| Feb 06, 08:14 |

| Feb 06, 07:54 |

| Feb 06, 05:23 |

| Feb 06, 06:56 |

| Feb 06, 06:50 |

| Feb 06, 06:37 |

| Feb 05, 16:52 |

| Feb 06, 06:18 |

| Feb 06, 06:32 |

| Feb 06, 06:00 |

| Feb 05, 15:24 |

| Feb 06, 05:46 |

| Feb 06, 05:46 |

| Feb 05, 13:13 |

| Feb 05, 13:12 |

| Feb 06, 10:05 |

| Feb 06, 09:32 |

| Feb 06, 07:42 |

| Feb 06, 06:58 |

| Feb 06, 06:51 |

| Feb 06, 06:22 |

| Feb 05, 16:22 |

| Feb 06, 07:49 |

| Feb 06, 07:47 |

| Feb 06, 06:32 |

| Feb 06, 09:37 |

| Feb 06, 06:30 |

| Feb 05, 12:03 |

| Feb 06, 06:14 |

| Feb 06, 06:12 |

| Feb 06, 06:11 |

| Feb 06, 05:47 |

| RBI to cut interest rates this week - consensus poll |

- Most economists expect 25bps rate cut

- Malhotra less interventionist with INR management

India's new central bank governor, Sanjay Malhotra, is expected to announce an interest rate cut in his first Monetary Policy Committee (MPC) meeting, as the Reserve Bank of India (RBI) shifts its focus towards supporting economic growth amid global uncertainties. According to a Bloomberg survey, most economists predict that the RBI will lower the benchmark repo rate by 25bps to 6.25% on Friday. Some analysts believe there is a possibility of a larger 50bps cut.

Malhotra, who took office in mid-December, is chairing an almost entirely new six-member MPC. Deputy Governor M. Rajeshwar Rao has temporarily replaced Michael Patra, who retired last month, while three new external members joined in October. Malhotra has not made public statements on inflation and currency policy, but RBI insiders indicate that he favors a less interventionist approach to the rupee than his predecessor, Shaktikanta Das. Since his appointment, the rupee has depreciated over 3% against the dollar, reflecting increased volatility compared to the managed approach under Das.

A rate cut would follow the government's USD 12bn tax relief announced in the Union Budget, aimed at stimulating consumption. Recent economic data has also shown slower-than-expected growth, while US President Donald Trump's tariff threats have created fresh uncertainty in global markets.

Malhotra is scheduled to announce the RBI's rate decision at 10 a.m. in Mumbai. This decision will be closely tracked to get signals on his policy stance, future rate-cut trajectory, and views on the rupee and liquidity management.

Click here for our comprehensive database of macro forecasts.

| Ask the editor | Back to contents |

| Exit polls show BJP in lead in Delhi state election |

- 60.42% voter turnout

- BJP in the lead according to most exit polls

- Congress to secure minimal or no seats

Exit polls for the 2025 Delhi Assembly elections indicate a significant shift in the capital's political landscape. The Bharatiya Janata Party (BJP) is projected to secure a majority in the 70-member assembly, marking a potential end to the Aam Aadmi Party's (AAP) decade-long governance.

In the 2025 Delhi Assembly elections, approximately 60.42% of the 15.6mn eligible voters cast their ballots, marking the lowest voter turnout since 2008, which saw a 57.8% participation rate. This provisional figure is subject to revision as final data becomes available. The current turnout reflects a decline from previous years, with 66% in 2013, a record 67.5% in 2015, and 62.8% in 2020. Notably, the 2024 Lok Sabha elections held in May had a turnout of 58.6%.

The Election Commission has indicated that these turnout figures are provisional and will be updated in the coming days. The election featured three major political parties-Aam Aadmi Party (AAP), Bharatiya Janata Party (BJP), and Congress-competing for 70 assembly seats. Polling was largely peaceful, with no significant incidents reported. The counting of votes is scheduled for February 8, and if a clear majority emerges, the new government is expected to be formed by February 11.

Various exit polls have provided the following seat projections:

| Exit Polls (seats) | |||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||

| Source: Media Sources |

These projections suggest a resurgence for the BJP in Delhi, a region where it has not held power for over two decades. The anticipated outcome is a considerable setback for AAP, led by Arvind Kejriwal, which has maintained a stronghold in the capital since its inception. It's important to note that exit polls have a mixed track record in accurately predicting election results in India. The results are expected to be declared on February 8.

| Ask the editor | Back to contents |

| Press Mood of the Day |

India open to revive US trade deal talks during PM Modi's upcoming visit (Business Standard)

Growth in services sector slows to more than 2-year low: PMI survey (Business Standard)

Rate cut expectations push rupee to a new low despite falling dollar index (Business Standard)

Exit Polls: BJP's likely to gain majority in Delhi (Economic Times)

Indirect tax to rise by 8.3 pc, corporate tax by 10.4 pc in FY26: Report (Economic Times)

Expect 25-50 bps rate cut from RBI's MPC on Feb 7, says CII President Sanjiv (CNBC TV18)

Growth in India services sector slows to more than two-year low in Jan, PMI shows (CNBC TV18)

| Ask the editor | Back to contents |

| Prabowo threatens to reshuffle ministers who do not work for people |

- He did not name ministers, but we see energy minister Bahlil Lahadalia as most likely candidate

- Recent Celios survey, media rumours link three other ministers with possible reshuffle

President Prabowo Subianto threatened to reshuffle ministers who do not work for the people. Speaking at a press conference, Prabowo said that he will maintain a clean government, which meets people's interests. He did not name ministers under consideration to be replaced.

We view this mostly as a populist statement, given Prabowo's political profile. However, we would not be surprised to see a minor reshuffle, with Energy Minister Bahlil Lahadalia the main candidate so far due to the LPG canister crisis.

We should note that there are also media rumours linking three other ministers with a possible reshuffle. Law Minister Natalius Pigai, Cooperative Minister Budi Arie and Forestry Minister Raja Juli scored negative in a recent Celios survey, emerging as ministers seen as slacking in their jobs.

| Ask the editor | Back to contents |

| Govt urges exporters to diversify products due to US tariff threat |

- Exporters should focus on goods not produced in US - trade minister

- US is largest contributor to Indonesia's external trade surplus with USD 16.8bn in 2024

The government urged exporters to diversify their products ahead of potential US tariffs Indonesia could face. Speaking at a press conference, trade minister Budi Santoso urged exporters to shift their focus to goods not produced in the US to avoid being affected by the tariffs. The minister assured that Indonesia is well prepared to face potential import tariffs by the US, though he did not give context.

We remind that the US is the largest contributor to Indonesia's external trade surplus, with the latest data pointing to USD 16.8bn surplus in 2024. India followed closely with USD 15.4bn and the Philippines with USD 8.9bn trade surplus. The trade minister's statements came after US President Donald Trump threatened to impose 100% import tariffs on goods from BRICS countries. We remind that Indonesia only recently joined BRICS.

| Ask the editor | Back to contents |

| Press Mood of the Day |

Prabowo Says He Will Reshuffle Ministers Who Don't Work for the People (Tempo)

Indonesia Condemns Donald Trump's Plan to Relocate Palestinians from Gaza (Jakarta Globe)

Health Ministry Has to Cut $1.2 Billion After Prabowo Orders Budget Trims (Jakarta Globe)

Prabowo warns ministers: Perform or lose your position (Antara News)

Indonesia's Prabowo vows firm action against corruptors (Antara News)

RI Remains Committed to Addressing Climate Issues Despite Trump's Withdrawal from Paris Agreement (Bisnis)

[Deputy parliament speaker] Dasco: There are Ministers Who Are Not in Tune with Prabowo (Kompas)

Chinese Companies Control 75 Percent Of Indonesia's Nickel Capacity (Republica)

| Ask the editor | Back to contents |

| Govt backtracks on LPG distribution policy |

- Prabowo rolls back energy minister's regulation

- Media rumours emerged about possible cabinet reshuffle

The government abandoned its policy of allowing only registered distributors to sell the popular 3kg canisters of LPG to households, local media reported. The decision was taken by President Prabowo Subianto after some public backlash over the new government policy, which led to queues in front of registered distributors as consumers were unable to obtain the LPG canisters at small convenience stores. In turn, this raised concerns about possible price speculations, although the canisters are sold at a subsided price of IDR 20,000.

