lobito Corridor plays a growing role in linking the continent's interior to global markets. Authorities expect the new framework to foster more structured and regular cooperation, helping attract private investment, create jobs, and strengthen regional integration. Last month, the government unveiled a plan to create a state-owned Lobito Corridor Development Company to manage, coordinate and promote economic activities linked to the Lobito Corridor. The government sees the new entity as a tool to turn the corridor into a broader development axis, attracting strategic investment in agriculture, industry, tourism and services, while boosting competitiveness, job creation and technology transfer. Rail operations will continue to be handled by the Lobito Atlantic Railway consortium, backed by close to USD 1bn in investment, with support from the International Development Finance Corporation and the Southern African Development Bank, alongside EUR 600mn from the EU's Global Gateway via the G7-backed PGII. The Lobito Corridor operates under a 30-year concession, managed by a consortium led by Mota-Engil, Trafigura and Venturis, providing a key route for transporting minerals from the Democratic Republic of Congo's Copperbelt region. Additionally, the 1,300km rail route connects to the Lobito Port Mineral Terminal, which is known for its efficiency and low congestion. Extending the railway northward into Zambia is another possible next step. The first cargo shipment took place in July this year, and the corridor should be fully operational in 2028. The corridor is expected to significantly impact Angola's economy by generating USD 1.6 to USD 3.4bn annually over the next 30 years. |

|

|

|

| Gemcorp targets March fuel sales from Cabinda refinery |

|

| Angola | Feb 05, 05:27 |

|

- Second expansion phase to start in first half of 2027, doubling capacity to 60,000bpd

The Cabinda Refinery, inaugurated five months ago, is expected to begin selling refined fuels as early as March, according to Gemcorp CEO Marcelo Hofke. Performance testing is currently underway and should be completed by the end of this month, reflecting standard safeguards before full commercial operations begin. Sonangol, which holds a 10% stake, will market the refinery's output, including diesel, jet fuel and naphtha. In its first phase, the refinery has a capacity of 30,000bpd, making it Angola's first post-independence refinery. Engineering work for the second phase will run until October, after which a construction tender will be launched. The aim is to start the expansion in the first half of 2027, doubling capacity to 60,000bpd, with an estimated investment of USD 700mn. Gemcorp has invested close to USD 3bn in Angola to date, including nearly USD 1bn over the past year, across oil and gas as well as water, energy and health infrastructure. Despite being Africa's second biggest oil producer, Angola currency imports 80% of its fuel needs. The government is pressing ahead with plans to add three new refineries by 2027 to reduce this dependence, even as it reassesses the stalled Soyo project after the withdrawal of its US partner Quanten, which failed to secure post-Covid financing. Oil and gas minister Diamantino Azevedo has said authorities are exploring alternatives to unblock Soyo, while maintaining momentum elsewhere: Cabinda's first-phase 30,000 bpd unit has been operating since autumn, and construction of the 200,000 bpd Lobito refinery, funded by Sonangol, is about one-quarter complete with commercial operations targeted for 2027. Overall, Angola aims to raise domestic refined product output from 1.96mn metric tons in 2021 to 2.97mn by 2027 through new capacity and improved logistics, signalling a gradual but strategic shift toward fuel self-sufficiency. |

|

|

|

| Ethiopia |

|

| Country launches EUR 6.5mn EU–ILO project on safe labour migration |

|

| Ethiopia | Feb 05, 08:55 |

|

- Project to run for four years, focus on governance, worker protection and fair recruitment

Ethiopia launched a EUR 6.5mn labour migration project in partnership with the European Union and the International Labour Organization (ILO), aimed at strengthening safe, regular and orderly inter-regional labour migration. The four-year programme seeks to improve labour migration governance, protect migrant workers' rights, and enhance institutional coordination at federal and regional levels. Officials say the initiative will address persistent challenges including limited access to safe migration channels, skills mismatches, and weak protection mechanisms. The project focuses on strengthening institutional capacity, improving labour market information systems, promoting fair recruitment practices, and enforcing regulatory frameworks to reduce exploitation and illegal trafficking. EU officials highlighted that around 2mn young Ethiopians enter the labour market annually, underscoring the economic importance of overseas employment and remittance inflows. Improved migration governance could support remittance sustainability and reduce social costs linked to irregular migration. |

