| BCRA to keep policy rate and crawling peg moving closely in line with m/m CPI |

| Copom likely to hold Selic but give hint on future cuts |

| CNB to remain retrenched, despite soft headline inflation |

| MPC may cut interest rates by 100-200bps in February as FX rate firms |

| Policy rate cut remains on agenda for February |

| Strong growth, low inflation provide ample room for rate hold |

| Bank Indonesia to delay rate cuts until Q2 |

| CB shows will to resume monetary easing relatively soon |

| MPC to prioritize stability over aggressive rate cut in February |

| SBP rate hold signals commitment to preserving hard-won macroeconomic stability |

| Hold decision, 25bp rate cut both possible in February |

| MPC to hold fire in February as it awaits future data |

| CBT set for 150bps cut, but 2026 disinflation constraints remain binding |

| Final MPR cut gets closer as inflation completes convergence to 3.0% |

| BanRep’s hawkish majority seen driving rate hikes at the Jan 30 meeting |

| MPC likely to make no move in February |

| NBK leaves base rate at 18%, on-hold decisions likely throughout H1 |

| BOK to adopt neutral stance due to FX volatility, real estate price surge |

| Steady growth, contained inflation to give BNM room for extended rate pause |

| NBR very likely to keep policy rate steady at 6.5% at least by end-Q1 2026 |

| Progress with disinflation is visible, but pace of rate cuts remains uncertain |

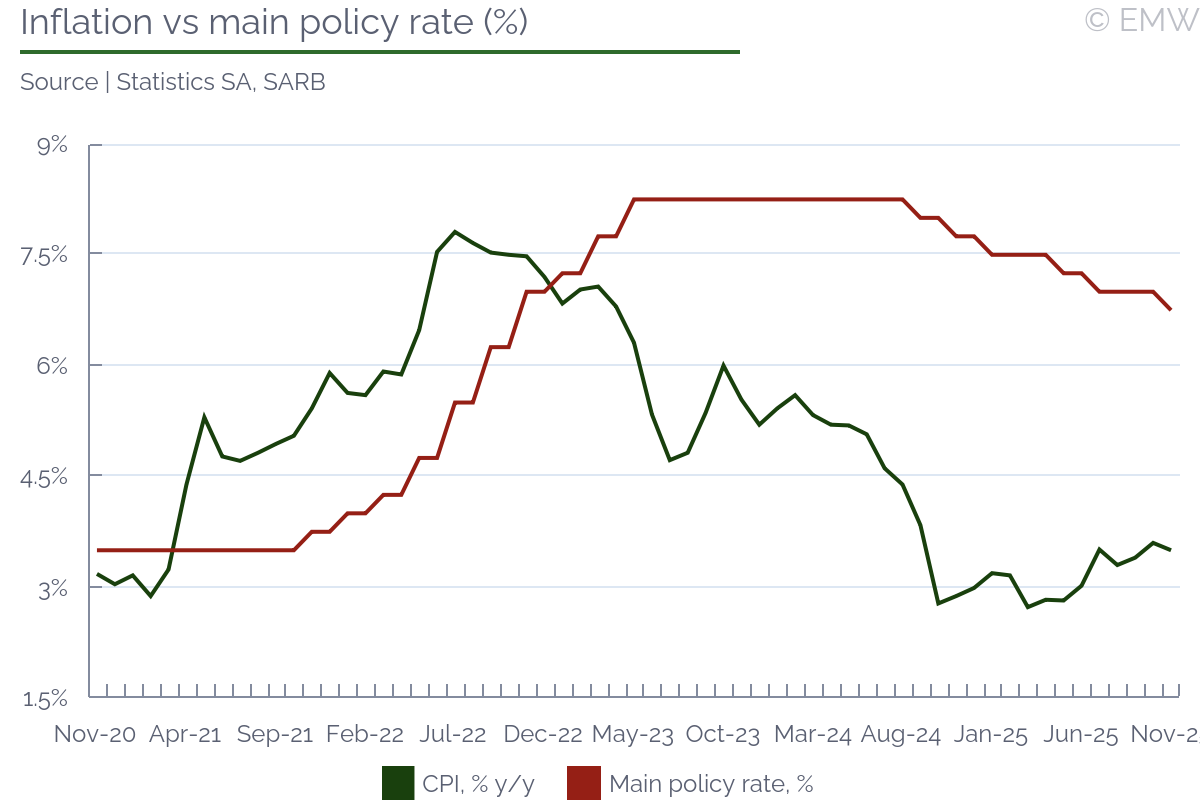

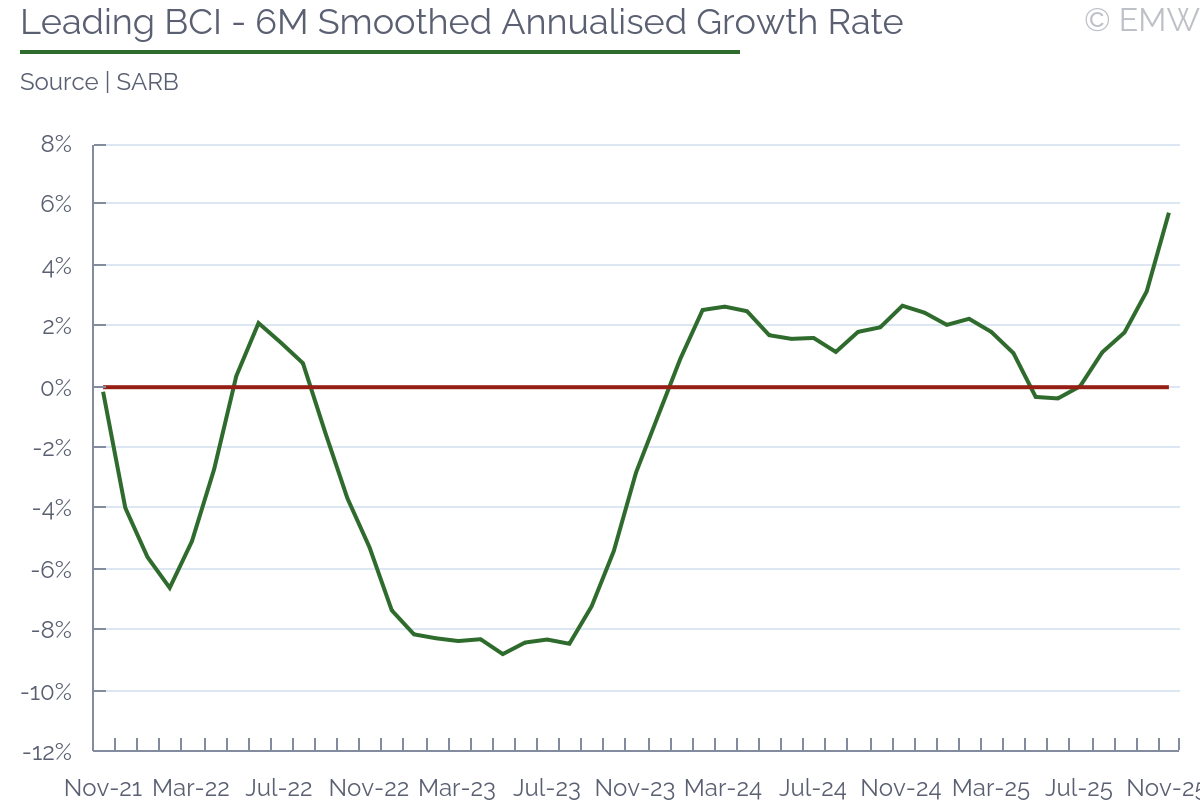

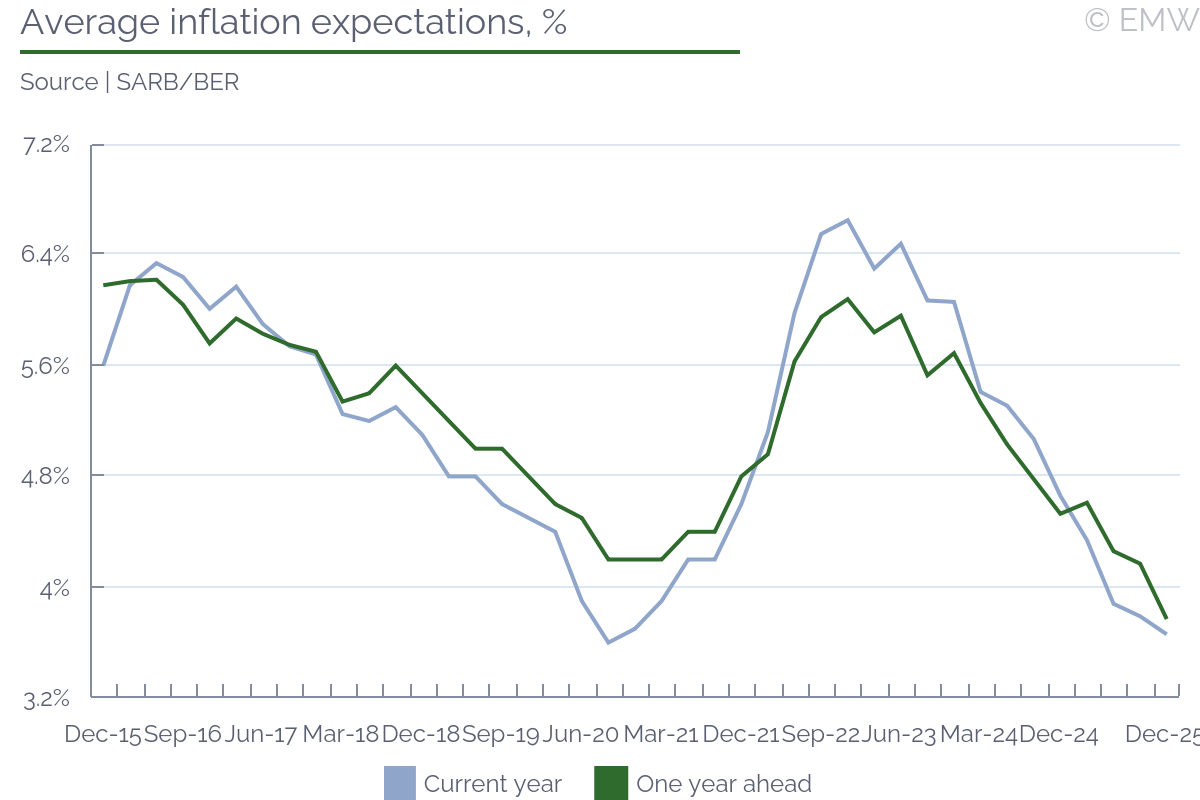

| SARB has room to cut but views are split on timing |

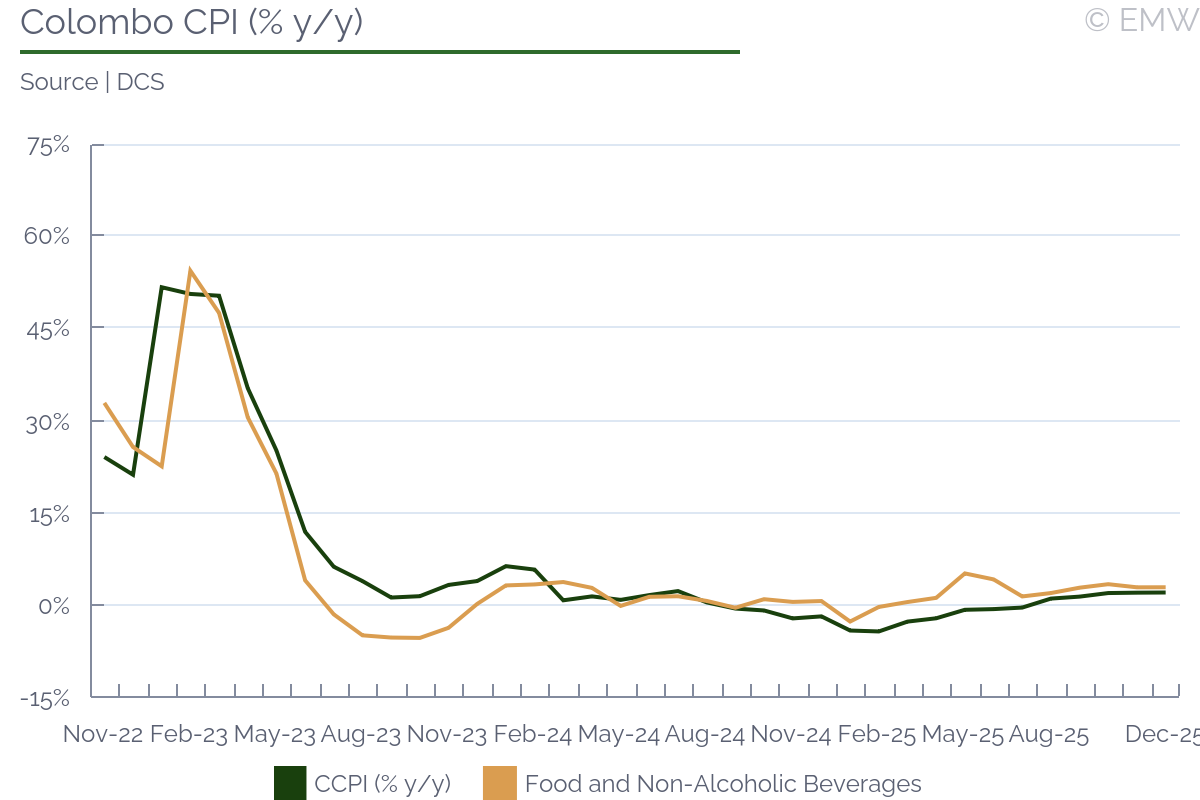

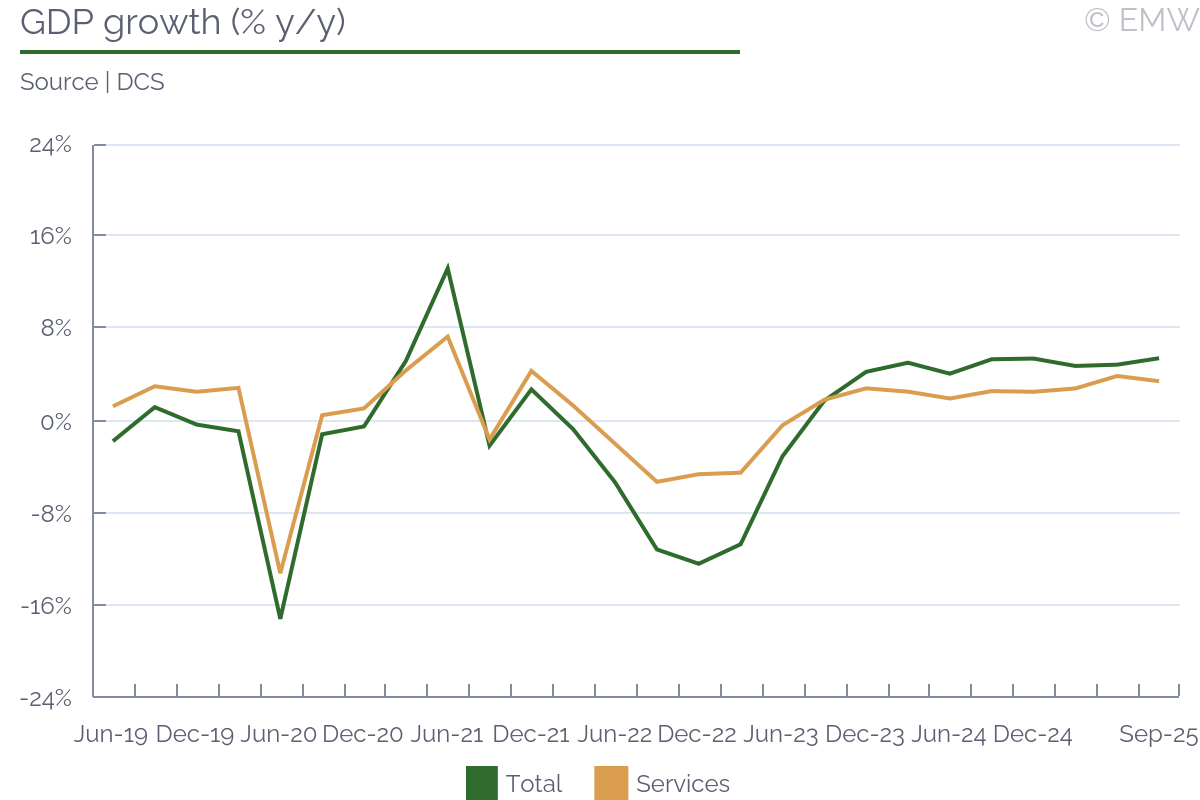

| CBSL to hold rates in Q1 |

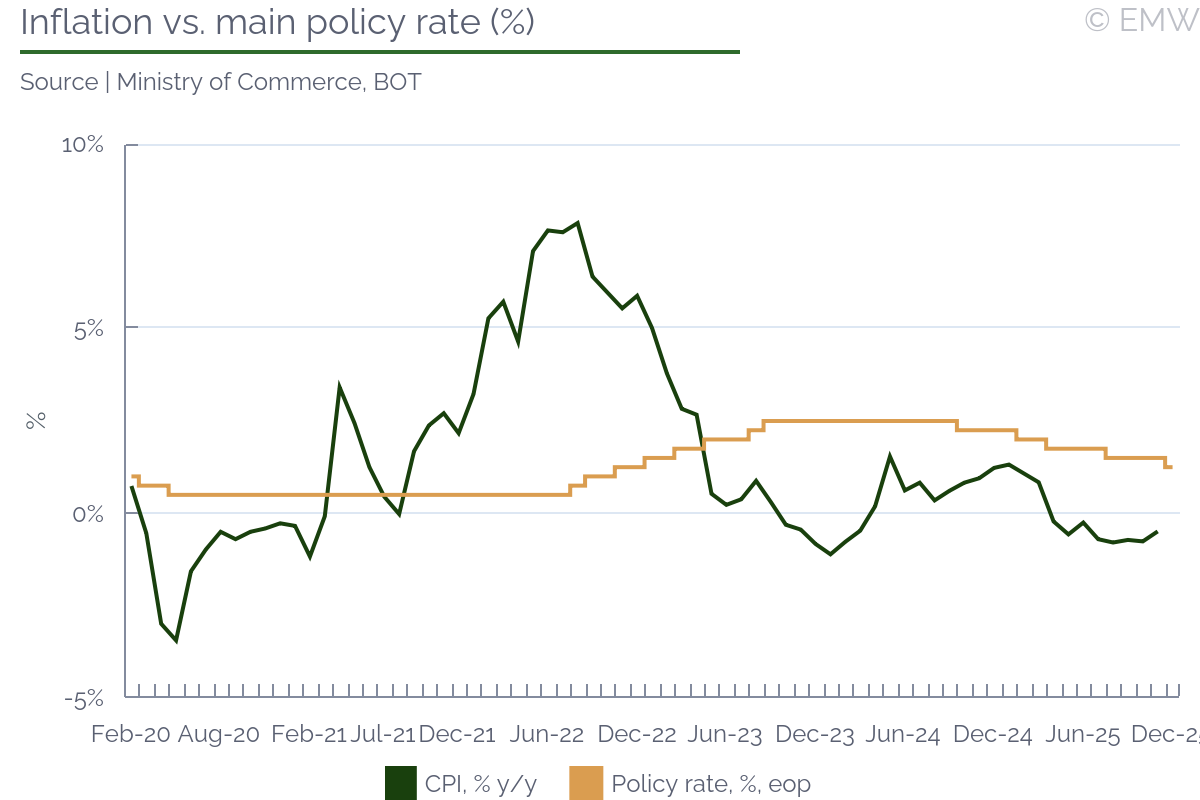

| BOT likely to continue with 25bps rate cut in Q1 2026 amid weak growth |

| Central bank is likely to start easing cycle |

| BCRA to keep policy rate and crawling peg moving closely in line with m/m CPI |

- BCRA to raise quickly next time CPI inflation comes at 7.0% m/m or close

- BCRA needs to keep monthly effective rate and crawling peg closely in step with inflation to reduce export delay and portfolio dollarization incentives

- Unsustainable deficit+debt dynamics keep BCRA from pursuing positive real rates or depreciation

- BCRA can only passively respond to rising inflation, this status quo likely remains until regime change

The BCRA's future monetary policy rate decisions will remain bounded by the evolution of effective inflation, expected inflation for the short-term, and the interest rate limitations the central bank faces if it is to keep the official real exchange rate steady in the coming year, which is something the bank is paying close attention to. The BCRA hiked its benchmark 28-day bill rate by 300bps to 78.0% in mid-March to accommodate the monthly effective rate at 6.5%, up from 6.3%, in what was the first move for the rate since last September. The decision was taken following the release of a surprisingly high 6.6% m/m CPI inflation print for February and with market expectations of a similar reading for March. The BCRA is likely to raise another 200bps or 300bps if the CPI reading for March is close 7.0% m/m, unless high-frequency price trackers show a deceleration in early April.

Monetary policy has been passive for most of the past three years, sitting under the weight of massive fiscal dominance and past policy mistakes, and there are no prospects for this to change until the end of this government in December. To put it in short, the BCRA needs to keep its monthly effective benchmark rate and the official exchange rate crawling peg moving right in step with CPI inflation, and it doesn't have room to deviate much or for too long, which means monetary policy should be fairly predictable this year. The BCRA has slightly more room to delay rate cuts if inflation declines than it has room to delay rate hikes if inflation rises, but it seems very unlikely that inflation will decline this year anyway.

The dangerous inflation spiral and the massive real exchange rate appreciation that took place in 2021-22 put pressure on the BCRA to raise nominal interest rates and push the pace on the crawling peg when inflation rises. If the crawling peg lags versus inflation, the government would be increasing the incentives for exporters to withhold sales abroad and wait for an inevitable devaluation, while also reducing competitiveness (most exporters are forced to convert their FX income into local currency). This would add to an FX market crisis that has the government burning through its low FX reserves. However, if the nominal crawling peg is to move faster, interest rates also need to rise in step to avoid creating incentives to delay exports. Interest rates that at least match inflation are also key to discourage portfolio dollarization through parallel exchange rates, which are an increasingly important benchmark for price-setting practices.

The BCRA also needs to be careful of not going too high with real rates because it would contribute to the explosiveness of public debt dynamics and inflation. With the government running a fiscal deficit of more than 4.0% of GDP every year despite having virtually no access to market financing, the deficit has been covered by a mix of inflation tax and central bank balance sheet deterioration. The higher the real interest rate goes, the faster the deterioration of the central bank's balance sheet and the growth of the federal government's short-term debt. However, the evolution of market financing for the government and the BCRA's remunerated liabilities suggests that the room to get financing through these avenues is pretty much closed now, which only leaves inflation tax as an option. In this scenario, nominal interest rate hikes are inflationary as long as there are no drivers to increase the private sector's willingness to finance the government.

| Ask the editor | Back to contents |

| Copom likely to hold Selic but give hint on future cuts |

- MPC meeting: Jan 27-28, 2026

- Current policy rate: 15.00%

- EmergingMarketWatch forecast: Hold

The BCB's Monetary Policy Committee (Copom) is likely to hold the Selic rate unchanged at 15.00% at its first policy meeting of 2026 on Jan 27-28, but we do expect it to provide more hints regarding the beginning of the easing cycle, which we believe will start at its second sitting in March. While the inflation scenario for 2026 is more benign, resilient economic activity, a robust labor market, real wage gains, and fiscal stimulus amid an election year continue to weigh on the Copom's decision to begin cutting the Selic. Having adopted a significantly hawkish tone throughout 2025, we believe the Copom will prefer to hold the Selic once again until clearer data on the impact of monetary tightening on the economy and how fiscal measures hinder it become available. Still, we expect the Copom to give further hints of potential Selic cuts starting in March, as its December minutes already seemed to have prepared the ground for the beginning of an easing cycle this year.