The turmoil over the LPG canisters reportedly led to rumours about a cabinet reshuffle, with energy minister Bahlil Lahadalia the main culprit behind the public backlash. So far, Prabowo has not commented on the rumours, but we doubt he would reshuffle the cabinet so soon, just after his first 100 days in office amidst record-high approval. Moreover, he reinforced his populist stance by taking a stand against the energy minister in favour of public demands.

| Ask the editor | Back to contents |

| Press Mood of the Day |

PTI ropes in ex-PM Abbasi to steer opposition alliance (Dawn)

US aid suspension to hit 60 health facilities in Pakistan (Dawn)

Review of GSP+ status stokes fear in industry (Dawn)

Gold scales new peak, nears Rs300,000 per tola (Dawn)

Terrorist attacks will not disrupt Pakistan-China's long-standing ties, Zardari assures Xi (Express Tribune)

SBP net FX intervention in interbank market reaches $3.8bn in five months (The News)

Erdogan to visit next week: Pakistan, Turkiye to expand SEF (Business Recorder)

| Ask the editor | Back to contents |

| House refers impeachment of Vice President Duterte to Senate for trial |

- Senate can only act on impeachment complaint in June - Escudero

- Potential impeachment will make Duterte ineligible to run in the 2028 presidential election

The House of Representatives on Wednesday supported the fourth impeachment complaint against Vice President Sara Duterte and referred it to the Senate. The petition against Duterte was supported by 215 MPs. The complaint needed the approval of one-third of the 306 members of the lower chamber.

There are several allegations against Vice President Duterte, such as misuse of public funds and threats to have President Ferdinand Marcos Jr., his wife and the House speaker assassinated. She denies any wrongdoing.

On Thursday, Senate President Francis Escudero said that the upper chamber can only act on the impeachment complaint on Jun 2, when the Congress resumes after the midterm elections in May. In June, the 24-seat Senate must convene an impeachment tribunal. A conviction requires 16 votes.

Only four officials have been impeached in the Philippines so far and there has been one conviction - of then-Supreme Court chief justice Renato Corona - whose trial took five months back in 2012, Agence France-Presse noted.

Probably the most significant consequence of a potential impeachment of Vice President Duterte is that she will not be eligible to run in the 2028 presidential election. While the Philippine president can serve one term only, it is very likely that the powerful Marcos family will be a key player in the 2028 election.

On a related note, the net trust ratings of both President Marcos and Vice President Duterte continued to fall, according to a Stratbase-SWS survey conducted from Jan 17-20. The net trust rating of Marcos decreased to +24 in January from +29 in December, +33 in September and +42 in July. The net trust rating of Duterte declined to +19 in January from +23 in December, +29 in September and +45 in July.

| Ask the editor | Back to contents |

| Press Mood of the Day |

Sara Duterte impeached; House gets 215 to sign (INQUIRER)

Five things to know about Sara Duterte and her impeachment (INQUIRER)

Senate, House start review of impeachment raps vs. VP Sara (Philippine News Agency)

Pangandaman says gov't could adjust growth target if necessary (BusinessWorld)

Term deposit yields slip on dovish BSP signals (BusinessWorld)

Joblessness dips in December 2024 - PSA (INQUIRER)

DOF chief: Low inflation allows BSP to further cut interest rates (Philippine News Agency)

DTI says US expressing 'renewed interest' in FTA (BusinessWorld)

Gov't procurement law IRR due next week (BusinessWorld)

DA OKs 4K MT of onions importation to prevent 2022 crisis (Philippine News Agency)

| Ask the editor | Back to contents |

| BSP may cut policy rate by 25bps on Feb 13 |

- Next monetary policy meeting: Feb 13

- Current policy rate: 5.75%

- EmergingMarketWatch forecast: 25bp cut

- Rationale: Comments by Governor Remolona; GDP data for Q4; CPI data for January

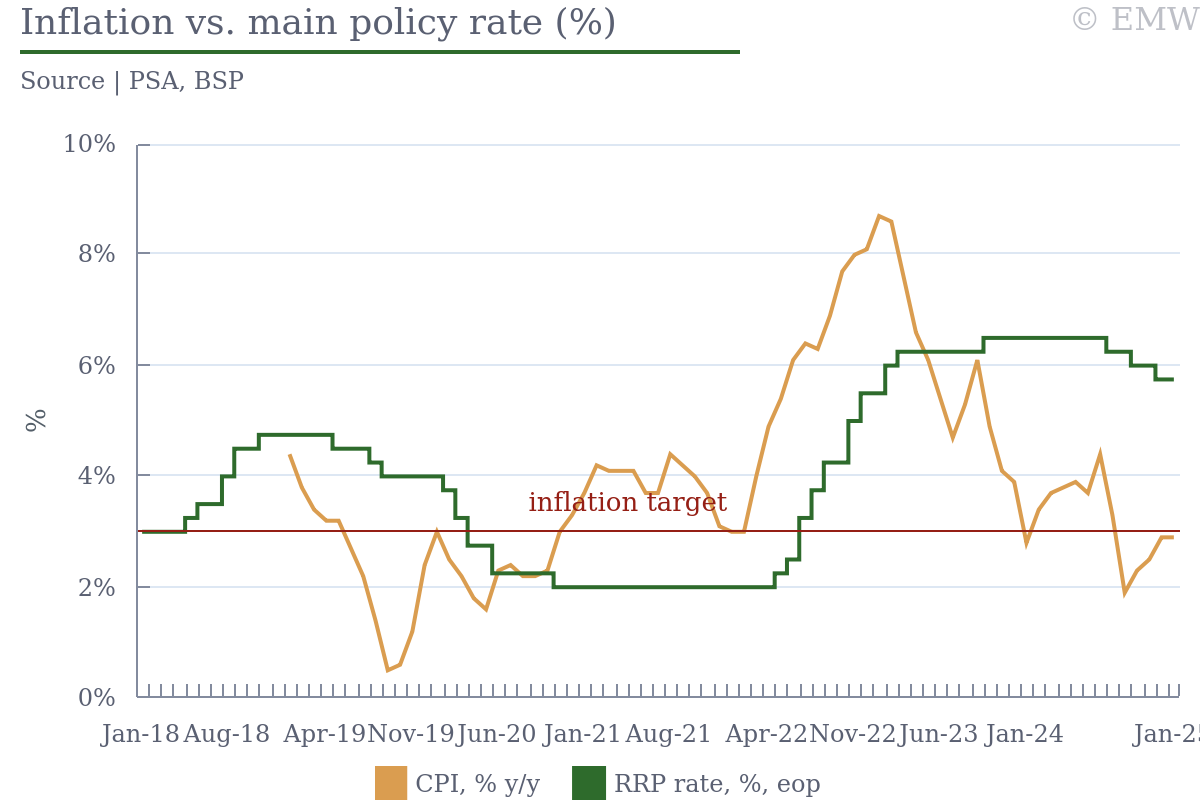

We think that BSP's Monetary Board (MB) may reduce the policy rate by 25bps at its meeting on Feb 13. The BSP has made three consecutive 25bp policy rate cuts at the last three MB meetings for 2024. The latest meeting was held on Dec 19 and the key rate was reduced to 5.75%.