|

|

|

| Country, EIB sign EUR 110mn loan to expand rural finance |

|

| Ethiopia | Feb 05, 06:59 |

|

- EUR 110mn EIB loan to finance Rural Finance and Development Project

- Financing complements IFAD and EU grant support

Ethiopia and the European Investment Bank (EIB) signed a EUR 110mn loan agreement aimed at expanding access to finance for rural financial institutions, reinforcing concessional funding flows amid tight domestic credit conditions. The agreement was signed by Finance Minister Ahmed Shide and EIB public sector division head Diederick Zambon. According to the Ministry of Finance, the loan will finance a Rural Finance and Development Project designed to improve access to credit for micro-enterprises and small businesses, particularly those linked to agriculture and rural value chains. The funds will be channelled through the Development Bank of Ethiopia (DBE) to microfinance institutions and cooperatives operating across the country. The EIB loan forms part of a broader co-financing package that includes a USD 35.1mn grant and USD 4.8mn loan from the International Fund for Agricultural Development (IFAD), alongside EU support comprising €8.5mn in technical assistance and EUR 8.26mn in additional grants. We note that the operation aligns with Ethiopia's strategy of prioritising concessional external financing while limiting non-concessional borrowing under the IMF-supported programme. However, credit transmission risks remain, given capacity constraints among rural financial institutions and DBE's growing balance sheet exposure. |

|

|

|

| | Country mobilises over USD 18bn forex inflows in H1 of FY 2025/26 |

|

| Ethiopia | Feb 05, 06:59 |

|

- Prime Minister Abiy says export earnings exceeded target as merchandise exports hit USD 5.1bn

- Services, remittances and FDI lift total inflows above USD 18bn, import bill stands at USD 11.3bn in H1

- Govt revises federal revenue target upwards to ETB 1.5tn after strong half-year haul

Prime Minister Abiy Ahmed told parliament that Ethiopia mobilised over USD 18bn in foreign exchange inflows during the first six months of the fiscal year, pointing to improved external sector performance. Merchandise exports generated USD 5.1bn, exceeding the USD 4.2bn target, while service exports contributed USD 4.0bn. Remittance inflows reached USD 4.6bn, foreign direct investment USD 2.3bn, and aid and concessional loans exceeded USD 2.0bn, according to the Prime Minister. Over the same period, Ethiopia's import bill amounted to USD 11.3bn, highlighting continued pressure on the trade balance despite stronger inflows. On industry, mining revenues rose 30%, iron production increased by 36%, and cement output expanded by 28%, reflecting continued construction activity. Agriculture remains central to the growth narrative, with authorities reporting 999mn quintals of output, around 78% of the annual 1.3bn quintal target achieved in the first six months. Abiy also said the federal government collected ETB 709bn in tax revenue during the first half of the year, prompting authorities to revise the full-year federal revenue target to ETB 1.5trn, with regions expected to raise an additional ETB 1.0trn. We recall that in early January, government announced that it had collected ETB 704.4bn in tax revenue over the first six months of FY 2025/26, exceeding the ETB 640.4bn target for the period by 110%, according to the Government Communications Service as cited by local media reports. Revenue from domestic taxes contributed ETB 362.4bn, while ETB 341.9bn came from export duties and related levies. The total represents an increase of ETB 63.7bn compared to the same period in the previous fiscal year, reflecting rising economic activity and the government's drive to strengthen internal fiscal capacity and reduce dependence on external financing. We further note that the ETB 362.4bn in domestic tax revenue collected in H1 FY 2025/26 already accounts for roughly 30% of the budgeted original domestic revenue of ETB 1,228.5bn and about 19% of the total federal budget of ETB 1.93trn, according to our calculations. With half of the fiscal year already elapsed, this strong start indicates that Ethiopia is on a positive trajectory toward meeting its ambitious domestic revenue target, which is expected to fund nearly 64% of the total budget, reducing reliance on external grants (ETB 282.4bn) and loans (ETB 139.3bn). The performance reflects both improved tax administration and compliance, as well as rising economic activity, particularly in domestic and export sectors. |