The January IPCA-15 inflation reading, which is known as a proxy for official inflation, rose to 4.50% y/y, returning to the upper limit of the +/-1.50-pp fluctuation band around the 3.00% target, though this is likely a temporary move. On a monthly basis, IPCA-15 inflation eased to 0.20% m/m, driven by higher health care prices but partially offset by transportation and electricity. Although the acceleration is likely temporary, the IPCA-15 reading is set to support the BCB's conservative stance and help deliver the expected Selic hold, in our view.

The impact of fiscal stimulus on economic demand remains a key concern for the Copom members. Fiscal risks also continue to weigh on the outlook, as doubts surrounding the medium-term fiscal framework and the effects of recent measures -- such as the income tax reform and directed credit policies -- add uncertainty to demand dynamics and inflation expectations. Inflation expectations remain de-anchored over longer horizons, as the BCB forecasts inflation returning to the 3.00% target midpoint only by end-Q1 2028, while analysts polled by the BCB don't see it at the midpoint even by 2029 (they forecast inflation at 3.50% in 2029). This persistent de-anchoring remains a central concern for the Copom and limits room for an immediate easing cycle, particularly amid ongoing fiscal uncertainty, reinforcing the committee's preference for a cautious and data-dependent approach and supporting another Selic hold at the first meeting of 2026.

Overall, the Copom is likely to keep the Selic rate unchanged at 15.00% this Wed., in line with the broadly conservative stance adopted throughout 2025 while the impact of fiscal stimulus becomes clearer. We note that the meeting will include only seven of the nine board members as the two directors appointed by former President Jair Bolsonaro left office in late 2025 but President Lula da Silva has not yet nominated their replacements. Lula has argued that the delay reflects a turbulent political environment with Congress, which must approve the nominees. Even so, this reduced board size is unlikely to alter the expected Selic hold.

Looking ahead, we expect the Copom to provide additional hints regarding the easing cycle, even if not through explicit forward guidance. We believe the outlook supports the start of rate cuts in March, but the magnitude of the first move remains uncertain. The Copom's minutes, to be published on Feb 4, should offer further clarity. For now, we expect the easing cycle to begin with a 25-bp cut, though the committee's tone, incoming data, and potential electoral uncertainties could justify a larger 50-bp cut.

| Copom structure and latest voting results | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: BCB |

| Ask the editor | Back to contents |

| CNB to remain retrenched, despite soft headline inflation |

- Next MPC meeting: Feb 5, 2026

- Current policy rate: 3.50%

- EmergingMarketWatch forecast: hold

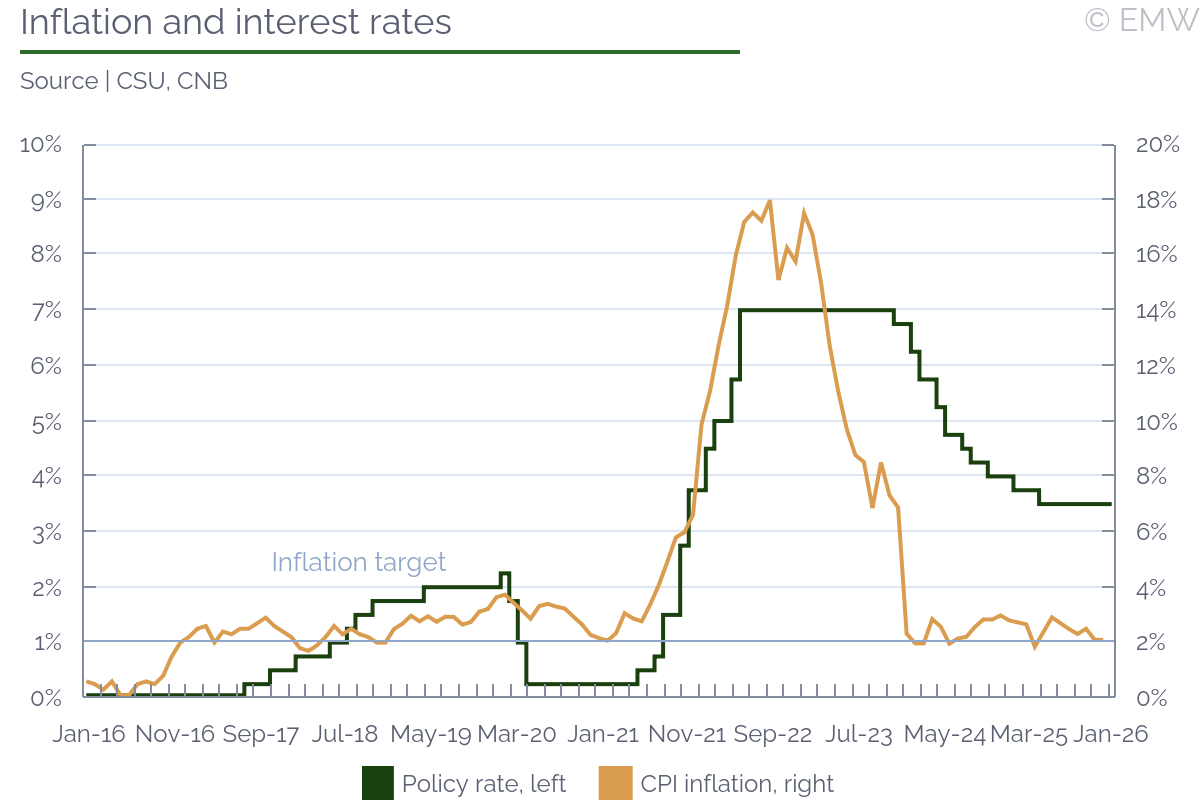

Rationale: The CNB remained cautious after it kept the policy rate at 3.50% yet again at its MPC meeting in December. The decision was unanimous once again, even in the absence of Eva Zamrazilova, who is one of the biggest hawks on this board. While the outlook is now considered moderate, rather than strongly inflationary, the language of the post-meeting statement did not give any dovish notes. Quite the contrary, the CNB board remains entrenched in its current position, preferring to see a noticeable deceleration in core inflation before it feels it can act. The minutes from the meeting confirmed that the statement's language is a bit misleading, as it showed a clear majority being happy with where monetary policy is currently at. There was no single board member who pushed for easing monetary conditions in the near future, which is indicative of the board's overall mood.

Core inflation has been increasingly singled out as the indicator to watch, including by CNB governor Ales Michl, who said the cautious stance would remain in place until core inflation is near the 2% target. The CNB board is currently braced for any effects that global uncertainty may unleash. Even though expectations are that headline CPI inflation will near, and possibly fall under the 2% target in 2026, it is anticipated to pick up again in 2027, which justifies the current CNB stance. In fact, it even implies that interest rates may remain stable quite longer than currently anticipated. Michl reiterated those remarks early in 2026, arguing that the CNB was looking at price stability in 2027 and 2028 as well, hence its cautious positions. Zamrazilova, who did not attend the latest MPC meeting, chimed in with a hawkish stance, arguing that sticky service prices and looser fiscal policy could eat away any space for rate cuts that could have existed in 2026. She mentioned easing of 25-50bps, which is in line with our expectations that the current floor for the policy rate is 3%.

Recent economic data has been supportive of this stance. Even though CPI inflation was close to the target, at 2.1% y/y in December, it was again due to volatile prices. Core inflation remained elevated and end the year at 2.8% y/y, only slightly below the CNB's projection. Service price inflation has remained sticky, already indicated by service provider prices that retained their robust growth. There will be some relief in food prices, as agricultural producer prices have eased even further. Furthermore, fuel prices will likely be soft as well, given how oil prices decreased after the US intervention in Venezuela, and the possibility of regime change in Iran. On the other hand, the labour market hasn't loosened enough, and wage growth pressure is still solid. The finance ministry has just upgraded its wage growth projections for 2026, which we find warranted. Where uncertainty comes is mostly towards manufacturing, which, we believe, may witness a more difficult year than this one.

The elephant in the room is fiscal policy, which the CNB board has declined to comment on, at least for now. It appears increasingly likely that there will be some fiscal loosening as early as in 2026, based on recent remarks of FinMin Alena Schillerova. Appetite for stronger spending is growing, and the fiscal commitments made by the new ruling coalition are considerable. Furthermore, budget performance at the very end of 2025 was disappointing, though mostly due to poor absorption of EU funding. Still, the state government budget ended up with a deficit almost CZK 50bn above the target. Besides, Schillerova remained ambivalent on the 2026 budget, which implies that deficit targets will remain high. This is likely one of the unspoken reasons why the CNB board remains so cautious, even if risks to economic growth are on the downside in 2026.

It is why we continue to expect that interest rates will remain stable throughout H1 2026, but that there might be room for some monetary easing in Q3 at the earliest. One reason could be energy prices, which the new government will reduce, both for households and business. It may prove insufficient if external demand takes a plunge, but it may provide some relief to supply side prices. On the other hand, depending on how large fiscal loosening is, the state could easily erase any favourable effects from lower energy prices, which makes the situation so uncertain. This is why we remain fairly confident about stable interest rates in H1 2026, with some possibility for a cut later in the year. Overall, however, the odds of a rate cut this year remain relatively low.

| CNB board summary | ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

| Source: EmergingMarketWatch estimates based on statements and voting behaviour of board members |

Further Reading:

CNB board statement from latest MPC meeting, Dec 18, 2025

Post-meeting press conference, Dec 18, 2025 (in Czech)

Q&A after the latest MPC meeting, Dec 18, 2025

Minutes from the latest MPC meeting, Dec 18, 2025

Monetary Policy Report, November 2025

Macroeconomic forecast, November 2025

Meeting with analysts, Nov 7, 2025

CNB board members' presentations, articles, interviews (Czech)

CNB board members' presentations, articles, interviews (English)

| Ask the editor | Back to contents |

| MPC may cut interest rates by 100-200bps in February as FX rate firms |

- Next MPC meeting: February 12, 2026

- Current policy rate: 20.5%

- EmergingMarketWatch forecast: 19.5% - 18.5%

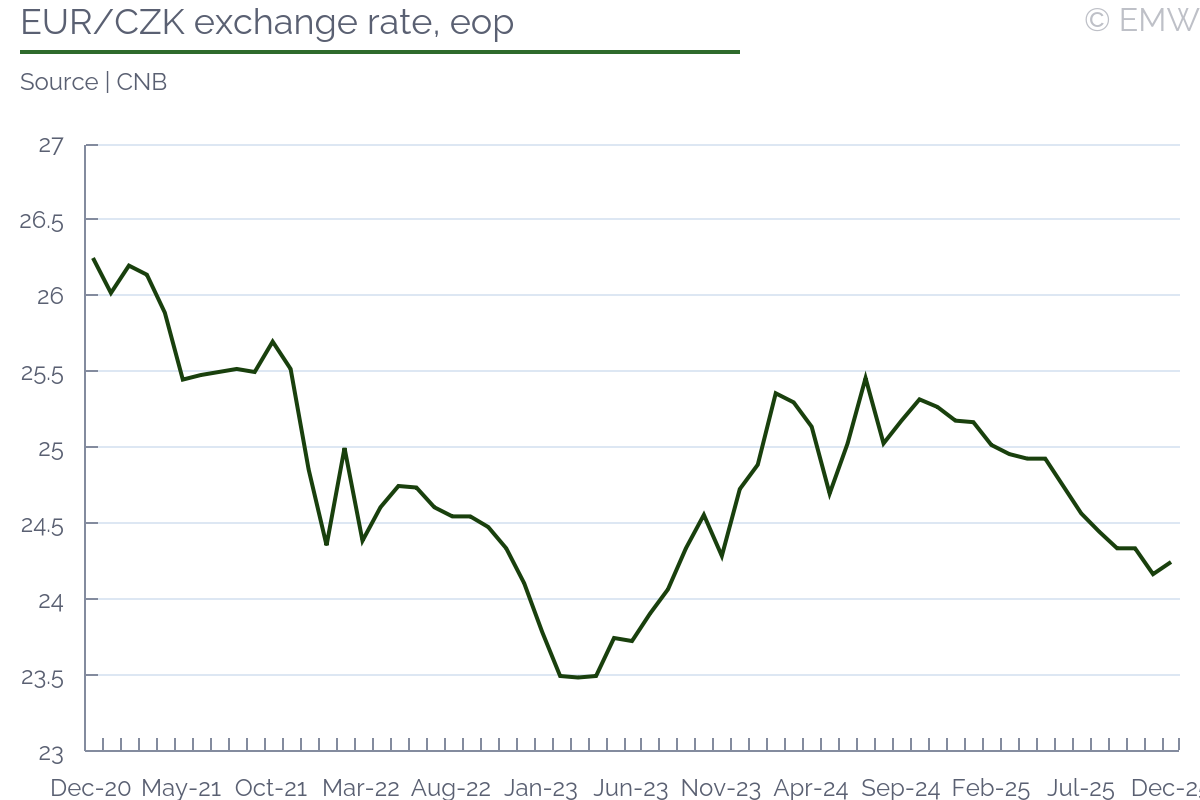

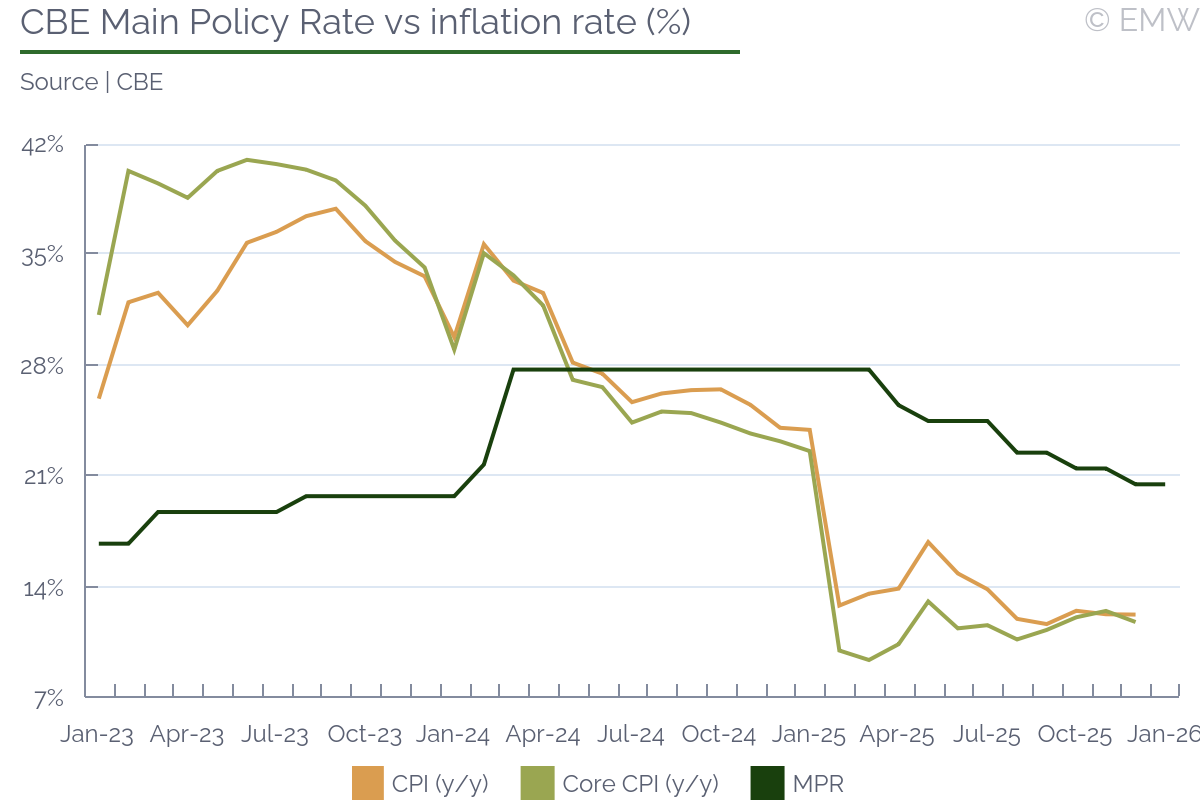

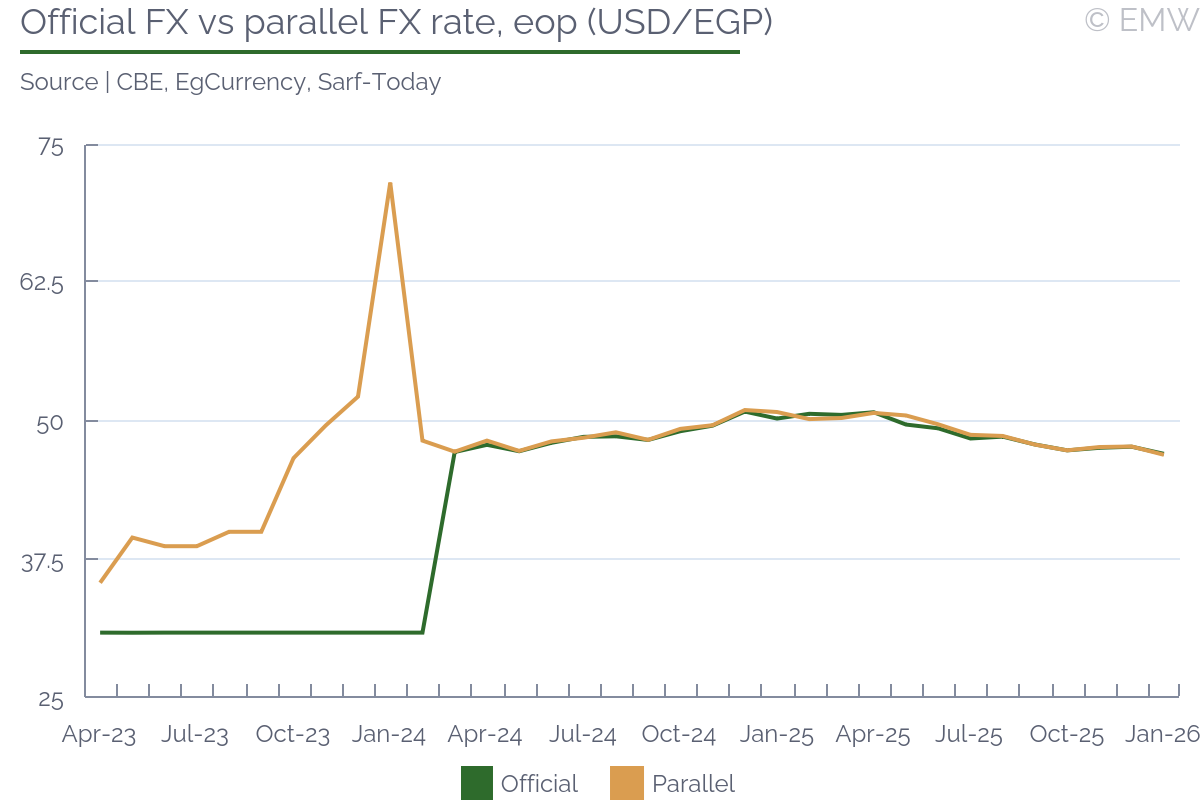

The MPC is expected to continue the monetary easing cycle that began in April 2025 as CPI inflation held steady at 12.3% y/y in December against market expectations of marginal acceleration to 12.5% y/y. We think that there is room for either a 100bps or 200bps rate cut, and the MPC's final decision will ultimately depend on the CPI inflation report due on Feb 10. More generally, CPI inflation is expected to moderate further this year, getting closer to the CBE's target of 7% +/-2pps by end-2026, supported by the stronger pound and further drop in global oil prices. The MPC has so far delivered a cumulative rate cut of 725bps since April, bringing the main interest rate to 20.5%, and analysts project further 600-800bps reduction this year. GDP expanded robustly in 2024/25 as non-oil manufacturing rebounded and private consumption and investments improved further, but economic growth is nearing its full potential, so some demand-side inflationary pressures are likely to resurface this year.