We think that another rate cut is somewhat more likely than a pause because the fourth-quarter GDP growth was below expectations and the January CPI inflation was slightly below the midpoint of the 2.0-4.0% target range.

BSP Governor Eli Remolona Jr. said on Saturday that the central bank may lower the key rate by 50bps this year, as they need a "bit of policy insurance." He said that the easing could involve 25bp rate cuts in each of H1 and H2. There will be six MB meetings in 2025. The governor sees no need for cutting the policy rate by 100bps this year because they do not expect a "hard landing" of the Philippine economy in the near future. A reduction of 75bps might be too much as well, according to him.

Remolona said on Friday that a policy rate cut was "on the table" at the MB meeting on Feb 13. He also noted that there is a negative output gap currently, and if it becomes more negative, that will necessitate more easing.

The BSP Governor also noted that the US Fed's moves impact the economy and hence affect the BSP's actions. Nonetheless, the BSP does not copy or just follow the Fed.

Remolona also said that they are considering another cut in banks' reserve requirement ratio (RRR) in 2025. The MB is discussing a reduction of 200bps to 5.0% for the big banks. The cut may be made in June or July.

Inflation

CPI inflation was 2.9% y/y in January, unchanged from December. The inflation target range is 2.0-4.0%. We note that the January headline inflation is at the midpoint of the central bank's month-ahead forecast range of 2.5-3.3% y/y.

On Wednesday, the BSP commented on the January CPI data and said that they are consistent with its assessment that inflation will remain anchored within the target range over the policy horizon. Going forward, the MB will maintain a measured approach to monetary policy easing to ensure price stability consistent with sustainable economic growth and employment, the press release said.

Economic growth

The GDP increased by 5.2% y/y in Q4, maintaining the same y/y growth rate as the one in Q3. The latest reading is below the 5.4% growth expected in a Reuters poll. The Philippine economy hence expanded by 5.6% in 2024, accelerating slightly from 5.5% in 2023. The latest reading is below the government's target range of 6.0-6.5%.

It is also below the estimates announced by the World Bank and the IMF in January. The two institutions saw the 2024 GDP growth at 5.9% and 5.8% respectively. With regard to the rate of economic expansion in 2025, both institutions forecasted it at 6.1%.

Lending growth

Outstanding loans of universal and commercial banks, net of reverse repurchase (RRP) placements with the BSP, rose by 11.1% y/y at end-November, speeding up from 10.6% y/y growth at end-October. On a seasonally adjusted basis, loans increased by 1.0% m/m at end-November. Annual loan growth has been in the double digits for the seventh month in a row.

Loans for production activities, net of RRPs, climbed 9.8% y/y at end-November, accelerating from 9.1% y/y at end-October. Consumer loans to residents rose by 23.3% y/y in November, decelerating from 24.0% y/y in October.

Exchange rate

The peso is trading at USD/PHP 57.956 at the time of writing, which compares with USD/PHP 59.076 on Dec 19, the date of the previous MB meeting.

Finance Secretary Ralph Recto said last month that he is comfortable with the level of the exchange rate of the peso against the US dollar. The exchange rate was USD/PHP 58.192 on Jan 20. The Philippine authorities intervene in the foreign exchange market to tackle volatility only, the secretary said.

Further reading

Press release after December 2024 monetary policy action

Schedule of monetary policy meetings

| Ask the editor | Back to contents |

| US-Sino trade war to have positive spillover for Malaysia in short run – Zafrul |

- It is too early to say if tariffs on China will harm or benefit Malaysia

- There is also uncertainty over what US' will do next to Malaysia or its neighbours

The trade war between the US and China is likely to have positive spillover for Malaysia in the short term, Minister of Investment, Trade and Industry Zafrul Abdul Aziz said in an interview with state media Bernama. However, he stated that it was too early to determine whether the tariffs imposed by the US on China will harm or benefit the Southeast Asian nation. Zafrul acknowledged that the resultant shift in global supply chain would benefit countries like Malaysia, which is politically stable, has an open economy and maintains neutral status in the geopolitical arena.

In 2024, Malaysia recorded a USD 72.4bn (around USD 16.5bn) goods trade surplus with the US, which was its second largest export destination after Singapore. In that context, Zafrul expressed uncertainty over what the Trump administration will do next to Malaysia or other countries in the ASEAN region.

| Ask the editor | Back to contents |

| Press Mood of the Day |

Malaysia rejects forced resettlement of Palestinians, reaffirms support for two-state solution (The Edge Malaysia)

Malaysia, Uzbekistan should enhance bilateral trade, investment - Anwar (The Edge Malaysia)

Khazanah completes transfer of MAHB shares to takeover vehicle (The Edge Malaysia)

5G subscriptions nationwide reach 18.19 mil in 4Q 2024 - Fahmi (The Edge Malaysia)

Zafrul: Malaysia wary of US tariffs, ready to capitalise on opportunities (The Edge Malaysia)

Economic disparity persists for Bumiputeras in East Malaysia, says World Bank (The Edge Malaysia)

Fuel prices unchanged till Feb 12 (The Edge Malaysia)

Floods worsen slightly in Johor, Sarawak and Sabah (Free Malaysia Today)

Malaysia rolls out generative AI tool to 445,000 civil servants (Free Malaysia Today)

No formal notice received on 435 Malaysians facing deportation from US, says Wisma Putra (The Star)

Foreigners make up 14% of 16.78 million workforce, Bangladeshi largest group (The Star)

Defence Minister defends RM16b lease of 28 helicopters for national security (Malay Mail)

Household incomes need to double for Malaysia to achieve high-income status, says World Bank (New Straits Times)