|

|

|

| Gabon |

|

| Country remains excluded from AGOA despite rising bilateral trade |

|

| Gabon | Feb 05, 08:26 |

|

- Gabon is still excluded following formal removal in Jan 2024

- Trump extended AGOA until Dec 2026, retroactive to Sep 2025

- Bilateral trade with US grew 23.1% in 2024, reaching USD 426.2mn

Gabon remains excluded from the African Growth and Opportunity Act (AGOA) for 2026, despite a strong increase in engagements and trade with the United States. This week, US president Donald Trump extended the programme until Dec 2026 with retroactive effect to Sep 2025. Following a coup in 2023, Gabon was formally excluded from AGOA in Jan 2024 because of the unconstitutional change of government. Official statements from the US did not specify why the exclusion continues in 2026. To qualify for AGOA, countries must demonstrate progress toward a market-based economy as well as respect for the rule of law and removal of barriers to US trade. Gabonese authorities will have to show measurable progress on democratic governance and economic reforms if they want to regain access to the programme in future. Gabon's exclusion comes shortly after the 2025 general elections and contrasts with growing bilateral trade with the US. Analysts note that total trade in goods and services between the two countries reached USD 426.2mn in 2024, up 23.1% from 2023. US imports from Gabon more than doubled to USD 171.6mn, while US exports to Gabon fell 5.3% to USD 170.6mn (resulting in a small US trade deficit of USD 1.1mn). Services trade totalled USD 84mn, with the US maintaining a USD 22mn surplus. |

|

|

|

| Ghana |

|

| GoldBod launches gold refining at Gold Coast Refinery |

|

| Ghana | Feb 05, 09:00 |

|

- Agreement was signed last month and envisages at least one tonnes of raw gold to be refined weekly

- Refinery capacity is to process two tonnes

- Local refining deal to boost gold exports, tax proceeds and jobs

The Ghana Gold Board (GoldBod) marked the start of refining of gold purchased from small-scale miners at the Gold Coast Refinery. The agreement to that effect with the Egypt-owned refinery was signed last month and it is set to process a minimum of one tonne of raw gold weekly. The refinery management said it has capacity to refine two tonnes weekly, and has partnered with South Africa's Rand Refinery to refine gold in line with international standards and help it obtain LBMA certificate. During a visit to the facility, finance minister Cassiel Ato Forson praised GoldBod's performance since it began full operations in May 2025 saying benefits have already been seen. He also noted that the refinery was first opened in 2016 but remained largely unused before the recent refining deal. It has crated 162 jobs and operates on a 24-hour basis, in line with the government's 24-hour economy strategy. |

|

|

|

|

| Ghana | Feb 05, 08:33 |

|

Parliament adopts report to expand legal education in Ghana (Joy FM) Mahama to seek parliamentary approval for sale of public lands (Joy FM) Trade Ministry claims diplomatic victory as U.S. extends AGOA for Ghana (Joy FM) Mahama: We inherited a sick country with governance in tatters (Citi Newsroom) Inflation at 3.8%, but borrowing still costly - Prof. Bokpin questions rate rigidity (Citi Newsroom) President Mahama to file motion on slavery at UN March 25 (Daily Graphic) Prez. Mahama gives SOE heads April deadline to submit annual accounts (Class FM) Fall in line or step aside - Transport Minister warns commercial drivers (Starr FM) |