We think that ultimately monetary policy will depend on the pound, whose 2025 performance surprised most analysts. The pound has appreciated since April 2025, despite the series of external shocks that marked 2025, and the outlook is significantly better now than just six months ago. Provided there are no extreme external shocks this year, the pound should remain stable supported by IMF's disbursements, proceeds from the divestment program, portfolio inflows, Chinese and Gulf direct investments, solid remittance inflows, growing tourism arrivals, and recovery in Suez Canal FX receipts. The merchandise oil balance is unlikely to swing to surplus this year, but recovering gas production can help narrow the deficit in this account. Egypt also hopes to be re-admitted to the JP Morgan Bond Index this year. In fact, some analysts see room for further FX rate strengthening this year, but given the influx of hot money since March 2024, the FX risk should not be underestimated.

| Ask the editor | Back to contents |

| Policy rate cut remains on agenda for February |

- Next MPC meeting: Feb 24, 2026

- Current policy rate: 6.50%

- EmergingMarketWatch forecast: Hold

- Rationale: Rate cut in February requires convincing disinflation drive in January

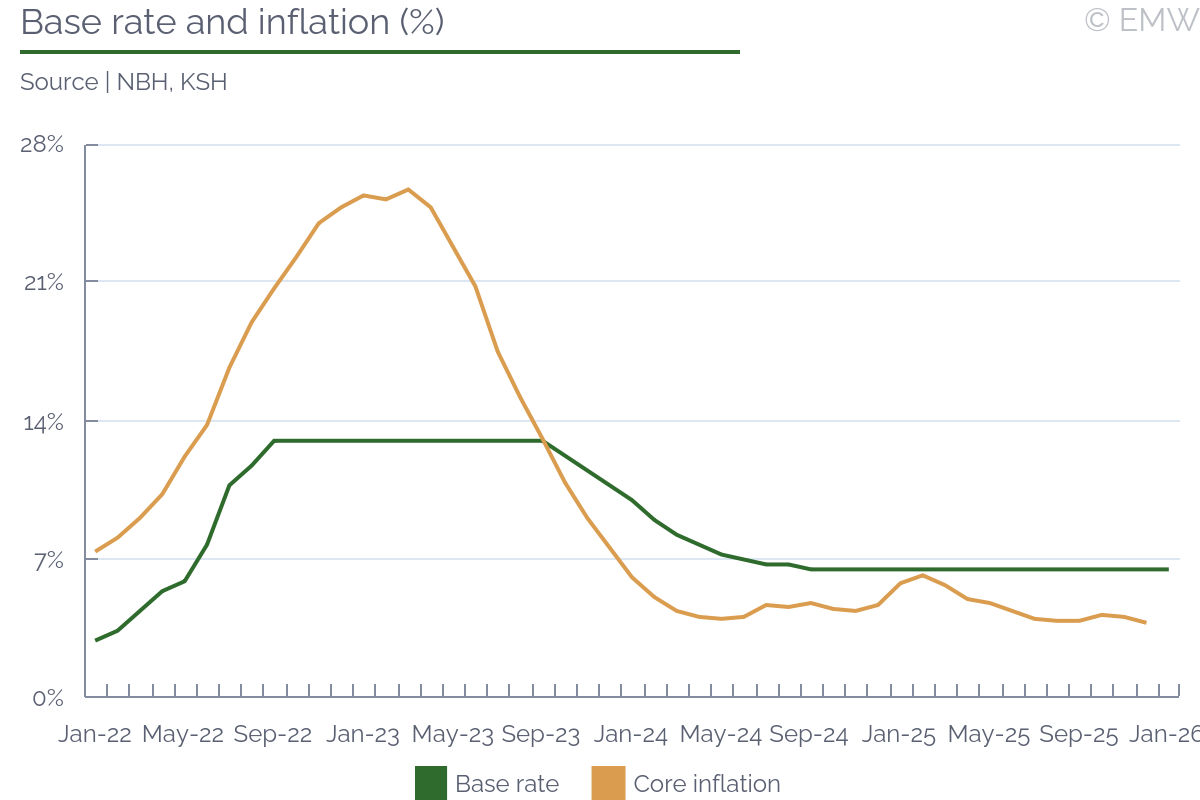

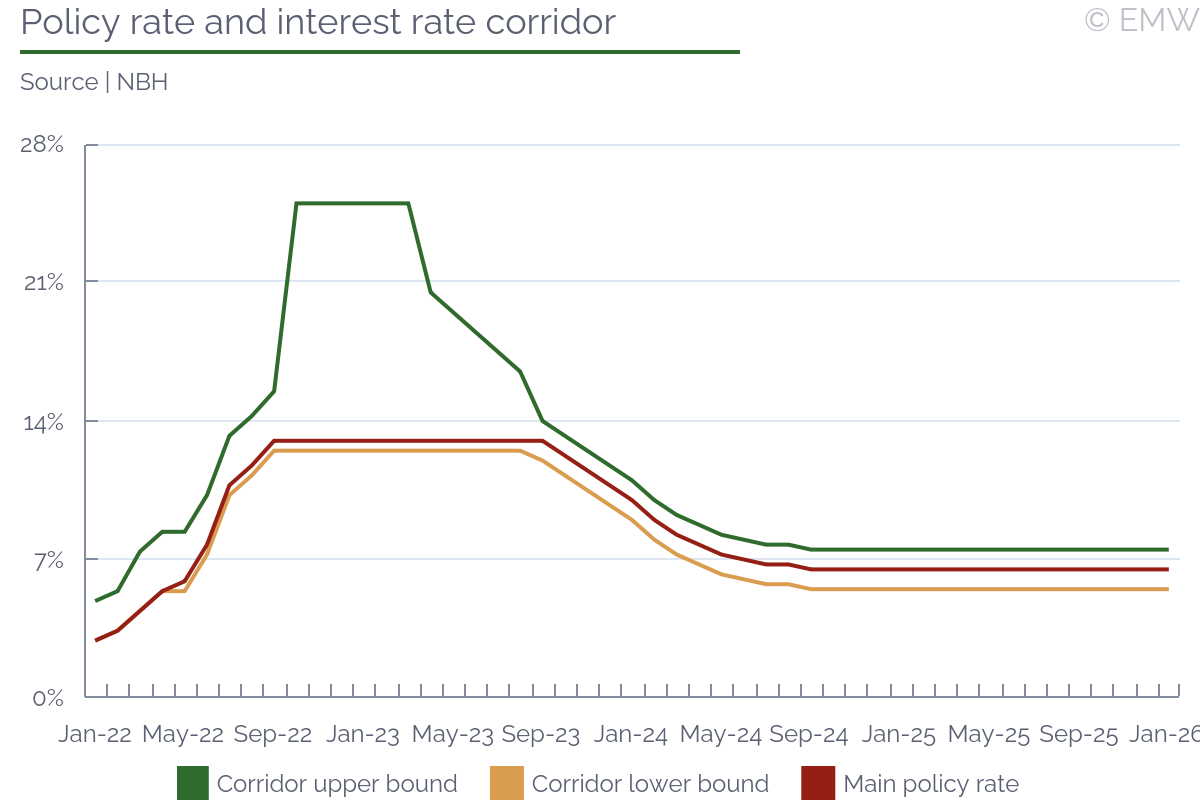

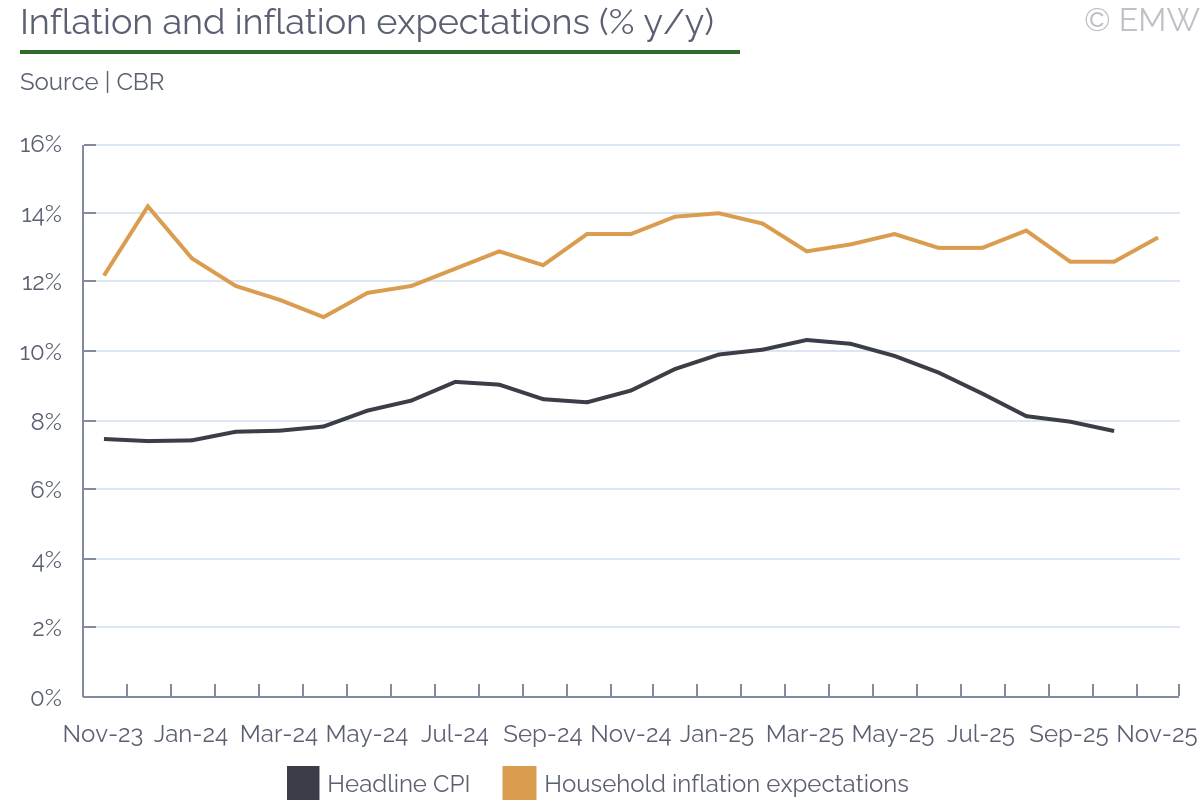

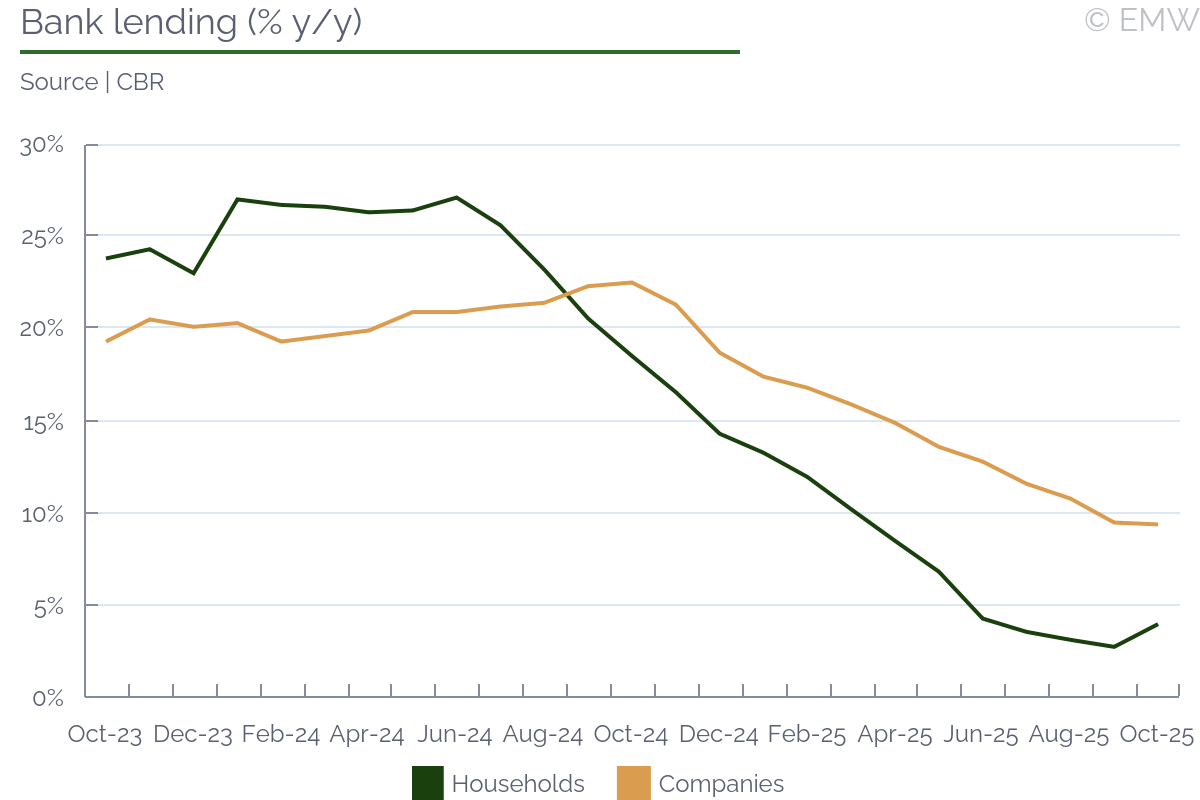

The monetary policy entered a new phase as of December as the MPC held the policy rate at 6.50% but revised the policy guidance in the direction of rate cuts. The previous guidance had been firm that no rate cuts were expected in the foreseeable future, while the current guidance loosened this stance and indicated that rate decisions will be taken on a month-by-month basis. This clearly opened the door to rate cuts, while the other change in the policy guidance indicated that the prospective rate cuts will be decided on an ad-hoc basis depending on the incoming data. Financial market stability and inflation developments will be the key indicators, which will shape monetary policy decisions, the MPC indicated. Pricing behaviour in the beginning of January will be key for the assessment of the inflation outlook, the MPC has said. The policy guidance remained unchanged after the MPC rate meeting in January.

The unchanged policy guidance meant that a policy rate cut of 25bps could be still on the agenda for February, we think. The likelihood for policy loosening in February has declined though due to the unfavourable December CPI print, we assess. NBH governor Mihaly Varga had said before the CPI data release that the NBH will mostly monitor services inflation and will want to see higher pass-through from the forint appreciation to tradable prices, while the December CPI disappointed on both counts. The CPI moderated to 3.3% y/y in December, which Varga qualified positively as it was the second month with inflation within the tolerance range but admitted that it exceeded the NBH expectations. Services inflation actually picked up on telecom and tourism services prices during the month, while durables goods prices did not indicate significant change in monthly repricings, in our opinion suggesting no further pass-through from the recent forint strengthening. In subsequent statement, NBH deputy governor Zoltan Kurali also signalled reduced chances for policy easing, saying on Jan 14 that the NBH needed to see more convincing disinflation before proceeding with rate cuts. We expect that inflation could fall further in January on the back of continued downside trend in food prices and base effects on fuel prices due to the six-month delay in the implementation of the excise tax hike. That said, we expect limited improvement in the core inflation metrics due to sticky services prices, elevated inflation expectations and healthy consumption demand, so we consider the odds to be against a rate cut in February.

Monetary policy will be based on a cautious and patient approach due to persistent risks for the inflationary outlook, the MPC said on its January meeting. It will continue to target a positive real interest rate for the sake of safeguarding financial market stability and for the sake of anchoring inflation expectations towards the 3.0% mid-term inflation target. Household inflation expectations have stagnated in the past months and have remained at levels inconsistent with price stability, according to the MPC assessment. The stability of the forint exchange rate will be therefore important for the sake of helping the elevated inflation expectations to cool down in line with the inflation target, the MPC said. We see it unlikely that January could produce a simultaneous disinflation and material downward correction in household inflation expectations, which reinforces our expectation that incoming data should prove insufficiently positive to support a rate cut already in February.

| MPC Members | ||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||

| Source: NBH, EmergingMarketWatch estimates |

Post-meeting MPC statement from January rate-setting meeting

Background presentation of NBH governor Varga after January rate-setting meeting

| Ask the editor | Back to contents |

| Strong growth, low inflation provide ample room for rate hold |

- Next MPC Meeting: 2-5 February 2026

- Current Policy Rate: 5.25%

- Last Policy Action: 25 bps cut (December 2025)

- Our Base Case: Hold (No Change)

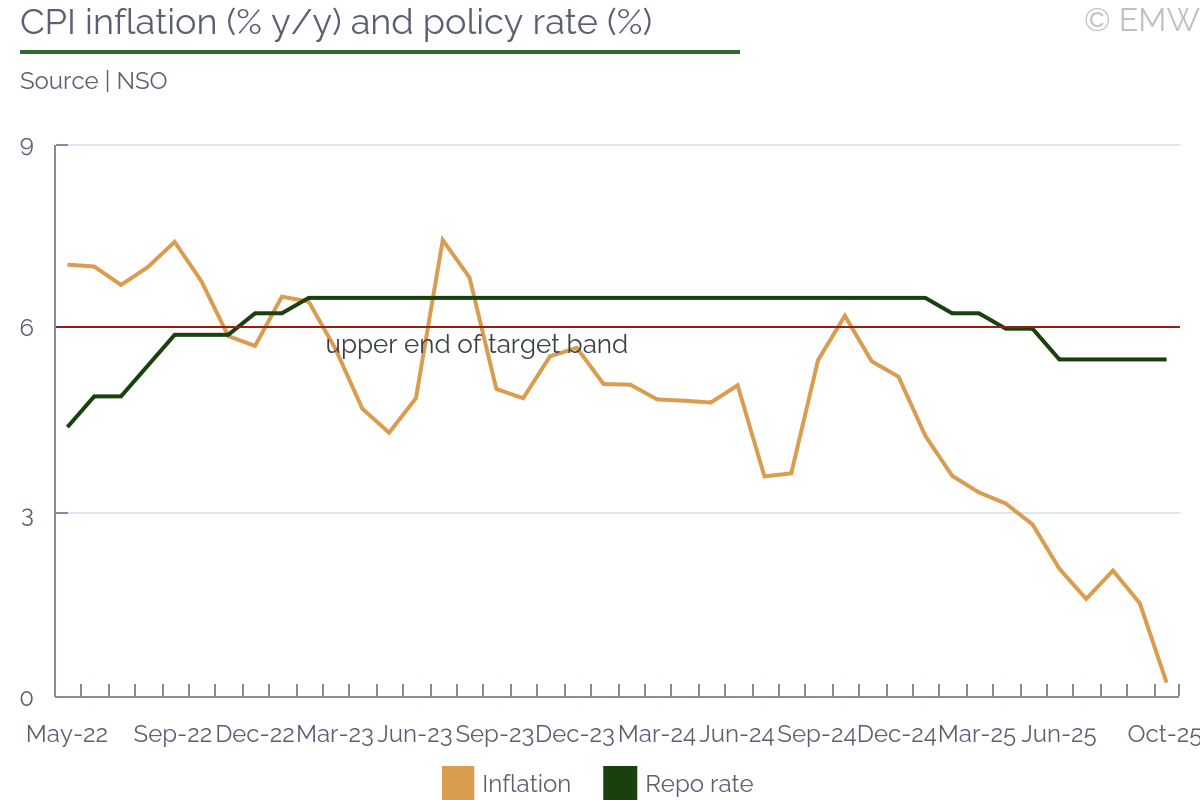

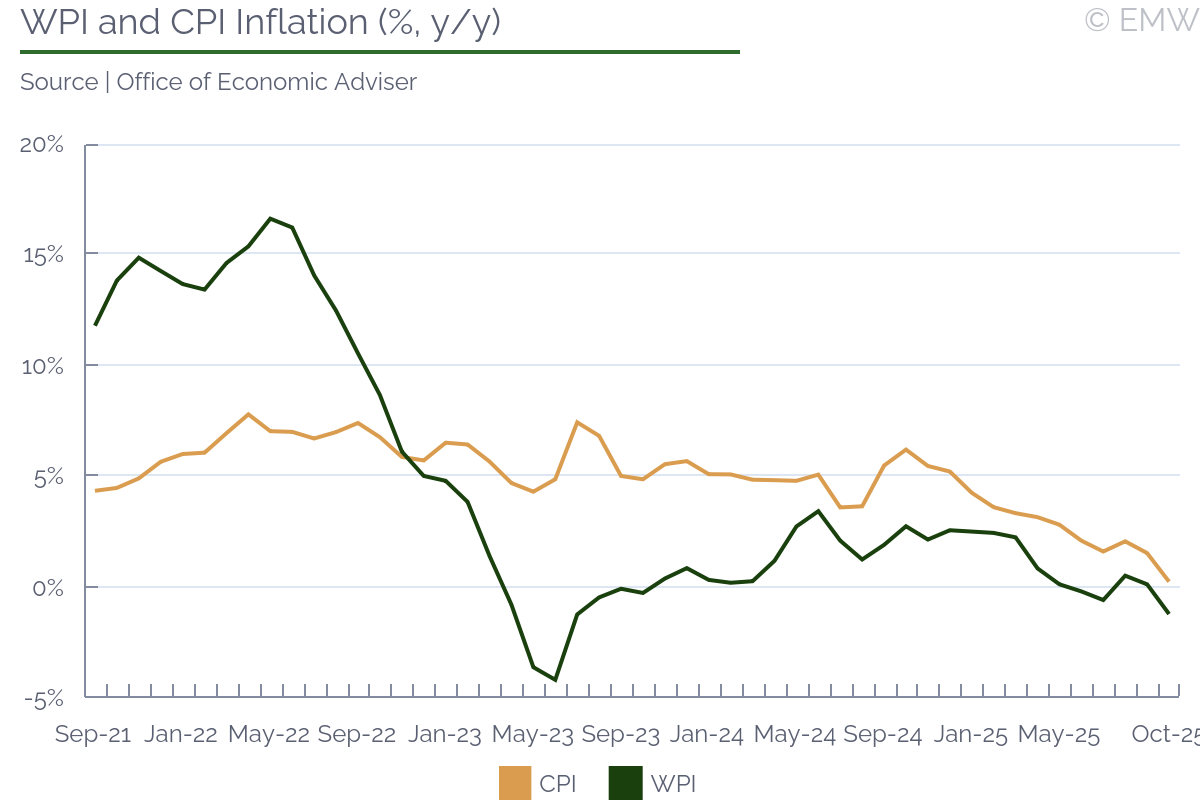

The RBI approaches the February policy meeting with significant easing capacity, but minimal impetus to deploy it. The December rate reduction has already injected measured accommodation into an economy experiencing historically low inflation and sustained above-trend growth. With real policy rates firmly positive, credit markets well-supplied, and fiscal momentum improving through GST 2.0 and direct-tax relief, the incremental payoff from an additional near-term cut has narrowed considerably. In sequencing terms, the RBI stands to gain more by monitoring transmission and safeguarding strategic flexibility than by advancing easing in a macro environment showing neither consumption strain nor funding stress. A policy hold in February should therefore be read not as restraint, but as intentional fine-tuning.

Inflation Dynamics

India's disinflation trajectory has been deeper and longer-running than originally priced, decisively trailing the RBI's central 4% target marker. Headline CPI printed a historic trough of 0.25% y/y in October 2025, rising only mildly to 0.71% in November, with food inflation dipping into negative territory on the back of corrections in vegetables, pulses, and edible oils. Core inflation signals have also softened, reflecting lower input costs and muted pricing power rather than a collapse in demand. The implementation of GST 2.0 on 22 September 2025 has amplified this disinflation phase. The streamlined two-tier rate regime (5% and 18%), alongside a 40% premium slab for luxury and sin goods, has reduced the effective tax incidence across key essentials, delivering a one-time downward shift in the price level. Upstream costs echo this softness, with WPI inflation at −1.21% in October 2025, validating subdued pipeline pressures. The more relevant policy signal is that inflation is likely past its floor. As statistical bases normalise and food prices stabilise, CPI is expected to drift higher through Q4-FY26, converging toward the target band without breaching it. With inflation rotating upward from ultra-low levels, rather than sliding further, the argument for pre-emptive easing in February is structurally thin. The RBI can afford to wait without undermining its growth priorities.

Economic Growth

India continues to exhibit relative macro strength. In Q2-FY26 (July-September 2025), real GDP expanded 8.2% y/y, reaching INR 48.6tn, while nominal GDP rose 8.7% to INR 85.3 tn. The outsized disinflation impulse inflated real growth through a favourable deflator effect, magnifying-but not artificially creating-economic momentum. Household demand signals remain robust. Auto retail sales hit 4.02 mn units in October 2025, reflecting 40.5% y/y growth, fuelled by the prolonged festive season, GST adjustments, and an observable rural demand rebound. Critically, fiscal levers aimed at improving disposable incomes are positioned to sustain consumption into H2 FY26. This is not a below-potential growth cycle that requires monetary backstopping. Meanwhile, the latest FY26 first estimates announced by the government earlier today indicate strong growth of 7.4% y/y in FY26, lending further credence to our view that there is no real concern for a rate cut in February.

External and Financial Conditions

India's external accounts continue to underpin policy headroom. The current account deficit narrowed to 1.3% of GDP (USD 12.3 bn) in Q2-FY26, from 2.2% (USD 20.8 bn) a year earlier, led by services exports and strong remittances. FX reserves remain elevated at USD 690 bn, equivalent to ~11 months of import cover, reinforcing buffer strength against global capital-flow volatility. The rupee has faced intermittent depreciation pressure but remains within a managed trading range, aided by RBI liquidity operations and intervention capacity. System liquidity is still ample following prior CRR cuts, and overnight funding rates continue to track the lower bound of the policy corridor.