| Ask the editor | Back to contents |

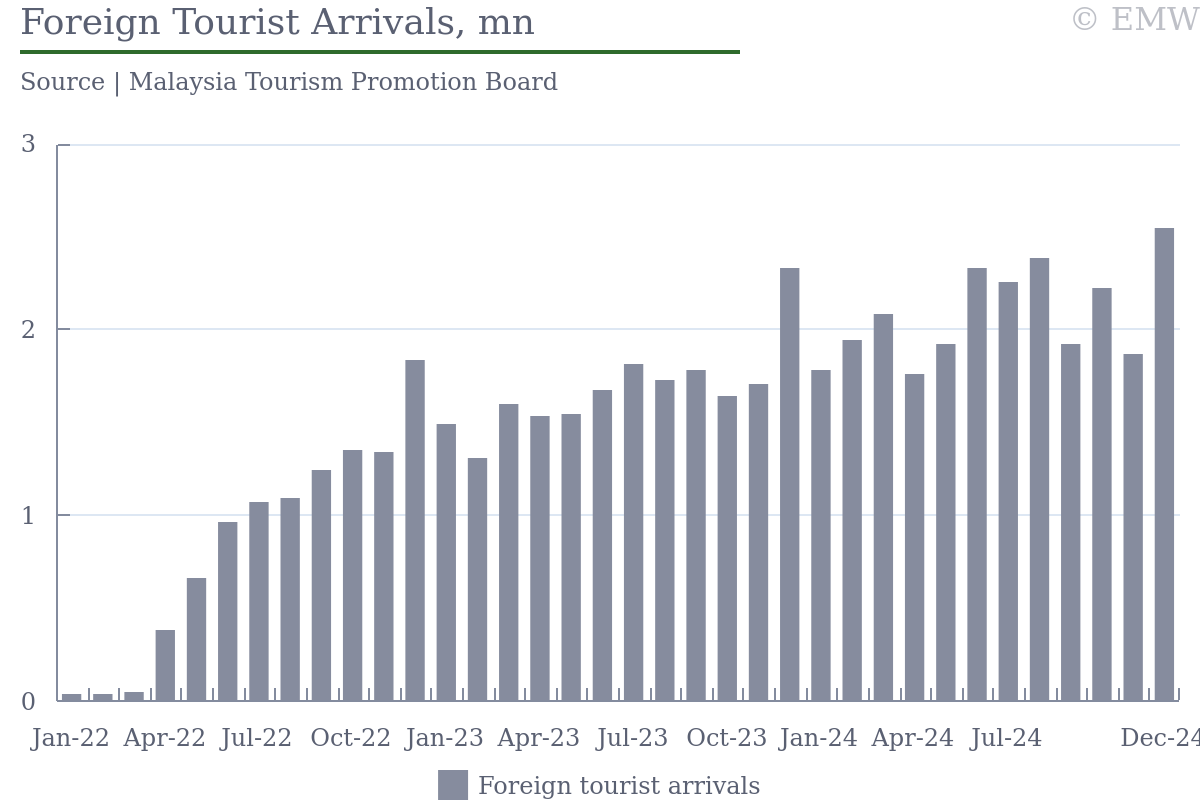

| Foreign tourist arrivals jump 24.2% y/y to over 25mn in 2024 |

- Singapore was the top contributor

- The arrivals fell short of 27.3mn target

Malaysia received over 25mn international tourists in 2024, the highest since 2019 and marking a growth of 24.2% y/y, media reports, citing Tourism, Arts, and Culture Minister Tiong King Sing. Singaporean made up over a third of total arrivals at 9.1mn, followed by Indonesians (3.7mn) and Chinese (3.3mn). It is noteworthy that the government in June last year extended visa exemption for Chinese nationals until the end of 2026 after China announced a similar policy during Chinese Premier Li Qiang visit to Kuala Lumpur.

The arrivals fell short of the government's target of welcoming 27.3mn foreign tourists last year. Moreover, they have yet to reach its pre-pandemic level, i.e., in 2019 when some 26.1mn tourists visited the Southeast Asian nation.

The sharp rise in foreign visitors supported Malaysia's economy, especially benefiting its services sector. Tiong did not provide information of Malaysia's international tourism revenue for 2024, which the government had targeted at MYR 102.7bn. For 2025, the country has set a target of 31.4mn international tourist arrivals.

| Ask the editor | Back to contents |

| Khazanah’s profit falls 13.6% y/y to MYR 5.1bn in 2024 |

- Net value assets surged 22.7% y/y on strong investment returns

- Some MYR 1bn dividend paid to government

- Officials termed 2025 to be a difficult year for the sovereign wealth fund

Khazanah Nasional Berhad posted an operating profit of MYR 5.1bn in 2024, down from MYR 5.9bn in 2023, its top officials announced at a press conference on Wednesday. The strong performance was attributed to disciplined monetization strategies, steady dividend income and fair value gains from global public equities. Realisable asset value (RAV) over debt ratio stood at 3.2, indicating a healthy balance sheet of the sovereign wealth fund. Meanwhile, net asset value (RAV minus liabilities) rose by 22.7% y/y to MYR 103.6bn in 2024, indicating strong investment returns and portfolio growth.

Khazanah declared a MYR 1bn dividend to the government for 2024, which is line with the FinMin's projections and unchanged from 2023. Since 2004, the Fund has paid MYR 19.1bn in dividends to the government.

Going forward, the officials said that 2025 would not be an easy year for Khazanah amid higher-for-longer US interest rates and volatile trade policies. However, they expressed confidence in domestic investments, which accounted for 58% of the sovereign wealth fund's total portfolio in 2024. Khazanah plans to keep the Malaysian portion "slightly over 60%" of its total portfolio, they added.

| Ask the editor | Back to contents |

| Fitch maintains Korea’s credit rating at AA- with stable outlook |

- Strong macroeconomic performance, dynamic exports and robust external finances underpin rating

- Fitch says political crisis doesn't threaten governance and economy for now

- Fitch revised GDP growth sharply to 1.7% in 2025 as Fitch expects 10% global tariff by US

Fitch maintained Korea's sovereign credit rating at AA- with stable outlook, according to a credit rating decision released on Feb 6. Fitch noted that the credit rating remains underpinned by strong macroeconomic performance, dynamic exports and robust external finances, which balance out geopolitical risks related to North Korea and the structural challenges from an aging population. Fitch noted that the ongoing political crisis related to President Yoon's impeachment doesn't threaten materially Korea's institutions, governance or economy. In addition, it said that if the political crisis is resolved in a constitutional manner, it will not fundamentally alter its assessment of institutions or governance.

However, Fitch also warned that a prolonged crisis could pose a risk for Korea's institutions and sustained political gridlock and could erode policymakers' effectiveness, economic outcomes and fiscal management. That said, Fitch base case is that elections will be held by late Q2 2025 as it expects President Yoon's impeachment to be upheld by the Constitutional Court.

In terms of the GDP growth forecast, Fitch revised down its 2025 GDP growth estimate by 0.3pps to 1.7%, citing the dampened confidence due to the political crisis, subdued recent data, and downside risks for exports. With regard to the latter, Fitch expects that the new US administration will implement a 10% global tariff. Still, Fitch expects activity to pick up throughout 2025 due to the front-load of government spending, the recovery of confidence, and the easing of monetary policy by the BOK to a terminal rate of 3.00%. In 2026, growth is expected to return to the potential rate of 2.1%.

The fiscal deficit (including the balance of social security funds) is expected at 1.0% of GDP in 2025, in line with the budget, down from 1.7% of GDP in 2024. At the same time, Fitch also said that it deems the passage of a supplementary budget to be increasingly likely. Government debt is projected to increase in 2025 to 48.4% of GDP, just below the AA peer median of 49.0% of GDP.

With regard to North Korea, Fitch saw rising challenges as the relationship between the two countries is becoming increasingly complex. North Korea's growing ties with Russia have complicated diplomatic re-engagement, Fitch said. At the same time, Fitch does not deem that the new US administration and South Korea's political volatility will necessarily lead to escalation in tensions.

The factors that could lead to rating downgrade include lingering political tensions, a significant rise in government debt, and a rise in geopolitical risks. On the other hand, factors that could lead to an upgrade include easing of geopolitical tensions, fiscal consolidation to put the debt-to-GDP ratio on a declining path, or reforms to mitigate the country's demographic challenges.

| Ask the editor | Link to source | Back to contents |

| BOK governor Rhee Chang-yong stresses fiscal stimulus needed to aid economy |

- Rhee says monetary policy cannot solve every problem, may "put the oil in the fire"

- Rhee notes rate cut not certain in next 3 months despite forward guidance given in January

- BOK now more likely to hold rates in February after Rhee's interview, hotter January inflation

BOK governor Rhee Chang-yong stressed that fiscal stimulus will be crucial and fended off suggestions that monetary policy easing is needed at all costs to aid the economy at present, according to an interview with him for Bloomberg TV released on Feb 6. Rhee stated that the Korean government is very good at expediting expenditure, which can be used for swift fiscal support and business cycle management. At the same time, Rhee noted that the government has room to implement a more accommodative fiscal policy due to the fact that it maintained a restrictive policy over the past two years during the period of high inflation. He also remained confident that the current government will do only a modest fiscal stimulus and will not erode fiscal sustainability.

With respect to monetary policy, Rhee said that it cannot solve any problem and it may actually "put oil in the fire" at a time in the when the exchange rate environment is depreciating quite rapidly. In terms of the exchange rate, he said that he doesn't think that the current level of the exchange rate is the "new normal."

Moreover, Rhee said that a rate cut is not certain despite the forward guidance given by the BOK in January when all six board members said that a rate cut is likely over the next 3 months. Members will definitely look at new evidence and the fallout of all different risks from domestic and external factors, he said. Rhee noted that impact of the rate cut on asset prices and exchange rates as the main negative effects from a rate cut.