|

|

|

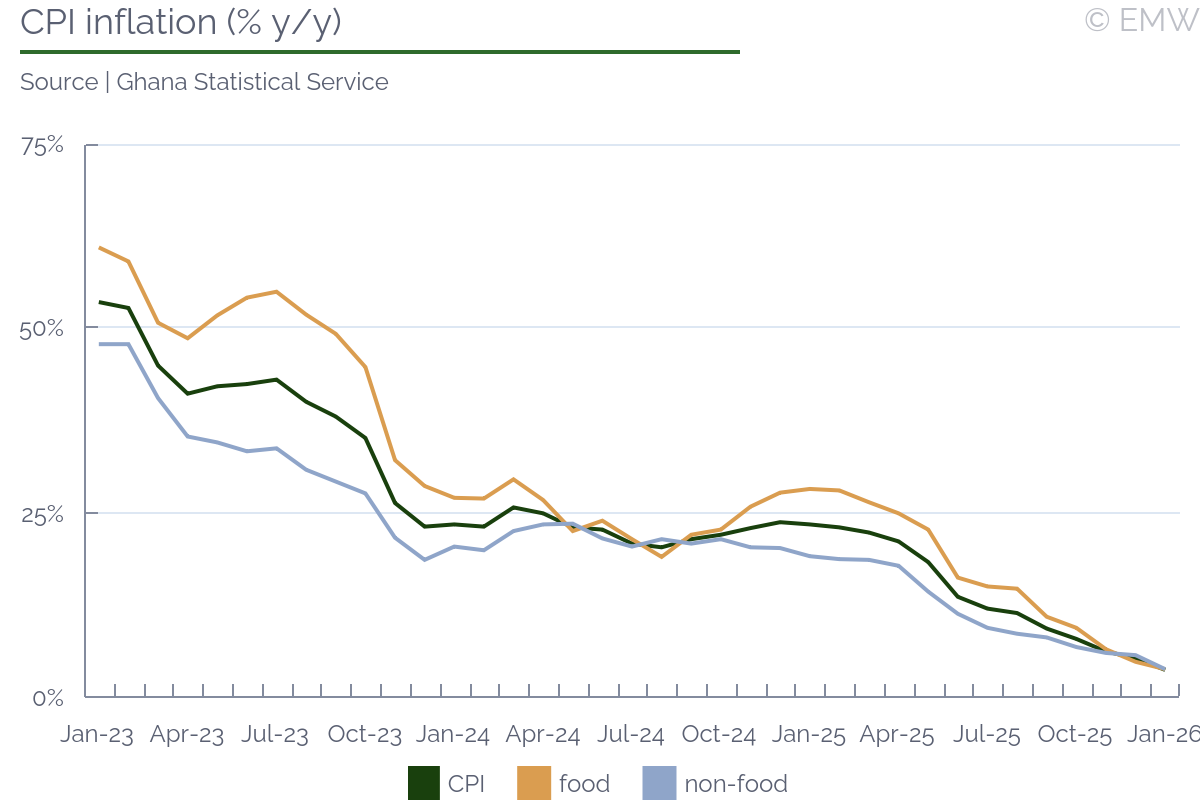

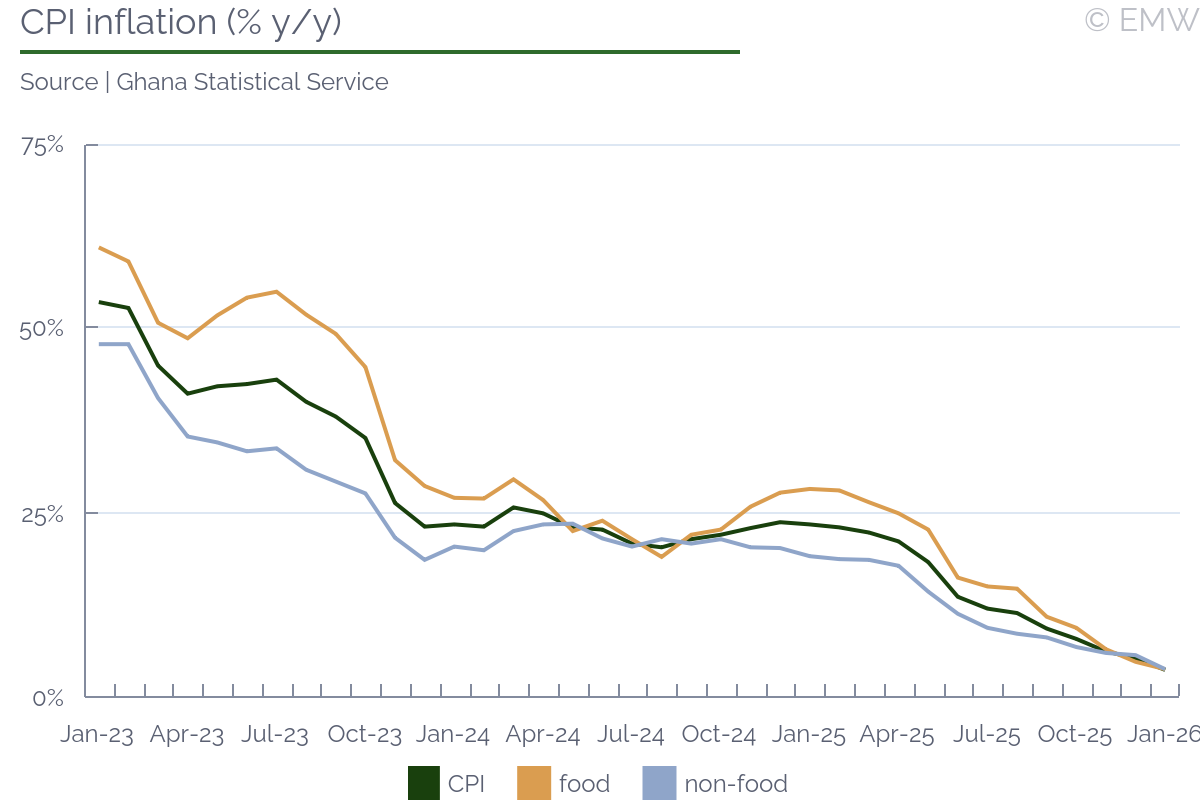

| | Inflation decelerates further to 3.8% y/y in January |

|

| Ghana | Feb 04, 15:55 |

|

- Both food and non-food inflation rates fall as lower VAT takes effect

- In m/m terms, CPI rises at slower pace of 0.2%

- Inflation slowdown opens room for another rate cut

The country's CPI inflation rate slowed down further to 3.8% y/y in January from 5.4% y/y in December, hitting the lowest level since 1985. The VAT rate cut, from 21.9% to 20.0%, as of Jan 1 has had an effect on the headline print, but the biggest downward contributions came from food, clothing and footwear, housing and utilities, and alcoholic beverages and tobacco. Food inflation fell to 3.9% y/y from 4.9% y/y in December, reflecting annual drops in some vegetable, fish and egg prices. However, in m/m terms, food prices still rose by 1.1% m/m, unchanged from the preceding month. Non-food inflation fell even faster to 3.9% y/y from 5.8% y/y, which was due to monthly drop in prices of automotive and solid fuels, as well as of clothing and footwear, and alcoholic beverages and tobacco. The overall CPI rose by 0.2% m/m in January, slowing from 0.9% y/y in December, thanks to the 0.4% m/m drop in non-food prices.  The drop in the inflation rate offers more scope for another rate cut by the central bank, possibly already at the next MPC meeting in March. At the meeting in January, it cut the rate by 250bps to 15.5%, after cutting it by a total of 1,000pps in 2025. The central bank said it expects inflation to stay within the