Outlook

With the December cut delivered, the RBI shifts to evaluation mode. The MPC is likely to prioritise adaptability, data-led decisioning, and financial-stability optics over signalling a renewed easing cycle. A February hold enables a clearer read on transmission lags, inflation normalisation, and exogenous risk vectors, including US tariff posture and market volatility. Our base view remains that the repo rate stays unchanged through at least mid-2026. Any further easing is expected to be modest and conditional, triggered only by a tangible growth miss or an inflation regime remaining anchored between 1-1.5% for longer than projected.

| Ask the editor | Back to contents |

| Bank Indonesia to delay rate cuts until Q2 |

- Next policy meeting: Feb 18-19

- Current policy rate: 4.75%

- Our forecast: Hold

- Last decision: Hold (Jan 20-21)

- Rationale: Rupiah depreciation is again main concern, CPI inflation also gains pace

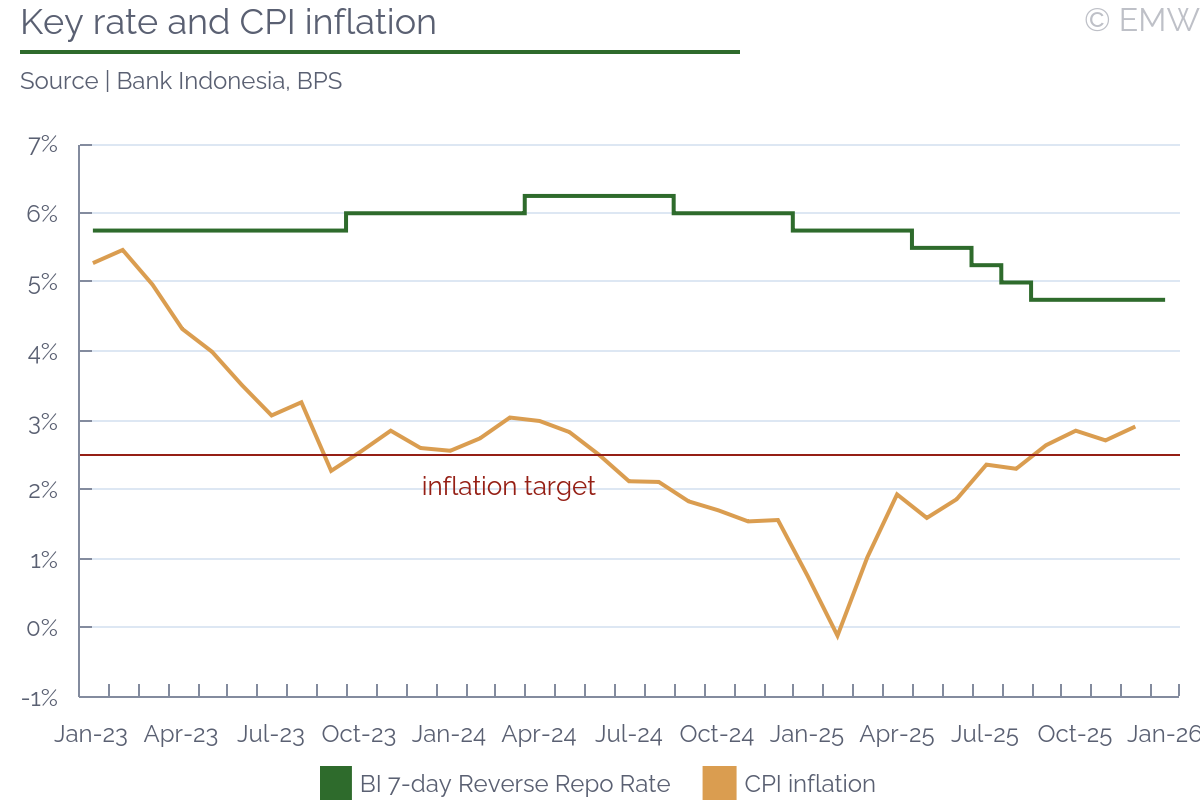

Back in 2025, Bank Indonesia cut the key rate by 125bps cumulatively, before pausing the monetary easing cycle in Q4. The central bank justified the rate cuts with the need to support GDP growth in a low-inflation environment, as the rupiah stabilised against the dollar in the period. However, the last four hold decisions came on the backdrop of renewed pressure against the rupiah, which brought to a temporary halt the monetary easing.

Still, Bank Indonesia claims it remains dovish as it would monitor the space for further rate cuts and focus on improving the transmission of monetary policy into loan interest rates, so that bank lending gains pace. However, the accelerating inflation and the depreciating rupiah will likely weigh on further rate cuts in Feb-Mar, in our view, particularly given the rupiah is approaching the psychological threshold of USD/IDR 17,000.

We should note that CPI Inflation remains within the central bank's 2.5+/-1% target band, though it has been accelerating on the back of the growing food prices. Core inflation remains firmly anchored to the central bank's target.

On the other hand, FinMin Purbaya Yudhi Sadewa criticised the central bank for being too hawkish and late with rate cuts to stimulate economic growth. The FinMin advised that the key rate should be 1pp higher than inflation, which suggests he sees it at 3.5-4.0% in the long term. Moreover, the parliament will likely appoint Prabowo's nephew Thomas Djiwandono as deputy central bank governor, which raises concerns over the central bank's independence and future policy rate decisions.

As a result, we think BI will resume monetary easing once the rupiah stabilises, possibly in April.

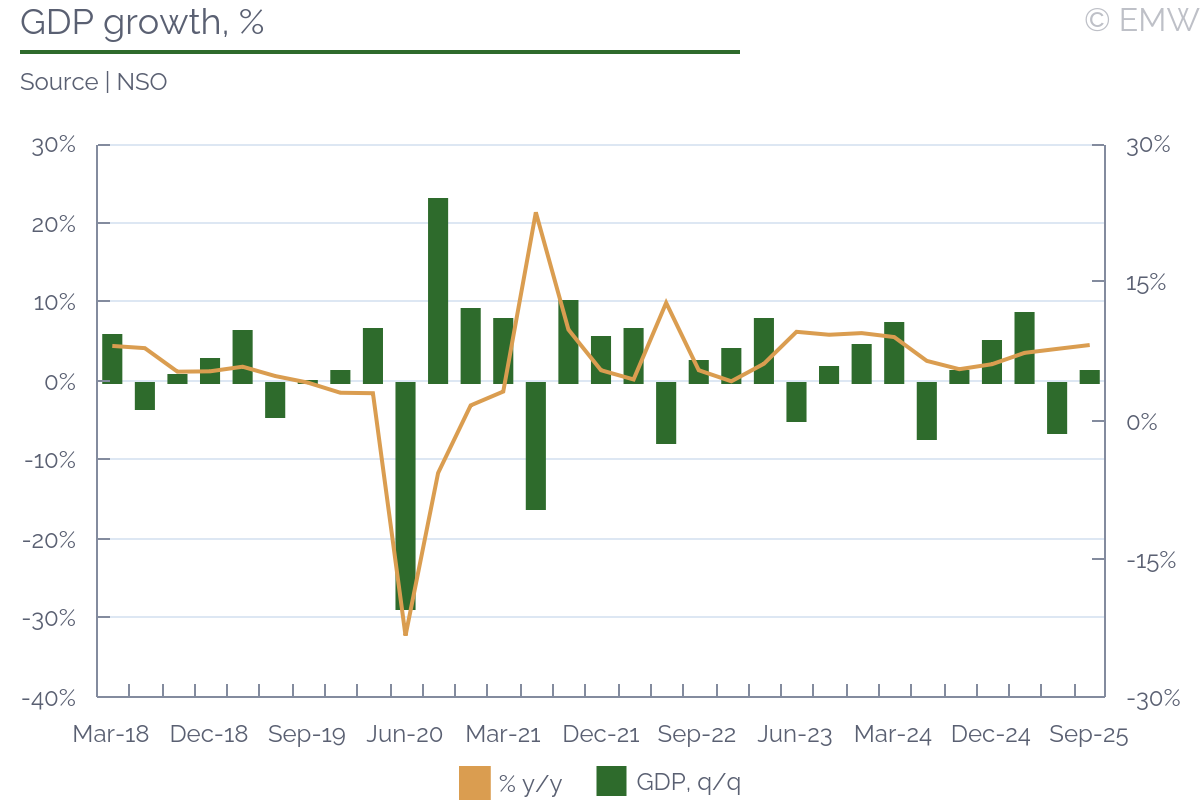

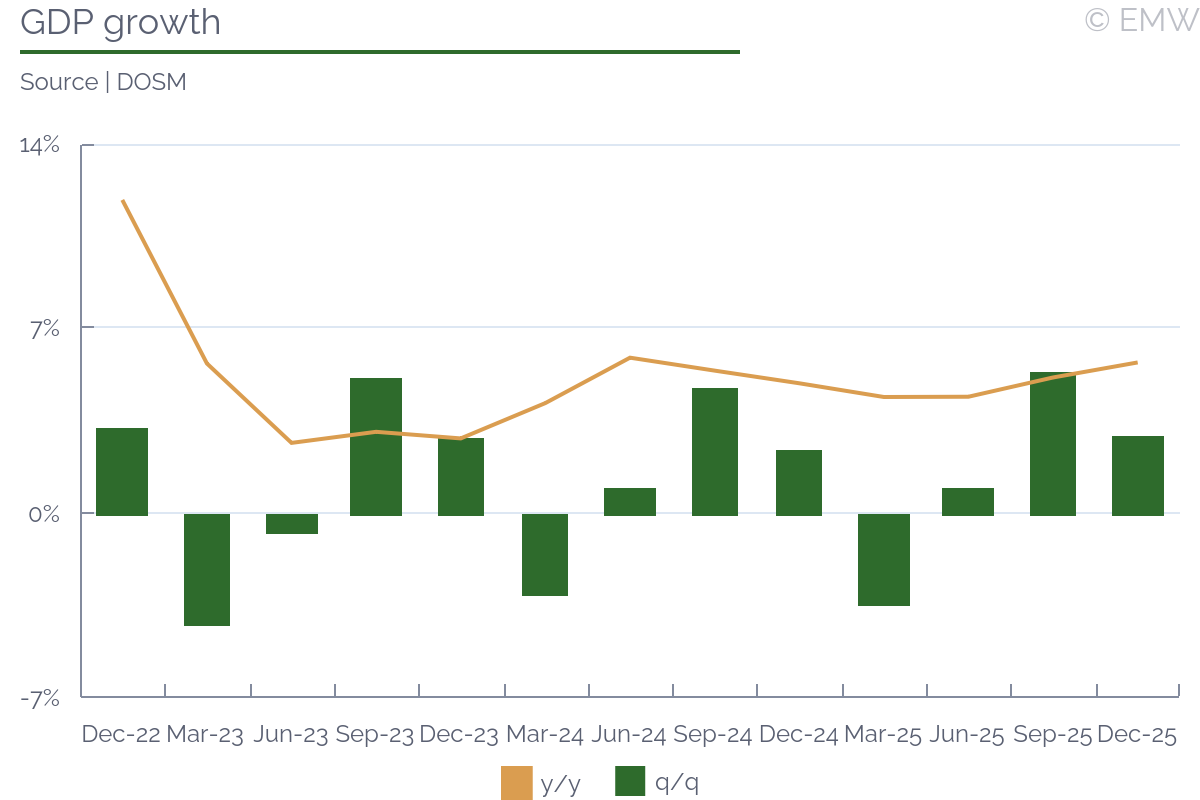

GDP growth

GDP growth eased slightly to 5.04% y/y in Q3 from 5.12% y/y in Q2. Investment and private consumption were the main factors behind the slowdown, while higher public spending largely offset their impact. The BI has maintained its GDP growth forecast at 4.6-5.4%, but said economic growth will be slightly above the midpoint, while most IFIs and rating agencies have their forecasts even lower at 4.7-4.9% in 2025.

We should note that the government has taken steps to support economic growth in H2. These include two stimulus packages worth IDR 43tn combined, which were disbursed in Q4, mostly in December, as well as the placement of IDR 200tn government funds from the surplus budget balance (previously kept with the central bank) into commercial banks in a bid to boost lending.

On the other hand, the floods in Sumatra will lower overall GDP growth, with BI estimates pointing to a marginal impact of about 0.02pps. At any rate, the full impact is yet to be estimated, with large-scale reconstruction of public infrastructure likely to offset the impact of the lower economic activity in the region.

Exchange rate stability

The rupiah depreciated by about 1.8% against the USD in 2025, with renewed pressure in Q4 after the successive rate cuts in Q3. The rupiah now trades in the USD/IDR 16,800-16,900, edging close to the psychological threshold of USD/IDR 17,000.

The BI governor stated that Bank Indonesia will continue to use its tools to keep the local currency stable. In fact, the BI regularly intervenes in the forex market through its so-called triple intervention, which includes purchases on the spot FX market, domestic non-deliverable forwards (DNDF) and buying government bonds on the secondary market.

We should note that BI's aggressive rate cuts in 2025 were also partly influenced by the Fed Funds rate cuts as well. Looking forward, the outlook now is for a much more stable environment with the Fed likely to cut by 50bps cumulatively in 2026.

Inflation environment

CPI inflation accelerated to 2.92% y/y in December from 2.72% y/y in November, approaching the upper end of the BI's 2.5+/-1% target band. Still, inflation remains anchored well within the band and hence remains of little concern to the central bank.

Looking forward, inflation expectations also point to CPI inflation remaining close to the midpoint of the central bank's 2.5+/-1% target band on average this year. The latest IMF forecast points to 2.9% CPI inflation this year, with most other forecasts being in the range of 2.5-3.0%.

At any rate, Bank Indonesia expressed confidence that CPI inflation will remain under control and within the target band in 2026. This projection looks realistic, in our view, especially given the recent stabilisation around the midpoint of the target band.

Conclusion

Looking forward, we expect Bank Indonesia to keep the key rate on hold in February and March and focus on the rupiah's stability. However, should the Fed take the lead and slash the Fed Funds rate first, this could take away some of the depreciation pressure on the rupiah, and we may see a surprising rate cut sooner than anticipated.

On the other hand, we should note that BI has been largely surprising markets in 2025, with half of the rate cuts coming against consensus forecasts for a hold decision. However, we believe this is not the case now, given the renewed pressure against the local currency.

Further reading

| Ask the editor | Back to contents |

| CB shows will to resume monetary easing relatively soon |

- Next MPC meeting: February 5

- Current policy rate: 7.00%

- EmergingMarketWatch forecast: Hold

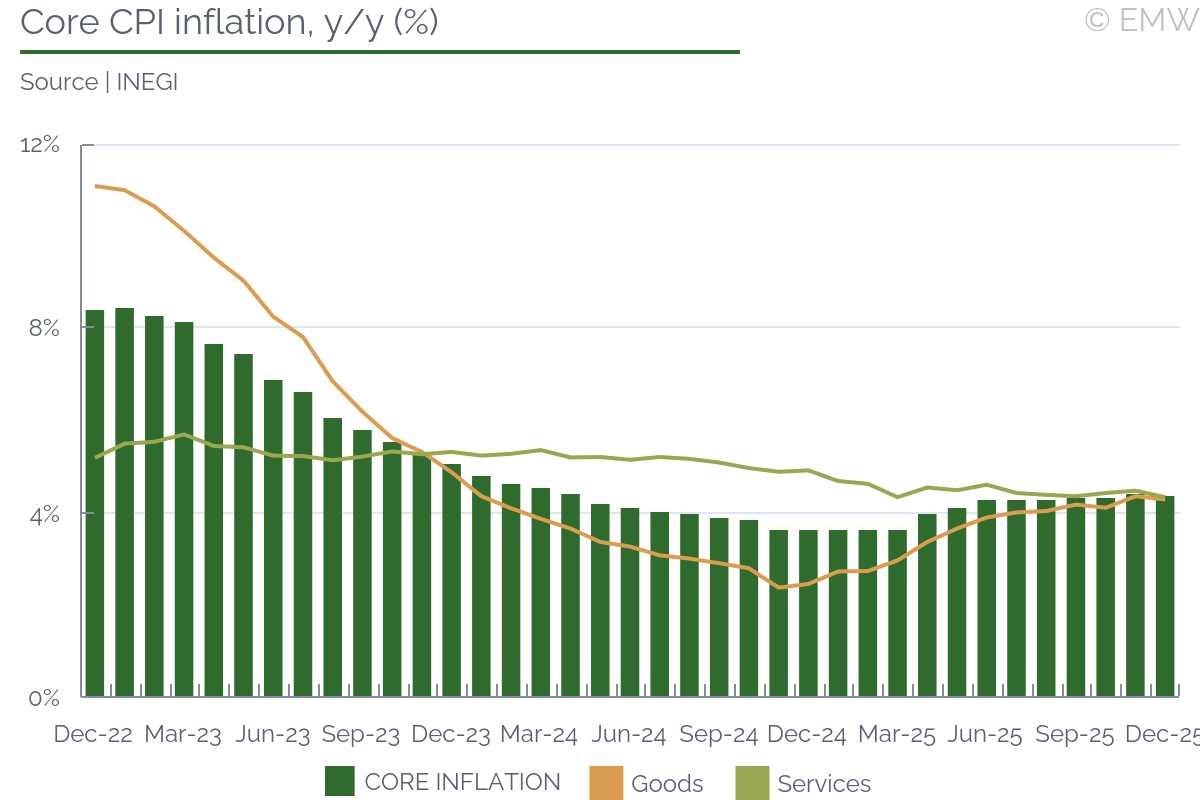

The CB was clear in its Monetary Program, published on Tuesday, to say it plans to cut the Monetary Policy Rate (MPR) moving forward. However, it wasn't so clear about the timing, considering the CB said such easing will come once it sees no second order effects appear from the inflationary pressure expected in early 2026.

This position is unsurprising in the sense that the market already expects 50bps easing this year. In our view, it is notable to see the CB failing to make a commitment to keep the policy rate on neutral territory, which could mean the CB is willing to slide into expansive territory. This diverges from the market's expectation for 2027, with expects seeing the MPR at 6.50% through 2027.

The Monetary Program is consistent with the dovish position assumed by the bulk of the board in the latest minute, in our view. We believe the latest minute showed the Monetary Policy Council's (MPC) willingness to take only a brief pause in the easing cycle despite lingering inflationary pressures and poorly anchored expectations. Thus, we believe the Monetary Program strengthens our expectation of a new 25bps cut in Q2.

Regarding the risks of second order effects, the CB recognized inflationary pressures from tax hikes and tariff increases to begin the year. The CB says the tax increases on sugary drinks, tobacco and video games, along with the higher tariffs imposed on goods imported from countries without a free trade agreement, are to have a modest, transitory and limited impact on inflation. Banxico sees the full impact of the tax revision to wear off within the year, while the impact of higher tariffs will have a short-term effect.

It's notable to see the CB looking beyond the new two-digit increase to the minimum wage. This decision not to recognize its inflationary effect seems like a political calculation, in our view, trying to stand on the good side of President Claudia Sheinbaum.

Indeed, we do not expect an immediate increase in prices from higher tariffs, considering businesses had time to build up their inventories and given the currency appreciation should offset the tariff's pressure on consumer prices. Moreover, it's important to consider many goods needing the imported supplies are exported and might play a relatively modest role in the domestic consumption basket.

On the higher taxes, CPI inflation data already show pressure on tobacco prices. However, as Banxico predicted, these hikes are likely to be limited to the targeted items, considering there is no reason for contagion from these very specific goods.

However, the minimum wage hike should have an inflationary effect that might have second order effects, in our view. Indeed, CB Deputy Governor Jonathan Heath had warned this much, noting the share of workers earning a minimum wage has increase sharply as the government has continuously increased it swiftly.

Furthermore, we believe the CB is showing its dovish stance by only worrying about new inflationary pressures rather than first recognizing worrying recent performance. Indeed, the CB's Monetary Program celebrates disinflation in 2025 but fails to acknowledge CPI inflation remains well above the CB's 3.00% target, with expectations only loosely anchored, with no analyst expecting an actual convergence on the foreseeable future.

Overall, we are confident the CB will hold its policy rate at 7.00% in February. We expect the pause to be relatively brief; we expect a rate cut in May, even as CPI inflation pressures persist and core inflation remains high. We continue to believe 2026 easing shouldn't exceed 50bps; however, the dovish position of the bulk of the board leaves the door open to a bit more easing, in our view, even if further easing could bring the policy rate into expansive territory.