Overall, we think that the BOK is now more likely to hold its base rate in the next policy meeting on Feb 25 due to the rather hawkish comments made by Rhee today and the hotter-than-expected inflation print for January. In such case, we think that the BOK could take a wait-and-see approach in February and continue with another 25bps rate cut in April. It should be also noted that the meeting in April could come after a Constitutional Court's decision on President Yoon's impeachment, which can potentially further reduce domestic political uncertainty and help to strengthen the won.

| Ask the editor | Back to contents |

| Government extends fuel tax cut by additional two months until end-April |

- Fuel tax cut has been extended repeatedly since Nov 2021

- Fuel tax cut elimination could potentially boost CPI inflation by 0.31pps

The government decided to extend the fuel tax cuts that were scheduled to expire at end-February by two additional months until end-April in order to alleviate the burden on local consumers, local media reported. In addition, the degree of fuel tax breaks will be confirmed at the current level of 15% reduction for the gasoline tax and 23% reduction for the diesel and LPG taxes. The fuel tax cuts were implemented in Nov 2021 and have been extended more than a dozen times since then, even though the scale of tax cuts has been adjusted multiple times since then. Recently, the jump in CPI inflation above 2% y/y in January might have prompted the government to extend the tax cuts.

The fuel tax cuts amount to KRW 123/litre for gasoline, KRW 133/litre for diesel and KRW 46 per litre for LPG. If the tax breaks were eliminated today they would lead to an increase in fuel prices by 7.1% for gasoline, 8.3% for diesel and 4.3% for LPG. In turn, this would increase headline inflation by combined 0.31pps, according to our calculations which account for the weight of fuels in the CPI basket and the current fuel prices.

| Ask the editor | Back to contents |

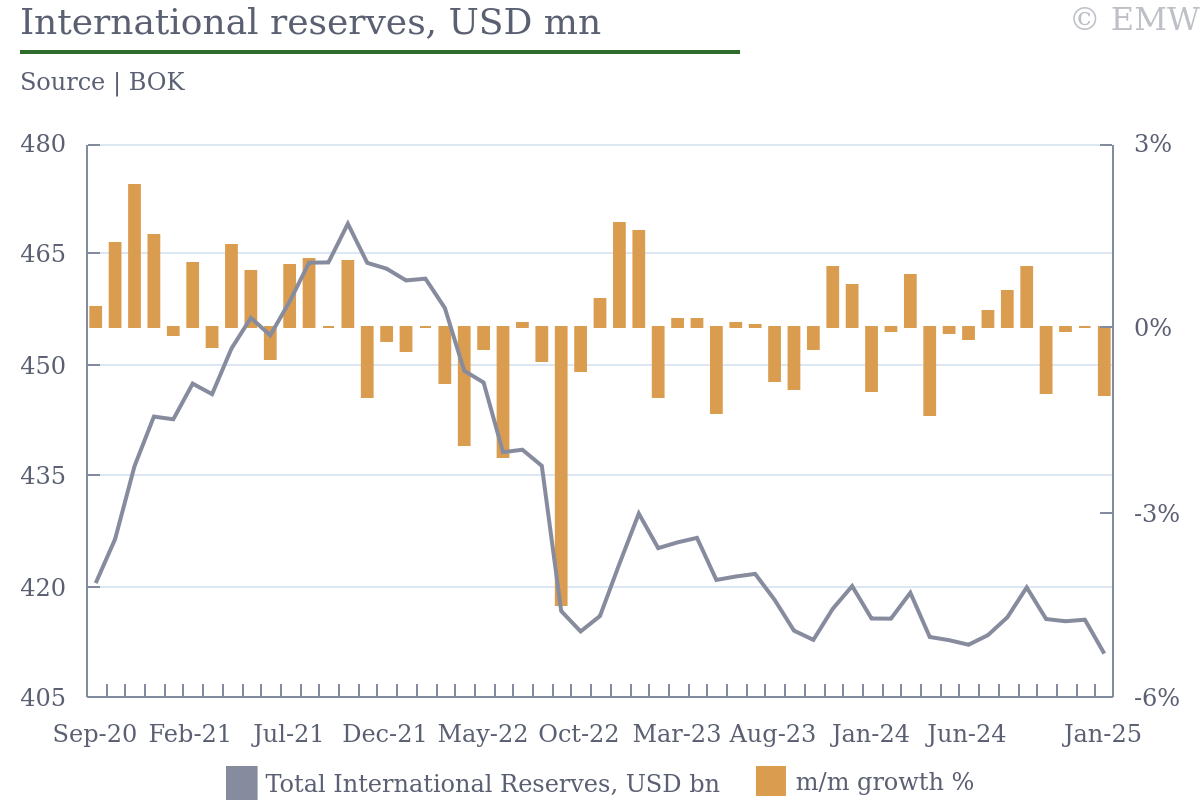

| Foreign exchange reserves decline by 1.1% m/m to USD 411bn in January |

- Reserves decline due to quarter-end effect and expansion of FX swap with the NPS

Foreign exchange reserves declined by 1.1% m/m to USD 411bn as of end-January and by 1.1% y/y compared to end-2023, data from the central bank BOK showed. Reserves thus posted the highest m/m drop since April 2024. The main explanations for the decline were the decline in FX deposits of financial institutions due to the disappearance of the quarter-end effect and the expansion of the FX swap with the National Pension Service (NPS). We remind that the FX swap allows the NPS to temporarily tap BOK's reserves in order to hedge its foreign asset exposure. The BOK does not reveal concrete data on the usage of the NPS swap, but the swap was recently expanded to to USD 65bn in Dec 2024.