medium-term target of 6-8% over the coming year, barring potential spillover from the hikes in utility prices and commodity market volatility. GDP growth is seen to remain strong this year and although this is seen to exert some demand-side pressures, the current monetary conditions are assessed as still tight relative to prevailing inflation dynamics. | Inflation (% y/y, base 2021) | | Weight | Nov-25 | Dec-25 | Jan-26 | | Food & non-alcoholic beverages | 42.7 | 6.6 | 4.9 | 3.9 | | Alcoholic beverages & tobacco | 3.9 | 7.9 | 8.7 | 2.4 | | Clothing & footwear | 8.0 | 9.9 | 9.9 | 4.8 | | Housing & utilities | 10.2 | 13.2 | 11.8 | 9.3 | | Household equipment & maintenance | 3.2 | 5.7 | 5.3 | 4.3 | | Health | 0.7 | 6.0 | 6.1 | 4.9 | | Transport | 10.5 | -4.8 | -5.0 | -5.9 | | Information and communication | 3.6 | 3.0 | 2.6 | 2.4 | | Recreation, sport & culture | 3.5 | 12.8 | 12.7 | 10.7 | | Education | 6.6 | 3.9 | 3.8 | 4.1 | | Restaurants & accommodation | 4.3 | 6.8 | 7.0 | 5.5 | | Insurance and financial services | 0.4 | 2.7 | 3.6 | 8.0 | | Personal care and miscellaneous goods | 2.5 | 9.7 | 8.3 | 4.8 | | All Items | 100.0 | 6.3 | 5.4 | 3.8 |

| | Source: Ghana Statistical Service |

|

|

|

|

| Ivory Coast |

|

| Regulator to increase cocoa purchases amid declining bean quality |

|

| Ivory Coast | Feb 05, 08:49 |

|

- Sources say purchases to be doubled to 20,000 tonnes weekly

- Purchased cocoa has been stored in poor conditions which raises concern about quality

- Industry sources note that regulator might find it difficult to sell acquire cocoa due to worsening quality