| Monetary Policy Council members | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Note: Overall bias calculated from voting behavior and comments | ||||||||||||||||||||||||||||||

| Source: Banxico |

| Ask the editor | Back to contents |

| MPC to prioritize stability over aggressive rate cut in February |

- Next MPC meeting: 23 - 24 February

- Current policy rate: 27%

- EmergingMarketWatch forecast: 26.5% - 26.75%

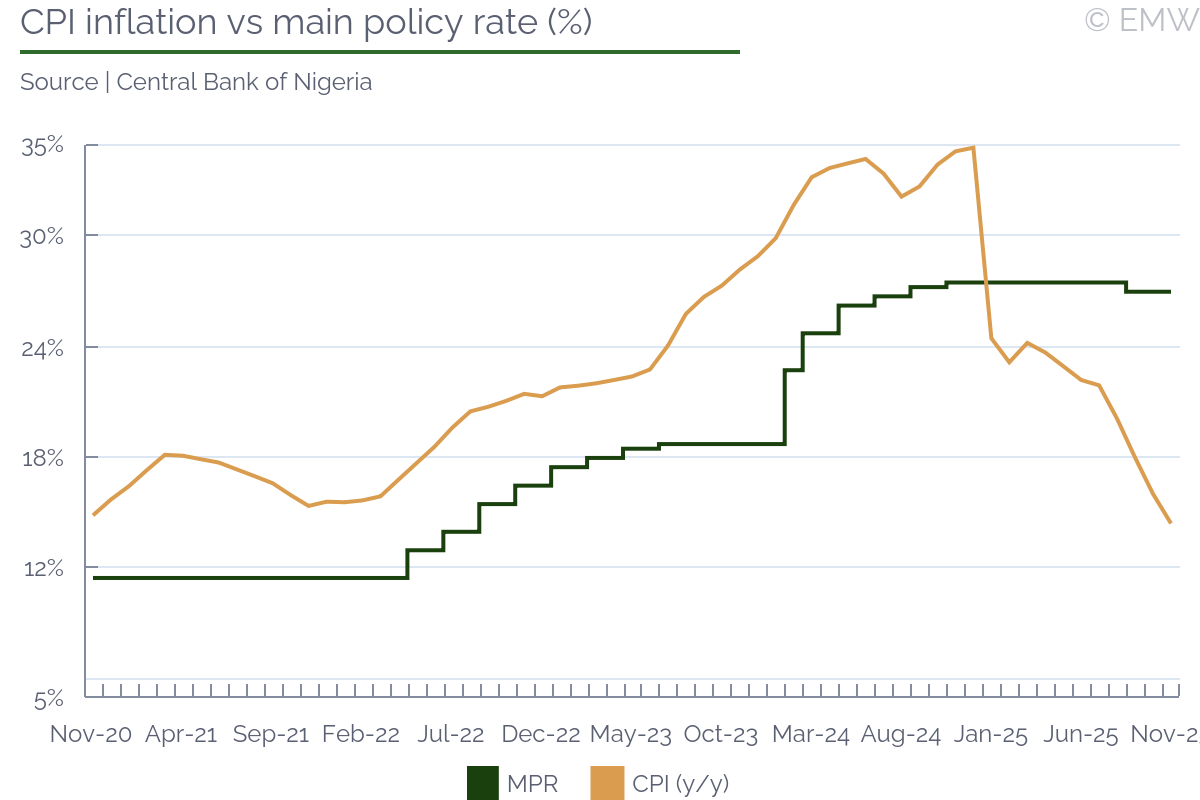

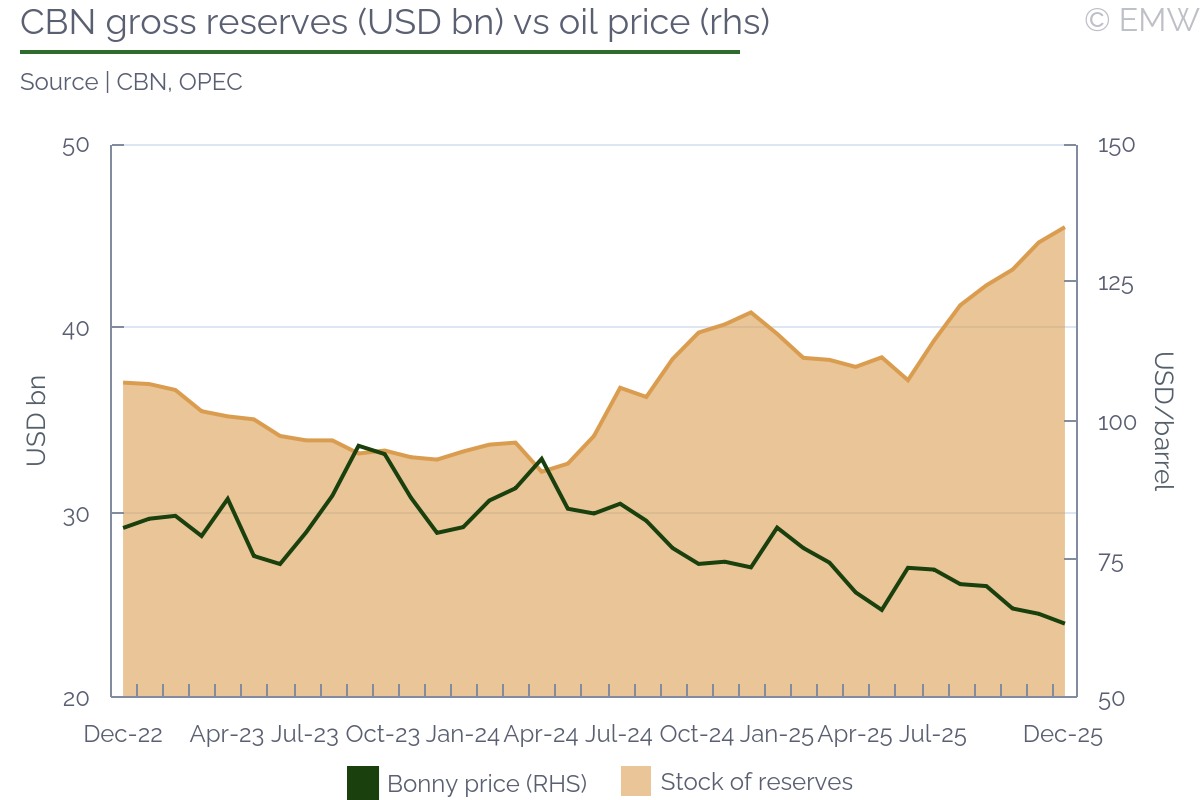

The first MPC meetings of the year will take place on February 23 and 24. At the November meeting, the CBN kept the monetary policy rate at 27% following a 50bps cut in September. The MPC personal statements for the November meeting have not yet been published so we are unclear how each MPC member voted. CBN governor Yemi Cardoso indicated that the rate hold was a majority vote rather than a unanimous vote. While headline inflation was easing, Cardoso said underlying price pressures remain high and therefore justified continued caution by the committee. The policy corridor was adjusted to +50/-450 bps from +250/-250 bps, creating a slightly more accommodative liquidity framework. Overall, the policy approach supports a balanced gradual easing. Nigeria's inflation trended downward in 2025 partly due to the rebasing of CPI, falling from 34.8% in December 2024 to 14.5% by November 2025. Food inflation remains high but price declines in staples like maize, sorghum, paddy rice and soybean have eased some pressure. Analysts project a temporary spike in December 2025 headline inflation due to the base-year effect from the CPI rebasing, which could lift the rate to 32% before normalising in 2026. Looking ahead, various forecasts indicate that headline inflation will average 14-16% in 2026. We also expect continued stability and a downward trend in inflation during 2026. While the CBN's approach prioritises naira stability and portfolio inflows over aggressive rate cuts, we anticipate a possible small rate cut in February.

The FX market stabilized in 2025 after sharp depreciation during 2023 and 2024. This was supported by CBN reforms such as the Electronic FX Matching System (EFEMS) and partial market liberalization. These measures improved liquidity and narrowed the gap between official and parallel rates, with the naira strengthening to USD/NGN 1,436 in December 2025 from USD/NGN 1,537 at the end of 2024. The CBN also expanded access for Nigerians in the diaspora through Non-Resident Nigerian Ordinary Accounts and Investment Accounts which encouraged remittances and FX inflows. FX reserves improved from USD 40.9bn at the end of 2024 to USD 45.5bn by December 2025. In their 2026 Macroeconomic Outlook, the CBN projects that external reserves will rise to USD 51.04bn by the end of 2026.

In November 2025, the CBN announced it is partnering with the ministry of finance on the new Dis-Inflation and Growth Acceleration Strategy (DGAS), a framework integrating fiscal and monetary policies to boost GDP growth above 7% and reduce inflation to single digits. DGAS aims to mobilize capital and establish Special Industrial Economic Zones. This framework is in line with persistent calls from experts throughout the year for Nigeria to strengthen coordination between fiscal and monetary policies.

Monetary Policy Committee Statement

Monetary Policy Committee Meeting Schedule

| MPC vote by members (bps) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: CBN |

| Ask the editor | Back to contents |

| SBP rate hold signals commitment to preserving hard-won macroeconomic stability |

- Next policy meeting: Mar 9, 2026

- Current policy rate: 10.50%

- Last decision: Hold (Jan 26, 2026)

- Our forecast: Hold

- Rationale: SBP is expected to stand pat throughout 2026 to ensure sustainable growth, preserve external sector stability and, chiefly, to keep real interest rates 'adequately positive' to anchor inflation within target range

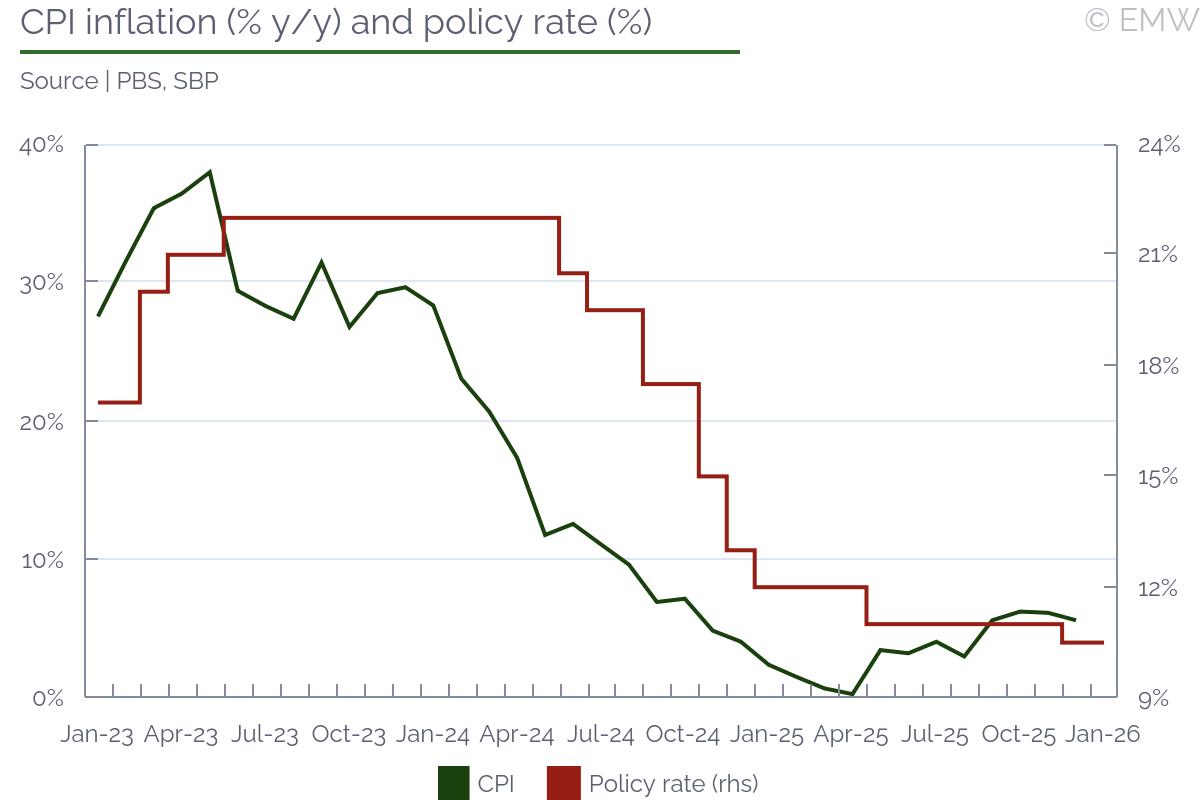

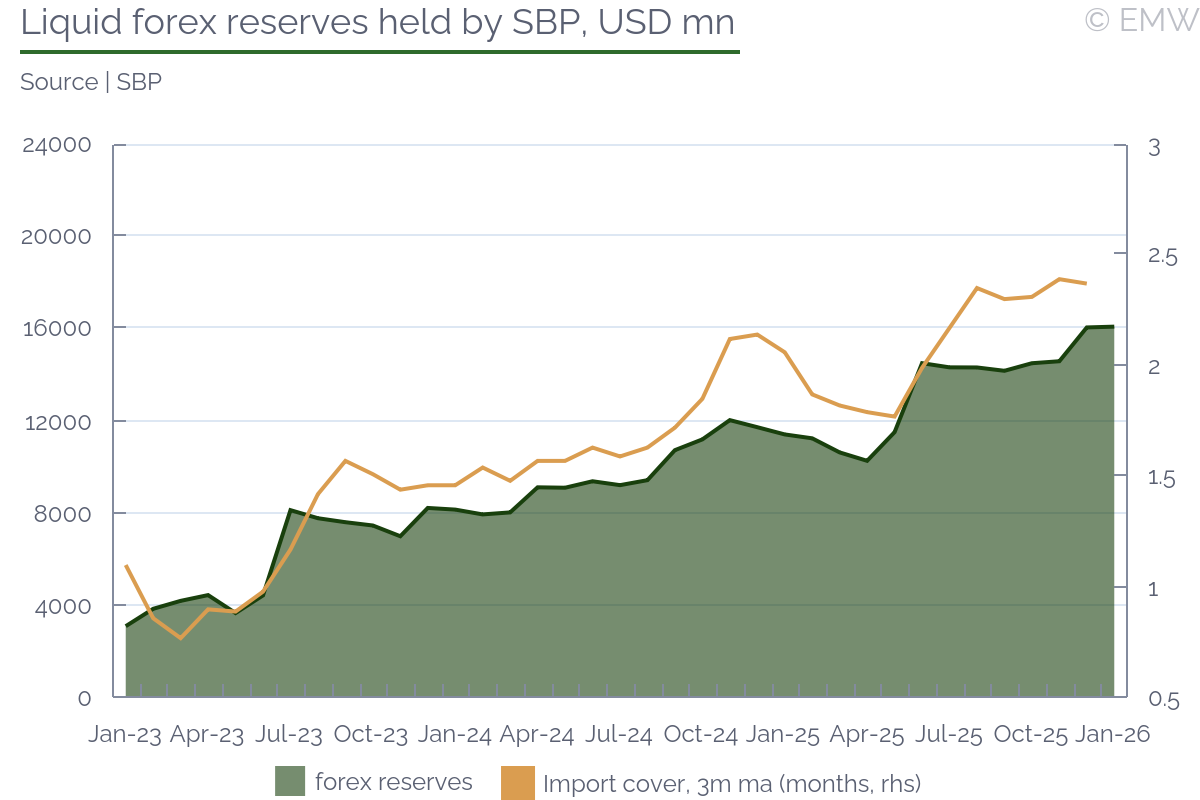

The State Bank of Pakistan (SBP) kept its policy rate unchanged at 10.50% on Jan 26, surprising the market, which had widely expected a 50bp cut. The primary factor underpinning the decision, in our view, was an improved growth outlook, as the central bank projected the economy to expand at a faster-than-expected pace in FY26. The SBP also cited concerns over sticky core inflation as well as rising imports, which could put pressure on the external sector. Nevertheless, projections for inflation and current account were maintained for the ongoing fiscal year, suggesting that near-term macro risks remain manageable.

A recurring theme in recent policy decisions has been the SBP's emphasis on keeping the real policy rate "adequately positive", likely on a 12-month forward-looking basis. With headline inflation expected to edge higher in the coming months, potentially reaching 8%-10% in the near term based on IMF projections, the SBP appeared comfortable with the current restrictive monetary policy stance to stabilise inflation within the 5%-7% target range.

The SBP highlighted that it was prudent to keep the policy rate unchanged to support sustainable economic growth. The emphasis on "sustainable" is key, as the central bank aims to avoid overheating the economy through further monetary easing, which could generate excess demand, fuel inflation, and ultimately jeopardise the recent hard-won macroeconomic stability. Thus, the rate hold signals a strong commitment toward maintaining price stability and ensuring durable growth.

Against this backdrop, we revert to our earlier stance that the December 50bp surprise rate cut was a one-off move and the SBP is unlikely to adjust its policy rate in either direction throughout 2026. The decision to cut cash reserve requirements by 100bps does not, in our view, signal a dovish tilt.

Inflation environment

CPI inflation in December eased to a three-month low of 5.6% y/y, down from 6.1% y/y in November, due to softer gains in the food and transport prices. On the other hand, core inflation remained relatively elevated at 6.9% in urban centres and 8.2% in rural areas, partly reflecting the impact of earlier upward adjustment in gas tariffs and higher jewellery prices amid a rally in the global gold market.

That said, the SBP maintained its benign inflation outlook, noting that CPI is likely to stabilise within the target range of 5%-7% in FY26 and FY27, after temporarily exceeding the upper bound for a few months during the current calendar year. This assessment is supported by the government's recent decision to keep gas and electricity prices unchanged, along with subdued global commodity prices, a stable exchange rate, and ample food supply amid expectations of a bumper wheat harvest.

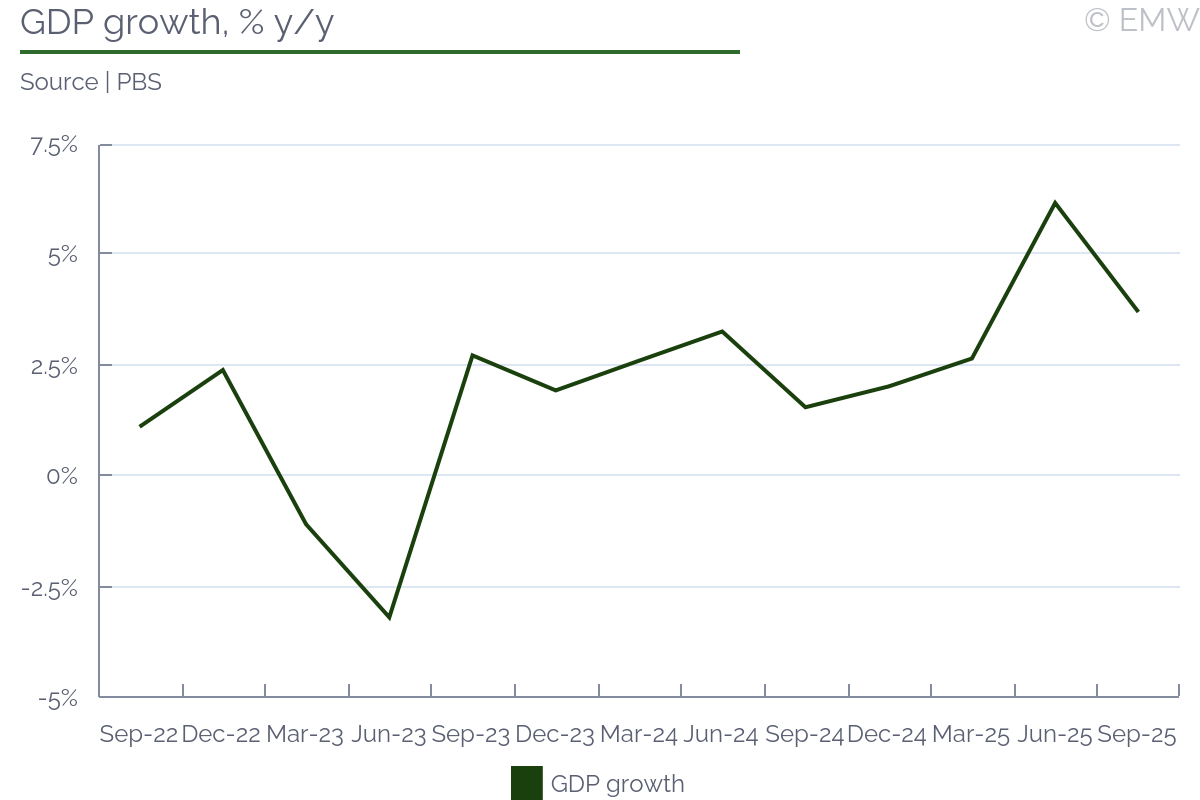

GDP growth

The SBP turned more optimistic on GDP growth, upgrading its forecast by 0.5pps to a range of 3.75%-4.75%. This outlook is bolstered by sustained domestic demand, aided in part by lower borrowing costs and improved farm output, especially wheat. The central bank noted that economic activity has picked up sharply, as reflected in strong readings of private consumption and investment-related indicators, including auto sales, cement dispatches, refined fuel sales, and imports of machinery and intermediate goods.

GDP growth came in at a solid 3.7% y/y in Q1 (Jul-Sep) of FY26, and the SBP noted that this momentum likely continued into Q2. The central bank's full-year growth forecast is quite upbeat than the IMF's and World Bank's projections of 3.2% and 3.0%, respectively.

External sector

The current account in H1 (Jul-Dec) of FY26 posted a USD 1.2bn deficit, swinging from a surplus of USD 957mn in the same period last year. This deterioration was driven by a sharp increase in imports and a fall in exports, primarily due to a plunge in rice shipments amid increased competition from India. Nevertheless, the deficit remains relatively contained, as the widening trade gap is offset by robust workers' remittances, low global commodity prices, and strong IT exports. The SBP kept its projection for current account deficit unchanged at 0-1% of GDP for FY26.

A favourable current account position (together with loan inflows, including IMF disbursements) has enabled the SBP to build up its foreign exchange reserves through interbank purchases, which, according to SBP governor Jameel Ahmad, totalled USD 22bn over the past three years. The reserves are projected to trend higher, reaching USD 18.0bn by June from USD 16.1bn as of Jan 16. Stronger forex reserves have significantly improved Pakistan's capacity to meet its external obligations.

Further Readings

Previous policy rate decisions

| Ask the editor | Back to contents |

| Hold decision, 25bp rate cut both possible in February |

- Next monetary policy meeting: Feb 19

- Current policy rate: 4.50%

- EmergingMarketWatch forecast: Hold or cut by 25bps

- Rationale: Comments by Governor Remolona; new macroeconomic forecasts

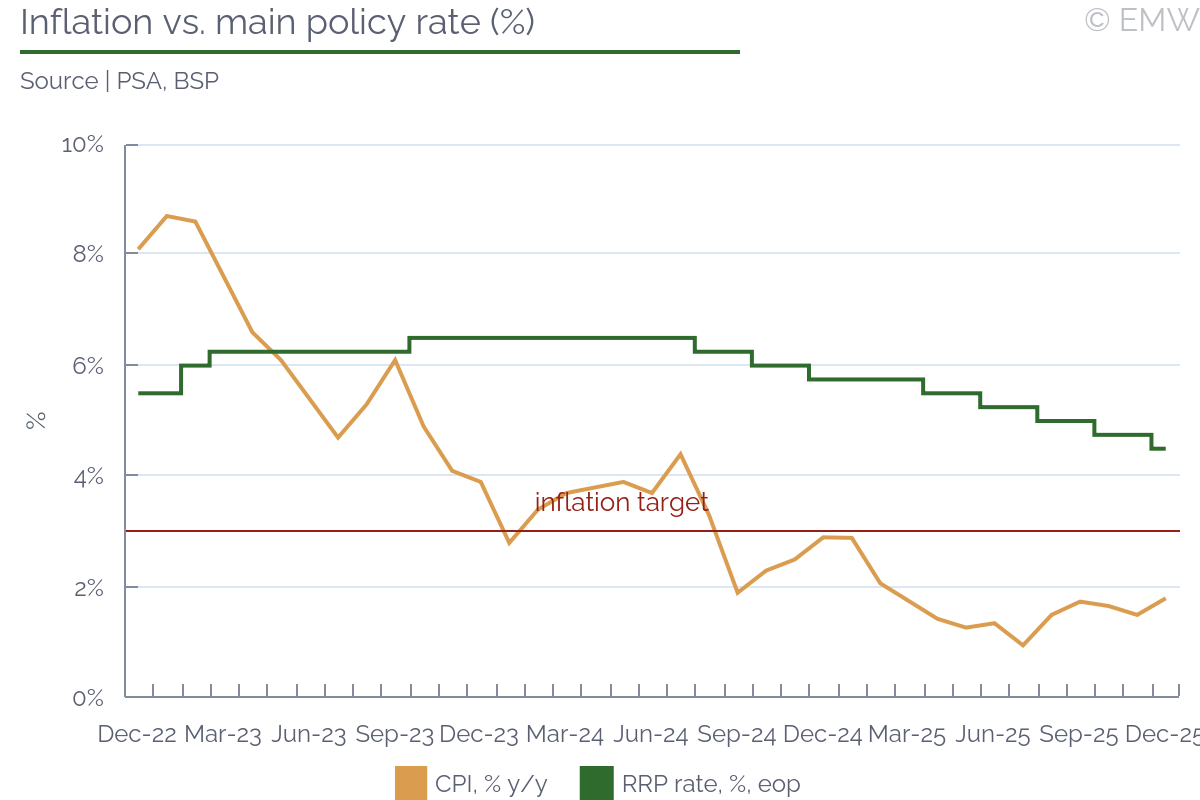

We think that a hold decision and a 25bp policy rate reduction are both possible at the next meeting of BSP's Monetary Board (MB) on Feb 19, the first one for 2026. In December, the MB cut the key rate by 25bps to 4.50%. A February rate reduction is on the table but is unlikely, BSP Governor Eli Remolona Jr. said last week. Two 25bp rate cuts this year will require a bad surprise in the data for 2026, according to the governor.

There are solid arguments in favour of continued easing, in our view. They include economic growth that is likely to be lower than previously expected and below-target inflation. The depreciation of the peso against the US dollar is the main argument in favour of a hold decision next month.