| Ask the editor | Link to source | Back to contents |

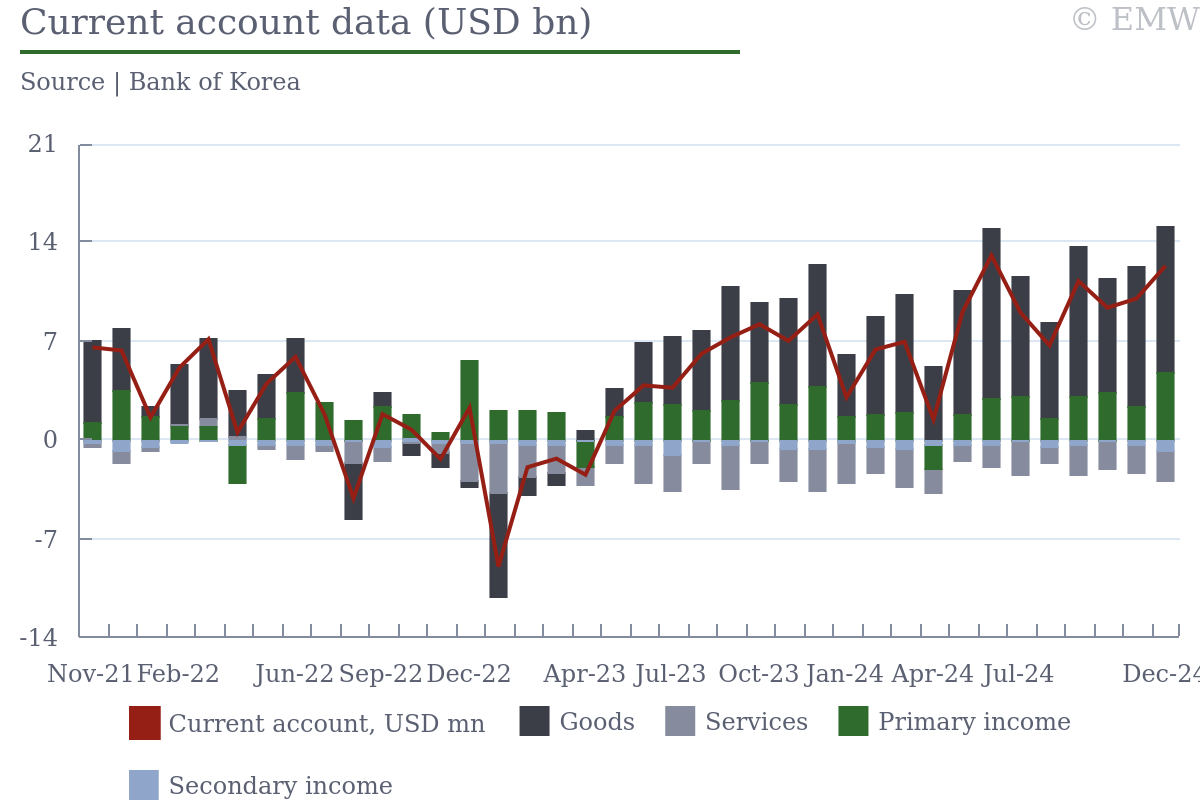

| Current account surplus rises by 38.4% y/y to USD 12.4bn in December |

- Goods surplus continues to expand robustly driven by export growth

- Financial account net outflows increase by 27.9% y/y to USD 9.4bn

- Portfolio investment liabilities decrease sharply in December amid martial law chaos

The current account surplus rose by 38.4% y/y to USD 12.4bn on December amid strong increase in the goods surplus by 20.5% y/y to USD 10.4bn, data from the central bank BOK showed. In seasonally-adjusted terms, the CA surplus inched up by 0.1% m/m to USD 9.6bn after rising by 22.4% m/m in November. Still, it marked the highest monthly CA surplus since June 2024. In 2024 as a whole, the current account surplus more than tripled to USD 99.0bn compared to USD 32.8bn in 2023, posting the second-largest annual surplus ever. The CA surplus swelled in 2024 as the country exported a significantly higher amount of semiconductors, while the sluggish domestic demand and falling energy prices helped to reduce imports.

In more details, exports increased by 6.6% y/y in December, while imports rose at a slower pace by 4.2% y/y. In addition, the services balance deficit narrowed by 29.2% y/y to USD 2.1bn as a result of the weakening domestic demand. The primary income surplus continued to increase robustly by 24.7% y/y to USD 4.76bn as residents continued to invest significant amount of funds abroad.

Looking at the financial account, total net outflows also rose strongly by 27.9% y/y to 9.4bn underpinned by a strong increase in net portfolio investment outflows to USD 4.7bn from USD 89.4mn a year ago. In particular, portfolio liabilities declined by USD 3.8bn in Dec 2024 compared to USD 2.6bn increase in Dec 2023 as foreign residents withdrew funds from the country due to the political crisis caused by the martial law chaos. On the other hand, other investment posted net inflows worth USD 4.3bn as residents accrued liabilities worth USD 3.9bn during the month likely in search of dollar funding due to the depreciating currency. Reserve assets increased by USD 1.4bn compared to 1.6bn in Nov 2024.

| Balance of payments, USD mn |

|

| Source: Bank of Korea |

| Ask the editor | Back to contents |

| Press Mood of the Day |

South Korean Government Blocks Access to DeepSeek Due to Security Concerns (Business Korea )

South Korean steel industry on edge as Trump revives tariff plans (Chosun)

South Korean universities face structural barriers in AI talent development (Chosun)

Yoon's impeachment trial a maze of conflicting remarks (Korea JoongAng Daily)

Yoon Arrives at Constitutional Court for Sixth Hearing in Impeachment Trial (KBS)

Acting President Choi Denies Reading Note before Martial Law Began (KBS)

S. Korea Posts Second-Largest Current Account Surplus in 2024 (KBS)

Army colonel says was told no more than '150 people' could be inside Nat'l Assembly during martial law operation (Korea Times)

KB Financial to buy back $359 bn shares after record net profit in 2024 (Korea Economic Daily)

Alternative stock exchange Nextrade to launch on March 4 (Korea Economic Daily)

Korean firms cut IPO prices, volumes amid bearish sentiment (Korea Economic Daily)

92% of South Koreans concerned about political conflict in society: survey (Korea Herald)

Yoon admits he ordered troops to election commission, but says 'nothing even happened' (Hani)

Seoul struggles to set up meetings with Trump administration (Hani)

| Ask the editor | Back to contents |

| Government targets foreign tourist arrivals to rise by 13% to 18.5mn in 2025 |

- Chinese tourists expected to play key role in tourism's recovery

The government expects that foreign tourist arrivals will rise by 13% to 18.5mn in 2025, beating the previous record high of 17.5mn visitors reached in 2019, the Korea Tourism Organization (KTO) said on Wednesday. The growth in foreign visitors will boost the local economy amid the ongoing political instability, the government said. On the downside, the target for 2025 is lower than the 2024 target which stood at 20mn and was badly missed by the tourism sector last year.

The country aims to capitalize on the growing popularity of Korean culture around the world and take advantage of the increase in independent travel demand. On the other hand, Korean tourism has been hit over the past few years by travel safety issues, a continued economic downturn in major inbound markets and rapidly changing sociopolitical circumstances at home and abroad.

China is expected to play a key role in the country's tourism recovery as visitors from China amounted to just 4.6mn in 2024, which fell below the record high of 6mn in 2019. The government has been actively considering whether to allow Chinese tour groups to enter the country without a visa and expand their current rights to enter the country for up to 30 days without a visa, but only on Jeju Island. The Chinese government has already introduced a visa waiver programme for South Koreans since Nov 2024 for a period of up to 15 days.

| Ask the editor | Back to contents |

| Government looks to secure USD 100mn from WB |

- Loan aimed at integrating rural-urban development

- Project focussed on agriculture sector

- Technical assistance to be made available by IFC

The government is looking to secure a USD 100mn concessionary loan from the World Bank to support climate-smart agriculture initiatives aimed at integrated rural-urban development and resilience. The project will receive technical assistance from the International Finance Corporation (IFC) as well.

The Integrated Village Development and Climate Resilience Project focuses on enhancing productivity across all agricultural sectors, including food crops, plantation crops, livestock, and fisheries. Key components include climate-smart agricultural practices, diversification, water resource management, economic sustainability, capacity building, and infrastructure development.

The initiative also aims to strengthen Sri Lanka's competitiveness in both domestic and foreign markets, ensuring long-term resilience and sustainability in the agricultural sector.

| Ask the editor | Back to contents |

| Tourist arrivals rise by 21.0% y/y in January |

- India, Russia and UK were key markets

- 21% y/y increase in January

- 5% increase since Jan 2018

Foreign tourist arrivals rose by 21.0% y/y to 252,761 in January, marking a record-high number, according to data from the Sri Lanka Tourism Development Authority (SLTDA). In fact, international visitors surpassed by 5.8% the previous record from January 2018, which was considered the best year for tourism. January 2025 now ranks as the second-highest month for tourist arrivals in Sri Lanka's history, just behind December 2018's record of 253,169 arrivals. The daily average arrivals stood at 8,153, while the weekly average reached 63,190.

India remained the largest source market, accounting for 17.2% of total visitors, followed by Russia (13.5%) and the United Kingdom (8.6%). Other key contributors included China, Germany, France, Australia, Poland, the United States, and the Netherlands.