The Coffee and Cocoa Council (CCC) will double cocoa purchases to 20,000 tonnes weekly amid concerns about the declining quality of cocoa stocks, sources told Reuters. The regulator launched its programme for purchase of 100,000 tonnes of unsold cocoa in late January and purchased about 5,000 tonnes over the first couple of days. However, efforts will be made to accelerate the process given the concerns over the quality of cocoa beans which has been stored in nylon bags instead of jute ones thus risking quick deterioration. A regulator source said that the purchased cocoa is sold as quickly as possible to exporters, but industry sources suggested that while purchasing stocks is unlikely to be problematic, finding buyers might be difficult given the low ban quality. The regulator is purchasing the cocoa at the guaranteed price of XOF 2,800 per kg which means that the total amount needed is about XOF 280bn or about 0.4% of the 2026 GDP projection. It is yet unclear whether the purchases will be funded from CCC's own resources (reserve fund) or the government will also step in. |

|

|

|

| Kenya |

|

| Parliament committee backs Safaricom stake sale |

|

| Kenya | Feb 05, 08:59 |

|

- KES 204bn Safaricom sale framed as a near-term fix for rising fiscal pressures

The parliamentary Finance and National Planning Committee has backed the proposed partial sale of the State's shares in Safaricom, citing severe constraints on development spending in the 2025/26 fiscal year. The committee said projected ordinary revenue of KES 3.321tn will be largely absorbed by interest payments of KES 1.097tn and a public sector wage bill of KES 960bn, leaving just KES 29.8bn for development. Under the proposal, the government plans to raise about KES 204bn by selling a 15% stake in Safaricom at KES 34 per share through a negotiated transaction. The deal also includes a KES 40bn dividend advance to be repaid over six years from future dividends, after which the State would continue to receive full dividend flows from its remaining stake. |

|

|

|

|

| Kenya | Feb 05, 08:54 |

|

Absa eyes Kenya buyout in race for retail market (Business Daily) Banks exclude fees, charges on existing loans in pricing change (Business Daily) Ruto promises free, fair UDA nominations (Nation) Kenyans import more shoes as cost of local production increases (Nation) How Azimio's revival has pushed ODM into legal traps (The Standard) Private sector growth slows to four-month low - report (The Star) US shows strong interest in Kenya's mining sector, takes jibe at China (The Star) Jubilee's Pauline Njoroge Declares Nairobi Governor Bid (Capital News) How Much Civil Servants Can Borrow Under Treasury's Revamped Car Loan Scheme (Kenyans.co.ke) Banks Issue New Demands to Govt After Ruto Slashes PAYE (Kenyans.co.ke) |

|

|

|

| South Africa |

|

| Government declares national disaster over drought and water shortages |

|

| South Africa | Feb 05, 08:26 |

|

- Disaster is declared over disruptions in Eastern Cape, Western Cape and Northern Cape

- Municipalities warn of approaching day zero scenarios as dry conditions persist

The government has classified drought conditions and water supply disruptions in three provinces as a national disaster, according to a government gazette published on Wednesday (Feb 4) by the department of cooperative governance and traditional affairs. The decision follows an assessment by the National Disaster Management Center (NDMC) which reviewed reports on drought and the potential interruption of large-scale water provision in the Eastern Cape, Western Cape and Northern Cape. Several municipalities have already warned of approaching 'day zero' scenarios when taps could run dry. NDMC head Elias Sithole said the scale and risks to life and water supply in these provinces warrants the national disaster classification. Responsibility for coordinating and managing the disaster now shifts to the national executive. South Africa's water challenges are also linked to ageing infrastructure and municipal management failures, with the Gauteng province experiencing severe outages unrelated to the national classification. This is the second national disaster declaration this year after severe weather and flooding affected Limpopo, Mpumalanga, KwaZulu-Natal, Eastern Cape and North West in January. |