Inflation

CPI inflation accelerated to 1.8% y/y in December from 1.5% y/y in November. The inflation target range is 2.0-4.0%. Remolona said that the December reading is a "reasonably low rate." The CPI growth has been below the target band for 10 consecutive months. The CPI rose by 1.7% in 2025. Annual core inflation was 2.4% in December, unchanged from November. The seasonally adjusted CPI increased by 0.7% m/m in December, following zero m/m growth in November.

In December, the MB said that the inflation forecasts for 2026 and 2027 have increased slightly to 3.2% and 3.0% respectively.

Economic growth

Since the latest MB meeting, several new economic forecasts for the Philippines have been issued.

| Recent forecasts of GDP growth in the Philippines, % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: EMW |

With respect to GDP growth, all involved downward revisions. Notably, the Philippine state bodies - the DBCC and the BSP - hold the most pessimistic views with regard to the GDP growth in 2025. The statistics office will release the GDP data for Q4 2025 and the entire 2025 on Jan 29, so there will be no uncertainty about this data point at the February MB meeting.

Last week, Remolona said that there was a loss of confidence of investors, which resulted in a decline in investments. Consumption also dropped, the governor said. He expects the effects of the loss of confidence to continue through H1 2026.

The Manufacturing PMI rose to 50.2 in December from 47.4 in November, according to the monthly survey by S&P Global. Production declined moderately last month.

LFS, lending growth

The unemployment rate was 4.4% in November, lower than 5.0% in October but higher than 3.2% in Nov 2024, according to the results of the latest labour force survey (LFS). In the y/y comparison, the number of unemployed rose by 35.5% y/y to 2.25mn in November. The y/y deterioration reflected weather-related disruptions and drops in employment across several major sectors, according to National Statistician and PSA Undersecretary Claire Dennis Mapa as quoted by the BusinessWorld. The number of employed fell by 0.6% y/y to 49.26mn. The labour force hence increased by 0.6% y/y to 51.52mn.

Outstanding loans of universal and commercial banks, net of reverse repurchase (RRP) placements with the BSP, rose by 10.35% y/y at end-November, marginally accelerating from 10.26% y/y growth at end-October. On a seasonally adjusted basis, loans increased by 0.9% m/m at end-November. Annual loan growth has been in the double digits for the 19th month in a row.

Exchange rate

The peso is trading at USD/PHP 59.496 at the time of writing, which compares with USD/PHP 58.99 on Dec 11, the date of the latest MB meeting.

Last Thursday, Remolona said that the central bank had resisted "tremendous" pressure to defend the peso. The Philippine currency had depreciated to a record low of USD/PHP 59.38 last Wednesday from a peak of USD/PHP 55.369 on May 9, 2025. Remolona also said that the BSP will not do anything if the exchange rate reaches USD/PHP 60, which is "just a number." Defending the domestic currency is not warranted by the structure of the economy, as the country is mainly service-driven and not reliant on manufacturing, the governor said. Nonetheless, the Philippine central bank intervenes to tackle excessive volatility, he said.

Further reading

Press release after Dec 2025 monetary policy action

Schedule of monetary policy meetings

| Ask the editor | Back to contents |

| MPC to hold fire in February as it awaits future data |

- Next MPC meeting: Feb 3-4, 2026

- Current policy rate: 4.00%

- EmergingMarketWatch forecast: 4.00%

Rationale: The Monetary Policy Council held its key rate at 4.00% at its Jan 13-14 sitting, thus deciding not to lower rates for the first time since way back in June. At all of the sittings from July through December (keeping in mind there is no sitting in Aug), the council cut rates by 25bps as part of its series of "adjustments," taking the key rate down from 5.75% in April to the lowest level since March 2022. But after it cut by 25bps in December, all MPC members indicated they would take a breather to gauge the impact of the monetary easing on the economy and to keep an eye on the early-year price changes.

This does not mean that another cut was not considered at the January sitting. MPC member Ireneusz Dabrowski had said there was a 50-50 chance of a cut in January since inflation had surprised to the low side at 2.4% y/y in December, compared with a rate of 2.5% in November and a consensus of 2.6%. That also means inflation is just below the central 2.5% target. Moreover, the energy regulator URE announced tariff decisions for 2026 that shouldn't mean any real impact on inflation from power and natural gas, compared with the 0.4-0.5pp assumed by the NBP in its November projection.

MPC members have tended to say that the real rate should be around 1pp. That would mean there is at least 50bps or so for further rate cuts. But the council clearly decided it did want more time to see what happens. Fiscal policy remains a big question mark, and the economy is expected to accelerate in 2026 based on massive EU fund flows combined with a still relatively robust consumer.

The timing of the next decision is, however, also impacted by statistical facts. First, the way Statistics Poland (GUS) updates its inflation basket every year means there will be a dearth of inflation data. While it conducts this process leading up to the release of the new basket and weights with the CPI release set for Mar 13, GUS stops publishing flash inflation releases. That means the Feb 3-4 sitting won't have any update to inflation data from the December print, making a council that pledges to be data dependent unlikely to change rates.

The Mar 3-4 sitting will be subject to the same potential problem, though the council will have partial, preliminary inflation for January. One extenuating circumstance this year, though, is that GUS will transition to the COICOP 2018 classification of household expenditures for CPI inflation from the COICOP one. The CPI and HICP for Poland have been calculated according to COICOP since 1999, with the European version, ECOICOP, in place since 2014. GUS has, according to the PAP news agency, not decided how the partial, preliminary January inflation release will be calculated, but is apparently leaning toward using the COICIP 2018 but with the 2025 weightings in place. PAP reported there is even a chance the January estimate would not be released.

The March policy sitting will also see the publication of the updated Inflation Report, which will extend the policy horizon, and the projections, to 2028. This does create some uncertainty and the potential pretext for a rate cut in March. If the projection should, say, show below-target inflation in 2027 or 2028, then that could motivate a cut. A cut in March would also likely mean that the MPC would not have to cut by 50bps in Q2. But if the council does not cut in March, it seems almost sure to cut by 50bps by end-Q2.

The question of how low the MPC will eventually go is unclear. Much will depend on the economy and inflation, particularly in light of the 1pp real rate that seems to be preferred by most council members. If inflation runs around 2%, then one could see a rate of 3% or so. Something around 3.25% would seem somewhat likely. But if inflation is rather to run closer to the 2.5% target, then a key rate around 3.50% would then be more probable.

| MPC breakdown | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: NBP |

Latest NBP inflation report (November 2025)

| Ask the editor | Back to contents |

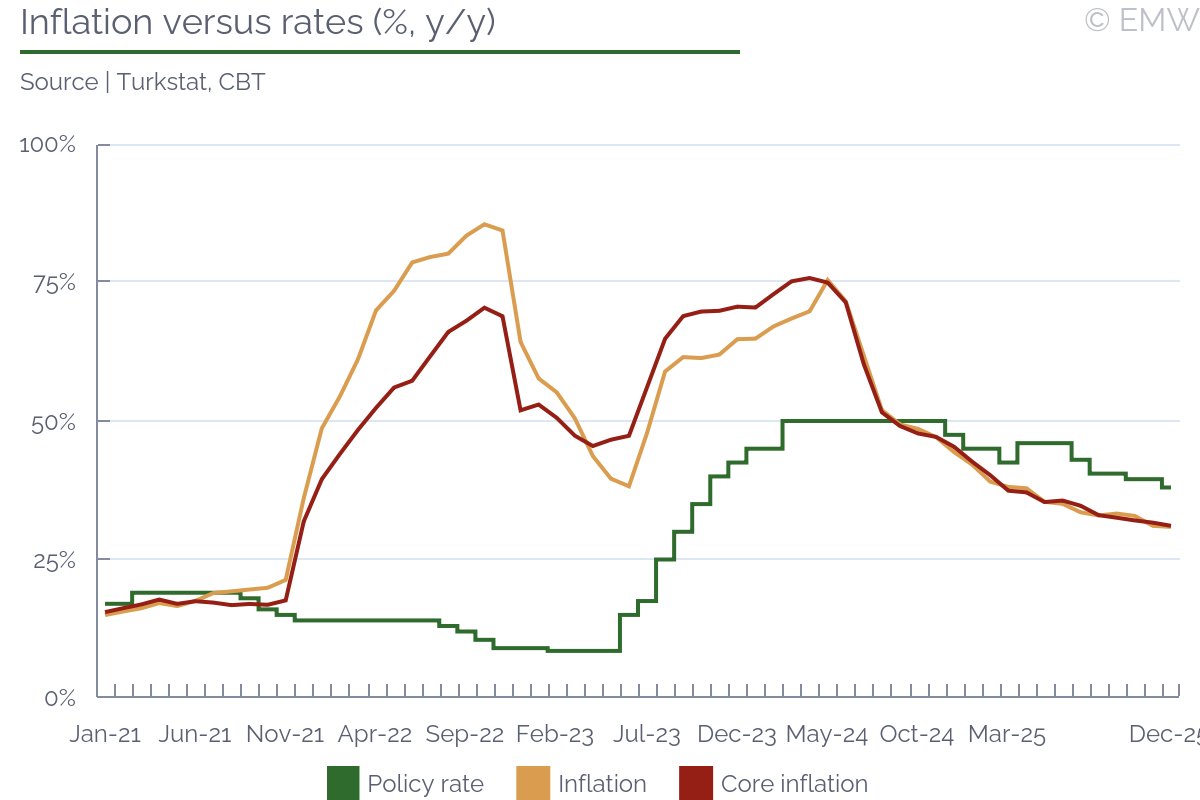

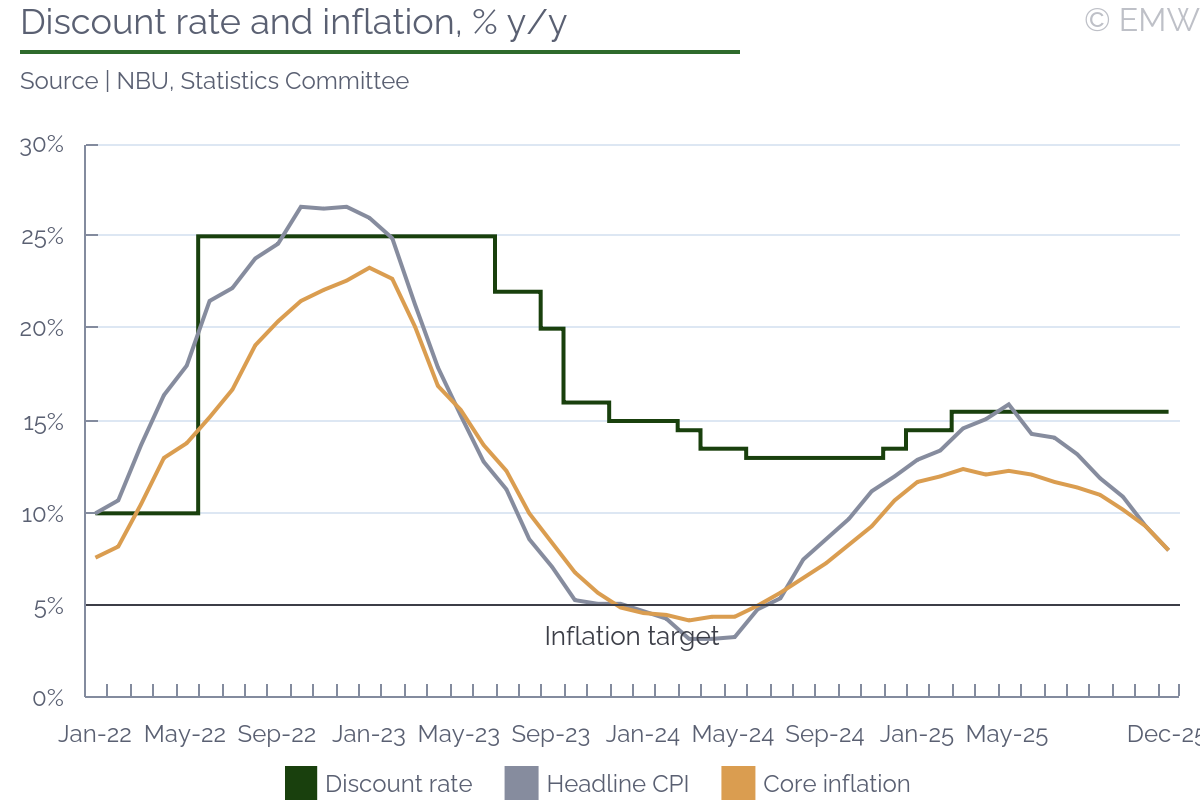

| CBT set for 150bps cut, but 2026 disinflation constraints remain binding |

- Next MPC meeting: Jan 22, 2025

- Current policy rate: 38.0%

- EmergingMarketWatch forecast: Cut by 150bps

- Rationale: Year-end inflation seasonality supports near-term cut, but weak credibility, food risks, firm demand and expectations gap keep 2026 disinflation challenging

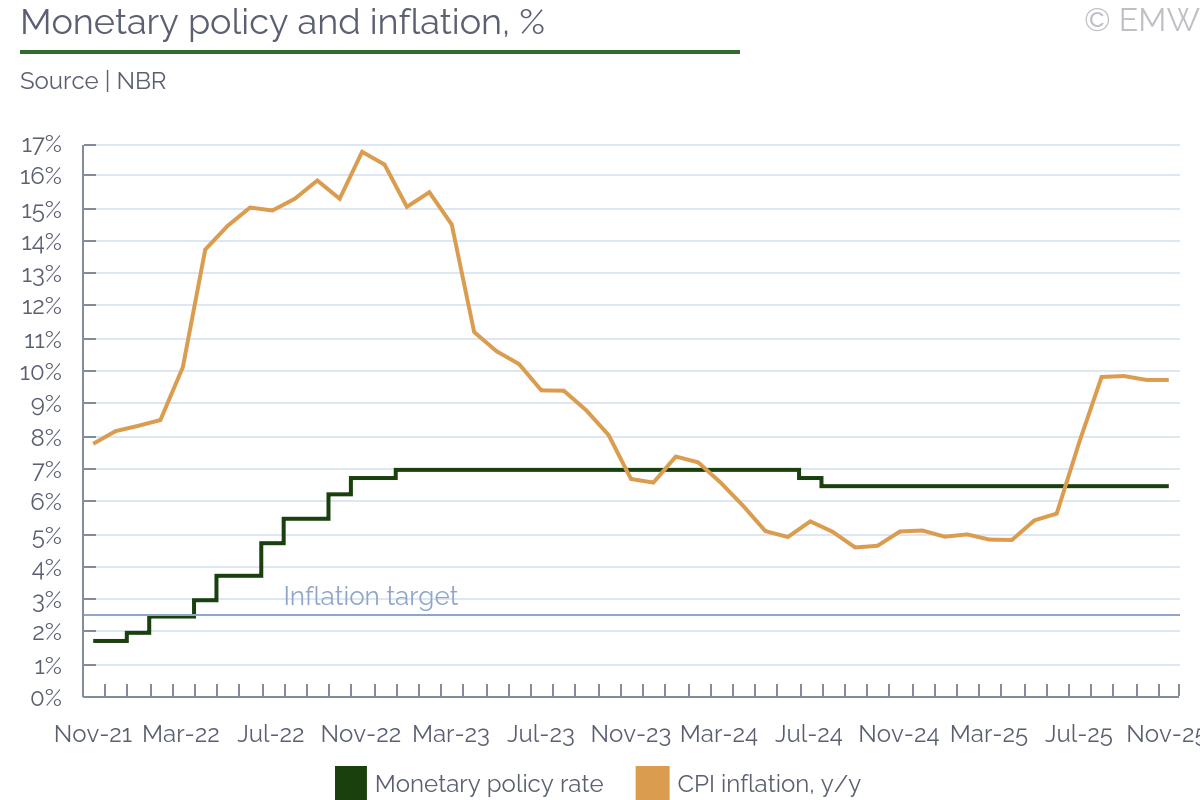

We expect the CBT to pursue measured easing at the upcoming MPC meeting, most likely through a 150bps rate cut. We still view further accommodation as premature, given that 2026 will likely prove demanding for the CBT to reach its 16% year-end inflation target. That said, the bank's credibility has not been strong over recent years and market pricing remained materially above the CBT's 2026 target. This signalled a clear gap between the announced disinflation path and what investors view as feasible even though historically the latter group stood on the optimistic side. In that context, we see a high likelihood of at least one upward revision to the 2026 target in forthcoming inflation reports, either to align the target with the prevailing expectations backdrop or to preserve internal consistency between forecasts, assumptions, and the policy stance. We think the CBT recognises this trade-off and is already calibrating policy accordingly.

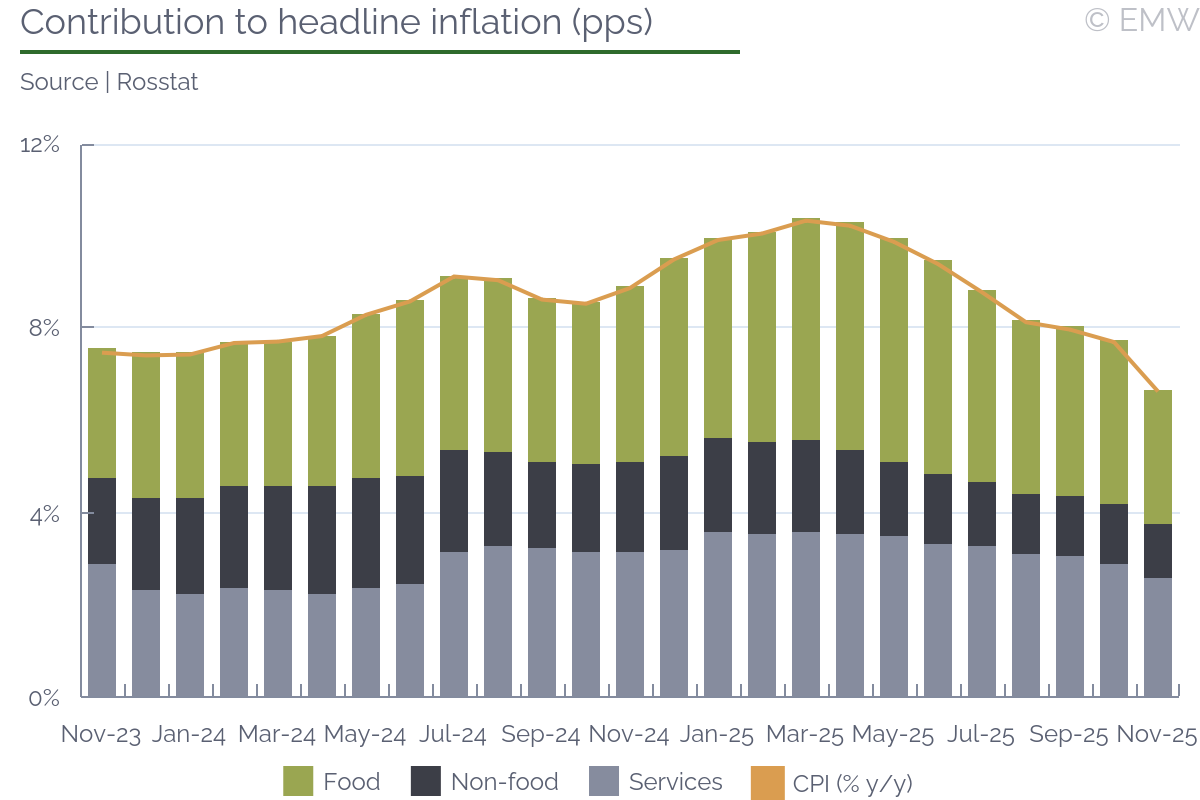

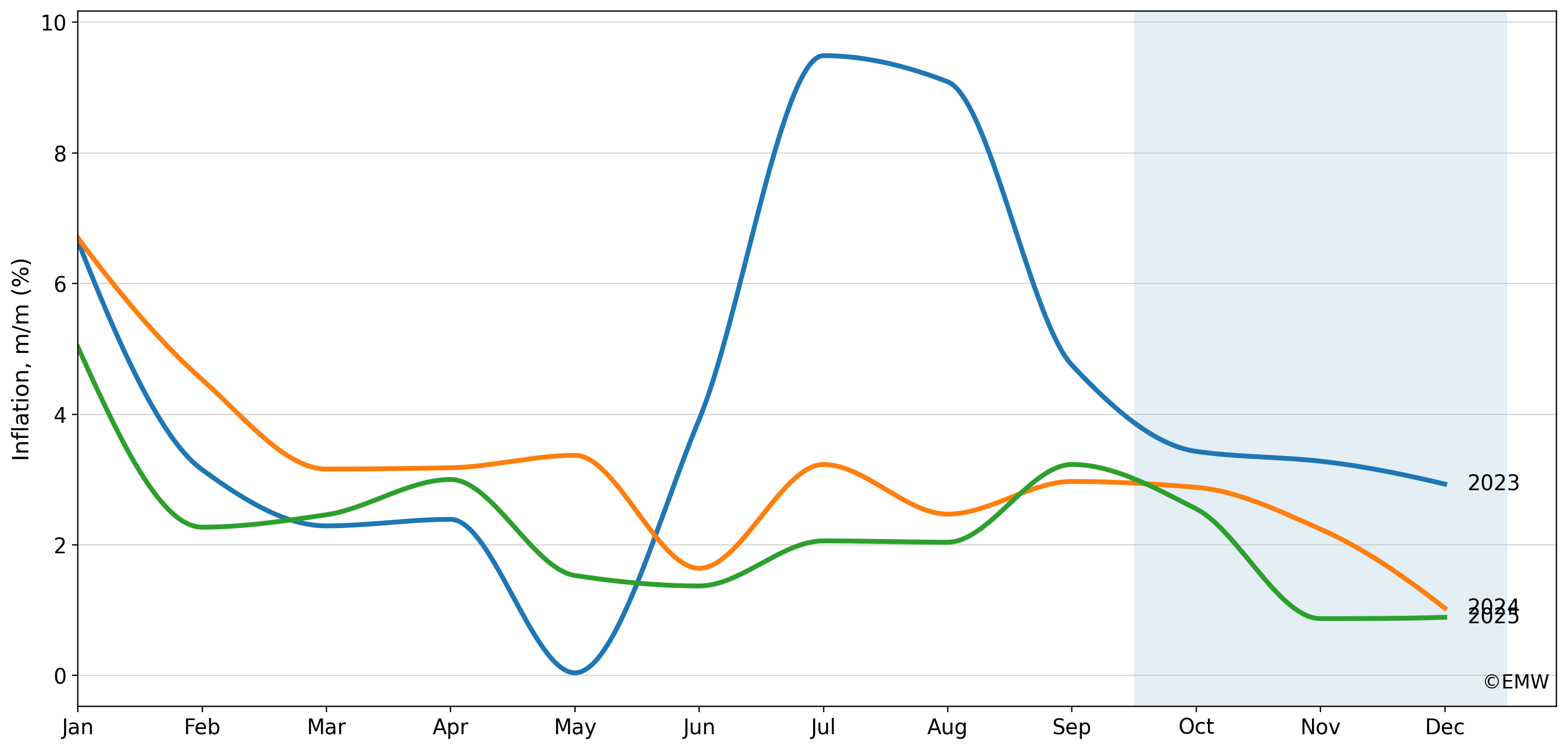

Q4 inflation figures remained mild. However, we believe it must be interpreted with caution as this is not unique to 2025. Figure 1 shows CPI inflation in m/m terms since 2023, with the Oct-Dec window shaded to isolate the year-end period. The profile is consistent as inflation tends to cool into year-end, with Q4 typically running below the late-summer/early-autumn pace and often easing further into the final prints. The shaded window makes this comparison immediate and helps separate intra-year volatility from the recurring year-end cooling pattern.