For 2025, the Sri Lanka Tourism Development Authority (SLTDA) aims to attract three million international visitors and generate USD 5bn in revenue. While official monthly targets are yet to be announced, January, February, March, July, August, and December historically see higher tourist arrivals.

| Ask the editor | Back to contents |

| Press Mood of the Day |

Sri Lanka ready to continue USAID funded projects with alternative funding: Minister (Ada Derana)

Two arrested with over 100kg of Kerala cannabis in Jaffna (Ada Derana)

Imported salt released to local markets, prices to rise temporarily (Ada Derana)

Sri Lanka seeks USD 100M loan from World Bank for climate-smart agriculture projects (Ada Derana)

Tourism sector hits new milestone with strong January arrivals (Daily Mirror)

Govt. to recruit additional staff to issue 4,000 passports daily via 24-hour monitoring system (Daily FT)

MPs begin paying Rs. 2,000 for daily meals in Parliament (Daily Mirror)

SL upgrades CRVS system (Daily Mirror)

Court summons Namal Rajapaksa over Krrish deal (Daily Mirror)

| Ask the editor | Back to contents |

| CPI inflation accelerates to 1.32% y/y in January |

- Core CPI rises by 0.83% y/y

- February headline inflation rate expected to be similar to the one in January

- Commerce ministry maintains forecast of inflation in the range 0.3-1.3% in 2025

The headline CPI increased by 1.32% y/y in January, accelerating from 1.23% y/y in December, the commerce ministry said on Thursday. The January reading is in line with a forecast rise by 1.30% in a Reuters poll. Headline inflation has been within the target range of 1-3% for two consecutive months. The CPI rose by 0.10% m/m in January. The core CPI rose by 0.83% y/y in January, speeding up from 0.79% y/y in December.

Prices of food and non-alcoholic increased by 1.78% y/y in January, accelerating from 1.28% y/y in December. Annual price growth in the non-food and beverages category slowed down to 1.00% from 1.21%.

The Trade Policy and Strategy Office (TPSO) expects that the February headline inflation rate will be similar to the one in January. CPI growth is anticipated to be about 1.1% to 1.2% in Q1, according to TPSO director Poonpong Naiyanapakorn as quoted by Reuters. The ministry still projects headline inflation in the range from 0.3% to 1.3% in 2025. The BOT forecasts headline inflation of 1.1% this year.

| Ask the editor | Link to source | Back to contents |

| Press Mood of the Day |

Thailand reports 1.3% inflation in January (Bangkok Post)

China's Xi meets with Thai prime minister (Bangkok Post)

Palang Pracharath to oppose casino bill (Bangkok Post)

Decision on Move Forward ethics case possible in two months (Bangkok Post)

Call for Thai team to handle Trump (Bangkok Post)

Thai business group keeps 2025 GDP forecast at 2.4% to 2.9% (Bangkok Post)

Task force to scrutinise imported goods (Bangkok Post)

SET signs carbon market deal with ICE (Bangkok Post)

Thailand Leads ASEAN In Dairy Exports, Hits $582M With 11.5% Growth (The Nation)

Thai provincial airport passenger service charge rising (Bangkok Post)

PTT unit ready to suspend oil exports to Myanmar (Bangkok Post)

| Ask the editor | Back to contents |

| JSCCIB maintains 2025 GDP growth forecast at 2.4-2.9% |

- JSCCIB maintains export growth forecast at 1.5-2.5% in 2025

- JSCCIB concerned about influx of Chinese goods into Thailand

The private sector Joint Standing Committee on Commerce, Industry and Banking (JSCCIB) maintained its projection that Thailand's economy will expand by 2.4% to 2.9% this year, Reuters reported. The panel estimates that growth has been 2.8% in 2024.

This year, challenges include intensifying global trade wars and increased competition from imported goods. The JSCCIB said that domestic demand remains weak, whereas the appreciation of the baht is a negative factor affecting exports. Nonetheless, the panel also maintained its export growth forecast at 1.5-2.5% in 2025.

Shipments rose by 5.4% to USD 300.5bn in 2024. Exports had increased due to stockpiling before the inauguration of President Donald Trump, according to Federation of Thai Industries chairman Kriengkrai Theinnukul. He hence said that shipments might not have risen due to real demand, and they would wait and see the performance in Q1.

The competitiveness of Thai exports could increase following US tariffs on other countries, Kriengkrai said. He sees a need for protecting domestic businesses against the large imports of Chinese goods into Thailand. These imports will affect as many as 30 industries in 2025, if no appropriate measures are taken, he warned.

In January, both the World Bank and the IMF said they forecast that Thailand's economy will expand by 2.9% this year. The two institutions' estimates of 2024 GDP growth were 2.6% and 2.7%, respectively. The official fourth-quarter GDP data will be released on Feb 17.

Click here for our comprehensive database of macro forecasts.

| Ask the editor | Back to contents |

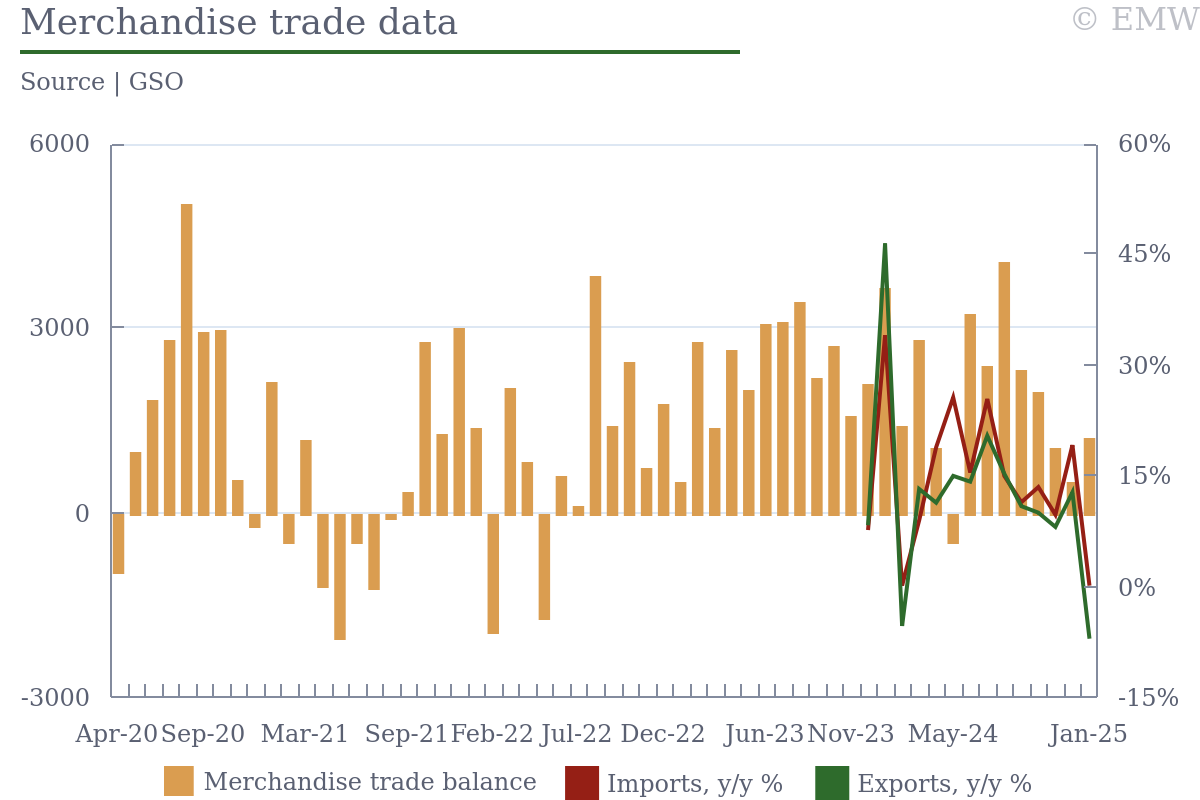

| Trade balance posts USD 3bn surplus in Jan, down 16.7% y/y |

- Trade surplus narrowed by 16.7% y/y to USD 3bn in January

The trade balance recorded a USD 3bn surplus in January, marking a 16.7% y/y decline, according to data from the General Statistics Office (GSO). The decline was driven by a 4.3% y/y drop in exports to USD 33.1bn, alongside a 2.6% y/y contraction in imports to USD 30.1bn.