|

|

|

| Trump extends AGOA by one year, South Africa still included |

|

| South Africa | Feb 05, 06:53 |

|

- US extended AGOA to Dec 2026, after 3-year extension was initially proposed

- Trade minister said short duration creates uncertainty for investors

South Africa and other eligible African countries have received a one-year extension of the African Growth and Opportunity Act (AGOA), following the signing of legislation by US president Donald Trump this week. The extension applies retroactively from 30 Sep 2025 and runs until 31 Dec 2026, according to the US trade representative. AGOA provides duty-free access to the US market for more than 1,800 products from eligible sub-Saharan African countries. Trade minister Parks Tau welcomed the extension on Wednesday (Feb 4) but raised concerns about its limited duration. He said the decision would provide some relief for South African exports under the scheme but the short time frame creates uncertainty for investors and exporters. While the US house of representatives initially passed a three-year extension, the senate reduced this to one year and this was later accepted by the house. Tau said South Africa continues to engage with the US on an agreement on reciprocal tariffs, aimed at reducing the 30% tariff on South African exports. The AGOA extension comes amid strained US-South Africa relations. Two 2025 bills in the US house and senate called for a review of US- South Africa relations and proposed excluding South Africa from AGOA. |

|

|

|

|

| South Africa | Feb 05, 06:03 |

|

Hill-Lewis weighs DA leadership bid after Steenhuisen bows out (Business Day) Drought declared a national disaster in three provinces (Business Day) Steenhuisen says no free-for-all on foot-and-mouth disease vaccines (Business Day) National Treasury concerned about costing of basic income support policy (Business Day) Brian Molefe resigns as MP to focus on being MKP treasurer-general (News24) Hill-Lewis 'seriously considering' DA leadership - but wants to stay mayor (News24) AGOA's back - but many SA exporters still face a tariff wall (News24) VAT the only 'wildcard' in an otherwise bland Budget (News24) SA secures R175bn loan package from Afreximbank (Moneyweb) Former Crime Intelligence officer Paul Scheepers faces imprisonment after conviction in landmark trial (Daily Maverick) Court case threatens Madlanga Commission's ability to compel testimony from key witnesses (Daily Maverick) |

|

|

|

| Uganda |

|

| Fitch affirms country’s long-term debt rating at B |

|

| Uganda | Feb 04, 16:09 |

|

- Fitch also assigns local-currency bonds a recovery rating of RR4

- Rating actions reflects expectations of average recovery prospects in a default scenario

- Debt rating is now equal to Uganda's long-term local-currency issuer default rating

Fitch Ratings affirmed Uganda's senior unsecured long-term local-currency debt rating at B and assigned the bonds a recovery rating of RR4. The rating actions reflect the application of Fitch's new sovereign rating criteria and for the first time incorporate recovery assumptions into the sovereign debt ratings. The debt rating is thus now the same as Uganda's long-term local-currency issue default rating which was affirmed at B with stable outlook in August last year. The recovery rating reflects Fitch's expectation of average recovery prospects in a default scenario. The debt rating is sensitive to any changes in Uganda's long-term local-currency issuer default ratings which in turn can be downgraded in case of a significant rise in government debt and fiscal deficit ratios, greater financing strains that weaken foreign reserves or liquidity buffers, or a significant worsening of medium-term growth prospects. On the other hand, the ratings could be raised in case of greater fiscal consolidation and sustained revenue mobilisation that improves debt and fiscal metrics, or sharper strengthening of the foreign-reserve buffer and external liquidity position. |

|

|

|

| Zambia |

|

|

| Zambia | Feb 05, 07:51 |

|

No worker will be fired for refusing unsafe tasks - Mopani CEO (News Diggers) I'll continue as president if Makebi declines NCP endorsement - NEW Congress Party (NCP) (News Diggers) 60% of people found with cancer don't survive - HEALTH Minister (News Diggers) Opposition will have difficulties winning because of disorganisation - UPND (News Diggers) Govt says economic reforms impacting Zambians positively as indicated in price cuts by manufacturers (Zambia Monitor) State moves to dismiss Tasila Lungu's challenge over vacant Chawama seat (Zambia Monitor) ZEMA claims 128 projects approved under new environmental management regulations (Zambia Monitor) New manganese processing investment marks industrial breakthrough for Luapula -Govt (Zambia Monitor) Policy centre calls for stronger domestic value addition as copper prices hit record highs (Zambia Monitor) Mineworkers Union demands comprehensive audit of safety standards as two die in 48 hours (Zambia Monitor) |

|

|

|

| Cabinet approves disaster management amendment bill |

|

| Zambia | Feb 05, 07:33 |

|

- Bill shifts focus from disaster response to risk reduction and resilience

- Additional approvals include road investment plan, cover heritage laws, toll operations and AU reporting