Looking ahead, we think 2026 will still pose a tougher disinflation challenge, even if the revised Turkstat series may offer some near-term relief in the optics. Note that this is something we cannot make sure for the time being and confirmation will be necessary with upcoming data releases. However, we know that food prices remain a key risk - agricultural output fell by 12.7% y/y in Q3 due to drought and frost, and that shock should feed into food inflation and household expectations, which often anchor on food and rent. If expectations deteriorate, the disinflation effort will become materially harder, we assess. Despite some relief during the last couple of weeks owing to rain and snow, drought conditions persist and dam levels remain low, keeping supply-side risks elevated, we note. Agricultural frost risk also should not be overlooked.

Underlying demand also looks firm. GDP excluding agriculture continues to signal solid momentum, consistent with demand-pull pressure in inflation. In addition, our estimates place households under-the-mattress gold holdings near USD 440bn. This stock can provide a discretionary liquidity buffer for consumption and investment and may help explain why conventional indicators have repeatedly understated private demand strength, in our view.

Overall, the case for a near-term cut rests on two pillars: a softer near-term inflation backdrop, reinforced by a recurring year-end cooling pattern in m/m CPI, and a policy framework that likely reflects diminished target credibility and a high probability of upward revisions to the 2026 path. At the same time, we see the 2026 disinflation challenge as structurally more demanding. Supply-side food risks look skewed to the upside amid drought stress, demand conditions remain firmer than standard indicators imply and market pricing continues to signal an expectations gap versus the CBT's targets. Taken together, these dynamics leave room for measured easing in the very near term, but they also raise the risk that the easing cycle runs into sticky expectations and renewed inflation pressure faster than the CBT's baseline narrative suggests, we caution.

Summary of December rate-setting meeting

| Ask the editor | Back to contents |

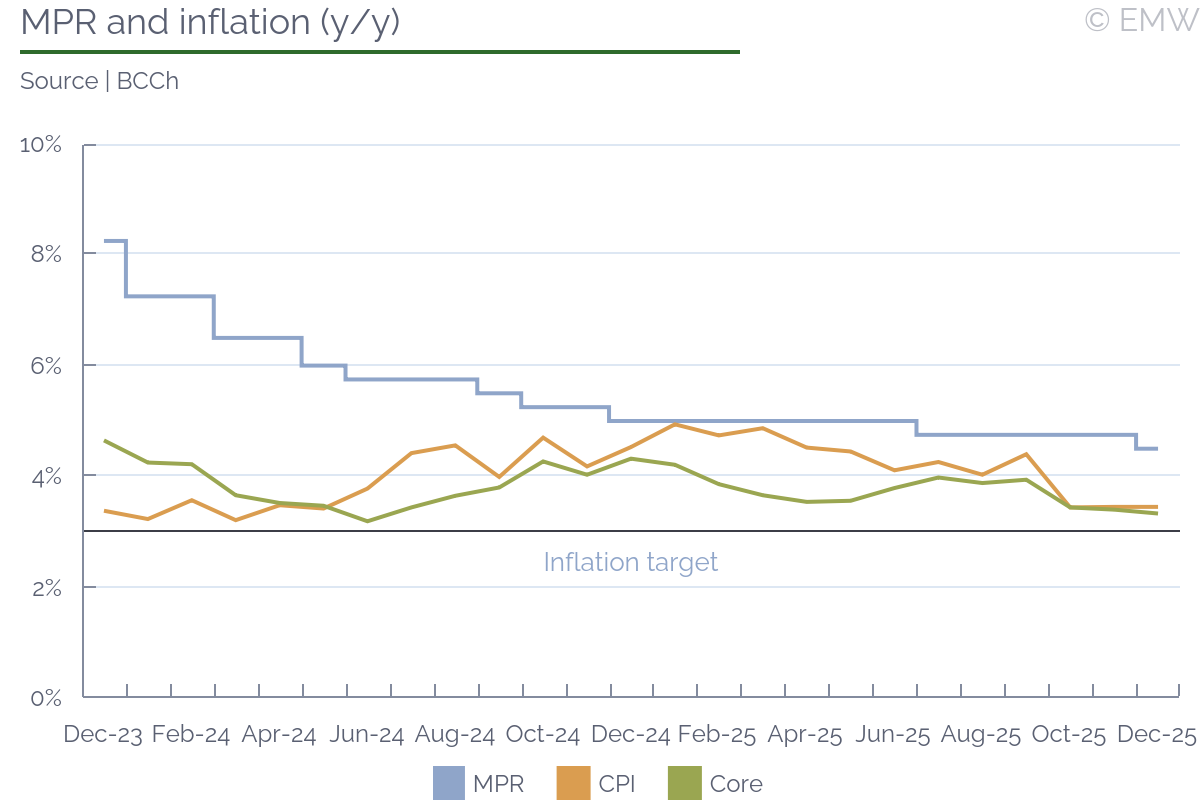

| Final MPR cut gets closer as inflation completes convergence to 3.0% |

- Next MPC meeting: Jan 27

- Current policy rate: 4.50%

- EmergingMarketWatch forecast: Hold

The final rate cut in the long monetary policy easing process is inching closer and it could arrive as soon as this quarter. The Monetary Policy Council cut its benchmark interest rate to 4.50% in December, leaving it just 25bps above the nominal neutral rate of 4.25% when CPI inflation sits at the policy target of 3.0%. Even though the last CPI print had inflation at 3.4% y/y, it is expected to decline to 2.8% when the CPI reading for January arrives in a few weeks. Inflation would be at the 3.0% target or below for the first time in five years. There is a strong consensus that a final 25bps rate cut to 4.25% is coming in the first half of the year, but the exact timing is not obvious.

The most recent consensus polls of traders and economists show big majorities forecasting a hold in January, and opinion gets evenly divided when forecasting whether the rate cut arrives in March or April. However, the case for a January cut has been getting stronger.

The case for a January cut:

- The latest CPI reading was a surprise to the downside for both headline and core inflation. With this surprise, inflation could now be below 3.0% in the first half of 2026. Medium-term expected inflation remains anchored at 3.0%, but if the BCCh delays its final rate cut while inflation sits below 3.0%, expectations could begin to shift a little to the downside.

- Economic activity was a big surprise to the downside in the last reading too, further reducing any risks that a positive output gap could open up. For now though, there doesn't seem to be a meaningful output gap in either direction.

- There is an ongoing CLP appreciation that has accumulated more than 7% over the last three months, which reduces cost pressure. This appreciation has been stronger than the central bank expected according to its last set of forecasts.

- The wait for the next rate decision is long. After the Jan 27 sitting, the MPC doesn't meet again until Mar 24.

- In sum, inflation is about to complete the convergence to the policy target, the CLP appreciation reduces cost-related pressure compared to prior expectations, and inflation risks seem to be subsiding on balance.

The case for a January hold:

- The next CPI won't be out by the time the MPC meets. After five years of above-target inflation, the MPC would do well to wait until inflation effectively gets to 3.0% before passing the final cut.

- The above is particularly relevant considering the last monetary policy minutes quoted MPC members as saying that the inflation problem wasn't fully resolved.

- Just as the lack of clear inflationary pressures could be used to justify a January cut, the reverse is true when arguing for a hold. If the economy works without relevant output gaps, expected inflation is anchored at 3.0%, and the balance of inflationary risks isn't tilted to the downside, then there is no rush for the MPC to pass this final cut.

Overall, we believe the MPC will hold in January while signaling a cut is likely in March if inflation remains at the 3.0% target and new risks don't develop. The next cut, whenever it arrives, could be the final movement for several months if the inflation outlook doesn't change.

| Ask the editor | Back to contents |

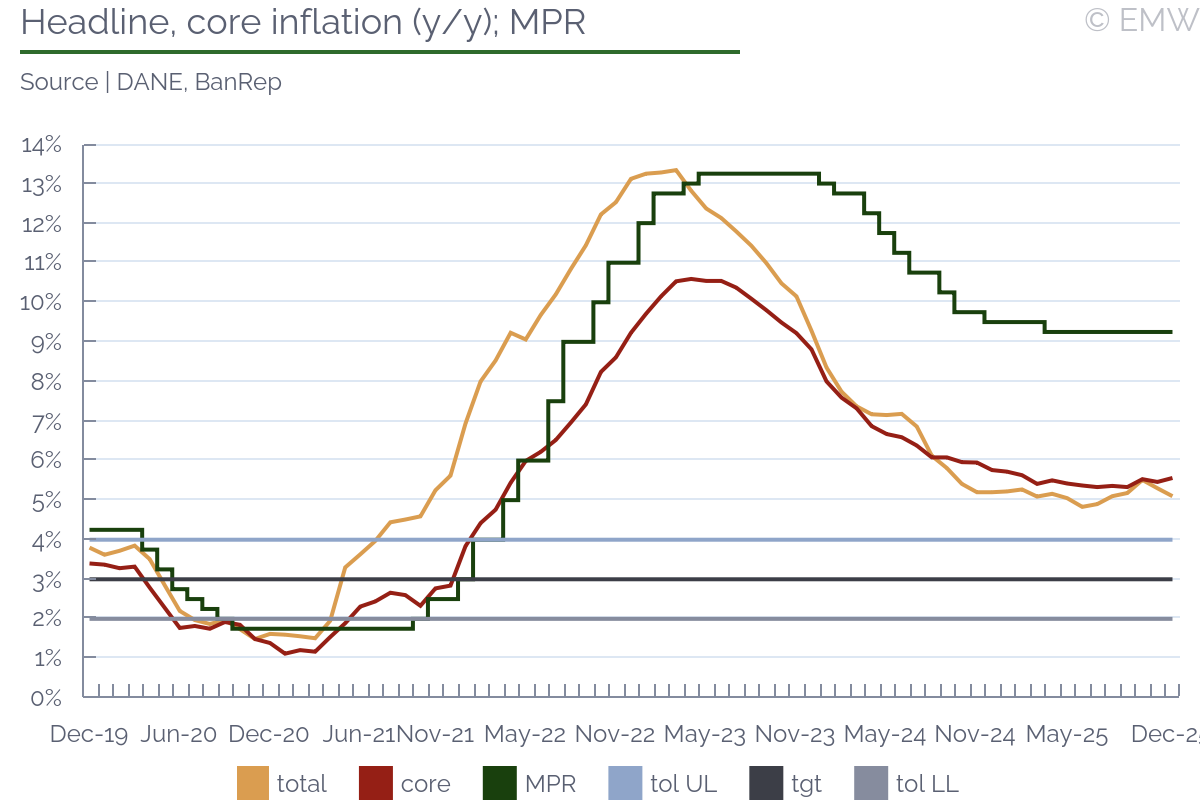

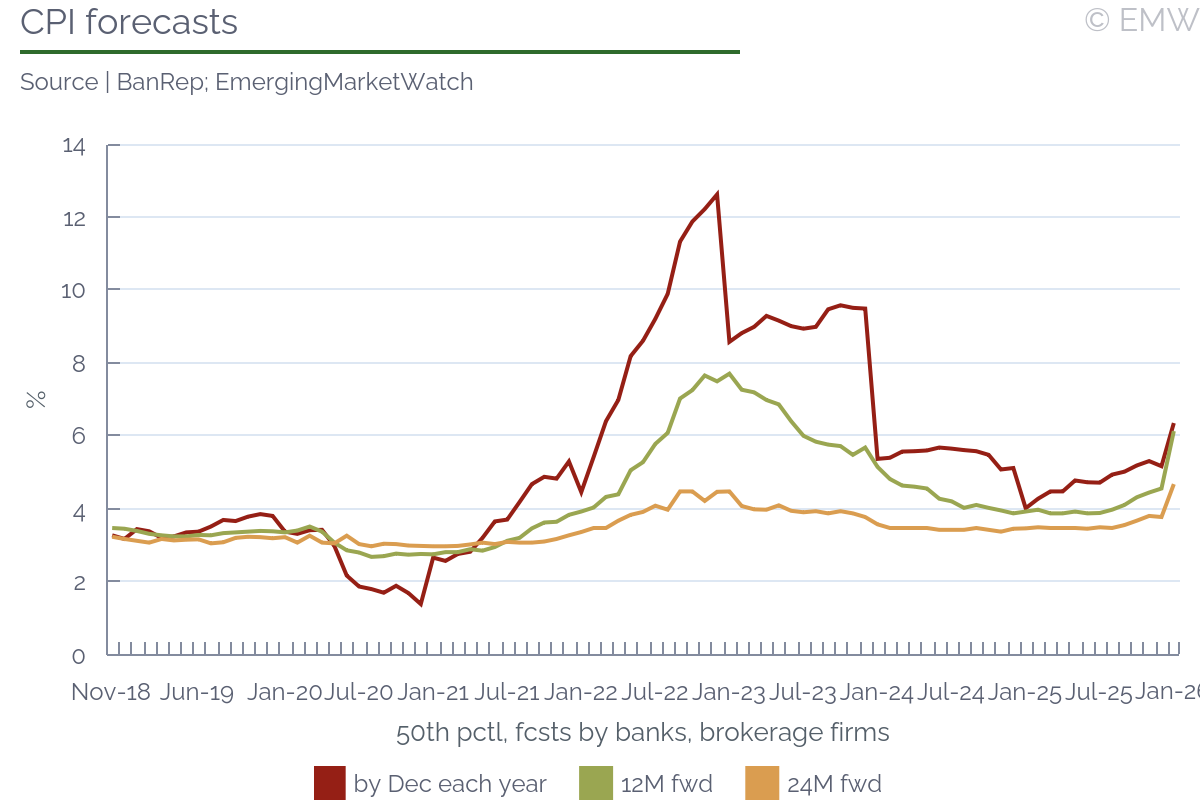

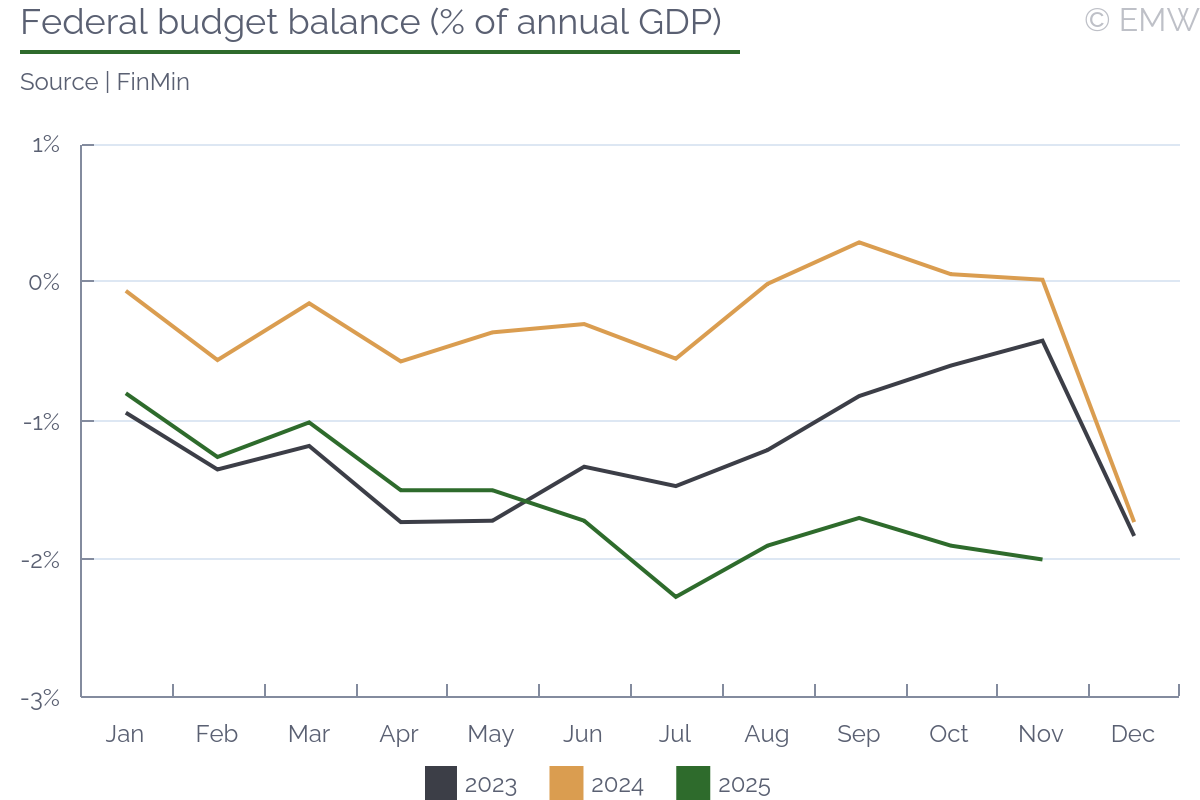

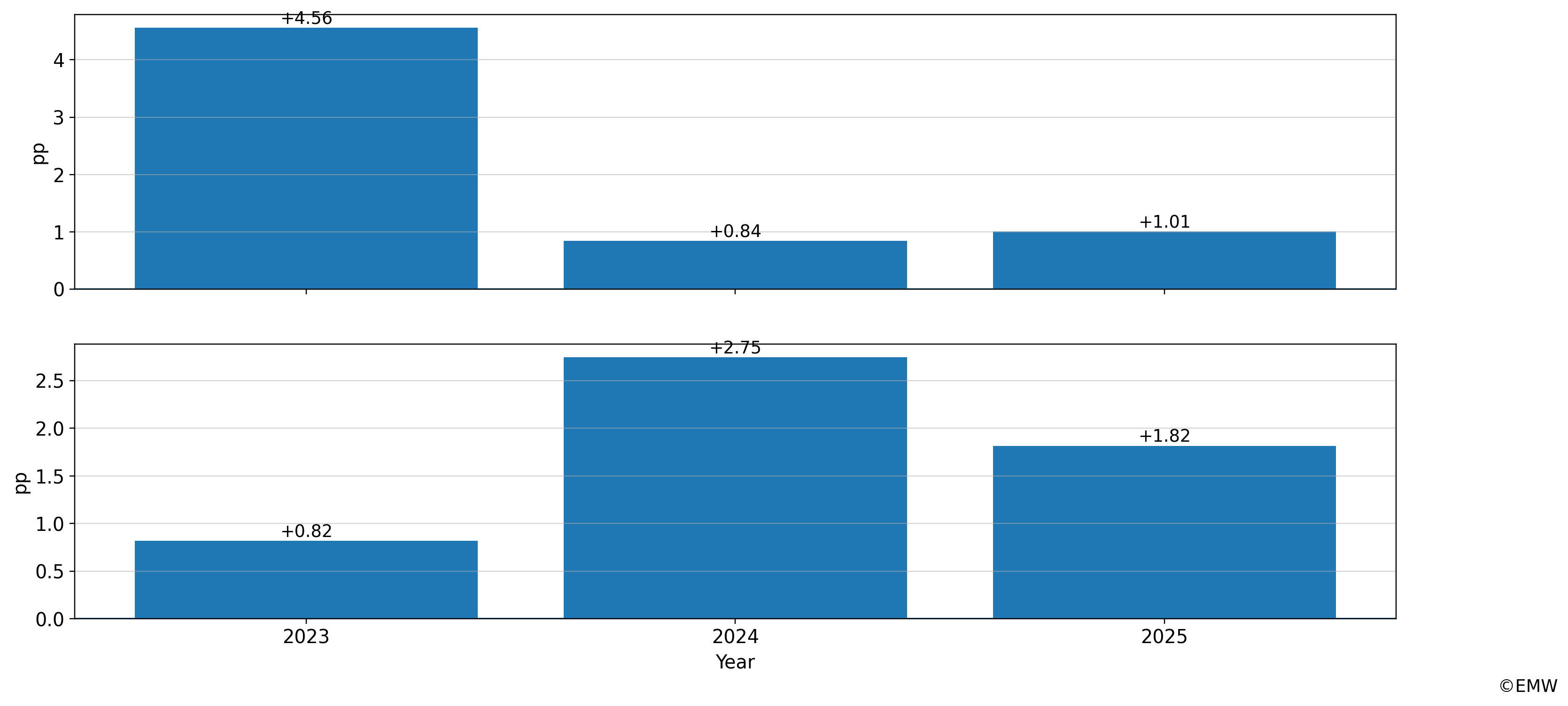

| BanRep’s hawkish majority seen driving rate hikes at the Jan 30 meeting |

- Board's meeting: Jan 30, 2026

- Current policy: 9.25%

- EmergingMarketWatch forecast: Hike 50-75bps

- Rationale:The 23% minimum wage hike has pushed one- and two-year inflation expectations further above the 3% target, effectively lowering the ex ante real policy rate if the Board keeps nominal rates at 9.25%. Market consensus centers on a 50bp hike, but, in our view a 75bp move is plausible as BanRep seeks to signal its willingness to prioritize anchoring expectations over other priorities, e.g., near-term growth.

BanRep has maintained its policy rate at 9.25% since April 2025, amid stubborn inflation. Although CPI inflation briefly dipped below 5% in June-July 2025, it has since then remained slightly above that level, with core prices proving sticky as well. Decisions have been made by a divided board, where BanRep's technical staff, led by Governor Leonardo Villar, has found the board's president, Finance Minister Germán Ávila, unconvincing in arguing for rate cuts. The technical team has identified several inflationary pressures that prevented a sustained decline in inflation: a widening trade deficit alongside double-digit import growth, the December 2024 minimum wage increase, and gradually de-anchoring inflation expectations, all of which undermine the central bank's credibility. The government, for its part, has argued that a high policy rate hurts productivity, investment, and, above all, growth.

Board decisions currently hinge on a narrow 4-3 majority: Villar, Mauricio Villamizar, Olga Acosta, and Bibiana Taboada versus Ávila, César Giraldo, and Laura Moisá. If this composition remains intact through March 2027 (when Acosta's current term is set to expire), the Villar bloc is likely to steer policy and use the benchmark interest rate as the main instrument to return inflation to target as quickly as possible.

In January, the only board member consistently visible in the press and at economic forums has been Mauricio Villamizar, who has made clear that sizable rate hikes are needed to avoid a more painful adjustment later. Inflation is expected to rise following the 23.7 % minimum-wage increase approved in December 2025, which, given the high degree of indexation in the Colombian economy, will feed into higher prices for frequently used or essential goods and services, such as security and tolls.

With markets already pricing inflation above 6% for December 2026, a more restrictive stance now seems urgent to avoid a sharper tightening later. In an inflation-targeting framework such as BanRep's, the only way to re-anchor expectations and reinforce the transmission mechanism is to prevent economic agents from continuously adjusting prices, wages, and contracts ex ante on the expectation of higher inflation, which would increase both the cost and duration of disinflation.