Most export categories registered declines this month, except for electronics and garments, which grew by 13.3% y/y and 1.8% y/y, respectively. In contrast, exports of phones, automobiles, and auto parts recorded significant contractions of 13.2% y/y and 10.2% y/y, respectively.

A similar pattern was observed on the import side. Electronic device imports surged by 13.8% y/y, while machinery and petroleum imports also increased, albeit at a modest pace. Among the declining import categories, crude oil imports saw the sharpest drop, plunging 25.7% y/y, while other sectors experienced mild declines of 2-3% y/y.

Looking ahead, exports are expected to face headwinds due to weaker global demand and persistent trade uncertainties.

| Trade performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: GSO |

| Ask the editor | Link to source | Back to contents |

| Industrial production posts 0.6% y/y growth in Jan |

- Industrial production grew by 0.6% y/y in January, constrained by fewer working days due to the Lunar New Year holiday.

- Key sectors maintained positive growth, led by motor vehicles, computers, and electronics.

- Industrial output is expected to resume its robust momentum in the coming months as seasonal effects subside.

Industrial production recorded a modest 0.6% y/y growth in January, according to data from the General Statistics Office (GSO). The limited growth was primarily attributed to the Lunar New Year holiday, which resulted in fewer working days compared to the same period last year.

Despite the overall slow growth, several key industrial sectors posted positive gains. Manufacturing output rose by 1.6% y/y, while the computer and electronics segment recorded a more pronounce growth, expanding by 3.8% y/y. The motor vehicle sector continued its strong performance, registering an exceptional 33.8% y/y growth. Meanwhile, the textiles and apparel sector also gained momentum, with growth rates of above 5%. In contrast, mining and machinery production contracted by 10.4% and 9.9% y/y.

Despite subdued production growth, employment in the manufacturing sector expanded by 4.5% y/y in January. The machinery subsector recorded the highest employment increase at 11.5% y/y. However, employment in mining and refined petroleum remained weak, mirroring the lackluster performance of these industries.

Looking ahead, industrial production is expected to regain momentum as the impact of the Lunar New Year fades. Additionally, fiscal stimulus measures and accommodative monetary policies are anticipated to support a recovery in output in the coming months.

| Industrial production and labour employed | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: GSO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ask the editor | Link to source | Back to contents |

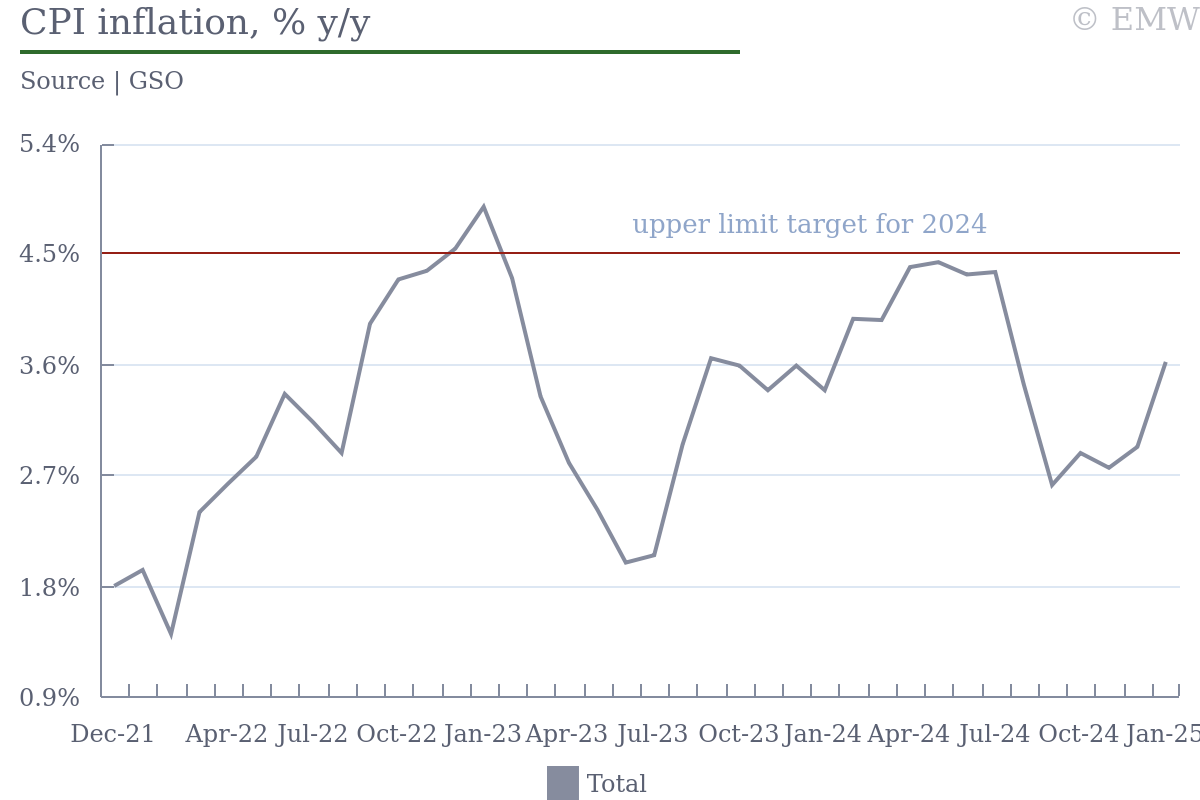

| CPI inflation accelerates to 3.6% y/y in January due to Lunar New Year effect |

- Headline inflation accelerated to 3.6% y/y, while core inflation edged up slightly to 3.07%

- Inflation is expected to remain below 4%, allow the SBV to maintains accommodative monetary policy for an extended period

Headline consumer price index (CPI) inflation accelerated to 3.6% y/y in January, according to data from the General Statistics Office (GSO). This uptick was primarily driven by higher demand and prices during the Lunar New Year, alongside rising medical service costs. Core inflation, which excludes volatile components such as food and energy, also saw a marginal increase, reaching 3.07% y/y from 2.9% in the previous month.

Food prices remained the largest contributor to inflation, posting an annual increase of 4.4%, which added 1.48 percentage points (pp) to overall inflation. The surge in food prices was largely attributed to heightened demand during the Lunar New Year period. Another significant driver was medicines and medical services, which recorded a sharp 14.1% y/y increase. This rise was primarily due to new medical service price adjustments following the implementation of Circular 21/2024/TT-BYT. Despite the overall acceleration in inflation, housing costs which are the second-largest contributor, saw a moderated pace of increase, rising 4.9% y/y and contributing 0.93pp to total inflation. Meanwhile, transportation, education, and communication were the only categories to record price declines in January, with a collective decrease of 0.4% y/y.

Looking ahead, inflation is expected to remain below 4%, as the seasonal impact of the Lunar New Year diminishes and consumption demand does not exhibit signs of a sharp increase. This outlook supports the likelihood of the SBV maintaining its accommodative stance on monetary policy in the near term.

| CPI inflation, % y/y | ||||||||

| ||||||||

| Source: GSO | ||||||||

| Ask the editor | Link to source | Back to contents |

| Press Mood of the Day |

Positive economic indicators recorded in early 2025: Gov't spokesperson (Vietnam news)

PM Chinh asks credit institutions to stabilise gold market (Vietnam news)

Registered FDI capital in Vietnam hits $4.33 bln in Jan, S Korea leads with 13.4-fold increase (The investor)

Apartment prices continue to soar in 2025: Construction ministry (Cong thuong)

Credit growth of 18-20% needed to reach 10% GDP target: Deputy Governor (Vietstock)

Investment and Planning ministry proposes measures to achieve 8% and higher GDP growth (Bao dau tu)

SBV sets 16% credit growth in 2025 (Bao dau tu)

| Ask the editor | Back to contents |