A forceful central-bank action is therefore essential. With the "hawkish" majority in place, the policy rate should rise by at least 50bps this Fri., in line with consensus, though an increase of 75bps, in our view, cannot be ruled out. The board will not meet in February, making an early signal to re-anchor expectations more important before beginning a gradual and orderly easing cycle.

Overall, looking ahead, inflation expectations will be the key driver of monetary policy. Debates about how policy affects real activity should, nonetheless, be secondary. The economy is growing, likely below what some economists hoped for and well under post-pandemic levels, with a clear caveat: growth is being supported mainly by the government's fiscal expansion, as recent ISE readings and, at the margin, the performance of commerce suggest. We do not expect the government to curb borrowing in the near term, so support for growth will be temporary rather than structural. Thus, although a more contractionary stance will likely weaken activity, it is now a secondary concern: BanRep can no longer allow inflation to remain outside the target range and must rely on its technical expertise to anticipate the inflation path and act preemptively. It must also provide clearer forward guidance so markets understand the expected inflation trajectory and how policy will adjust accordingly.

That said, Governor Villar has been notably cautious in press conferences following monetary‑policy decisions, sharing the podium with Ávila in a way that, in our view, raises more questions than it clarifies and fails to anchor expectations. As a result, interviews with right‑leaning or international media have become the primary signals for inferring the central bank's reaction function and expectations, ultimately creating an awkward setup for an institution that prides itself on being technical.

| Likely stance of BanRep's board members (updated Jan. 28) | ||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||

| Source: EmergingMarketWatch |

| Ask the editor | Back to contents |

| MPC likely to make no move in February |

- Current policy rate: 4.00%

- Next monetary policy meeting: Feb 23, 2026

- Expected decision: Hold

The MPC cut the policy rate for the second consecutive time to 4.00% in its latest meeting on Jan 5. The move was a surprise for the markets at the backdrop of no significant changes in major economic indicators and the rhetoric that the monetary policy would remain prudent and data-dependent, indicating a rather hawkish attitude towards further easing. After the announcement, BoI governor Yaron explained that inflation easing was faster, which enabled the BoI to move but insisted that the interest rate path in the future will continue to be gradual and cautious. He added that the MPC wants to see what the effect of the two interest rate cuts is, and then it can move forward in a balanced way. He stated that the current rate is close to the neutral one, estimated to be at about 3.5% or a little bit more, which is by 1.5% above inflation. He thus indicated that the rate will probably stabilize at about 3.5%, which level is expected to be reached by the end of the year, according to the latest research department assumptions, meaning that the easing cycle will most probably comprise two more cuts only. Therefore, we believe that the MPC will take a pause in the next rate meeting on Feb 23.

Inflation changed the trend and sped up by 0.2pps m/m to 2.6% y/y in December but this was expected and it remained within the 1-3% target range for the fifth month running. Yaron had warned in early January that inflation might even reach the upper limit in December but the reading was eventually smaller and in line with market expectations. He also said that inflation is expected to approach the mid-point of the target in Q1 already. The MPC still points to risks that can push inflation higher - "geopolitical developments and their impact on economic activity, an increase in demand alongside supply constraints, and fiscal developments." Private demand was robust after the war ended but its effect did not offset the easing of labour market constraints by now, Yaron also said adding that this would be a development to assess when taking the next decision.

GDP growth rebounded in Q3, at much higher-than-expected 11.1% in saar terms (seasonally-adjusted annualised rate). The deviations of the GDP and the business product from their long-term trends moderated but apparently have not closed. Economic activity remains strong and the MPC lists a number of high-frequency indicators supporting this view like credit card spending, consumer confidence, high-tech capital raising, as well as the increase in services exports. Yet, it also noted that the business sentiments survey of the stat office suggested that activity was lower compared to the pre-war period.

Board statements, press briefings, minutes from MPC meetings

| Ask the editor | Back to contents |

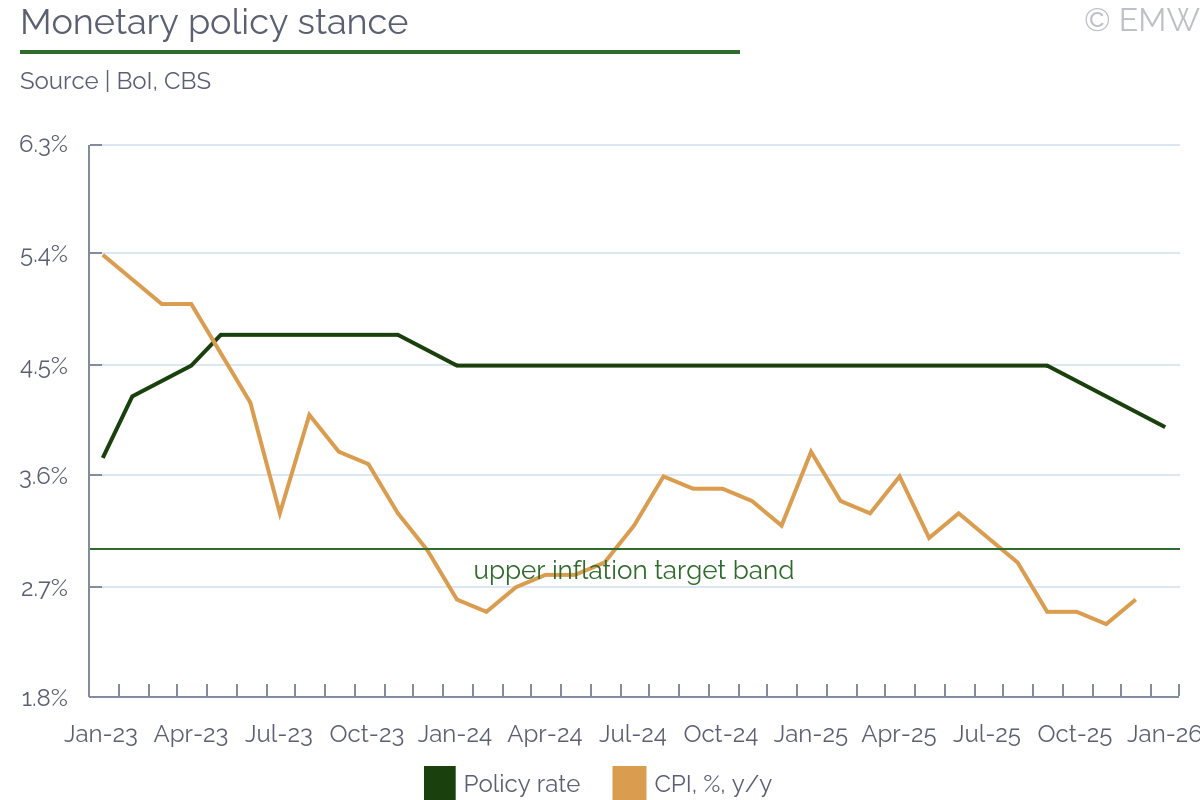

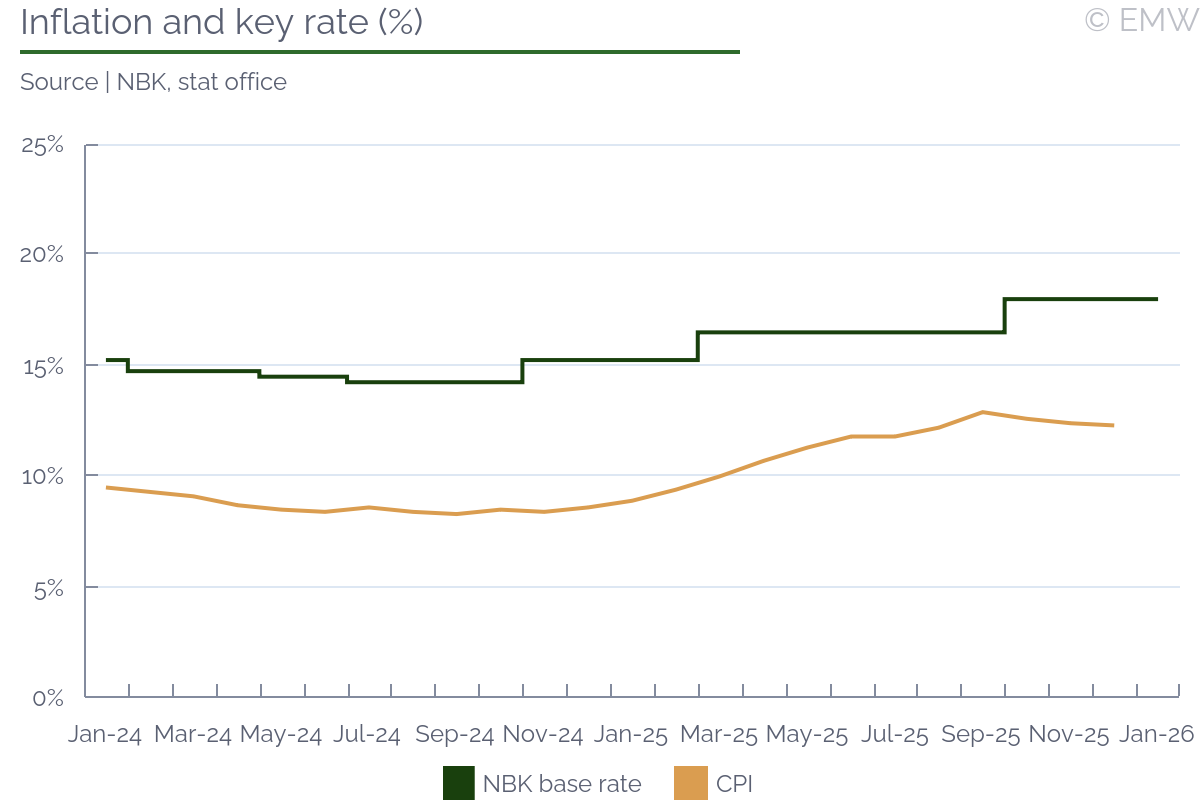

| NBK leaves base rate at 18%, on-hold decisions likely throughout H1 |

- Current policy rate: 18%

- Next monetary policy meeting: Mar 6

- Expected decision: hold

On Jan 23, the NBK kept the base rate on hold at 18%, which was expected. The bank noted year-end inflation (12.3%) was within its forecast range, but also expressed concern about the elevated rates of core inflation and monthly price growth. Food inflation is considered to be an upward factor due to production costs and high export prices. Households' inflation expectations are also deemed to be volatile, while geopolitical tensions are the main external source of pressure, according to the NBK.

Looking forward, the bank is wary of risks related to domestic demand trends, quasi-fiscal spending, the new tax code, as well as the secondary effects of tariff hikes and fuel price liberalisation. Overall, the NBK is confident that its policies can still foster disinflationary tendencies. At the same time, governor Suleimenov warned businesses could start hiking prices again after Q1, as the adaptation to the new tax code progresses. We also recall that tariff and fuel price hikes are expected to resume in Q2, which implies pressures could coincide in this period.

As a whole, the NBK has said the base rate will likely remain on hold throughout H1 2026. We think this is a probable scenario, as it will allow the bank to clarify the tax reform's impact. At present, the NBK is calm that all developments are in line with its macro forecasts. If this were to change as a result of near-term inflationary pressures, monetary tightening could become a possibility again, in our view.

| Ask the editor | Back to contents |

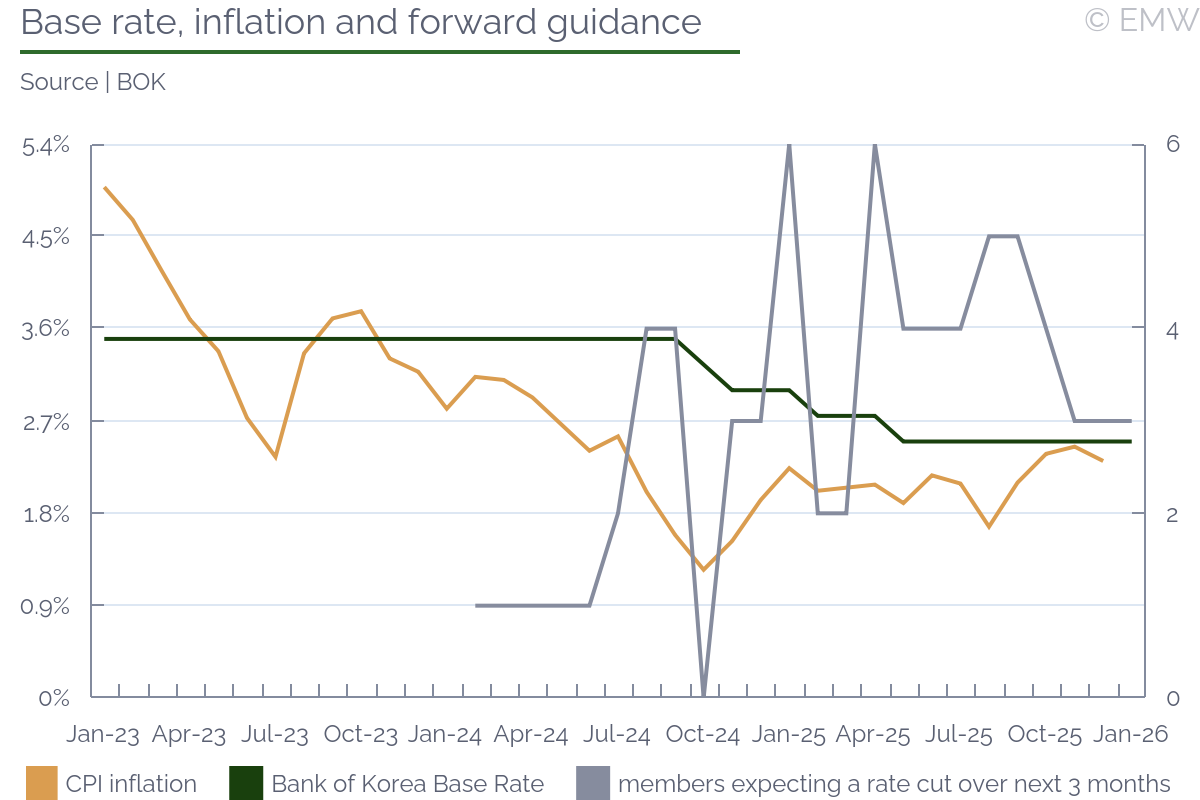

| BOK to adopt neutral stance due to FX volatility, real estate price surge |

- Next policy meeting: Feb 26

- Current policy stance: 2.50%

- Last decision: Jan 15 (Hold)

- Our forecast: Hold

- Rationale: Base rate likely to stay at 2.5% for protracted period of time

The Bank of Korea is likely to stay on hold yet again in its upcoming meeting on February 26 due the high FX market volatility and the surge of real estate prices, especially in the capital Seoul. The BOK has kept its interest rate unchanged since May 2025 and most recently it stayed on hold in its last meeting on Jan 15. However, the central bank left the door open to one last rate cut in its last meeting as 3 out of the 6 board members saw possibility for a rate cut in the next 3 months. Despite BOK's guidance and the Fed's recent dovish moves, we think that the BOK will be hard-pressed to keep rates unchanged in order to prevent further won depreciation and hamper speculative forces in the real estate market.

Thus, we think that the BOK will adopt a neutral stance in the near future and will likely change its guidance to no rate cuts over the next 3 months. The BOK has already removed any mentions of interest rate cuts in the last monetary policy statement. Overall, BOK's language has visibly turned more hawkish over the past 2 meetings, suggesting that a shift in its policy stance has already occurred.

At the same time, we do not think that the BOK is likely to hike rates in the near future despite a sharp increase in Korean bond yields in recent months. As of now, there have been no signals from the BOK that it is looking to adopt a restrictive policy stance. More likely, we think that the BOK will keep rates unchanged for a protracted period of time. This is also supported by BOK's expectations that inflation will remain around the target 2% throughout 2026.

Meanwhile, BOK raised in November its forecast for 2026 growth to 1.8% - very close to the estimated potential growth rate of 2%. BOK maintained an easing stance throughout 2025 mainly because growth remained below the potential growth rate. With growth expected to return to the potential growth rate, we think that the BOK will have significantly less reasons to consider rate cuts.

GDP weaker than expected in Q4, but exports remain booming in January

It should be noted that the economy posted weaker than expected growth of -0.3% q/q in Q4 amid a persistent softness in facility investment and construction. However, exports remained buoyant as they expanded by 14.9% y/y in the first 20 days of January led by a 70.2% y/y surge in semiconductor exports, according to data from the customs office.

The K-shaped recovery pattern of the Korean economy is becoming more evident as the semiconductor sector is accounting for an increasing share of exports and industrial production, while many other sectors are underperforming. The K-shaped recovery leads to large sectoral disparities and disconnect between how the economy is actually felt and headline growth, according to comments from BOK's governor Rhee from early January. Thus, we think that in normal conditions the BOK could have done one more rate cut in Q1 2026, but due to other factors such as FX volatility and real estate prices, the BOK is forced to stay on hold.

Real estate prices continue to surge in Seoul, while overall inflation has stabilized

Real estate prices in Seoul rose by 0.29% w/w in the week ending Jan 19 (16.3% annualized growth), posting their strongest increase since late October. Real estate prices were underpinned by the resumption of mortgage lending from start-2026 as many banks restricted lending in late 2025 in order to meet lending quotas. In our view, the current level of real estate price growth remains unacceptably high for authorities and there will be more packages to stabilize the real estate market.

Meanwhile, CPI inflation decelerated slightly to 2.3% y/y in December from 2.4% in the preceding 2 months amid easing fresh foods prices. Core inflation stood at 2.0% in December for the second month in a row. The government still expects CPI inflation in 2026 to stay at the same level as in 2025 at 2.1%. The decline in energy prices and won's depreciation remain two offsetting factors that will likely keep inflation stable throughout 2026.

Conclusion

We think that the BOK would have likely cut its base rate one last time in Q1 2026 if not for the continuing surge of real estate prices in Seoul and the looming concerns about FX volatility. Meanwhile, the stability of inflation and the expected economic recovery in 2026, which will bring growth close to potential, also reinforce our expectations that the BOK will not make any moves for the foreseeable future. In the longer-term, we think that the BOK will be likely forced to keep interest rates higher compared to regional peers due to the persistent pressures on the Korean won from outbound investment, which are only going to get exacerbated by the US-Korea trade deal.

Useful Links

| Ask the editor | Back to contents |

| Steady growth, contained inflation to give BNM room for extended rate pause |

- Next policy meeting: 5 March, 2026

- Current policy rate: 2.75%

- Our forecast: Hold

- Last decision: Hold (Jan 22, 2026)

- Rationale: growth momentum is expected to continue this year, while inflation is likely to remain moderate, allowing for an extended rate hold unless an external shock emerges

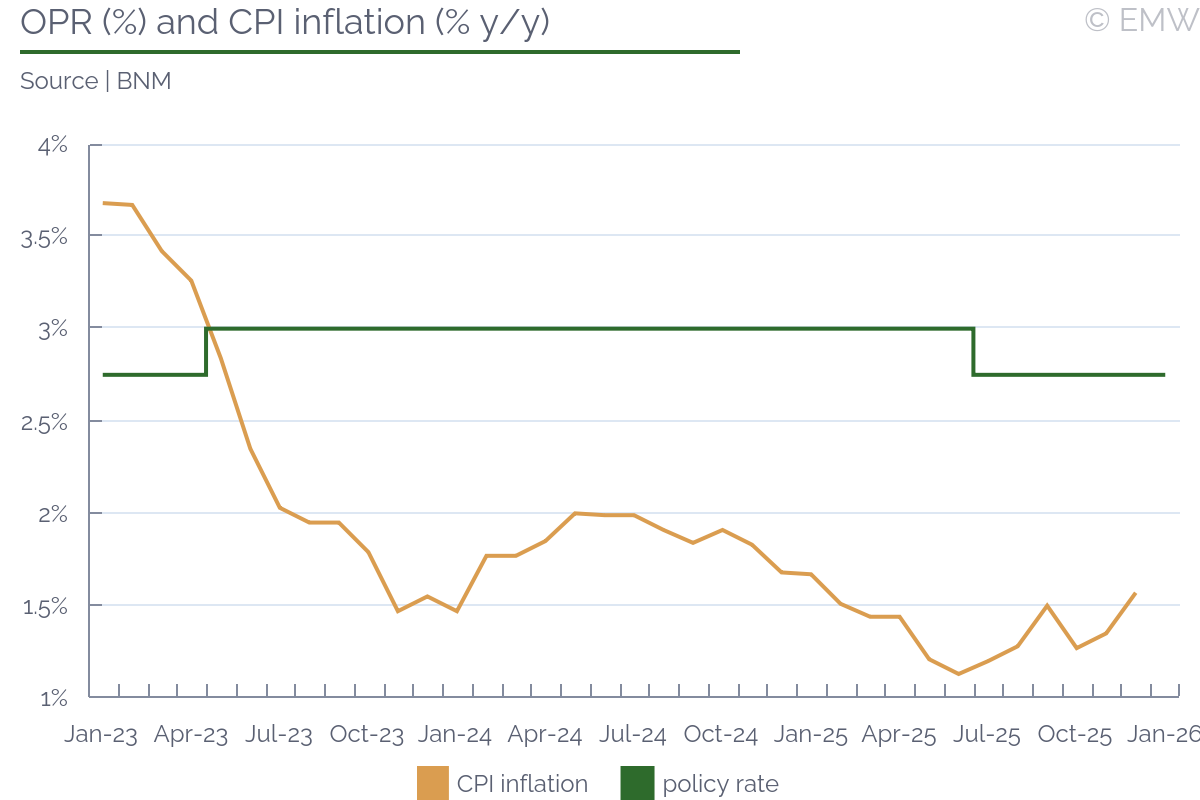

Bank Negara Malaysia on Jan 22 maintained its overnight policy rate (OPR) at 2.75%, taking comfort from strong GDP growth that beat official forecast in 2025 and subdued inflationary pressures. The central bank reiterated that the current monetary policy stance remains appropriate and supportive of the economy while ensuring price stability. The monetary policy statement struck a slightly more dovish tone than previous ones, particularly in its assessment of global growth, which it said is support in part by robust technology investments. These investments have helped buoy the boom in electrical and electronics (E&E) exports. Nevertheless, BNM flagged potential tariffs and a possible correction in the artificial intelligence (AI) market as downside risks. The decision was widely expected, as all economists polled by Reuters and Bloomberg had forecast no change to the policy rate. This marked the third consecutive hold. The OPR was last adjusted in July 2025, when it was cut by 25bps as Malaysia braced for potential economic fallout from tariffs imposed by President Trump.

GDP growth

GDP growth accelerated to 5.7% y/y in Q4 2025, the fastest pace since Q2 2024, according to advance estimate released by DOSM. The expansion was driven by a stronger factory and services activity, a sustained double-digit expansion in construction sector, and a sharp rebound in agricultural output. The key export-oriented manufacturing sector grew 6.0% y/y, its strongest performance in three years. Full-year GDP growth came in at 4.9%, exceeding the government's forecast range of 4.0%-4.8%. BNM, however, appeared a bit cautious, projecting 2025 growth to be around the upper end of the forecast range. This suggests that GDP growth for Q4 and full-year 2025 could be revised lower when DOSM releases its final estimates on Feb 13.